Author: ChainUp

The track of cryptocurrency wallets is becoming increasingly lively.

The rapid development of Web3 has given rise to new demands for infrastructure and also brought some hidden dangers, especially the entrance of blockchain wallets, which have long been plagued by hacker attacks and the loss of private keys. People are in great need of a more secure and user-friendly decentralized wallet. Driven by demand, many encryption companies have entered the market, striving to create encryption wallet products that are more in line with development trends and can be widely adopted, thus beginning the era of Wallet 2.0.

Counting numerous innovations, MPC wallets and smart contract wallets are the most noteworthy new generation wallets, both of which focus on solving the problem of private key management.

Due to its advantages in compatibility, privacy, and usage cost, MPC wallets, as an off-chain solution, are easier to land in the short term, making them a popular option in the wallet track competition. Not only have MPC wallet products for toC, such as UniPass and ZenGo, emerged, but more and more industry veterans like ChainUp Custody have also applied it to digital currency custody services.

Why is the MPC wallet so highly anticipated? What are its advantages compared to traditional wallets? Who are the players in this track, and what are their characteristics? In the following text, we will combine the concept and landing products of the MPC wallet, attempting to restore the changes from Wallet 1.0 to 2.0, and see how the new generation of wallets will contribute to industry development.

I. Decentralized MPC Wallet

1. What is an MPC Wallet?

MPC, or "multi-party computation," is a cryptographic technology that originated in 1982. It refers to the collaborative completion of computing goals by multiple participants in the absence of a trusted third party, with each participant only knowing their own computing results and unable to obtain any information from other participants.

The combination of MPC technology and digital currency wallets can achieve the goal of "de-memorization/private key elimination."

When creating an MPC wallet, it does not generate a complete private key, but rather shatters the private key and distributes it to decentralized holders or platforms (each holder only has a fragment of the private key and does not know the parts held by others). When a transaction requires a private key signature, the fragments are reassembled for signing. This distributed private key approach alleviates people's concerns about private key custody. Even if a user's private key is stolen, hackers cannot control the assets in the wallet.

2. Advantages of MPC Wallet

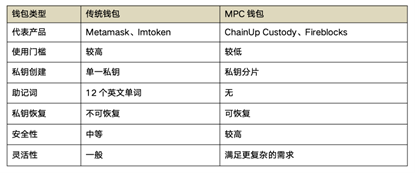

(MPC Wallet vs. Traditional Encryption Wallet)

With the development of cryptocurrency, the wallet track has been evolving. Compared to first-generation traditional cryptocurrency wallets like Metamask, second-generation wallets like MPC wallets exhibit the following advantages:

First, de-memorization: MPC wallets have lower usage thresholds.

Traditionally, conventional encryption wallets have high cognitive requirements for users. Users not only need to understand the meanings and uses of mnemonic phrases and private keys, but also spend a lot of time and effort learning how to safeguard private keys.

Imagine in the future, a first-time Internet user entering the Web3 field. They do not need to understand what a private key is or record mnemonic phrases on paper, worrying all day about whether it is stored carefully. Instead, they can create and use a digital currency wallet smoothly by using email, Face ID, or fingerprint, seamlessly navigating the world of Web3.

MPC is turning this scenario into reality, turning "roadblocks" like private keys and mnemonic phrases into things of the past. People can seamlessly connect to Web3 using familiar Internet interaction methods, greatly reducing the usage threshold. This is also why MPC wallets are gradually becoming popular.

Second, eliminating single points of failure: MPC wallets are more secure.

As is well known, traditional encryption wallets use a single private key. Once it is stolen or lost, the assets in the wallet disappear. Due to its unique creation form, the MPC solution directly eliminates the single point of failure problem in traditional wallets.

