Original | Odaily Planet Daily

Author | Loopy

On October 24th, Bitcoin surged past $35,000 overnight, reaching its highest level since May 2022.

Although we cannot be certain from a historical perspective whether the bull market has arrived, it is evident that the market's temperature and enthusiasm are rising.

Accompanying this is the pursuit of high-quality innovative assets. Compared to the steady and slow iteration of Bitcoin, small-cap coins in new tracks and innovative fields are more likely to attract investors during a bull market.

How to capture more high-quality assets has become the most concerning topic for investors.

For ordinary investors, selecting from a large number of assets in a complex market increases the probability of making the wrong choice. Choosing a CEX platform with screening capabilities as an investment channel is a more prudent choice.

Top-level CEX data interpretation, "Bull Start" or major rebound?

The current crypto market is at a very critical historical moment. The market is eagerly anticipating the approval of a Bitcoin spot ETF, and sentiment is gradually warming up, presenting a thriving bull market scene. In the past 3 days, Bitcoin has continued to rise, with an increase of 16.73%, and trading activity is quite active.

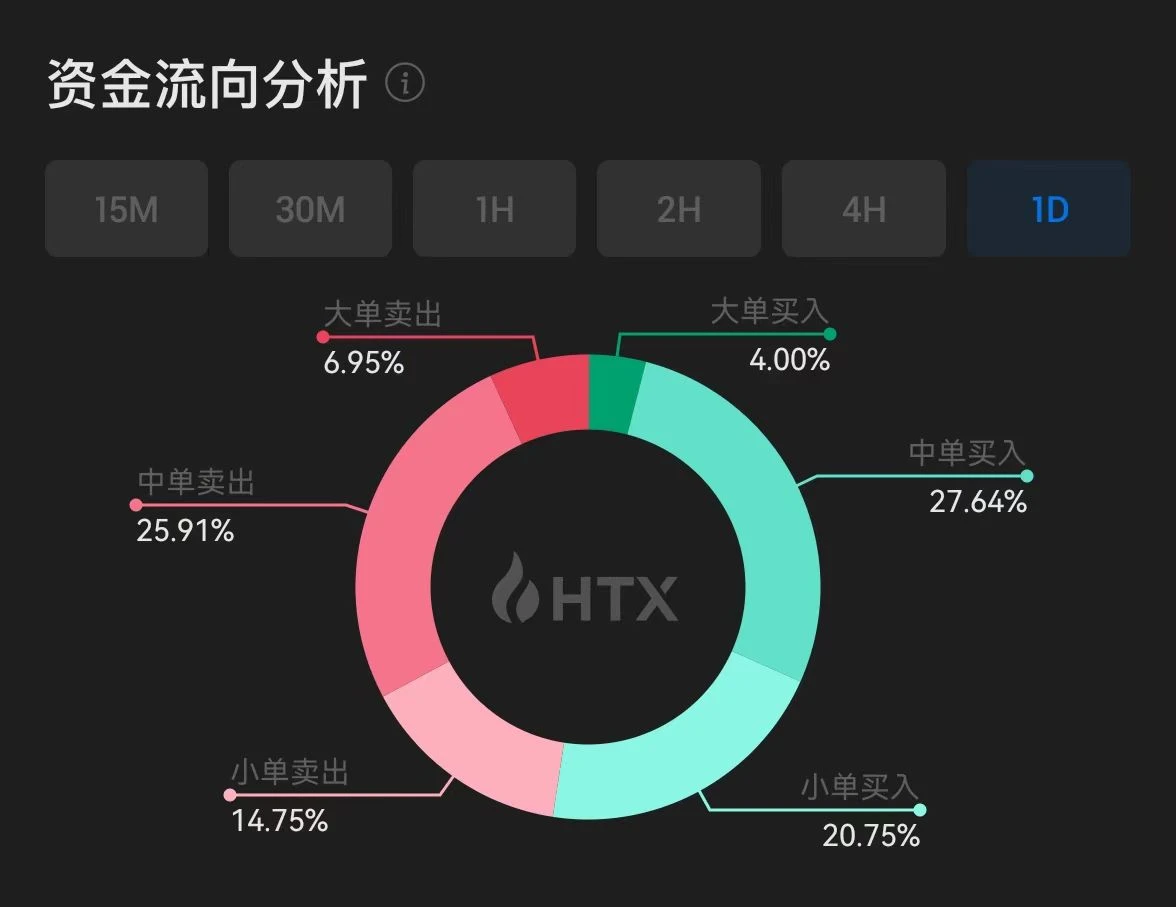

Screenshot from Huobi HTX data on October 26th at 16:00

If you want to better sense the market temperature, CEX is naturally the front line of trading. Taking the recently rebranded Huobi HTX as an example, as a veteran exchange, Huobi HTX's various data is showing an overall warming trend.

