Authors: Jack, Lu Dongxiao, BlockBeats

On October 31, it has been 15 years since Satoshi Nakamoto published the Bitcoin white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" on the P2P Foundation website. The Bitcoin network was officially launched on January 3, 2009, with an initial trading price of $0.0008.

According to market data, the current price of Bitcoin is $34,429.09, with a total market value of $672.9 billion. Since its launch, Bitcoin has appreciated over 43 million times. Let's go back to the origin of cryptocurrency and commemorate the release of the Bitcoin white paper.

The Beginning of Everything

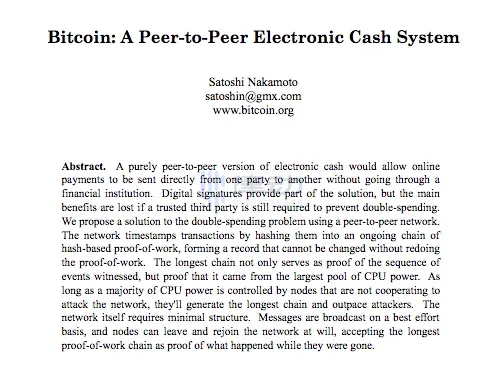

In November 2008, a paper attributed to Satoshi Nakamoto was published online, titled "Bitcoin: A Peer-to-Peer Electronic Cash System." The paper detailed how to create a "trustless electronic transaction system" using a peer-to-peer network.

The background of Bitcoin's creation by Satoshi Nakamoto reflects the original intention behind its creation. On September 15, 2008, following the collapse of Lehman Brothers, the financial crisis erupted in the United States and quickly spread worldwide.

In response to the crisis, the U.S. Treasury launched an unprecedented large-scale rescue effort, using an astonishing amount of public funds to save Fannie Mae and Freddie Mac, two major mortgage lenders. At the same time, the Federal Reserve adopted a policy of quantitative easing, attempting to stimulate the U.S. economy by flooding the market with money. The impact was not limited to the U.S., as the value of the U.S. dollar held by various countries plummeted, leading to a series of butterfly effects such as intensified exchange rate fluctuations and stock market crashes, plunging the global economy into a deep recession.

Out of disappointment with the current monetary system and a desire to protect privacy rights, Satoshi Nakamoto created Bitcoin. In the traditional monetary system, all currency is issued by central banks and recorded and confirmed by banks during transactions. Bitcoin, however, broke this traditional model, allowing individuals to conduct peer-to-peer transactions without the need for intermediaries such as banks or other financial institutions. With a limited total supply of 21 million coins, Bitcoin is protected from inflation, unlike traditional currencies that continuously inflate over time, thus preserving the value of the currency.

Amid the chaos in the traditional financial markets, Bitcoin gained the attention of cryptography enthusiasts. After two months of development, Satoshi Nakamoto officially launched the Bitcoin system on January 3, 2009. Following the launch of the Bitcoin network, the first open-source Bitcoin client software was released, and Satoshi Nakamoto used this software to "mine" the first Bitcoin "block" (also known as the genesis block), obtaining the first batch of 50 bitcoins. Initially, the value of Bitcoin transactions was negotiated among users on the "bitcointalk" forum, including an exchange rate of 10,000 bitcoins for a whole pizza.

Whenever Bitcoin enters the mainstream media's spotlight, mainstream economists are often invited to analyze Bitcoin. Initially, these analyses focused on whether Bitcoin was a scam. Nowadays, the focus of the debate is whether Bitcoin can become the future mainstream currency, with much of the discussion centered on Bitcoin's deflationary nature.

The Bitcoin network generates new bitcoins through "mining." "Mining" essentially involves solving a complex mathematical problem using a computer to ensure the consistency of the distributed ledger system of the Bitcoin network. The Bitcoin network automatically adjusts the difficulty of the mathematical problem to produce a qualified answer approximately every 10 minutes. Subsequently, the Bitcoin network generates a certain amount of new bitcoins as a block reward for those who obtain the answer.

Many Bitcoin players are attracted to Bitcoin's inability to be arbitrarily inflated. In contrast to the attitude of Bitcoin players, economists' views on Bitcoin's fixed total supply of 21 million are polarized.

Keynesian economists believe that governments should actively control the total amount of currency, using monetary policy to timely stimulate or brake the economy. Therefore, they believe that a fixed total supply of currency in Bitcoin sacrifices controllability and, worse, will inevitably lead to deflation, thereby harming the overall economy. In contrast, Austrian School economists believe that the less government intervention in currency, the better, and that a fixed total supply of currency in Bitcoin causing deflation is not a big deal, and may even be a sign of social progress.

Silk Road

Compared to Bitcoin's current glory, its birth was insignificant.

On January 3, 2009, Satoshi Nakamoto created the first block of Bitcoin, known as the genesis block, and received the first 50 bitcoins automatically generated by the system on a small server in Helsinki, Finland. For a long time after its birth, the world paid no attention to this new invention—what was the use of this thing? Satoshi Nakamoto, a recognized genius, did not answer. In December 2010, Satoshi Nakamoto left his last message online and was never seen again.

For the first one or two years after its birth, Bitcoin remained at $0.1 per coin. The famous story of 10,000 bitcoins exchanged for a pizza happened during this time. Bitcoin had a genius-like design but was a useless one.

Satoshi Nakamoto, like Shakespeare, wrote a perfect script, but there was no one to perform it. It wasn't until Bitcoin encountered another "genius."

Ross Ulbricht, born in 1984, had been involved in the drug trade since college. The U.S. government strictly controls drugs, and Ross was unable to expand his drug business. It wasn't until 2010 that Ross heard about Bitcoin from a customer, which became a turning point.

Ross Ulbricht

The core of the government's crackdown on illegal activities is the regulation of funds—behind this is the banking system, firmly controlled by the government. Bitcoin is a payment tool that is independent of the banking system—up to now, banks and Bitcoin continue to coexist.

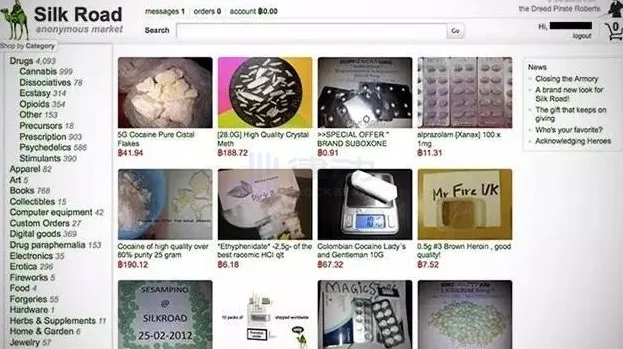

In January 2011, at the age of 26, Ross founded a "deep web," commonly known as the dark web. Ross named this website Silk Road, symbolizing a place for trading goods.

Silk Road did not trade tea, silk, or porcelain; it was the most famous and notorious "dark web" in history. The main transactions on this website included drugs, sex slaves, child pornography, private assassins, arms trading, and identity fraud.

All illegal transactions were concentrated on Silk Road. Eventually, even Ross himself became deeply involved, having hired a hitman with a high deposit to kill a Canadian user who had invaded a seller's computer and threatened him.

With the rise of Silk Road, Bitcoin finally found its first application—serving as a payment tool for criminal transactions. Data shows that Silk Road circulated over 9.5 million bitcoins, accounting for 80% of the circulating supply of Bitcoin at the time.