MPC wallets have private key recovery capabilities. When a user's private key is lost, an MPC wallet can often directly recover or replace the private key fragments, allowing users to maintain the security of their wallet without abandoning the original wallet. If a user's private key is stolen or the wallet is subjected to phishing attacks, hackers cannot directly transfer assets. They need to control other private key fragments at the same time to transfer the assets. At this point, the user can update the private key fragments, rendering the old private key immediately invalid.

MPC technology significantly increases the difficulty of wallet theft, greatly enhancing the security of wallets. People no longer have to worry about losing mnemonic phrases or private keys, nor do they have to bear the nightmare of losing assets immediately upon the loss of a private key during interaction and operation. Additionally, for enterprise users, since the complete private key does not exist on any device, it not only avoids the risk of theft but also eliminates the internal employee abuse and theft of digital currency. As a result, not only individual retail investors but also more and more enterprise-level users are transitioning from traditional wallets to MPC wallets.

Third, meeting complex requirements: MPC wallets solve the problem of self-custody of assets.

As insiders often say, "Not your keys, not your crypto." After the FTX incident, exchanges are no longer the primary choice for asset management. People have realized that encryption wallets are the best solution for managing digital currency.

The subsequent problem is that although users have control over their assets, there is a high demand for personal private key management capabilities. Traditional encryption wallets often face risks such as private key theft, social engineering intrusion, and phishing attacks when interacting with the physical world. While hardware wallets can alleviate security issues to some extent during the asset self-custody process, their complex usage makes it difficult to meet high-frequency usage scenarios.

The emergence of MPC wallets perfectly solves the problem of self-custody. It not only ensures that users hold their private keys but also eliminates private key management issues (storage, backup, recovery), while enhancing the security of asset self-custody. Users can manage and use assets without being limited by time and location. Additionally, due to features such as adjustable signature schemes and no need to change account addresses, MPC wallets are better suited to meet the diverse and complex asset management needs of enterprise-level users.

Due to these undeniable advantages, MPC wallet solutions are now commonly used by digital currency funds, family offices, exchanges, custody service providers, and various DAOs. It is believed that this solution will also become more widely popular among ordinary users in the near future.

Next, we will select several representative players in this track, understand their respective characteristics, conduct multidimensional comparisons, analyze their similarities and differences, and provide valuable references for selecting digital currency wallets.

II. Popular MPC Wallet Comparison

1. Introduction

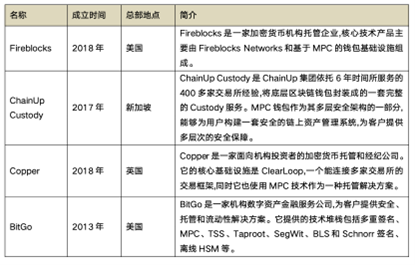

We have selected four well-known companies with high industry visibility and seniority, including Fireblocks, ChainUp Custody, Copper, and BitGo. These companies all provide digital currency custody services and have successively launched MPC wallet solutions in recent years. Below is a brief introduction about them:

2. Multidimensional Comparison

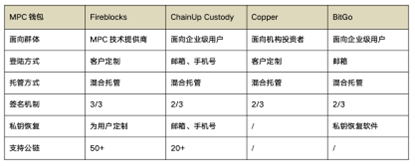

Although they are all MPC wallets, they have differences in product positioning in the market, login methods, custody mechanisms, private key recovery, and other dimensions. The following chart summarizes the similarities and differences of these products:

At the service group level, Fireblocks is an MPC technology provider, mainly providing customized MPC wallet services for dApp developers; ChainUp Custody and BitGo target enterprise-level users, such as exchanges, funds, mining pools, and Web3 enterprises; Copper mainly serves institutional investors, such as asset managers, private banks, and family businesses.

As the target user groups are different, the main operating platforms for these wallets also differ. Fireblocks' MPC wallet is mainly operated on the web, while ChainUp Custody and Copper provide mobile apps, allowing users to operate anytime, anywhere, making this mobile management method more convenient.

