Author: Nancy, PANews

With the release of higher liquidity and the promotion of more efficient capital allocation, RWA (Real World Assets) is attracting traditional institutions and native crypto enterprises to compete for layout, bringing new narrative structures and ecological participants to the crypto world.

Stablecoins are one of the main scenarios for tokenizing RWA assets and are becoming a new growth engine for this track. Stablecoin innovation has always faced a series of issues such as the authenticity and security of assets, and high default risks. The recent default of USDR is a typical case. Ensuring the security and transparency of underlying assets has become a top priority for users.

In the current macro environment of rising US bond yields, the Verified USD Foundation has launched USDV, a fully-chain native stablecoin supported by a 100% reserve of real-world asset tokenized reserves, which is worth the industry's attention. The underlying asset of USDV is the on-chain asset - Short Term Treasury Bill Token (STBT), launched by Matrixport's Tokenized RWA brand Matrixdock. USDV was first launched on five mainstream chains and supports cross-chain transactions. So, what are the innovations of USDV compared to other stablecoins? What are the future application prospects? Let's take a detailed look together.

Putting in Efforts in User Trust, Achieving Full-Chain Transparency and Value Verifiability

Stablecoins, as the fastest-growing segment in the crypto world, have become the cornerstone of liquidity and core assets in the crypto ecosystem. With more and more institutions entering the market, the influence of stablecoins is growing. According to the latest forecast by Wall Street investment bank Bernstein, the market size of stablecoins is expected to grow to $2.8 trillion within the next 5 years.

Trust and value stability are the anchors of stablecoins. Due to events such as the UST default, USDC, and USDR unanchoring incidents, users have experienced a crisis of trust, and ensuring asset transparency, security, and reliability is the basis for gaining long-term user trust.

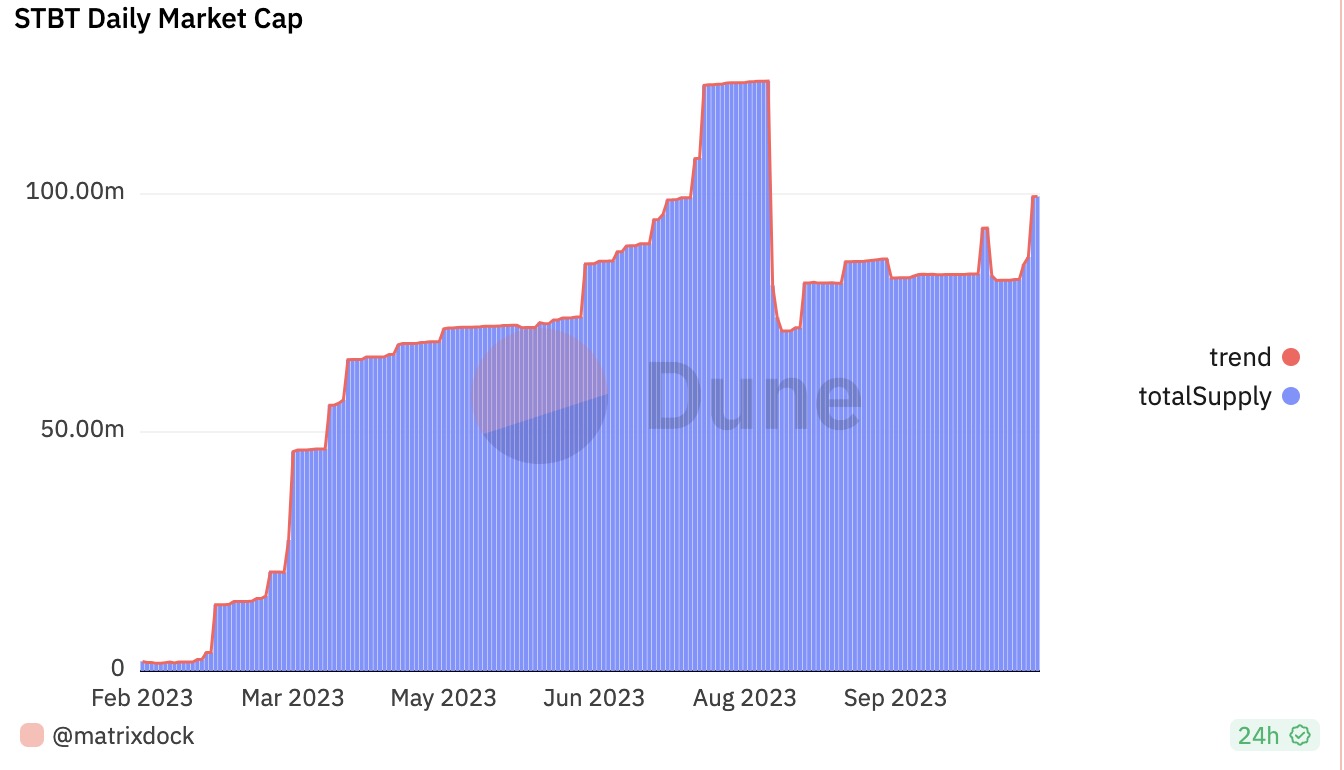

USDV, a fully-chain native stablecoin, has put in a lot of effort in gaining user trust and is the first stablecoin to achieve full-chain transparency and value verifiability. The first underlying asset of USDV - the Short Term Treasury Bill Token (STBT) - is an ERC-1400 standard token, and its value is always anchored to $1 through a rebase mechanism based on the closing price of each US bond trading day. According to Dune data, as of November 14th, the current market value of STBT exceeds $110 million.

