Preface

The cyclical nature of the cryptocurrency market every four years is truly amazing. Each time, it feels like things are different, but the result is always "it's the same this time too!" I have never liked predicting the market, buying altcoins, or trading with leverage. However, even so, I still cannot escape being harvested in each bear market. There is nothing else, as long as there is a little bit of greed in your heart, even if you don't like it, you still can't help but do it, and you will still fall into similar traps, just like the altcoin crowdfunding in 2013, the ICO in 2017, the DeFi summer in 2020, and even more so in the two crashes in 2021, where I actively liquidated my CDP to survive.

In my opinion, the correct way to break free from this infinite cryptocurrency cycle and ensure steady growth of one's wealth is to confine one's greed within the predefined rules of DeFi through technical means. This kind of automation of the functions of a financial protocol through pure mathematical deduction and code implementation is truly a wonderful thing. @aladdindao's series of products adhere to the same philosophy. Interested readers can refer to the article I wrote earlier.

https://mirror.xyz/darkforest.eth/gQuWj8-HKOxmCPKdx9etmCPGSylXWmXSVjRm-C_G2wE

As the fourth product produced by @aladdindao - f(x), he has contributed a new type of product to the Ethereum DeFi ecosystem by using a few simple mathematical equations, a product similar to the structured products of the financial field. He splits the underlying asset stETH into a certain number of stablecoin-like products fETH and high-volatility, high-yield leveraged products xETH.

These two types of native assets based on Ethereum correspond to two types of demand that exist in the market at the same time: hedging demand and leverage demand.

1. Leverage Demand Scenario

Assuming the market is at the end of a bear market and the beginning of a bull market, this means that underlying assets like Ethereum will have a relatively certain increase in the coming years. For hodlers, all they need is patience, just wait. But for leveraged players, if I believe the market will have this certainty, why not take a bigger risk, add a little leverage, and bet on the future?