As of October 10, 2023, Huobi HTX's annual registered user count has exceeded 4 million. The platform has 220,000 monthly active users, and user stickiness remains relatively stable. It is worth noting that Huobi HTX's average daily trading volume has remained stable with an overall increase—since the beginning of the year, the average daily trading volume per person has increased by 63%. These data indicate that Huobi HTX has made significant progress in market share, user attraction, and user activity.

Observing the data of mainstream coins, it is also evident that the market is continuously warming up. Taking the past week (October 14th to 21st) as an example, the BTC weekly trading volume on the Huobi HTX platform has reached 353% of the last week of 2022, and this data is based on coin-based trading volume, which is even higher when priced in USD.

It is easy to see from the data on the front line of trading that the current market is in a warming trend. And as the rebranding of the brand is completed, Huobi HTX is also rising continuously.

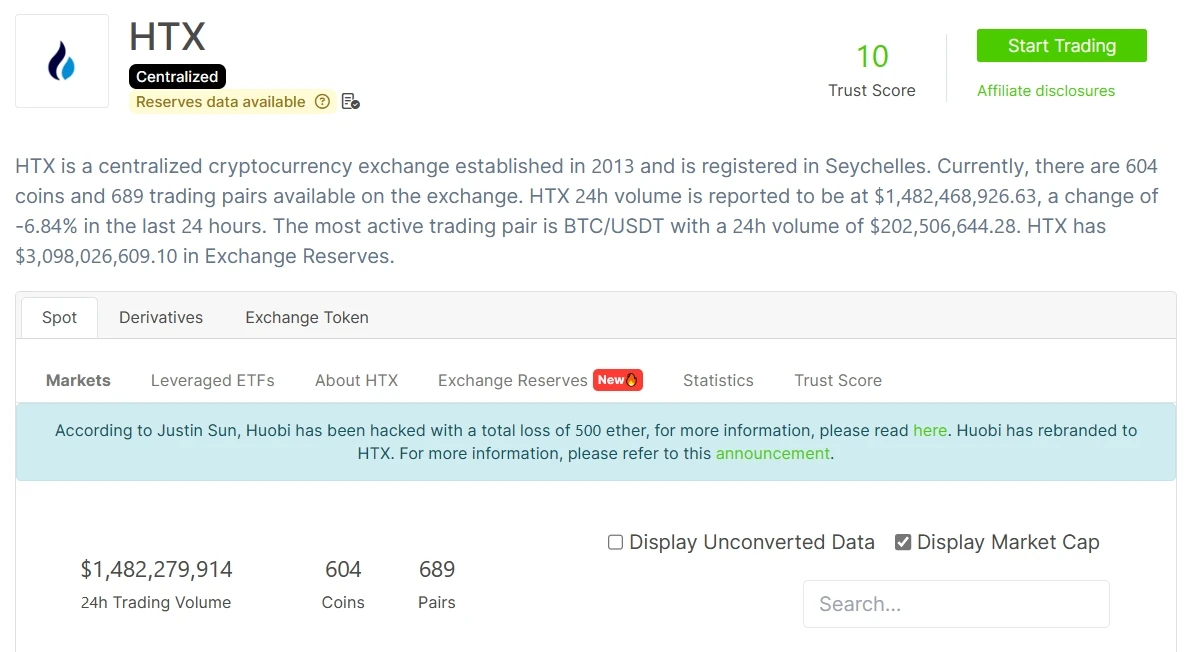

According to Coingecko data, the 24-hour trading volume of Huobi HTX is $1,482,279,914. As a veteran trading platform, Huobi HTX's comprehensive strength is still strong, and the data of top-level exchanges also to a certain extent represent the current market's judgment on the direction.

In this fiercely competitive and significantly cyclical industry, any trading platform that can traverse bull and bear markets has its advantages. From the old era of Huobi to the new era of Huobi HTX, how will Huobi HTX open a new chapter in global expansion and bring more surprises to the market?

With the bull market approaching, how does Huobi HTX capture high-quality assets?

Although we do not know when the bull market will arrive, new tracks and hotspots are constantly emerging. How should investors capture more market opportunities? Huobi HTX's exploration provides an example for the market.

In mid-July 2022, the market environment at that time was quite similar to the present. BTC had just broken through $30,000, market sentiment was high, and investors were quickly scouring the market for innovations.

The Telegram BOT sector quickly gained popularity in this special opportunity and became the focus of the crypto market. (Note: Odaily Planet Daily also noticed the surge of this popular sector and published multiple articles for analysis and reporting.)

Perhaps due to the rapid and intense rise, not only retail investors but also most industry practitioners were caught off guard by the rapid surge of this sector. With keen market insight, Huobi HTX was the first to complete the listing of the leading project in the BOT sector, UNIBOT, taking the lead among various CEX platforms.

On July 20th, Huobi HTX exclusively listed the leading project in the BOT sector, UNIBOT. UNIBOT is a project that provides fast and easy-to-use trading tools and real-time monitoring through a Telegram bot, allowing users to trade and manage cryptocurrencies within the Telegram application.