Screenshot of the Silk Road website

In August 2013, Ross was arrested at a public library in San Francisco. In 2015, he was sentenced to life imprisonment by the court, with no possibility of early release.

Black demand is still demand. Just as the consensus of fools is still consensus. Driven by criminal transactions, Bitcoin experienced its first surge in June 2011, reaching $31. After Ross's arrest, Bitcoin rose to $1,100 per coin within 2 months.

It is safe to say that Ross Ulbricht is an extremely important figure in the history of Bitcoin development. At a time when Bitcoin was about to be ignored by the world, he ended its history as a toy and gave it real-world significance—serving crime.

"Criminals are the most embracing of new technology," summarized Xu Zhihong, a partner at Biyou. However, in the long struggle, the police have mastered the tracing technology of Bitcoin. More black transactions have turned to more difficult-to-trace digital currencies such as Monero. Bitcoin embarked on a long and arduous bearish path.

Block Size War

Fast forward to 2015.

On August 15 of that year, two early Bitcoin pioneers, Gavin Andresen and Mike Hearn, jointly announced in a blog that their new version of BitcoinXT would implement the BIP-101 proposal, which did not require a vote by miners and would be activated directly. This day was later referred to as the "block size war outbreak day."

Since Bitcoin's birth in 2009, the Bitcoin community has been divided on some key issues. The debate surrounding the size of Bitcoin blocks has been the most intense. This controversy originally stemmed from the original intention of Bitcoin's design. In order to prevent meaningless transactions and data inflation, the mysterious founder Satoshi Nakamoto set a limit of 1 megabyte for the size of each block. However, as Bitcoin became more popular, this limit began to appear restrictive, leading to network transaction congestion and increased confirmation times. In fact, as early as 2013, core developer Jeff Garzik proposed doubling the block size to 2 megabytes, sparking the Bitcoin community's initial discussion on block size.

In 2015, the controversy escalated further. Developers who supported expanding the block initiated the Bitcoin XT project, attempting to directly increase the block size to 8 megabytes.

On one hand, Gavin Andresen and Mike Hearn, two original developers who had deep exchanges with Satoshi Nakamoto, leaned towards increasing the block size to 8 megabytes as a strategy to cope with the growth in transaction volume. On the other hand, core developers such as Greg Maxell, Luke-Jr, and Pieter Wuille warned that excessive expansion might lead to fewer nodes being able to run full nodes, reducing the decentralization of Bitcoin. They even suggested that a hard fork might cause chaotic division in the network, and that unlimited pursuit of block expansion was not the best solution for scalability.

Meanwhile, 2015 also witnessed the birth of Ethereum. Its founder, Vitalik Butarin, a staunch supporter of large blocks, focused his ideas on the Ethereum chain. He believed that the scalability of the chain should have no boundaries, and all smart contracts and data should be included in the chain, while providing larger blocks and lower transaction fees.

This controversy later evolved into a serious split within the Bitcoin community. Both sides engaged in multiple rounds of intense discussions about block size but could never reach a consensus. The block size war initially started as a debate about how to scale the network to handle increasing transaction volume, but it later evolved into a philosophical debate about the ultimate purpose of Bitcoin and the "political drama" of managing this open-source project.

In 2017, developers supporting large blocks initiated a hard fork to create Bitcoin Cash, directly increasing the block size to 8 megabytes. This led to the formal split of the Bitcoin community into two factions. Those supporting small blocks continued to maintain the original Bitcoin blockchain, while those supporting large blocks created a new Bitcoin Cash blockchain. Thus, the Bitcoin block size dispute led to the first and largest fork in blockchain history.

After the fork, both chains continued to develop, and the block size dispute persisted. Bitcoin maintained its 1-megabyte block size, while Bitcoin Cash further increased its block size to 32 megabytes in 2018. Ultimately, the block size war was won by the small block faction. However, winning one battle does not mean the war is over, as new BIPs continue to be proposed, and there are still many debates between the "small block camp" and the "large block camp."

Members of the Bitcoin community have proposed hundreds of solutions to address this issue, and the debates between these competing proposals have been extremely intense. It often seems like a war on the internet, sometimes seemingly detached from the original intention of solving the problem, with escalating debates, and even death threats and hacker attacks.

Amidst the chaos, two solutions gradually emerged and evolved into two factions. One was led by Bitmain, the dominant mining pool, advocating for directly scaling the Bitcoin network with larger blocks. The other faction, led by Bitcoin Core developers, did not support Bitmain's ideas. They advocated for maintaining a 1MB Bitcoin network and introducing second-layer network solutions such as Segregated Witness and the Lightning Network outside the Bitcoin network.

Fork in the Road

In 2017, the price of Bitcoin reached a high of $20,000 per coin. During this rapid rise, a player with a large amount of Bitcoin made a phone call to his close friend. At 31 years old, he almost begged his friend over the phone, saying, "Can't you just help me this once?"

The person on the other end of the call was Chang Jia, the founder of "8btc," China's largest blockchain forum and media outlet. He played a significant role in the Chinese blockchain community, and "8btc" also had a huge influence in the Chinese crypto world.

The man making the desperate phone call was Wu Jihan.

Wu Jihan had fought side by side with Chang Jia and co-founded "8btc." Today, he is one of the founders of Bitmain, the world's largest cryptocurrency mining machine manufacturer. In the Hurun 80 Rich List for post-80s self-made entrepreneurs, 32-year-old Wu Jihan was ranked among the top 50 with assets of 16.5 billion RMB.

At the time, Bitmain controlled over 60% of the computing power of the Bitcoin network and was considered the "only one with the opportunity to destroy and control Bitcoin."

Deciding to make this phone call may not have been easy for Wu Jihan, as he was not one to easily back down. But now he needed more support to hard fork Bitcoin. He waited for Chang Jia's response on the phone, hoping that his friend, with whom he had fought side by side, would support him.

Forks are common in the open-source software field for upgrades and updates. Usually, in a soft fork in a blockchain, the new and old versions can be compatible at the same time, while in a hard fork, the new and old versions cannot be compatible at the same time. A hard fork of Bitcoin means that Bitcoin will split into two incompatible versions.

"Anything else, I can agree to, but not this one," Chang Jia straightforwardly rejected his request. Perhaps Wu Jihan had not expected Chang Jia to refuse his request in this way. After all, he had helped Chang Jia during the most difficult times at "8btc," and perhaps he hoped that Chang Jia would help him out of old friendship.

In the end, Chang Jia and "8btc" remained neutral in this century's fork war.

Rewind to a year before the fork, on February 20, in Hong Kong Cyberport. The atmosphere at the meeting was tense, with representatives of Chinese Bitcoin miners and the U.S. Bitcoin development community engaging in 18 hours of intense debate in a small meeting room. Everyone was exhausted but excited. They did not know what impact the conclusions reached in this room that day would have on the crypto world in the future, but they knew that this was the first real "fork" that Bitcoin had faced since its birth.

At 3:30 am on February 21, the debate in the meeting room ended, replaced by a moment of silence. The tense representatives finally breathed a sigh of relief because they had reached a consensus on scaling Bitcoin, which was also known as the Hong Kong Consensus.

"No more division!" the attendees began to cheer.

"If you were previously worried about Bitcoin splitting into two coins, leading to a collapse in the price, now you can rest assured. The dispute between the two sides, which could have led to a military conflict that might split the country, has been downgraded to a parliamentary struggle, greatly reducing the danger."

The Hong Kong Consensus brought relief to many people in the Bitcoin industry, and they spread the word about this hard-won consensus.