STBT has taken various measures to create a reserve asset with high transparency and strict auditing, providing reliability and credibility for itself.

On the one hand, STBT's reserve proof can be queried on Etherscan and monitored in real-time, providing an immutable record of ownership of underlying assets. Compared to other projects that disclose asset reserves on a monthly or quarterly basis, STBT supports on-chain real-time viewing of the latest asset information, achieving transparency of asset reserves and making it easier to build user trust. In addition to self-disclosure of underlying asset records, Chainlink provides real-time third-party decentralized Proof of Reserve verification for STBT.

On the other hand, STBT's underlying assets are short-term US Treasury bonds maturing within six months and reverse repurchase agreements collateralized by US Treasury bonds. Moreover, USDV has the capability to be compatible with various RWA tokens on its underlying technology, and may include other high-liquidity and stable RWA assets as collateral in the future.

In the process of on-chain implementation of RWA assets, STBT has adopted an operation approach similar to asset securitization, effectively isolating the counterparty risk of the issuer by establishing an orphan trust structure with complete bankruptcy isolation capability, forming a natural firewall. In other words, when the issuer undergoes liquidation, STBT holders can receive priority access to the US bonds and cash assets held by the trust for settlement. Of course, the selection of collateral assets will be completed through governance to ensure that the ultimately selected collateral assets meet the requirements. The introduction of RWA assets such as US bonds can greatly enhance trust and attract more external flow.

In terms of code security, USDV's open-source smart contracts have been audited by third-party security auditors Zellic.io, Palladin, and OtterSec.

Breaking the Liquidity and Composability Dilemma, Unleashing the Potential of Stablecoin Assets

Although USDT and USDC dominate the stablecoin market, with changes in the market environment, increasing user demand, and expanding application scenarios, higher requirements are being placed on the application scenarios, liquidity, and participation of stablecoins.

Especially under the multi-chain trend, the demand for cross-chain asset transfers between different chains is increasing, and the circulation of assets can greatly maximize resource utilization and value appreciation. However, most cross-chain asset solutions seem to have issues such as low efficiency and high costs, such as time-consuming and expensive processes through centralized exchanges (CEX) and the risk of asset unanchoring through wrapped assets.

USDV empowers the liquidity and use cases of stablecoins by introducing innovative interoperability solutions. As an ERC-20 standard token, USDV can be integrated with any DApp compatible with ERC-20. At the same time, USDV also integrates LayerZero's OFT (Omnichain Fungible Token) standard for full-chain interoperability. OFT provides USDV with a more friendly and efficient cross-chain transfer solution, allowing tokens to be externally combined in any DApp, enabling seamless cross-chain exchanges and usage in any DApp. This standard also allows for the avoidance of wrapped assets, reducing the risk of token unanchoring and allowing holders to avoid certain counterparty risks.

On its launch day, USDV already supported Ethereum, BSC, Avalanche, Arbitrum, and Optimism, and will continue to integrate more chains and ecosystems in the future, with the technical capability to support over 40 L1 and L2 chains, providing users with a seamless and secure liquidity hub connecting different blockchains. Even users unfamiliar with on-chain operations can easily transfer assets across different chains.

It can be said that USDV has strong accessibility and cross-chain capabilities, greatly improving the liquidity and composability of stablecoins, providing users with a convenient and efficient fund management experience, and unleashing unlimited potential for stablecoin assets.

Introducing a Fair Incentive Mechanism, Creating a Self-Growing Community to Benefit the Ecosystem

Having a wide range of use cases is one of the key factors for the success of stablecoin projects, as it can enhance user participation and improve its own sustainable development, thereby establishing a strong flywheel effect and innovation space. A sustainable scenario construction cannot be achieved without fair and effective incentive and recognition mechanisms.