After UNIBOT was listed, it experienced a significant surge in a very short time, with a maximum increase of 1500%; UNIBOT's subsequent market performance has remained stable without a "plunge," and its current increase still exceeds 300%. This project was also a rare high-quality asset under the market background at that time, demonstrating Huobi HTX's unique vision.

Screenshot from Huobi HTX official website data on October 26th at 16:00

In addition, a horizontal comparison reveals that other CEX platforms significantly lagged behind Huobi HTX in listing: on July 20th, Huobi HTX listed UNIBOT; on July 21st, Gate.io listed UNIBOT; on July 30th, MEXC listed UNIBOT.

For the leading project, every minute, there would be a huge difference in price. Huobi HTX was able to list UNIBOT immediately at the first moment, which not only required the support of an agile technical team but more importantly, the ability to judge the market.

After experiencing multiple rounds of bull and bear markets, Huobi HTX undoubtedly has excellent asset discovery capabilities.

For ordinary investors, separating redundant information from the complex market and selecting from a large number of assets is a complex and tedious task. The preliminary screening conducted by CEX platforms can help investors filter out some significantly risky inferior projects to a certain extent.

More innovations are still happening, and Huobi HTX will be a industry builder

Currently, besides the BOT sector, what other potential sectors are worth our attention? Data from Huobi HTX also to a certain extent reflects the current market's temperature.

Layer1 has always been a concentrated area of innovation in the crypto industry. Historically, although the crypto market has had many Layer1s, each new bull market will have its new rise. Although we cannot predict which Layer1 will become the new king when the bull market arrives, some excellent projects have already emerged in the bear market.

Taking Sei as an example, it is a Layer 1 blockchain developed based on the Cosmos SDK, with its core being a trading infrastructure based on the central limit order book (CLOB). Sei can not only integrate with dApps on its own chain but also leverage the liquidity of the entire Cosmos ecosystem and create a trading market for its assets on Sei.

This innovative mechanism makes Sei a unique Layer1, and Huobi HTX also discovered the advantages of this project at the first moment.

As the first asset launched on Huobi HTX, SEI reached a high of 0.27 USDT the day after its launch, a 2600% increase from the initial price of 0.01 USDT, and is currently maintaining at 0.11 USDT. Although we do not know if Sei will complete the next bull market cycle, based on its current performance alone, it is undoubtedly an important member of the list of high-quality assets, once again proving Huobi HTX's ability to capture key assets in potential sectors.

In more innovative fields, Huobi HTX still has a keen sense. For example, the WorldCoin project, which has attracted attention due to its grand vision and renowned founder, also had its token WLD launched on Huobi HTX, with a maximum increase of 256%.

Another hot sector this year is LSD (Liquidity Staking Derivatives), and the standout performer in this sector is the DeFi yield protocol Pendle, whose token also achieved a 350% increase as a first-time asset on Huobi HTX.

Looking back at the high-quality assets listed by Huobi HTX in the past, we can also see its unique insight in asset discovery. Huobi HTX's asset listings will enter a new stage, selecting globally popular assets with traffic, heat, and topics, as well as deepening cooperation with mainstream ecosystems.

Conclusion: Huobi HTX will play an important role in the next bull market

At the recent Token2049 conference, Sun Yuchen, a member of the Huobi HTX Global Advisory Committee, announced the official upgrade of the Huobi International brand to HTX.

As we stand at the present moment and look back at history, we can easily see this wonderful coincidence. The timing of this conference coincides with the transition of market sentiment. It may herald the beginning of the bull market for us.

The announcement of the rebranding of Huobi HTX at this time carries the vision of Huobi HTX playing a more important role in the next bull market. The renaming of Huobi HTX represents a transformation towards globalization. Huobi HTX will embark on a new mission to "build a metaverse financial free port" and open up a strategic layout of "global expansion, ecological prosperity, wealth effect, and security and compliance" under the vision of "enabling 8 billion people worldwide to achieve financial freedom." These changes will ensure that Huobi HTX continues to occupy a dominant position in the new market landscape.

At the same time, on October 25th, Huobi HTX was awarded the first prize for "Cryptocurrency Exchange of the Year" at the top crypto summit Blockchain Life 2023, and Sun Yuchen, a member of the Huobi HTX Global Advisory Committee and the founder of TRON, won the honor of "Cryptocurrency Person of the Year." Since completing the brand upgrade in September this year, Huobi HTX has once again appeared at an international crypto event and received important industry awards, highlighting its increasingly solid competitive position in the global crypto market and its commitment to driving the development and application of crypto globally.

For users, a more diverse range of services also gives investors more choices. Huobi HTX closely follows the dynamics of the crypto market, focusing on expanding scale and maximizing profits, and building a diversified business structure, including PrimeVote, large-scale current financial management, and Shark Fin, among others.

Through outstanding asset discovery capabilities, market insights, and continuous innovation, Huobi HTX may be able to achieve its ambitious goals and further expand its market share in the globalization process in the upcoming next bull market, as it strives to return to the market peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。