By: flowie, ChainCatcher

Compared to the embarrassment of last year's FTX crisis, Solana has been quite triumphant at this year's Breakpoint. Dan Albert, Executive Director of the Solana Foundation, finally announced the launch of the Firedancer testnet to address the downtime issue, receiving praise from various tech giants such as Georgios Konstantopoulos, Chief Technology Officer of Paradigm, and Raoul Pal, Founder of Global Macro Investor. What's even more exciting is that during the conference (October 30 to November 3), the token price of Solana reached a high of $45, setting a record high within 14 months, with an increase of over 80% in the past month. As of the time of writing, the price of the Solana token has fallen to $39.6.

Despite the significant surge, many crypto users have joked about Solana's price manipulation during every Breakpoint. Arthur, Founder of DeFiance Capital, even quipped, "If opening Breakpoint is so effective for Sol's rise, Solana can open every week." However, despite this, we cannot deny that Solana's recovery cannot be separated from the hard work of "post-disaster" reconstruction over the past year.

Almost at the same time last year, shortly after the Breakpoint conference, ChainCatcher also wrote an article "How did Solana deal with internal and external troubles after being deeply trapped in the FTX dilemma?" documenting Solana before and after Breakpoint. At that time, Solana was in a sorry state, facing continuous downtime and unprecedented large-scale attacks on its ecosystem in the crypto winter, and being fiercely chased by new public chains Aptos and Sui. Amidst unresolved challenges from various sides, Solana was also affected by the FTX collapse, with the token price dropping below $8, teetering on the brink of life and death.

And now, after the survival, Solana has returned once again, with various indicators showing an upward trend, and its technical foundation and ecosystem construction are also recovering and even making breakthroughs. As summarized in Messari's third-quarter Solana ecosystem report, "The development momentum is stronger than when it first entered the bear market." Perhaps more people are willing to believe that Solana, the "Ethereum killer," is writing a story of "what doesn't kill me makes me stronger" as it is about to cross two bull and bear cycles.

Looking at Solana's Fundamentals from the Data

Although the significant rise in Solana's token price inevitably involves institutional investors manipulating the market, various key indicators of Solana have indeed shown a warming and upward trend. According to Defilama, Solana's TVL has reached $4.6 billion, more than double the $2.1 billion at the beginning of the year, currently ranking eighth in the public chain race.

More convincing than TVL is its DeFi Velocity data. DeFi Velocity evaluates the activity and adoption of a chain based on the trading volume (DeFi Velocity) per dollar of TVL. According to Nansen's latest data, Solana's DeFi Velocity ratio for the 7 days from September 26 to October 2 was 0.71, indicating that for every $1 of liquidity per week, the trading volume is close to $0.71. This ratio is higher than that of various public chains such as Arbitrum, BSC, Base, Optimism, and Ethereum.