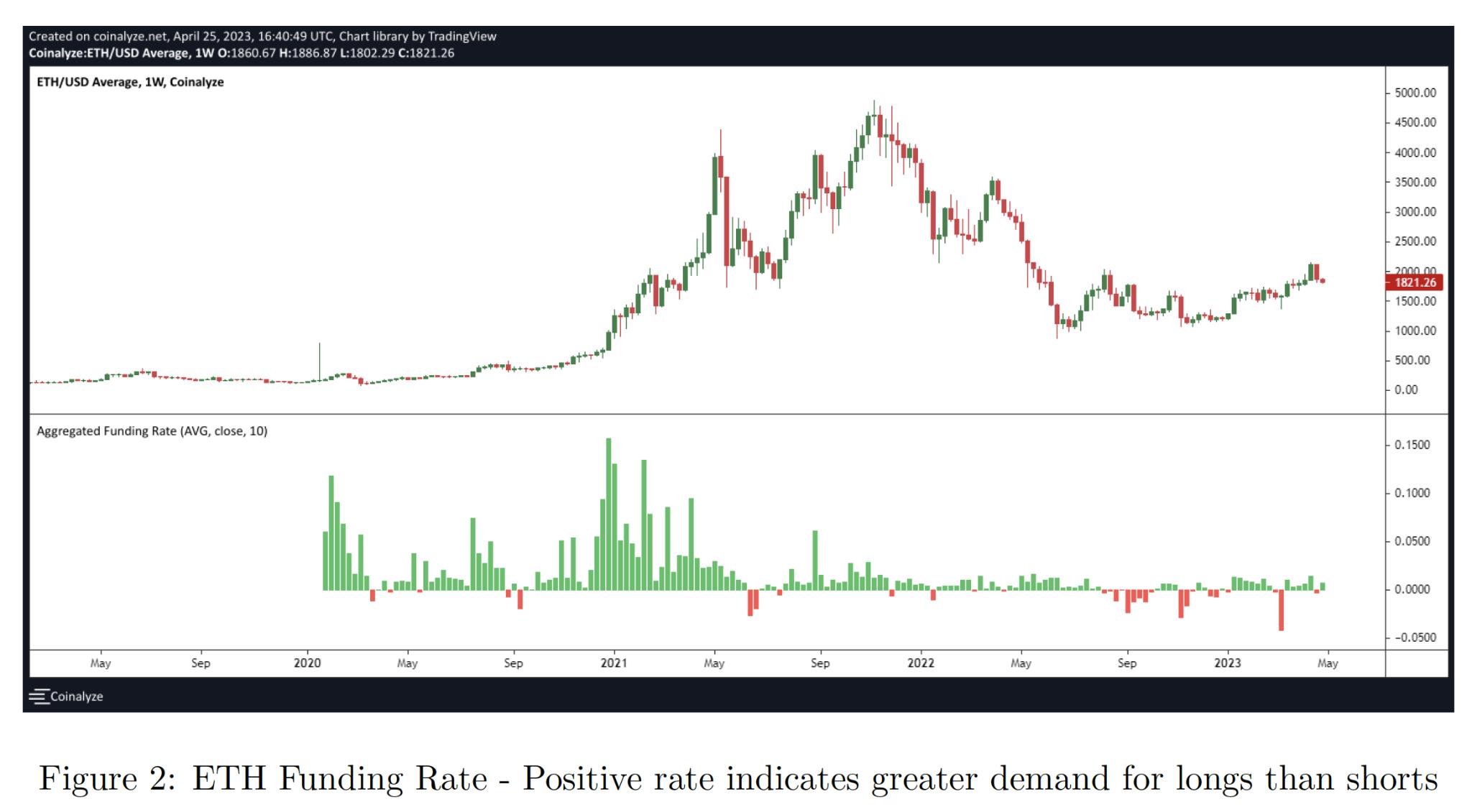

But we all know that during a major bull market, there are often short, brutal downturns. The hurdle that leveraged players cannot overcome is that you may not be able to survive the darkness before dawn, and you may not see the sun of the next day. Moreover, perpetual contract funding rates on centralized exchanges mostly charge long positions, and whether your earnings can withstand the funding rate is also an unknown.

But if there is a product now that allows you to hold leverage while also avoiding the risk of liquidation that could come at any time, and the most amazing thing is that the funding rate is zero or even negative, with very low holding costs, then wouldn't many hodlers also want to add a little leverage to increase their earnings?

2. Hedging Demand Scenario

On the other hand, if it happens to be in the midst of a major bull market, with the price of the coin soaring, at this time you have a clear need for hedging, but you are unwilling to switch to stablecoins and completely lose the potential for future growth. Besides, which stablecoin hasn't had its FUD moments? At this time, what you need is fETH, a native asset based on Ethereum and without external risks of RWA ("Real World Assets") to reduce the overall volatility of your assets.

https://mirror.xyz/darkforest.eth/7O4rGUDHCMwA45m33zUYYwnjw3jl1rps8mgxRCcgZbY

Assuming the price of Ethereum plummets by 90% after you mint fETH (just thinking about it is terrifying), but the fETH you hold only causes you to lose 9%, you have just managed to evade a super bear market, and this operation can be called a "perfect top escape strategy" under the premise of "not giving up the last penny."

Thinking about this, I am a little tempted, after all, for cryptocurrencies, the security level of native assets is much higher compared to various mining LP-packaged assets. But for someone like me who has experienced countless setbacks, there is no protocol that only has benefits and no costs. I need to have a complete understanding of the risks of this protocol in order to make decisions with real money.

Three Key Questions about the f(x) Protocol

How does the f(x) protocol achieve the volatility grading of assets, how will the stability of the system perform in extreme market conditions, and where is the boundary at which the system collapses?