Wu Jihan, who usually appeared with a baby face, round glasses, jeans, and sneakers, had a rare smile on his face after signing the Hong Kong Consensus agreement. The reason the entire Bitcoin industry was so excited about the Hong Kong Consensus was that the Bitcoin community had been embroiled in three years of quarrels and divisions over the "scaling debate." This time, they could finally set aside their differences and work together.

Since the participants in this consensus included Bitcoin Core developers, the five major mining pools led by Bitmain (which accounted for 80% of the Bitcoin network's computing power), representatives from four major exchanges (BTCC, Bitfinex, OKCoin, and Huobi), and other individual or industry representatives, the Hong Kong Consensus was also considered the most important official document in Bitcoin history since the white paper.

In 2013, the Bitcoin network began to face a tricky problem. As the number of Bitcoin users grew, the block capacity designed by Satoshi Nakamoto was no longer sufficient. Bitcoin transfers became increasingly slow, and the transaction fees required also increased. This caused unprecedented concern in the entire Bitcoin community. If this continued, Bitcoin would become as mediocre as bank card transfers. People began to argue about how to solve this issue.

Just a month before the Hong Kong Consensus meeting, Bitcoin developer Mike Hearn announced that he would be leaving the Bitcoin industry and declared it a "failure." As a result, the price of Bitcoin dropped from $440 to $360 due to this negative news.

After much mediation, the Hong Kong Consensus was reached. On the day of the Hong Kong Consensus, the price of Bitcoin also recovered to $440.

After the Hong Kong Consensus meeting, Bitcoin Core claimed that the developers who had promised various changes at the meeting were all programmers without the authority to modify the Core source code. None of the five people with the authority to modify the Core source code attended the meeting, and none of them signed.

Adam Back also stated that his signature at the meeting only represented himself and could not represent Bitcoin Core's agreement with the Hong Kong Consensus. His attitude had changed 180 degrees, and he strongly opposed the Hong Kong Consensus that he had recently signed himself.

The rejection of the Hong Kong Consensus directly stimulated the miners, who supported the Hong Kong Consensus and accounted for 80% of the network's computing power. The Bitcoin community, which had just reached a consensus, once again fell into continuous quarrels and divisions. The miners, represented by Bitmain, described the Bitcoin Core developers as conservative Bitcoin purists, while the Bitcoin Core developers did not respect the miners and considered them to be money-grubbing businessmen.

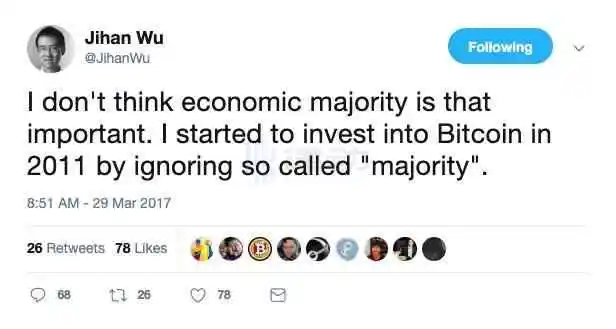

One day in March 2017, Wu Jihan wrote on Twitter, "I believe that the economic majority is not important, and I have ignored the so-called majority since I started investing in Bitcoin in 2011." He decided to start anew and no longer play with Bitcoin Core.

On May 23, 2017, 58 representatives from 22 countries gathered in New York for a meeting convened by Barry Silbert, the founder of the top cryptocurrency investment company, Digital Currency Group.

To convene this meeting, Barry Silbert and the main companies and developer representatives in the industry had one-on-one contacts and put in a great deal of effort to soften the positions of all parties. At the time, Adam Back also promised Barry that he would attend face-to-face negotiations in New York in May.

Unexpectedly, a representative of the Bitcoin Core faction, Adam Back, backed out again.

He was sternly stopped by another important partner within Blockstream just before leaving. On the eve of the meeting in New York, he suddenly announced that he would not attend the meeting and sent a lower-ranking representative, Miao Yongquan, to the meeting.

Miao Yongquan joined Blockstream as Chief Strategy Officer in April 2017. When he represented Bitcoin Core and Blockstream at the meeting, he was refused entry at the door by Barry Silbert. Due to previous disputes with many people on Twitter, Barry Silbert was concerned that Miao Yongquan's presence would make everyone unhappy.

As the defensive side with control over Bitcoin code development, Bitcoin Core only needed to avoid making mistakes to maintain the initiative and continue on its original path. As the attacking side advocating for a hard fork, Bitmain needed to persuade others to support the new path. After being shut out in New York, the Bitcoin Core faction proposed its own soft fork solution before the deployment of Segregated Witness, although it was not implemented for various reasons. This action greatly stimulated the mining faction.

As a result, a mining pool invested in by Bitmain, ViaBTC, launched a hard fork solution to counter the Bitcoin Core soft fork proposal. Ultimately, on August 1, 2017, the ViaBTC team mined the first block, and thus, the forked coin BCH, competing with BTC, was born. BCH's capacity reached 8M, able to accommodate over eight times the transactions of BTC and was not compatible with Segregated Witness.

On January 13, 2018, Bitcoin's market share of the entire cryptocurrency market fell to 32.45%, hitting a historic low. Many people at the time believed that Bitcoin being replaced was only a matter of time.

For Wu Jihan, computing power was the greatest advantage and weapon, and he hoped that the forked coin BCH, which he led, could replace BTC. However, BTC held the orthodox status and naming rights of Bitcoin, as well as nine years of user accumulation and industry ecology. After the birth of BCH, it faced a serious challenge - no one recognized it.

In addition to the opposition from the Bitcoin Core camp and most industry companies maintaining a neutral stance, after the BTC fork, most BCH was sold by users as if it were candy, and the price of BCH was initially only a little over $200.

After the fork, Wu Jihan, on the one hand, raised the price of BCH to attract miners to mine BCH, and on the other hand, continuously sold BTC, causing the price of BTC to be unstable. In the end, "many miners would choose to continue mining BCH, leading to a decrease in Bitcoin's computing power, a more congested network, more people losing confidence and selling Bitcoin, and finally more miners transferring to BCH, forming a vicious cycle, leading to the collapse of Bitcoin."

So, Wu Jihan's first attack was to boost the price. The price of BCH soared all the way, and less than twenty days after the fork, on August 20, the price surged to $898, more than tripled. Miners saw that BCH was profitable, and with the decrease in BTC's computing power and more congested transactions, more and more people began to invest in BCH, further boosting the price of BCH, and this cycle continued, with the price of BCH rising all the way.

Then, Wu Jihan's second attack began to seize Bitcoin's computing power. In extreme cases, BCH diverted nearly half of BTC's computing power, causing a significant congestion in transactions on the Bitcoin chain. However, in November, BCH's computing power reached twice that of BTC, but its price was still only one-third of Bitcoin's. Eventually, BCH's computing power quickly collapsed and never exceeded that of Bitcoin again.

For a long time, the price of BCH was artificially anchored at 7% to 10% of BTC.

In May 2018, the CoinGeek Hong Kong conference was held, and major mining pools, exchanges, and developers came to Hong Kong to celebrate BCH's first anniversary, jointly witnessing the "exciting" development of BCH over the past year. Roger Ver, the founder of bitcoin.com, Jiang Zhuoer, the founder of the ViaBTC mining pool, and Jiang Jiazhi, a BCH core developer, were photographed together at the event, representing public opinion, mining pools, and development, celebrating the first anniversary of the birth of Bitcoin Cash.