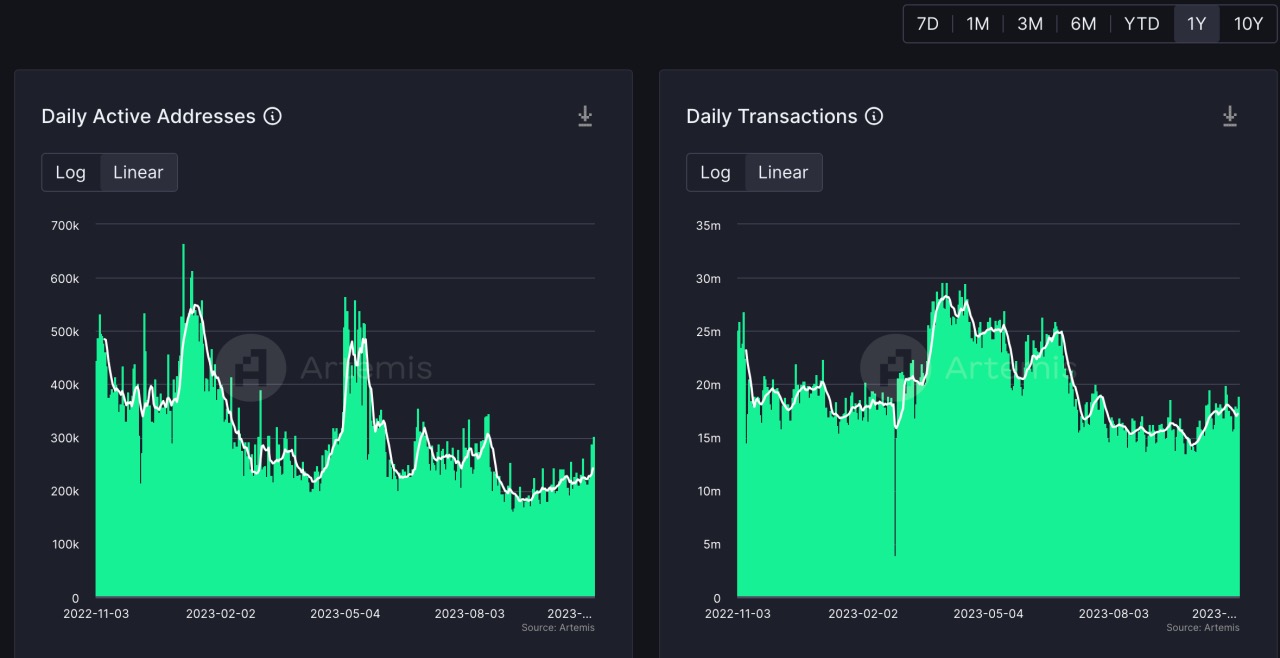

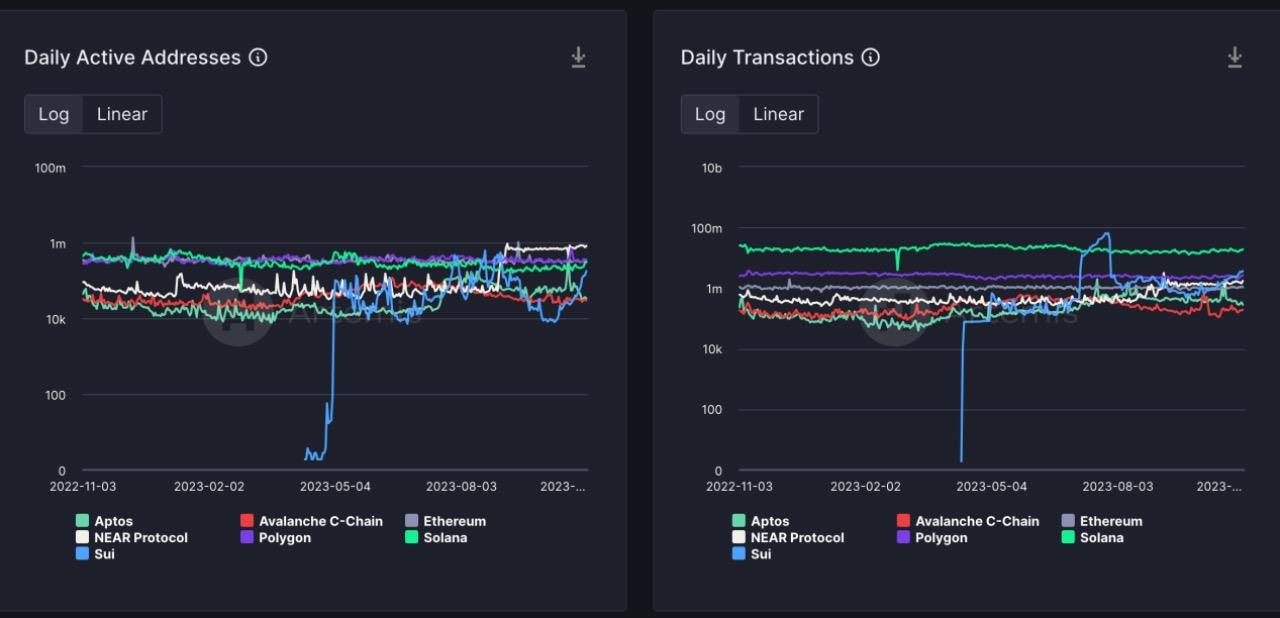

Looking at the number of daily active addresses and daily transaction volume, active trading on Solana has not declined significantly since the FTX debacle. Although the number of daily active addresses was briefly quiet in the early part of the year, it peaked around May-June, exceeding 500,000. The daily transaction volume also peaked in May-June, exceeding 25 million transactions. The overall transaction volume is also ahead of Ethereum, Polygon, and Aptos. At that time, Bitcoin ecosystem protocols and meme coins were booming, causing congestion and increased transaction fees on the Bitcoin and Ethereum networks, leading many developers and users to choose the lower-cost Solana for transactions.