1. Volatility Grading Principle

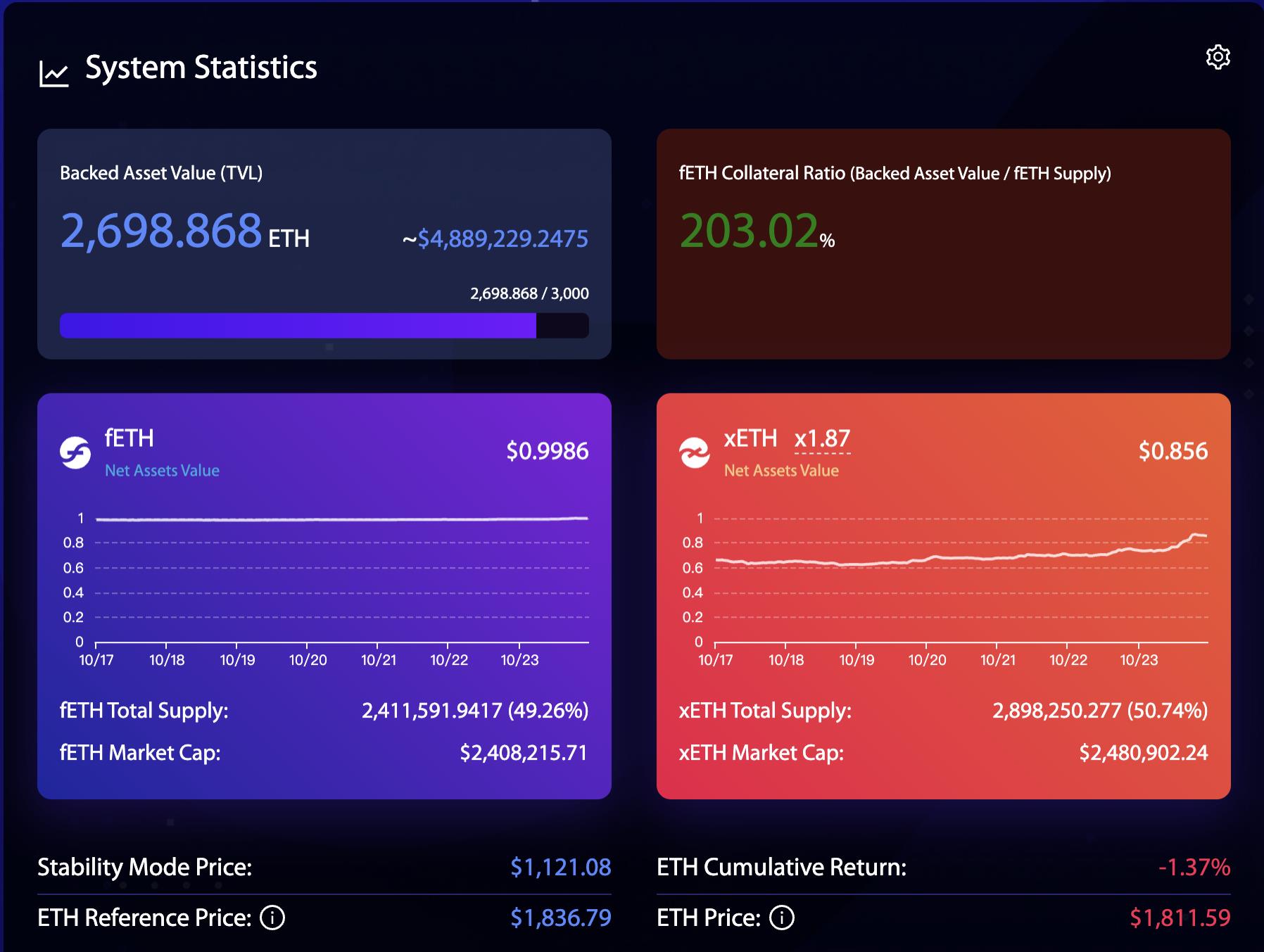

Understanding the f(x) protocol is important to comprehend the following dashboard. The underlying asset ETH is staked through Lido to become stETH, which is then split into a certain number of stablecoin-like assets fETH and leveraged assets xETH. fETH only has 10% of the volatility of the underlying asset, while xETH bears all the remaining volatility.

The essence of the protocol lies in the simple formula below:

We can see that the underlying asset of the protocol is 2698.868 ETH, with a TVL of $4,889,229. This TVL is equal to the sum of the NAV (Net Asset Value) of the two decomposed assets, namely fETH market cap + xETH market cap. The price volatility of fETH is pegged to 10% of the Ethereum price volatility, meaning the price pf of fETH is fixed, and the quantities nf and nx are constant, allowing us to calculate the price px of xETH.

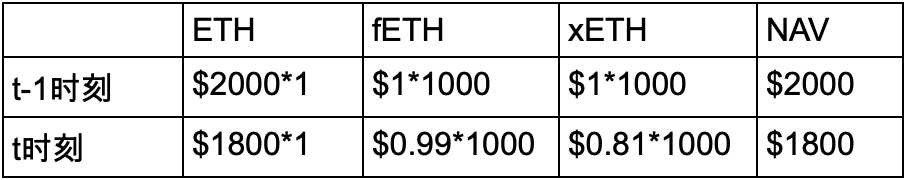

Let's use an example to illustrate more clearly:

Initially, a user mints 1000 fETH and 1000 xETH with 1 ETH worth $2000. The next day, Ethereum drops by 10% to a price of $1800. According to the protocol, the volatility of fETH can only drop by 1%, so the price of fETH becomes 0.99. Using formula 1, we can calculate that the price of xETH becomes 0.81. What is the volatility of xETH? It is (1-0.81)*100% = 19%, corresponding to a leverage ratio of 1.9x.