In the bear market of 2018, Bitmain heavily invested in the BCH track and converted the company's Bitcoin and cash into BCH, suffering heavy losses. After that, whether in terms of price or computing power, BCH roughly maintained a 1:20 ratio with Bitcoin. Also, due to the heavy holdings of BCH, Bitmain was questioned for relying on selling BCH to generate income when it went public in Hong Kong in 2018.

Looking back two years after the Bitcoin fork, the BTC fork event had long since settled, and BCH had taken a parallel path. However, this fork had a profound impact on the entire Bitcoin ecosystem.

Miners' Stories

If someone told you today that there was a chance to control Bitcoin in China ten years ago, would you believe it?

On a night in May 2010, a hungry programmer exchanged 10,000 bitcoins for two pizzas worth $30, giving Bitcoin its first valuation - $0.003. This invisible and intangible protocol now had real value, leading to a round of bull markets filled with wealth myths and the rise of the crypto mining industry.

In the early days, Bitcoin had no value, with few people participating in the network, and mining only required a computer CPU. Hal Finney was one of the earliest miners, and within a week or two, he mined thousands of bitcoins with his computer. Later, due to the CPU overheating and the annoying noise of the computer fan, he turned off the mining software.

But the $0.003 valuation transaction changed everything. Seeing that Bitcoin mining was profitable, more and more people joined the network, and soon, geeks began writing their own GPU mining programs and building targeted mining machines, which we now know as mining rigs.

Soon, this wave of technology spread to geek forums in China, sparking heated discussions among a small group of people. In 2011, Wu Jihan funded Chang Jia to establish China's first Bitcoin forum, 8btc, and began discussing mining on the forum. Zhang Nangeng, who was studying integrated circuit design at Beihang University, gained fame for creating FPGA mining machines and was known as "Pumpkin Zhang" by netizens. Another software engineer from Guilin, Li Xiaolai, developed the popular "Watermelon Mining Machine."

While GPU mining was popular, a small company in the United States called Butterfly Labs began claiming that it was developing a machine specifically for Bitcoin mining - ASIC. This machine abandoned all other computer functions and was designed specifically for the Bitcoin SHA-256 algorithm, with a speed far exceeding that of GPU mining rigs.

After the concept of ASIC mining machines spread to China, action was quickly taken. In addition to Zhang Nangeng, another legendary figure in the mining circle was Jiang Xinyu, also known as "Roasted Cat." At the age of 15, Roasted Cat entered the University of Science and Technology of China and later pursued a computer science doctorate at Yale. He was attracted to the concept of Bitcoin when he first heard about it and returned to China to become a miner before finishing his studies, becoming the second person in China to develop ASIC mining machines after Zhang Nangeng.

In August 2012, Roasted Cat established a company in Shenzhen and conducted an IPO on the internet, issuing 160,000 shares at a price of 0.1 bitcoins per share, with the code ASICMINER. He then used the funds raised to open a mining farm in Shenzhen and mined Bitcoin with his mining machines, reportedly earning 200 million RMB in three months.

After Roasted Cat's ASIC prototype was released, Zhang Nangeng also formed his own Avalon team and delivered the first mining machine, Avalon 1. As Roasted Cat and Zhang Nangeng quickly developed, another competitor also entered the scene. In the first half of 2013, Wu Jihan founded Bitmain and, within just 13 months, launched three types of computing chips, forming a tripartite situation with Roasted Cat and Zhang Nangeng. Later, Bitmain's Antminer S1 swept a large number of competitors, making a lot of money for its mining machine agents.

Roasted Cat and Zhang Nangeng were also in high demand, and the era of Bitcoin ASIC mining machines was in full swing.

The huge wealth effect attracted countless entrepreneurs to enter the industry, producing various types of Bitcoin mining machines, including Chrysanthemum Mining Machines, Little Strong Mining Machines, and Silverfish Mining Machines, among others. Manufacturers competed fiercely, and mining machines iterated faster and faster, leading to the crazy phenomenon of early pre-ordered futures mining machines becoming obsolete upon arrival. Later, manufacturers found that their mining machines were still on the production line, while their customers had already received better-performing machines from their competitors. Companies that entered the industry early, such as Bitmain, began deploying larger-scale computing power in the terahashes, firmly establishing over 70% of Bitcoin's computing power in China.

On the other hand, under the leadership of geek miners, a large number of gold diggers flooded into China's Bitcoin market. Under the impetus of the "Chinese moms," the price of Bitcoin skyrocketed, approaching 7,000 yuan after breaking through the 4,000 yuan mark, while at the beginning of the year, Bitcoin was worth less than 80 yuan. In just a few months, about 10 billion yuan was invested in the market, making China the world's most enthusiastic market for mining and trading Bitcoin.

In 2013, Bitcoin created one wealth myth after another, and Li Xiaolai is the most typical example. This former New Oriental English teacher purchased 100,000 bitcoins in 2011 and has now become China's "Bitcoin richest man." He not only founded BitFund but also established Yunbi. Lao Mao is another example. In 2010, Lao Mao, who had been in the industry for ten years, changed his life trajectory after reading about Bitcoin in a newspaper at a newsstand while on a business trip with his boss.

The Great Migration

Fast forward to 2021, and the dark times for miners have arrived.

At midnight on June 20, all Bitcoin mining farms in Sichuan were forced to shut down under a government directive. Prior to this, from Inner Mongolia and Qinghai to Xinjiang and Yunnan, Chinese Bitcoin miners had been constantly moving their machines under the pressure of policy documents, with Sichuan becoming the last gathering place. However, the issuance of the shutdown order in Sichuan shattered the miners' hopes, marking the theoretical end of mining farms within China. The computing power that once accounted for 75% of the entire Bitcoin network would disappear from the map.

After that unforgettable night, the city of Chengdu, the capital of the crypto mining industry in China, was filled with miners who were full of despair and confusion.

On June 22, in a jazz bar on the top floor of a five-star hotel in Chengdu, young men with solemn faces sat in groups of three or four, smoking and talking. Their T-shirts sporadically printed with slogans such as "Bitcoin" and "To Da Moon," their conversations were filled with keywords such as "mining machines," "going overseas," and "connecting with overseas resources." In the corridor outside the bar, a few people were scattered, making phone calls to sell mining machines while pacing back and forth, one cigarette after another.

On the same day, in a conference room at another five-star hotel in Chengdu, the "Global Mining Resource Connection Conference" was held quietly. Miners from all over Sichuan, where the power had been cut off, came here to systematically learn about the process of going overseas from various overseas companies, attempting to find the "Noah's Ark" to sail to the other side of the ocean through group warmth and collective wisdom.

From the state of the miners, it was clear that the suspended Bitcoin mining industry in China was in a state of confusion and panic.

In Dujiangyan, 50 kilometers from Chengdu, the majestic Minjiang River rushed down, and the Li family from the Warring States period saw the world-famous hydraulic engineering project in the surging waters. In modern times, Bitcoin miners saw the power resources on which their mining machines depended for survival.

Old Wu's mining farm was located in the mountains of Dujiangyan, covering an area of about 1,000 square meters, and the daily roar of over 10,000 mining machines was sustained by the impact of the water flow.

"When the policies to shut down mining farms in Inner Mongolia and Xinjiang were announced in May, I wasn't worried," Old Wu told BlockBeats. Having been in this industry for a long time, starting from 2013, there has been a crackdown on mining policies every one or two years, especially in Inner Mongolia, which relies on thermal power generation. "We are used to it."

