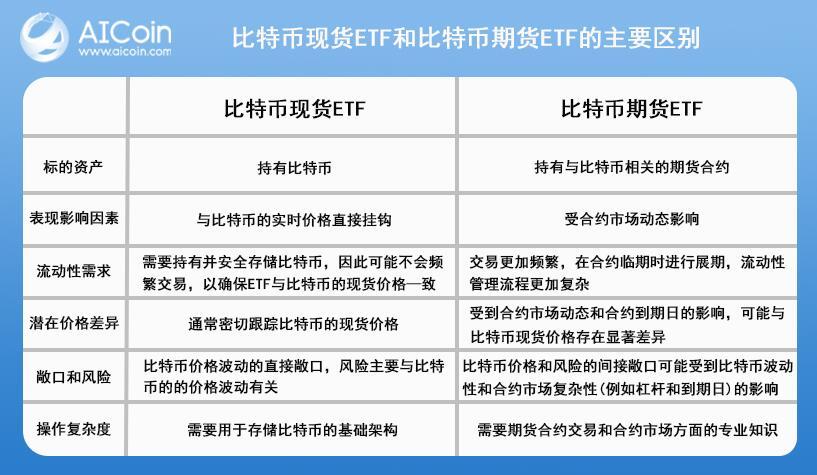

The main differences between Bitcoin spot ETF and Bitcoin futures ETF are summarized as follows. Please note that these differences also generally apply if the underlying asset is Ethereum or other assets.

Which Bitcoin ETFs can investors buy?

There are a large number of Bitcoin ETFs and Ethereum ETFs available for investment in the market, and investors can easily find lists of such funds from reliable sources. If you are interested in investing in these ETFs, be sure to carefully read the fund details to understand their fee structure, fund management company, and liquidity.

Different ETFs have different fee structures, and you need to understand factors such as management fees, trading fees, etc., which may reduce returns. When choosing, consider the reputation and performance record of the ETF provider. It is relatively safer to choose well-known fund management companies with excellent performance records. Check the liquidity of the ETF. ETFs that can be seamlessly bought and sold with minimal price fluctuations usually have an advantage.

In addition, some Bitcoin ETFs may also offer diversified exposure to other cryptocurrencies. If you want to diversify your cryptocurrency investments, you can consider holding ETFs with multiple digital assets.

As of 2023, well-known financial institutions such as BlackRock, Invesco, Ark Invest, and Fidelity have submitted applications for Bitcoin spot ETFs. If these applications are approved, investors will have a more diverse selection of Bitcoin ETFs to choose from in the future.

Who should consider investing in Bitcoin ETFs?

Understanding the differences between Bitcoin spot ETF and Bitcoin futures ETF and which investors they are suitable for is crucial.

- Bitcoin spot ETF is suitable for investors who want to have direct exposure to real-time price fluctuations of Bitcoin without holding or managing Bitcoin.

For example, investors who are confident in the long-term value of Bitcoin and want to participate in closely tracking the Bitcoin market price. They may prefer a simpler spot ETF over complex contract trading.

- Bitcoin futures ETF is suitable for more experienced investors who are interested in the price of Bitcoin and can adapt flexibly to the complex futures market.

For example, investors may want to take advantage of the dynamics of the futures market, hedge other investments, or seek opportunities in short-term price fluctuations. In addition, such investors may be willing to take on the potential risks and returns of contract trading, including complex contract rollover issues.

Conclusion

Bitcoin ETFs are a bridge connecting traditional investors with the cryptocurrency world.

Bitcoin spot ETF provides direct exposure to Bitcoin price fluctuations by holding Bitcoin.

Bitcoin futures ETF provides exposure through futures contracts that predict future Bitcoin prices.

However, caution must be exercised with all investments. Bitcoin and related investment tools come with many potential risks. Before making a decision, successful investors should conduct thorough research. Consult a reliable financial advisor, who will provide targeted professional advice based on individual financial goals and risk tolerance, which may be the most important aspect.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。