At the custody model level, there are two types: self-custody and hybrid custody, distinguished by the control of private keys. Currently, most MPC wallets use a hybrid custody model:

- Fireblocks: 3 private key fragments, with 1 held by the user and the other 2 backed up by Fireblocks to Microsoft and IBM cloud service providers.

- ChainUp Custody: 3 private key fragments, with 1 held by the user and the other 2 saved by ChainUp in HSM servers at Amazon and Microsoft cloud service providers.

- Copper: 3 private key fragments, with 1 held by the user, 1 held by Copper, and 1 stored with a trusted third party.

- BitGo: 3 private key fragments, with 1 held by the user, 1 held by the custodian (which can be the user or a key recovery service provider), and 1 held by BitGo.

At the signature mechanism level, Fireblocks uses a 3/3 signature mechanism, requiring each private key fragment to participate in the signature when a user triggers a request. ChainUp Custody, Copper, and BitGo use a 2/3 signature mechanism, where 2 out of the 3 private key holders sign the authorization, providing a more flexible approach.

In terms of disaster recovery mechanisms, i.e., private key recovery, each company has provided different solutions:

- Fireblocks: If an administrator changes devices, they need to contact the platform and undergo identity verification through a video conference to recover the private key fragments.

- ChainUp Custody: Private key fragments are strongly tied to the account. When a user changes devices, they can log in to the new device and import the mnemonic corresponding to the private key fragments to recover usage. Alternatively, the backup private key fragments stored in the cloud can be automatically downloaded to the new device (the recovered private key fragments are encrypted and require a password to unlock).

- Copper: No specific private key recovery solution is currently provided.

- BitGo: Users can recover assets using wallet recovery wizard software, but to use this software, they must have backup public keys, BitGo public keys, wallet passwords, and other information.

In terms of support for public chains and currencies, Fireblocks supports 50+ public chains, ChainUp Custody currently supports 23 public chains, and is continuously adding more public chain assets. The actual asset support situation for Copper and BitGo MPC wallets is unknown.

In summary, we can conclude that:

- In terms of product design, ChainUp Custody focuses more on convenience and user experience.

- In the signature mechanism, ChainUp Custody, Copper, and BitGo can better balance security and convenience.

- In terms of private key recovery, ChainUp Custody, Fireblocks, and BitGo all provide disaster recovery solutions, with Fireblocks having a more complex recovery process and ChainUp Custody having the most flexible recovery process.

- In terms of asset support, Fireblocks and ChainUp Custody can meet the asset needs of most mainstream public chains, enabling more efficient on-chain interactions in the wallet.

III. The Future of MPC Wallets

Compared to the successive developments in DeFi, NFTs, public chains, and GameFi, the innovation in the field of wallets seems unusually slow. The combination of "private key + mnemonic phrase" for wallet management has seen almost no new changes in the past decade.

On one hand, users outside the industry are often discouraged by complex terminology and concepts, delaying the widespread adoption of Web3. On the other hand, industry insiders have long suffered from private key risks. Reports show that private key leaks and losses are the leading causes of security incidents in the blockchain ecosystem, involving technically sophisticated project teams, exchanges, and market makers.

In the face of these problems, MPC wallets are an excellent solution, and more and more individuals and enterprises are choosing them as their first choice for asset self-custody and treasury collaboration management.

MPC wallets can eliminate single points of failure, balance flexibility and security, and, most importantly, weaken the concepts of private keys and mnemonic phrases. By creating wallets through commonly used Web2 account systems such as email and Face ID, they lower the entry threshold and make Web3 more accessible, thereby encouraging more retail and institutional participants to enter the digital currency market. Because of these advantages, many industry professionals have hailed MPC wallets as the "holy grail of usability and private key security."

Currently, the competition in the MPC wallet track is becoming increasingly fierce, with more and more exchanges, wallet service providers, and custody service providers joining in, refining products to adapt to different scenarios and meet different needs, collectively driving the development of the Wallet 2.0 era. It is hoped that when the market rebounds, these Web3 traffic gateways will also experience explosive growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。