So when mining farms in Inner Mongolia were shut down, Old Wu continued to buy second-hand mining machines online and attracted more machines to be hosted at his mining farm. At the time, he calmly told his friends, "Don't panic."

As time entered June, even Old Wu was feeling restless. The mining farm had received wind of the situation from various channels, but Old Wu still held out hope. "Sichuan is different from Inner Mongolia and Xinjiang. There is a large amount of abandoned water and electricity here, all of which are clean resources. If we don't use these resources, they will be wasted."

The unsettling news initially started in Ya'an. On June 17, there were market rumors that Ya'an, Sichuan, was implementing a "one-size-fits-all" policy for mining farms, requiring all to be shut down before the 25th, including the absorption and abandoned water electricity. On June 18, a notice from the Sichuan Development and Reform Commission and the Sichuan Energy Bureau began circulating in the community, requiring 26 suspected virtual currency "mining" projects to be shut down by June 20.

On the evening of the 19th, Old Wu finally let go of his luck and sighed, "I have to change careers again," as he turned off the constantly roaring mining machines and began to prepare to transfer the mining farm.

Compared to miner Old Long, Old Wu was considered lucky, as his mining farm had been operating for several years, and the profits from the previous years were still considerable.

"I started building a hosting mining farm in Ganzi Prefecture in March this year, completed in May, with a capacity of 50,000 kilowatts, capable of accommodating more than 30,000 mining machines, but it was blocked by policies just before construction began," Old Long told BlockBeats. The total investment in this mining farm was close to over 20 million RMB, and it can be said that it was a total loss. "After all, the profit of the hosting mining farm comes from the difference in electricity fees and hosting management fees."

This time, the swift and forceful government policy and the resolute national attitude left Old Long feeling a bit desperate. "I've been in this industry for 5 years, and there has been a policy crackdown every one or two years, but this time it's too serious. Mining farms, miners, mining pools, all mining communities have been affected."

In the mining circle, Old Long's experience was not the most bitter. "I have a friend who also has a hosting mining farm that was already in operation. His mining farm had an investment of 160 million, and the total value of the mining machines reached 400 million, but after the policy was announced, not only was the mining farm shut down and the machines stopped, but the road in and out of the mining farm was also blocked, and the machines couldn't be moved out. It's a real headache."

Faced with the mining crisis, selling mining machines became the forced choice for many miners.

Unlike the famous mining machine sales point "SEG Plaza" in Shenzhen, although Chengdu is an important gathering place for miners and is known as the "Zhongguancun" of Chengdu, the computer city did not see a bustling scene of selling mining machines.

BlockBeats found that there were no mining machine-related booths at Chengdu Computer City. When further inquiring with the merchants, it was found that the merchants were not unfamiliar with mining machines. "There are very few second-hand Bitcoin mining machines flowing out through offline channels, and we also need to inquire with the suppliers. Instead, there are more graphics card mining machines," a salesperson at the computer city told BlockBeats.

In contrast to the quiet offline market, online Bitcoin mining machines are experiencing a 50% discount.

In the mining circle, where reputation and privacy are important, information from strangers can easily make them wary. They prefer to trade with familiar miners and mining farms within the same circle, so the main trading market for this round of [mining crisis] is still the large online intermediaries and communities.

Mr. Tu from CoinCore Technology told BlockBeats, "Now the price of mining machines has dropped by more than half, and it has entered a buyer's market, with the price being determined by the buyer." Taking the Antminer S19 Pro 95t, which is commonly seen in the market, as an example, the price during the peak of the bull market could reach 60,000-70,000 RMB, but the current price in China is only 30,000+ RMB.

BlockBeats also found that although overseas mining companies and mining farms are buying mining machines at low prices due to the "mining crisis" in China, they are pushing the prices even lower. A buyer from overseas expressed, "I hope to receive the S19j Pro at $40 per T," which is only 252 RMB per T when converted to RMB, and the total selling price of a 100T machine is only 25,200 RMB, which can be said to be the "floor price" in recent months.

With such low prices, it indicates that the second-hand mining machine market has become saturated. Bitmain also announced the suspension of spot mining machine sales. However, some miners believe that the prices are too low and choose to wait and see.

"Perhaps because I have experienced multiple rounds of policy crackdowns, I still believe that the mining industry has prospects," Old Long told BlockBeats. "The prices of mining machines are too low now, and I would rather shut down and wait and see than sell at a loss."

Senior mining industry figure Ah Hao also told BlockBeats that most mining farms are currently shut down and waiting, not selling, and are waiting for the policy to become clearer. "Most of them are struggling now."

As the living space in China continues to shrink, miners who are unwilling to sell mining machines and leave the industry are seeking a lifeline overseas.

Currently, there are about one million mining machines with a load of over 10 million in Sichuan that need to go overseas, Ah Hao told BlockBeats. If they stay in China, the owners and funders of these mining machines will face very high capital costs. Like using leverage to speculate in real estate, the mining circle is also full of miners using borrowed funds to buy machines and build mining farms, carrying the pressure of hundreds of millions of RMB. "They have to replenish funds every day and are very anxious," Ah Hao said.

In the face of the demand to go overseas, mining machine companies that have been operating overseas for a long time have seen business opportunities and designed customized "overseas module containers" to address the miners' plight. These containers integrate equipment such as cold and hot isolation, fans, networks, monitoring, and distribution cabinets, and are essentially mobile mining farms built from containers.

Naturally, the design comes with a high price. Taking BitDeer as an example, the minimum unit price for each container is 142,000 RMB, and it can accommodate 180 units of the 19 series mining machines. Given the scale of mining farms in China, which often have thousands of mining machines, the cost of sending a container overseas for a medium-sized mining farm would be nearly a million, and for a large-scale mining farm, it would be tens of millions.

Currently, the main directions for mining to go overseas are North America and the Middle East. In North America, represented by the United States and Canada, the local policies are relatively stable, and the legal system is relatively sound. Many large mining companies have already settled there, but the comprehensive cost of mining farms in North America is too high, and the United States also imposes a 25% tariff on Chinese electronic products.

Another relatively inexpensive option is Kazakhstan. The region has abundant energy resources, is closer to China, and has lower labor and construction costs, and the tariffs are much lower than in the United States. However, the level of legal governance is not high, the business environment needs to be improved, and like China, policy is the biggest risk.

The road to going overseas is long, and it is not easy. "There are too many pitfalls in going overseas," Ah Hao also believes. "In the past, Kyrgyzstan talked about attracting investment, and it attracted mining farms in the past, but in the end, the military directly took away the Chinese mining farms, and they were left with nothing."

Building factories overseas in legal countries such as the United States and Canada faces extremely high costs. Ah Hao told BlockBeats that building a mining farm with a load of 10,000 in China requires about 3.5-5 million RMB. At the same scale, it would require 18-40 million overseas, and Bitmain's quote is 18 million, while BitDeer's quote is 40 million.

It is worth noting that despite various resource connections and one-stop services during the process of going overseas, the ultimate losses are often "borne entirely by the miners."

Western Development

Since the comprehensive ban on Bitcoin mining activities in the mainland in June 2021, the center of Bitcoin computing power has shifted from China to North America.

By the end of 2021, the change was visible to the naked eye. According to the Bitcoin mining map developed by the Cambridge Bitcoin Electricity Consumption Index, if the data on the average monthly hash rate share is used as a standard, the global center of Bitcoin mining was still in China in January 2021, but by December 2021, this center had shifted to North America.