From the corresponding volatility curves of different assets on the dashboard, we can see that the volatility of fETH is very small, while the volatility of xETH is greater than that of ETH itself. The project could make the UI more intuitive in this regard.

2. How is System Stability Ensured

The first law of stability for f(x): The volatility of the price of stablecoin-like fETH is always accurately stable at 10% of the volatility of ETH.

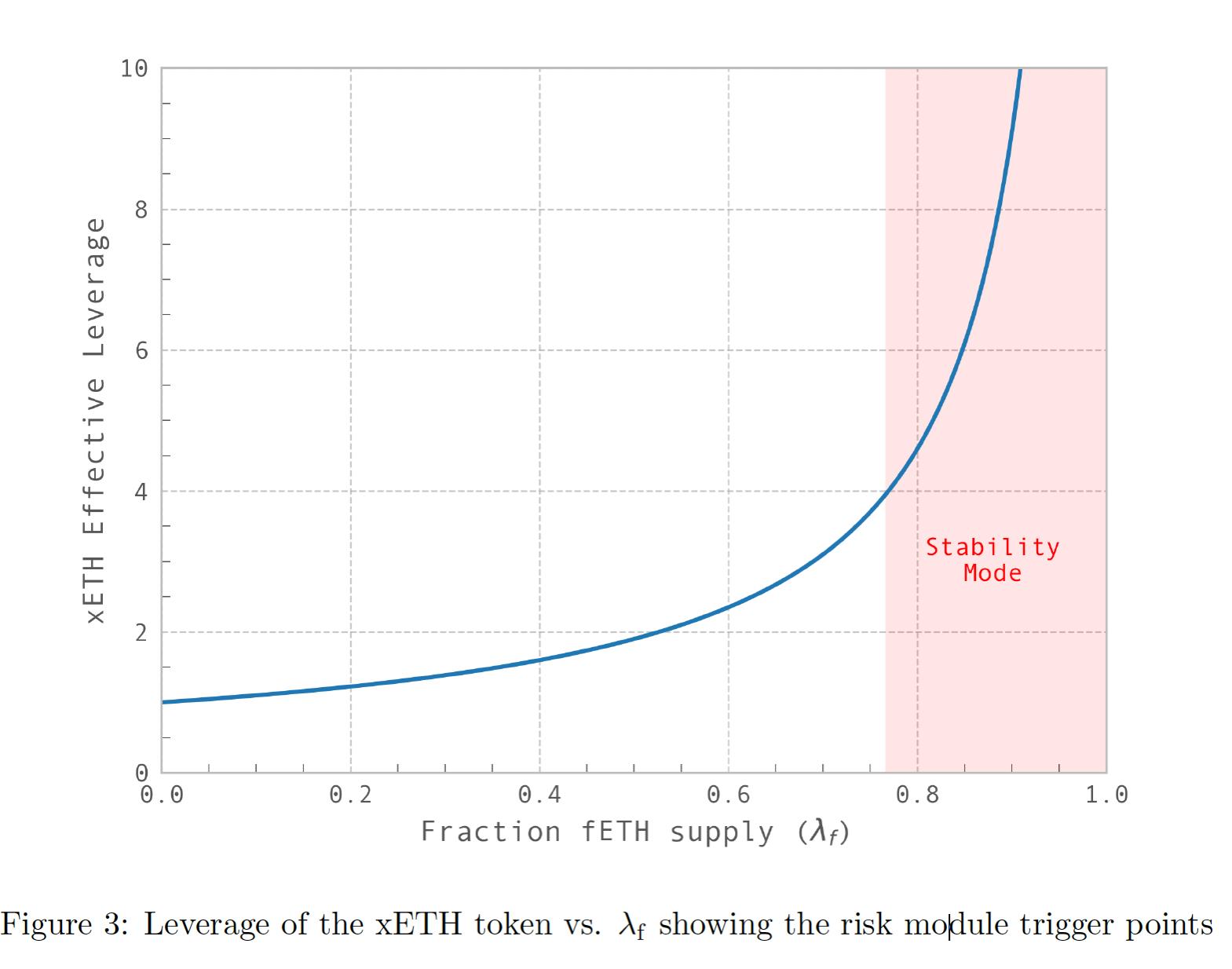

First corollary: To satisfy the first law, there must be enough leveraged asset xETH to absorb the overflow of underlying asset volatility beyond stablecoin-like fETH. If the quantity of xETH is relatively small, then the leverage ratio of xETH needs to be increased to absorb volatility (see the red part on the right side of the image below). If the quantity of xETH is large, then the leverage is reduced (see the left side of the image below), and low leverage can dilute volatility.

These simple principles form the basic conditions of the f(x) protocol. However, this curve is not a financial system that will spontaneously return to stability. We need to pay special attention to the extreme situations on both sides of the curve.

(1) Left end of the curve: There is an excessive amount of leveraged asset xETH relative to stablecoin-like fETH. This situation is likely to be more common in a bull market, where more people are willing to buy leveraged products rather than holding stablecoins. The extreme situation is when the leverage ratio of xETH drops significantly close to 1, which is no different from holding the native asset Ethereum. However, even in this case, there is no harm to the entire protocol, as the system will automatically return to the middle of the curve.