In terms of developer activity, the FTX collapse last year did not actually cause a large-scale exodus of Solana developers. In November last year, X platform conducted a survey of the developer community, with about 73% of developers believing that there was no need to leave Solana, and about 67% of developers choosing to deploy exclusively on Solana.

According to the data from the Solana official website, the number of monthly active developers has exceeded 2000, compared to 1234 monthly active developers in the second quarter of Solana's report (as of April), showing a significant increase and gradually returning to the peak in March of this year. According to the Electric Capital developer report, after the FTX debacle, Solana's developer activity increased significantly in March, with monthly active developers reaching 2,732, but has declined since March, with the main reason being significant changes in part-time developers, while the decrease in full-time developers is not significant.

Overall, the trauma brought to Solana by FTX did not destroy the solid fundamentals that Solana established in the previous cycle.

Multiple Boots on the Ground, Impressive Technological Breakthroughs

The long-discussed downtime solution and EVM compatibility solution have gradually made progress this year.

First is the launch of the highly anticipated Firedancer testnet at Breakpoint. Firedancer is a new generation node validation client for the Solana public chain launched by Jump Crypto. As Solana's second client, it will reduce the single-client single-point risk, increase the diversity of node clients, and improve the stability of the Solana blockchain, with an expected 10-100 times increase in Solana's throughput.

Firedancer is the most anticipated infrastructure upgrade for Solana in the coming years. Solana co-founder Anatoly Yakovenko referred to it as the long-term solution to Solana's downtime in a recent interview, highlighting its importance. Since its launch in 2020, Solana has experienced at least five major interruptions, three of which occurred in 2022. The significant instability of Solana has led to ecosystem projects being attacked on a large scale and fleeing to new public chains such as Aptos and Sui.

The mainnet for Firedancer is expected to launch in 2024. However, it is worth noting that analysts at Delphi Digital believe that the launch at the Breakpoint conference is actually only the network component Frankendancer of Firedancer. There are still significant challenges in between the launch of the full version of Firedancer, which may not be achieved until 2025.

In terms of downtime issues, network upgrades including QUIC, Stake-weighted QoS, and localized fee markets have improved Solana's network stability significantly this year compared to 2022. The second-quarter report from Solana stated that there was one network interruption on February 25 (during the last software upgrade), and there have been no such issues after the improvement.

In addition to addressing downtime issues, the EVM ecosystem compatibility solution has also been implemented. In July of this year, the Solana EVM compatibility solution Neon was finally launched on the mainnet, followed by the release of the Solidity smart contract compiler Solang, making it easier for developers to write Ethereum applications on Solana.

Furthermore, the new anchor GameFi announced by Solana during last year's Breakpoint has also made progress. During this year's Breakpoint, Solana also announced the launch of the GameShift game development tool for testing, aiming to reduce the difficulty and complexity of developing games on the Solana blockchain.

In addition, Solana's Web3 phone Saga was publicly released in May of this year. Although the sales performance was not impressive, it represents Solana's early layout in the mobile entry.

After solving long-standing issues such as downtime, Solana has also made some impressive technological breakthroughs. In April of this year, Solana announced the launch of state compression. State compression is a new method of storing data that can reduce the cost of minting NFTs by over 2000 times. According to the Nansen report, through state compression technology, the cost of minting 1M NFTs has decreased from $25,300 to $113, compared to costs of $33.6 million and $32,800 on Ethereum and Polygon, respectively. Helium benefited from state compression technology during its migration to Solana in April of this year. During the migration, nearly 1 million hotspots on the Helium network were minted as NFTs, which would have cost over $200,000 without compression technology, but only cost around $110.