This change is due to the continuous rise of mining companies in North America. Since 2020, leading North American mining companies such as Core Scientific (NASDAQ: CORZ), Riot Platform (NASDAQ: RIOT), Bitfarms (NASDAQ: BITF), and Iris Energy (NASDAQ: IREN) have begun to purchase a large number of mining machines and have successively gone public in North America, embarking on a path of compliant operations.

In February 2020, Bit Digital (NASDAQ: BTBT) went public;

In June 2021, Bitfarms, Hut 8 (TSE: HUT), and HIVE Digital (CVE:HIVE) went public;

In November 2021, Iris Energy went public;

In January 2022, Core Scientific went public;

Riot Platform, formerly a biopharmaceutical company, took off after joining the mining wave.

These mining companies' main business is Bitcoin mining, so their development is highly related to the price of Bitcoin. During the bull market from January 2021 to May 2022, the stock prices of these companies soared. According to Nasdaq data, compared to their initial public offering, the stock prices of Core Scientific, Bitfarms, Hut 8, and HIVE Digital rose by 57%, 707%, 371%, and 228%, respectively, during the bull market in the crypto market.

The changes in January 2021 and December 2021 are visible. The left image is from January 2021, and the right image is from December 2021. Image source: Cambridge Bitcoin Electricity Consumption Index

During this period, most mining companies achieved profitability through mining power + debt/equity financing. Taking Marathon Digital (MARA) as an example, its main business is self-operated Bitcoin mining. The strategy is to purchase mining machines through financing to deploy mining farms, hold Bitcoin as a long-term investment after paying the cash operating costs, and data shows that in 2021, Marathon Digital spent $120 million to purchase 30,000 Antminer mining machines from Bitmain. They also obtained a $100 million revolving credit line from Silvergate Bank and planned to raise $500 million in debt through the issuance of senior convertible notes to continue purchasing mining machines, making it the largest Bitcoin holder in North America for a time.

Similarly, Core Scientific was even more exaggerated, operating over 200,000 Bitcoin mining machines in five states in the United States. In June 2022 alone, they produced over 7,000 Bitcoins. In addition, Core Scientific has received a $54 million investment from Celsius and signed a $100 million equity investment agreement with investment bank B. Riley.

However, due to its high-leverage business nature, the sudden bear market caught these mining companies off guard.

Firstly, Marathon Digital recorded a net loss of $686.7 million for the entire year of 2022; Riot Platform recorded a net loss of $509.6 million in 2022; Bitfarms recorded a net loss of $239 million in 2022; and Core Scientific had already incurred a loss of over $1.7 billion in the first 9 months of 2022, to the point where it was on the brink of bankruptcy by the end of 2022.

According to a report from the Hashrate Index, the total collective debt of mainstream centralized mining companies by the end of 2022 exceeded $4 billion, with Core Scientific having the most debt, owing creditors $1.3 billion as of September 30, 2022; Marathon Digital owed approximately $851 million in debt, but most of it was in the form of convertible notes; and the third debtor was Greenidge Generation, owing $218 million.

Many institutions believe that the development of centralized mining companies is highly correlated with the price of Bitcoin, so the "business model of financing to purchase Bitcoin mining machines for mining is a severe test of the company's cash flow management ability in a bear market," and it is also easy to face the risk of insolvency.

The Regular Army

In 2017, during the bull market, the cryptocurrency industry spread the seeds of Bitcoin to the world. Across the ocean in China, a Bitcoin trading platform called OKcoin quietly emerged, and this exchange, known as the "Whampoa Military Academy of the Chinese coin circle," was founded by Xu Mingxing. Xu Mingxing came from the internet industry and was previously the CTO of DouDing.com.

There were many others doing the same thing as Xu Mingxing. They were dedicated to solving another fundamental need—how to make it easier for ordinary investors to buy Bitcoin.

Miners need to pay electricity bills, mining machine companies need to develop more advanced machines, and development teams also need to be maintained—all of which require money. Bitcoin needs more support from the fiat currency world, and this is a matter of life and death.

After the first bull market of Bitcoin, cryptocurrency exchanges began to flourish. OKcoin, Huobi, Binance, Coinbase, bitFlyer, BitMEX, Bitfinex, and other exchanges began to rise.

Cryptocurrency exchanges built a bridge, allowing investors to easily buy Bitcoin as if opening a stock account. For a considerable period of time, cryptocurrency exchanges were even the only place for the general public to buy Bitcoin.

Regardless of how Bitcoin has risen or fallen since then, wealth from the fiat currency world has continuously flowed into the world of cryptocurrency, supporting the trading price of Bitcoin and allowing various innovations in the cryptocurrency field to continue.

From the day of its birth, exchanges have been exploring various ways to expand their customer base in the fiat currency world. The majority of exchange customers are investors who prefer new things and high-risk investments. But to truly bring Bitcoin into the real world and to the general public, more financial innovation is needed.

In February 2021, when the price of Bitcoin broke through $50,000, Wang Xing, the founder of Meituan, made a statement on Fanfou. Satoshi Nakamoto is widely recognized as the father of Bitcoin and owns 1.12 million Bitcoins. Just two months after Wang Xing's statement, the price of Bitcoin rose by 30%, exceeding $64,000.

The myth of Bitcoin's wealth creation goes even further. On Wednesday, the largest digital currency exchange in the United States, Coinbase, went public, closing at $65.4 billion on its first day, surpassing China's largest brokerage, Citic Securities.

Wang Xing is a supporter of Bitcoin. In late 2013, Wang Xing bought Bitcoin, "showing respect for this extraordinary creation with practical actions." This investment brought returns of about a hundredfold, even surpassing Meituan— which has been one of the most successful technology companies in China over the past decade.

Now, Bitcoin is seen as a form of currency, a means of saving wealth and making payments, much like gold. Few of China's Bitcoin supporters come from the financial industry. Most supporters, like Wang Xing, come from the internet.

Xu Zhihong, a partner at Coinbest, was one of the earliest Chinese concept stock investors. In 2013, Xu Zhihong received a wedding invitation from a friend. Instead of giving a large red envelope as before, this time he prepared a special gift—a Bitcoin, worth about $300.

"Keep this Bitcoin. When your child gets married, it can buy a house in Beijing." After giving it away, Xu Zhihong was still worried and instructed his friend to hold onto it for the long term.

Over the past decade, the price of friendship has remained stable, while the price of Bitcoin has soared. Today, no one gives Bitcoin as a wedding gift to friends anymore.

"Bitcoin will quickly (within 1.5-2 years) approach 80% of the market value of gold, i.e., $400,000 per coin," predicted Chen Weixing, the founder of KuaiDi. After the merger with Didi, Chen Weixing ventured into blockchain and founded Dache Chain. With the rise of Bitcoin, similar predictions are becoming more common.

Bitcoin supporters often mention "faith." Only investors with "faith" can overcome obstacles, endure the ups and downs, hold onto Bitcoin, and gain immense wealth. Those who founded exchanges and helped investors buy Bitcoin more easily are more like evangelists in the human world. Do they have faith in cryptocurrency?

In the face of Bitcoin, there are even greater peaks—how to enter the investment portfolios of mainstream financial institutions and how to enter the balance sheets of listed companies—this is very difficult.

Over the past decade, Bitcoin has been the highest-performing investment category globally—from $0.1 to $64,000. Unfortunately, this investment category has been ignored for a decade, and almost all investment institutions worldwide have missed out.