In the f(x) whitepaper, it is mentioned that although the demand for fETH determines the supply of fETH, in order to meet the demand at any time, the quantity of fETH that can be minted at the lowest cost is usually much higher, and this quantity is only limited by the supply of xETH. Here, the protocol can have a space for operations similar to the AMO (Algorithmic Market Operations) in the frax protocol. For example, if xETH grows too much, causing the leverage ratio to be too low and reducing attractiveness to the market, the f(x) protocol can proactively increase the issuance of fETH to maintain the leverage ratio at, for example, above 1.5x, while also being able to address the future decrease in demand for xETH and then destroy the additional fETH issued to minimize the surge in leverage ratio. (2) Right side of the curve: There is an insufficient amount of leveraged asset xETH relative to stablecoin-like fETH. This is a situation that the system needs to guard against, as it usually occurs in extremely pessimistic market conditions, with continuous price declines and few people willing to take the risk of leveraged long positions. In this case, the curve shows a steep surge in the leverage ratio of xETH, leading to a deadly negative death spiral, with fewer people willing to take leveraged long positions, higher leverage ratios, and even less willingness to take leverage... In the face of this situation, the free market is unable to spontaneously solve this problem, but fortunately, the f(x) protocol uses some methods to prevent such tragedies from occurring. 3. f(x) Protocol Risk Boundary The f(x) protocol introduces a concept from the CDP lending protocol - the Collateral Ratio (CR). From the protocol's perspective, the underlying assets collateralized in the protocol are the collateral, and the stablecoin fETH minted is the borrowed asset. The protocol must ensure that the value of the borrowed stablecoin does not exceed the value of the collateral, i.e., CR > 100%. Otherwise, bad debts will occur. The value of xETH is not considered here because in extreme situations, xETH is possible to go to zero, but even so, the protocol must ensure normal operation and avoid bad debts. The f(x) protocol uses data on the daily changes in the price of Ethereum since January 1, 2017 for calculation. In the case where the probability of risk occurrence is less than 0.1%, which is equivalent to a 25% drop in Ethereum's price within a day, a CR of 130% can completely withstand this level of disaster. Therefore, the protocol sets 130% CR as a safety threshold. Below this threshold, the stability mode is automatically activated. In the stability mode, the protocol takes the following measures: (1) Control of protocol entry and exit The f(x) protocol controls the minting and redemption fees of fETH and xETH, and can even stop the minting of fETH, with the aim of increasing the value of xETH relative to fETH and enhancing the protocol's ability to absorb underlying asset volatility. (2) Internal asset rebalancing - Rebalancing Pool Similar to the stability pool of the Liquity project, the protocol encourages fETH holders to deposit their coins in the protocol's pool to earn a certain staking income, and the protocol has the right to use this portion of assets to redeem fETH for reserve assets, i.e., stETH, when the CR falls below the safety threshold. fETH holders with hedging needs can increase their income while significantly reducing their own volatility through the Rebalancing Pool, and the protocol, through incentive guidance, temporarily includes fETH in its protocol liquidity (the latest change from a lockup of two weeks to a lockup of one day), effectively adjusting the protocol's CR to operate far from risk. Of course, if the assets in the Rebalancing Pool are depleted and there is a continuous risk of CR decline, the f(x) project will use protocol revenue to incentivize xETH minters. Unlike Liquity, the income received by Rebalancing Pool liquidity providers comes from outside the protocol, i.e., from the Ethereum staking income of the Lido protocol, while Liquity uses its own token emissions as incentives, leading to long-term selling pressure on the $LQTY token. However, this is also the cost that it must pay for using the purest native token ETH.In my opinion, the f(x) protocol can also learn from Liquity's approach. After the CR falls below 130%, the redemption process of fETH should