Ecosystem Maintains Resilience

In addition to technological advantages, Solana has always been known for its ecosystem development. Despite a brief lull in the Solana ecosystem during the crypto winter and after the FTX debacle, this year, with technological upgrades, the Solana ecosystem unexpectedly welcomed giants of Web2 such as Visa and Shopify.

Around September, payment giant Visa announced the expansion of USDC stablecoin settlement functionality to the Solana blockchain. E-commerce giant Shopify also announced integration with Solana Pay, allowing its platform users to use USDC for payments. Visa outlined the reasons for choosing Solana, emphasizing "Solana's unique technical advantages including high throughput parallel processing, low-cost localized fee markets, and high elasticity of a large number of nodes and multi-node clients." The addition of Visa and Shopify has brought a promising start to the use cases of the Solana ecosystem in the payment field.

In addition to the support from Web2 giants, top players and star projects in Web3 are also backing Solana. In particular, MakerDao founder Rune, at the risk of offending Vitalik, publicly stated in a comparison of many public chains that Solana is the most suitable for being the NewChain. The L2 blockchain Eclipse's solution also embeds Solana's SVM (Solana Virtual Machine) and mentions the growing network effect of SVM.

With the support of top players, Solana is actively promoting ecosystem incentives. Throughout the third quarter, Solana not only hosted the Solana Hyperdrive hackathon with a million-dollar prize pool, but also participated in several hackathon events such as OPOS Hackathon, Hacker Houses, and PlayGG through sponsorship. Recently, Solana has also launched an incubator aimed at attracting startup founders to choose Solana.