"Currently, the biggest restriction on institutional participation in Bitcoin investment is the financial regulations of various countries," said Zhu Xiaohu, a partner at GGV Capital, in an interview with Tencent Technology. He has invested in a series of cutting-edge technology companies such as Didi, Ofo, and Yingke. Where there is a trend, he is there.

"The biggest challenge for institutional participation in Bitcoin investment is still the financial regulations of various countries," said Yuan Yuming, CEO of Huobi Technology. In 2018, Yuan Yuming, who was the chief analyst of TMT at Industrial Securities, caused a stir in the industry when he announced his move to join Huobi China after leaving Industrial Securities.

MicroStrategy, Silicon Valley, and Wall Street

When asked why there was a new round of market trends, almost all practitioners in the coin circle gave the same answer—the United States.

"The center of blockchain innovation has always been in the United States, and in the past two years, blockchain innovation, Ethereum innovation, has basically had no connection with China," said Chen Yong, the founder of Coinbest. Before entering the coin circle, he was the senior vice president of Cheetah Mobile. "It is still impossible to change the situation that financial innovation in the United States is the cornerstone."

Another company from the United States that has been buying Bitcoin is MicroStrategy.

In August of this year, MicroStrategy CEO Michael Saylor tweeted, recalling the experience of MicroStrategy purchasing Bitcoin three years ago. On August 11, 2020, MicroStrategy purchased Bitcoin at an average price of $11,653, spending $250 million to purchase 21,454 Bitcoins at the time.

During these three years, precious metals with "safe-haven properties" have experienced varying degrees of declines, while mainstream stock indices in the United States have risen at an annual rate of nearly 10% per year. Bitcoin, on the other hand, has outperformed with a 145% increase, and MSTR, heavily invested in Bitcoin, has also profited greatly, with a stock price increase of over 200%.

According to the financial report at the beginning of the month, as of July 31, MicroStrategy held 152,800 Bitcoins, with a total cost of $4.53 billion, an average cost of $29,672 per Bitcoin, and the current Bitcoin price fluctuating in this range. CoinMarketCap data shows that the Bitcoin price was $29,340 at the time of writing, slightly lower than MicroStrategy's average holding price, but even so, MSTR still rose nearly 200% in this year's significant rebound in the price of Bitcoin, earning it the title of "Bitcoin concept stock."

In addition to MicroStrategy, there is also an asset management company in the United States that has broken the boundaries between the world of digital currency and traditional finance—commonly known as Grayscale Fund.

In the world of Bitcoin, holding 1,000 Bitcoins is called a whale, and there are about 2,000 whales worldwide.

Among all the whales, Grayscale Fund is undoubtedly one of the largest whales—it manages over 650,000 Bitcoins. At the current price, Grayscale has at least $38.5 billion in assets under management, enough to rank it among the most successful asset management companies globally.

Barry Silbert, Founder of Grayscale Fund

Through financial product innovation, Grayscale Fund has for the first time reduced the difficulty of purchasing Bitcoin assets to the level of buying US stocks. With just a US stock account, investors can trade GBTC like stocks, without having to worry about complex deposit processes or platform defaults.

For a long time, Grayscale Fund has been continuously growing at a scale of 2,000 Bitcoins per day, rapidly expanding its size. Its innovation is very simple—establishing a trust fund for holding Bitcoin as a crypto asset, with investors holding trust shares and being able to trade them on the secondary market.

"In the United States, institutions directly participate in Bitcoin investment mainly through trust fund products (ETPs) operated by institutions such as Grayscale and 21Shares, or directly through compliant trading platforms like Coinbase," explained Yuan Yuming.

In the United States, the management fee rate for trust funds is generally between 0.3-1.5% per year. Grayscale's products have an annual management fee standard of 2%-2.5%. Even if Grayscale does nothing, it can still collect management fees for tens of thousands of Bitcoins every year.

Grayscale Fund is a typical example of all Bitcoin startups. It makes it easier for more investors to hold Bitcoin and gain huge returns. The profit-seeking behavior of these financial institutions has brought a continuous stream of investors to Bitcoin, driving its continuous rise.

"Trading Bitcoin is an 'extremely inefficient way,' and the energy consumed by these exchanges is astonishing," said US Treasury Secretary Janet Yellen, who once criticized Bitcoin, stating, "Bitcoin is often used for illegal financing, and investors should be cautious."

Despite Yellen's dislike of Bitcoin, it does not affect the financial innovation in the United States. In September 2017, the People's Bank of China and seven other ministries comprehensively banned ICOs. However, three months later, the Chicago Mercantile Exchange launched Bitcoin futures.

Now, global top asset management institutions such as Bridgewater and BlackRock are eager to try their hand. As long as they can collect management fees, financial institutions can use your money to buy any asset.

On the other hand, Silicon Valley, the innovation hub, is experiencing FOMO.

Jack Dorsey, the founder of Twitter, is a well-known technology leader in the United States and a more staunch supporter of cryptocurrency than Elon Musk. He believes that cryptocurrency will become the "single currency" of the world.

Although Twitter is well-known, it is not the most successful business company founded by Dorsey. Square, under Dorsey's leadership, is a pioneer in Bitcoin innovation and is currently valued at $120 billion, twice the value of Twitter. If Grayscale Fund is like a pump, drawing fiat currency from the fiat world into the Bitcoin world, Silicon Valley tech companies have invented new tools to gradually erode Bitcoin holdings, much like ants moving house.

In January 2018, Square's Cash App launched a new feature allowing users to buy Bitcoin. "In 2020, 3 million people bought Bitcoin through Cash App, and in January 2021, an additional 1 million people," revealed the Square CFO, indicating that Bitcoin is entering the wallets of the general public through various means.

Under pressure from competitors, in October 2020, the world's largest online payment tool, PayPal, announced support for purchasing Bitcoin, Litecoin, and other digital currencies.

Research shows that the amount of Bitcoin stored in exchanges has decreased from 3 million to 2.2 million over the past year, a decrease of 800,000. The amount of Bitcoin stored in exchanges continues to decrease.

In February 2021, Tesla announced that it had purchased $1.5 billion worth of Bitcoin and declared that Bitcoin could be used to purchase Tesla cars. The price of Bitcoin instantly surged by 10%.

Musk also announced that customers would be able to buy Tesla cars with Bitcoin, and Tesla would not sell these Bitcoins.

Tesla is not the first tech company globally to eat the crab. In 2020, Square invested about $50 million to purchase 4,709 BTC. Square's attempt marked the first time Bitcoin appeared on the balance sheet of a publicly traded company in the United States and was recognized by accounting standards.

With limited Bitcoin and increasing demand, a more serious supply-demand contradiction is emerging.

On June 16, 2021, one of the world's largest asset management groups, BlackRock, submitted a filing to the US SEC for a spot Bitcoin ETF through its subsidiary iShares. According to the application, the ETF is named "iShares Bitcoin Trust," and its assets mainly consist of Bitcoin held by the trustee of the trust, with the "trustee" holding the assets through custody on the cryptocurrency exchange Coinbase.

As an asset management company with assets under management exceeding $10 trillion, BlackRock's managed assets even far exceed Japan's GDP of $4.97 trillion in 2018. BlackRock, Vanguard Group, and State Street Bank were once known as the "three giants," controlling the entire index fund industry in the United States. Therefore, BlackRock's submission of a spot Bitcoin ETF filing to the US SEC,

BlackRock's application for a spot Bitcoin ETF was not without precedent. In early 2021, BlackRock CEO Larry Fink publicly stated that he "sees Bitcoin as a global market asset," and its Chief Investment Officer for Fixed Income, Rick Rieder, subsequently stated that BlackRock had begun to get involved in Bitcoin.