receive a certain reward similar to liquidation proceeds, encouraging more fETH to enter the Rebalancing Pool. This is different from the situation with the stablecoin LUSD. The most important function of stablecoins is circulation, while fETH plays an important role in hedging when held, and fundamentally does not require a large circulation in the market. (3) Protocol Treasury Income Subsidizes xETH Minters If using the Rebalancing Pool is a way to increase CR by shrinking the protocol's TVL scale, subsidizing xETH minters is a more positive way to expand TVL to increase CR. The specific subsidy intensity and actual effects still need to be tested in practice. User Decisions in Extreme Market Conditions Risk-Averse Users For holders of stablecoin-like fETH, if they deposit their fETH into the Rebalancing Pool, they need to pay attention to whether the CR will drop below 130%. If this trend appears, they should withdraw from the pool in a timely manner. The latest modification of the lock-up period is only one day, which is very user-friendly. However, for the protocol, a large-scale withdrawal of liquidity will inevitably have a serious impact on the security of the protocol. For users seeking stability, it is safest to keep fETH in hand to avoid possible forced redemptions. But if the protocol reaches the extreme boundary of CR = 100%, the volatility of fETH will be equivalent to the volatility of ETH, which is not difficult to bear, as the epic-level plunge at this point is probably close to the end, and the asset has already survived the largest stage of decline. Leverage Players For leverage players, if the leverage ratio is very low, it means losing the fun, but it's not a big problem. The real concern is if the CR drops below 130%, leading to a surge in the leverage ratio. This will inevitably accompany a sharp market decline, with losses accumulating rapidly, and redemption will incur an 8% fee. When CR approaches 100%, it will be the day when xETH goes to zero. However, in the case of a sharp market decline, holders of stablecoin-like assets and leverage asset holders or minters are not static in their decisions. There is a game balance between them. When CR is close to 100%, holding fETH becomes meaningless and adds an additional layer of contract risk. Naturally, some users will choose to redeem the underlying asset ETH and hold ETH at a low level. At this time, the leverage ratio of xETH will surge to 20 times, or even 100 times. The risk-reward ratio has completely shifted in favor of the leverage players, and a small investment may yield a return of 100 times. Will no one take the risk? I don't believe it. This will definitely lead to a gradual increase in CR, bringing the system back to stability. So, CR will not truly reach 100%, because leverage cannot go to infinity, and 100% CR is a mathematical limit concept. From this perspective, the system has the inherent ability to return to stability. Of course, this is purely theoretical analysis, and the actual market trends and the operation of the protocol under pressure may not necessarily be as I have described. Another external risk of the protocol that cannot be ignored is if Lido encounters problems or other reasons lead to the decoupling of stETH. If the price difference between stETH and ETH exceeds 1%, the protocol temporarily stops minting. Redemption remains normal, but the redemption of fETH uses the higher of the two prices (stETH, ETH), and the redemption of xETH uses the lower price. This also protects the interests of holders of stablecoin-like fETH.Conclusion

After all the analysis above, the official promotion of "xETH is the first ever levered ETH you can HODL" is actually not an exaggeration. Currently, the Ethereum price in stable mode is $1078, and the protocol's CR is 207%, indicating a relatively high level of security margin.

In my opinion, the greatest significance of the f(x) protocol lies in providing a decentralized financial tool for users with different risk preferences, allowing users to completely avoid centralized exchanges, eliminate real-world asset risks, and rely entirely on native cryptocurrency assets to fully implement their strategies. This truly enables users to become the masters of their own assets, which is in line with the spirit of Satoshi Nakamoto and represents the greatest significance of the emergence and existence of DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。