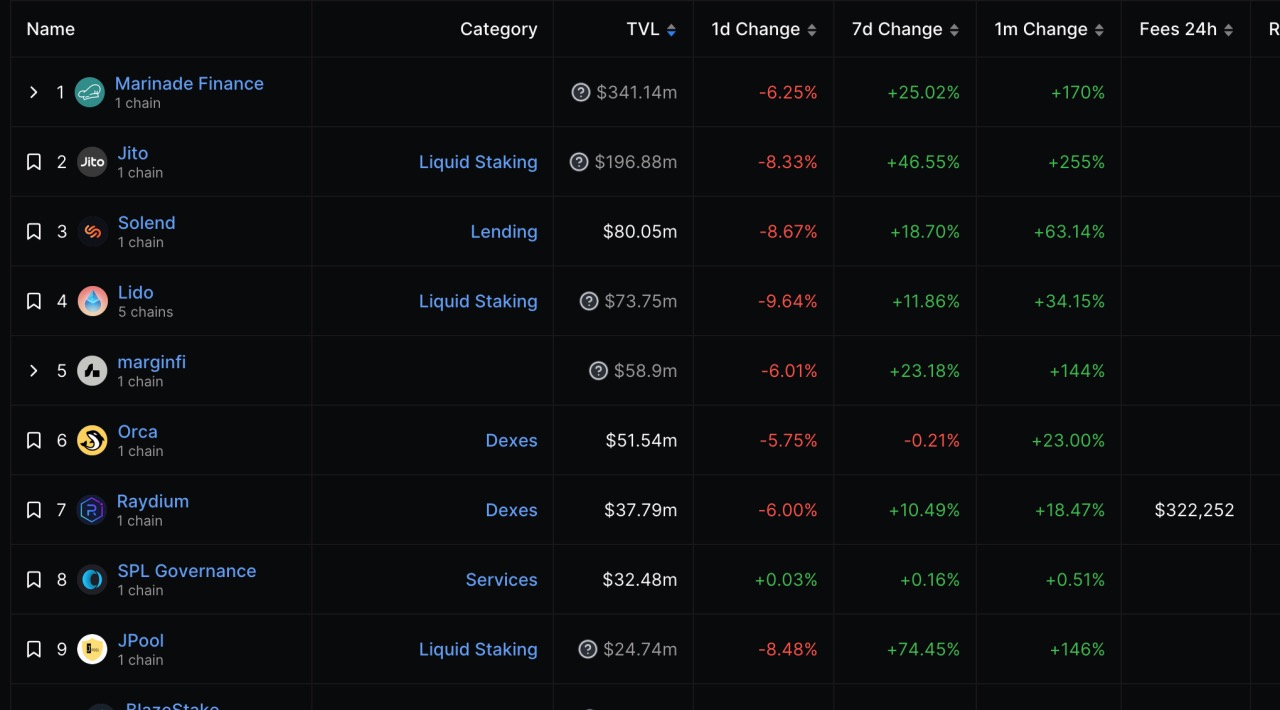

In the Solana ecosystem this year, established DeFi protocols like Marinade Finance, Lido, and Solend have not only shown impressive growth, but also some dark horses such as Jito, marginfi, Ocra, Tensor, and Backpack have emerged, with most of them appearing in the liquidity staking sector. According to DeFilama's data, protocols with high SolanaTVL have generally increased in the past month, with three protocols achieving over 100% growth, with the highest exceeding 255%.

One of the liquidity staking protocols, Jito, which went live shortly after the FTX collapse, saw its TVL climb from $4 million to nearly $200 million in a year, making it the second-ranked protocol in the Solana ecosystem, second only to Marinade Finance. Jito's unique feature is that it offers stakers additional MEV rewards in addition to staking rewards. According to the latest data from Solana, over 31% of Solana validators are running the Jito Labs client. In addition, the DeFi margin protocol MarginFi saw a more than 700% increase in TVL in the third quarter, leading the development of incentive mechanisms in Solana DeFi, followed by the perpetual contract trading platform Cypher and the Solana ecosystem lending protocol Solend, which subsequently introduced incentive mechanisms.

Recently, the Web3 integrated application Backpack in the Solana ecosystem has been making frequent moves and is worth paying attention to. Backpack was the first to innovate the construction of Web3.0 wallets. Unlike other wallets, it allows developers to build permissionless asset management tools in a single interface through the revolutionary new standard xNFT, and is capable of driving new core functions through request interfaces to provide a more user-friendly experience for mobile clients.

Recently, Backpack also launched the NFT project Mad Lads, which is currently the highest valued NFT project on Solana, with sales exceeding the top 5 NFT series within 24 hours. Backpack also announced the launch of the regulated cryptocurrency exchange Backpack Exchange. The Backpack Exchange has already obtained a Virtual Asset Service Provider (VASP) license from the Dubai Virtual Assets Regulatory Authority (VARA) and will launch a beta version to existing Backpack and Mad Lads community members in November of this year.

The "Goodwill" Behind Solana

Looking back, during difficult times, Solana has not lacked support from influential figures and their fans. After the FTX debacle, industry figures such as Vitalik, MakerDao founder Rune, Bankless founder, and Placeholder VC partner Chris Burniske, as well as Web2 asset management giant VanEck and payment giant Visa, have all voiced their support for Solana.

If we carefully examine the reasons given by each supporter, most of them point directly to Solana's technical strength and community vitality, and they have become even more bullish on Solana after the FTX collapse. Shortly after the FTX collapse, Vitalik Buterin tweeted that he hoped the Solana community would have a fair chance to thrive because someone smart told him that Solana is a serious and smart development community, and now those terrible, opportunistic people have been washed away.

The "smart person," Placeholder VC partner Chris Burniske, also took the opportunity to explain the specific reasons for his support, such as the fact that the Solana community has staunch and hardcore developers, and compared to Ethereum and Cosmos, Solana's on-chain innovation is more independent. In terms of the ecosystem, developers of Dapps on Solana are more like a hybrid of Web2 and Web3, with a very encrypted operating mode on the backend and the ability to engage with the mainstream on the frontend. MakerDao founder Rune's reasons for favoring Solana include the high code quality of Solana and the resilience of its ecosystem after the FTX collapse.

VanEck's lengthy report directly expresses optimism for Solana, comparing Solana and Ethereum from various aspects such as ecosystem applications and revenue costs. VanEck believes that "Solana's community has a strong sense of identity, which has enabled it to maintain resilience in the face of significant setbacks, even though these setbacks could have destroyed many other blockchain ecosystems."

After experiencing ups and downs, Solana may be telling us that in the brutal elimination game of Web3, continuously innovating and maintaining "resilience" in the face of major setbacks makes you even stronger.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。