In the same year, BlackRock stated that its global allocation fund obtained some Bitcoin risk exposure through CME's Bitcoin futures issuance. BlackRock's two fund companies, "BlackRock Global Allocation Fund" and "BlackRock Funds V," stated in their investment prospectus submitted to the US Securities and Exchange Commission that some of their funds can participate in Bitcoin futures contract trading. The investment prospectus also stated that not all Bitcoin futures contracts are eligible for investment, but only those registered with the Commodity Futures Trading Commission (CFTC) and settled in cash. According to the SEC, Bitcoin's spot market is undeniably decentralized, in sharp contrast to Bitcoin futures traded only on the Chicago Mercantile Exchange (CME).

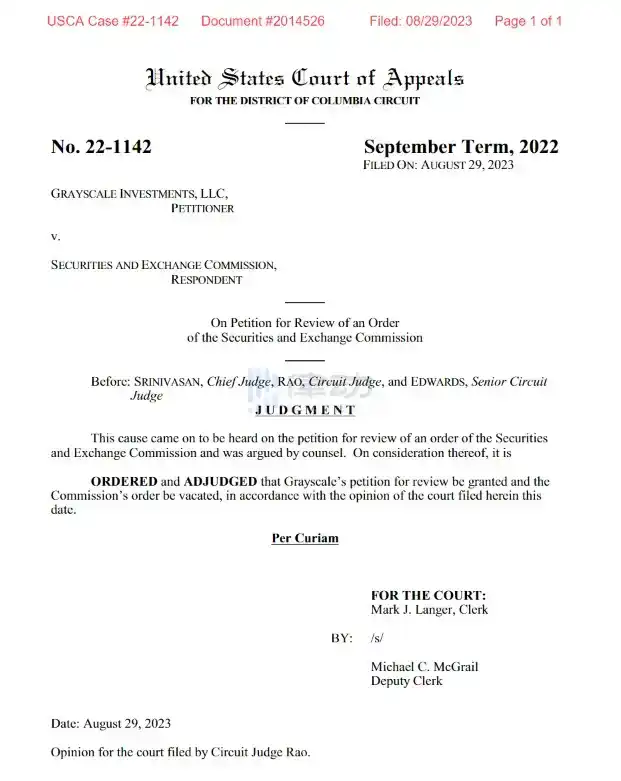

After years of litigation, on August 30, 2021, Grayscale won the lawsuit, overturning the SEC's decision to block the Grayscale ETF. Although this victory does not mean that GBTC can be freely converted into an ETF, "it is a step forward in the conversion process."

According to court documents, a three-judge panel in Washington overturned the US Securities and Exchange Commission's (SEC) decision to block the Grayscale ETF. The court called the refusal of Grayscale's proposal "arbitrary and capricious" because the SEC failed to explain the different treatment of similar products.

Grayscale stated that "this ruling is a milestone progress for American investors and the Bitcoin ecosystem," and it is a milestone because if a spot Bitcoin ETF is launched, the cryptocurrency will experience a historic moment. At that time, GBTC is expected to be smoothly converted into an ETF, and its negative premium will no longer exist.

New Ecosystem

The Taproot upgrade of Bitcoin inadvertently opened up a new design space, allowing users to engrave arbitrary content on the blockchain.

The Bitcoin ecosystem this year has seen some unexpected developments, including BRC20, ordinals, and Bitcoin NFTs. Yuga Labs, Degods, and even real-world luxury car brand Bugatti have all made moves in this space. The related infrastructure is rapidly developing, including trading markets (Magic Eden, Gamma, Ordswap, Ordinals Wallet, etc.), wallets adapted for Bitcoin NFTs (Hiro, UniSat, Xverse, etc.), aggregators (bestinslot.xyz), and more advanced browsers (OrdinalHub, ordiscan).

As of October 8th, according to Dune data, the total minted amount of Bitcoin NFT protocol Ordinals has exceeded 35 million, reaching 35,274,213, with a current total transaction fee of 2,121.1597 BTC (approximately $59,385,414).

The emergence of these developments has led to a surge in gas fees. From the miners' perspective, this is undoubtedly a good thing, as the Bitcoin block space was almost deserted from the summer of 2021 to early 2023, and miners' income was very low. However, for some who cannot afford high gas fees, this is not a good thing. "I mainly work in Africa. They don't have the privilege to pay these high fees like you do. They really need BTC, and you guys are just playing," wrote Bitcoin educator Anita Posch on Twitter.

However, BRC20 and Bitcoin NFTs have also challenged the original 1MB block size limit of Bitcoin, casting doubt on their value.

"This is Not What Ethereum is Built For!" This was Vitalik's assessment of BAYC in a March 2022 interview with Time magazine. Even in the diverse Ethereum ecosystem, the development of NFT "IP giants" like Yuga Labs is not recognized by OG developers.

In the Bitcoin ecosystem, this "resistance to industrial culture" seems even stronger, with many Bitcoin OGs completely denying the legitimacy of NFTs on the Bitcoin network, throwing out the statement "This is Not What Bitcoin is Built For."

Udi Wertheimer, founder of Meme NFT Taproot Wizards, orchestrated the largest block and transaction in Bitcoin history, with a block size of nearly 4MB, dubbed the "largest Bitcoin block ever." However, many have criticized this as an attack on Bitcoin.

Blockstream CEO Adam Back, Bitcoin Core developer LukeDashjr, and others believe that this will cause rapid expansion of the Bitcoin blockchain size, significantly increasing the requirements for devices running full nodes and leading to a decrease in the number of full nodes on the network, reducing censorship resistance. Additionally, unexpectedly large transactions and blocks will impact wallets, mining pools, browsers, and other ecosystem facilities, leading to anomalies in some facilities, such as the failure to properly parse certain transactions. Furthermore, mining pools or miners may choose not to download and verify such large transactions and blocks in order to reduce the time for synchronization and verification, posing security risks.

They even harshly accused the Taproot Wizard's behavior, stating: "This is an attack on Bitcoin. The Bitcoin block has a 1MB limit, and the 4MB data from Taproot Wizard is put on the chain in the witness, bypassing the 1MB limit for both blocks and transactions. If 4MB is allowed, then 400M is also allowed! In this sense, this is not innovation, it is an attack on the vulnerability!"

In response, Udi stated that he owns a large amount of BTC and did this to make it stronger. Like anything that resists pressure, what doesn't kill it will make it stronger. He wants to prove a point: the vitality around Bitcoin has stagnated, and he wants to change that, knowing that if people like him really pose a threat to Bitcoin, then Bitcoin should fail.

Just as no one can decide whether Bitcoin will fork, no one can determine the development path of Bitcoin based on one person's words. Knowing that Bitcoin has no CEO, its governance structure consists of users who pay transaction fees, miners who build the Bitcoin blockchain, and node operators who verify transactions. This decentralized structure to some extent ensures the security and decentralization of Bitcoin, but also presents governance challenges.

Behind these debates is not just about technical differences, but a deeper discussion about the purpose of Bitcoin and its underlying philosophical principles. Governing a decentralized open-source project remains a challenge.

However, after fifteen years, one thing is certain: the spirit and culture of Bitcoin will not wither due to community disagreements. Each of us is not only a witness to this history, but also a participant deeply involved in it. Bitcoin, after fifteen years, is still changing the world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。