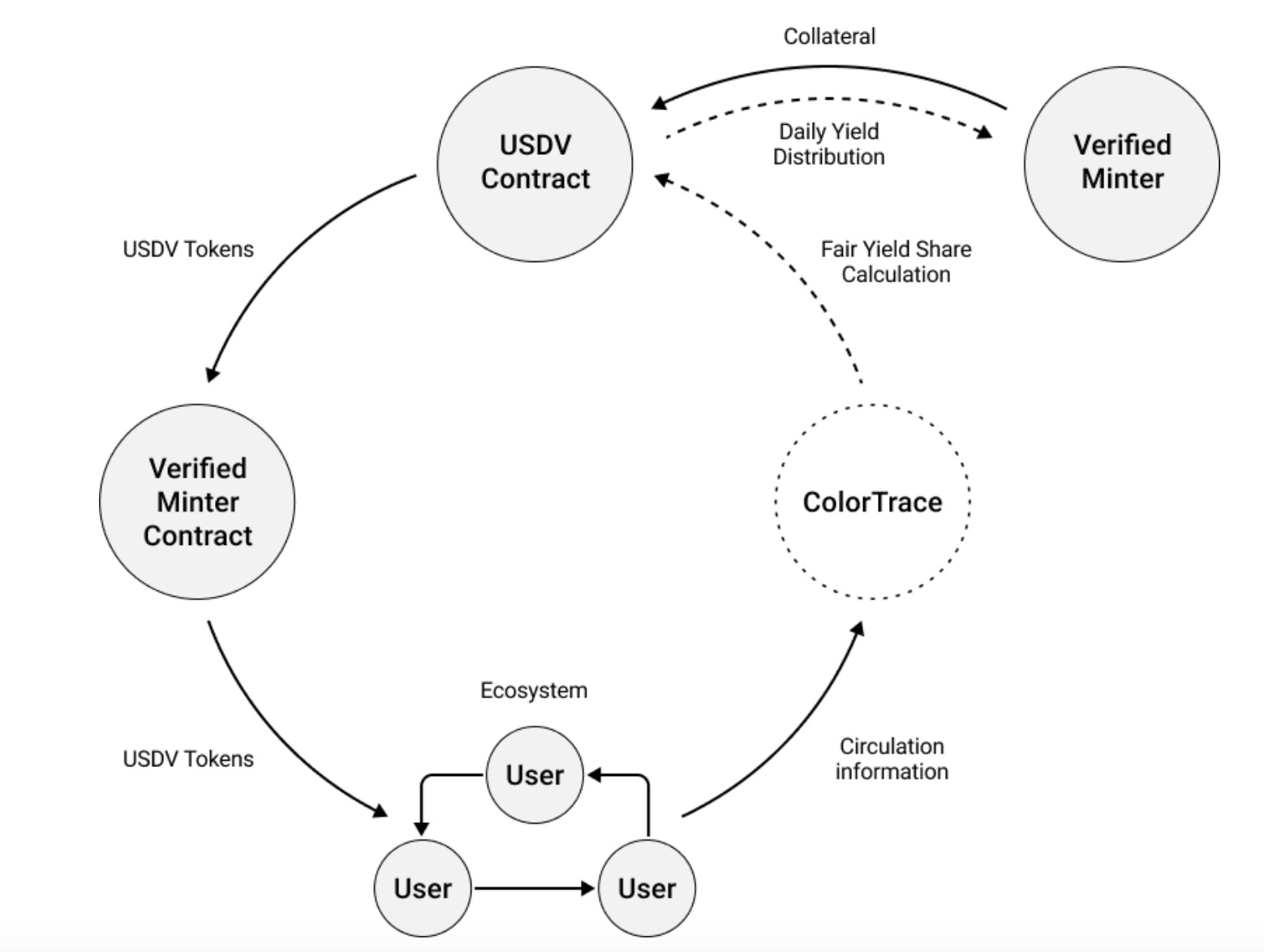

Similar to the early stages of Bitcoin mining, the network security and development of USDV are also driven by contributors to the ecosystem, and economic incentives are based on the degree of contribution (i.e., the amount of USDV created). In order to create an ecosystem community composed of contributors with multiple influences and self-growing capabilities, USDV has introduced the value attribution algorithm ColorTrace developed by LayerZero Labs into its smart contracts.

The innovative ColorTrace algorithm rewards contributors to the ecosystem in proportion to their actual contributions, such as adding USDV as collateral or lending options in cooperation agreements, deploying USDV in DEX trading pairs or pools, etc. The greater the circulation and demand contribution of USDV, the greater the reward. The introduction of the value attribution mechanism allows USDV to freely circulate as a fungible token in various ecosystems, while leveraging the advantages of large-scale ecosystem contributors.

This fair and reasonable incentive mechanism can help ecosystem partners continue to contribute, thereby generating exponential growth cycles and increasing the further liquidity and utility of USDV. It is important to note that contributors to USDV are only open to verified ecosystem partners, who need to undergo KYC or be included in a whitelist. This approach can to some extent improve transparency and achieve effective supervision and compliance.

As the issuer of USDV, the Verified USD Foundation is responsible for recruiting new ecosystem partners and formulating the roadmap and governance plan for USDV. Its future plans include collaborating with third-party institutions to explore more usage scenarios for USDV, building bridges for real-world assets, and providing users with a wider range of services. For example, DeFi mining, lending, staking, fund management, cross-border payments, and even the future introduction of debit cards.

In the current situation where hot money is difficult to enter, new users are scarce, and the industry scale is limited, stablecoins like USDV not only significantly increase user trust, but also capture more liquidity and innovation in the crypto market through the introduction of cross-chain transfer solutions and incentive mechanisms, thereby breaking through the development bottleneck of the current market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。