Bitcoin Breaks $35,000, Forcing Liquidation of $418 Million Position

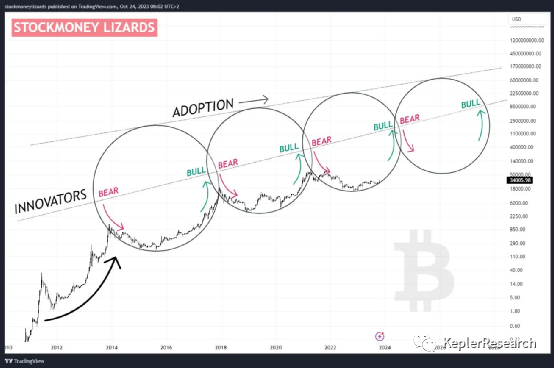

In the past 24 hours, it has reached an impressive high, exceeding $35,000. The current price is $34,408, up 13.3%, reaching a 17-month high.

Bitcoin prices are continuing to rise in the crypto market, and continue to pressure short positions to surrender. Although there is talk of the imminent approval of a Bitcoin spot ETF, in reality it is pressuring short liquidation. According to CoinGlass analysis, as many as 100,074 traders are facing liquidation, resulting in a liquidation value of $418 million. Binance witnessed the largest single liquidation amount of $10 million for BTC-USDT.

BlackRock's Bitcoin ETF Enters Final Stage!

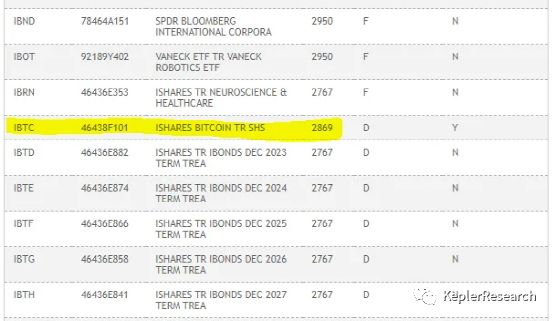

BlackRock has explicitly stated that they will provide funding for a Bitcoin spot ETF in October. They need to gather the necessary minimum liquidity, which is a prerequisite for launching the ETF. Their intention seems to be materializing. They need a specific amount before launching. The iShares spot Bitcoin ETF proposed by BlackRock is now listed on the DTCC (Depository Trust & Clearing Corporation), which strongly indicates that the U.S. Securities and Exchange Commission will have to give the nod soon.

In short, the iShares Bitcoin Trust Fund is being incorporated into the DTCC, with the stock code $IBTC. This is a crucial step in bringing the Bitcoin spot ETF to the market.

Yesterday, the U.S. Court of Appeals officially ruled that the SEC must review Grayscale's filing to convert the Bitcoin Trust Fund (GBTC) into an ETF. The sentiment surrounding the Bitcoin spot ETF continues to heat up, driving prices higher.

So, what's next? We must be patient and wait and see!

Overall, it can be seen that software management company MicroStrategy's holding of 158,000 bitcoins has generated approximately $746 million in unrealized profits. 79.72% of bitcoin wallets currently holding bitcoin are profitable. The recent rise in Bitcoin looks like a short squeeze, and volatility is set to erupt once again, with the ThorChain indicator looking very promising.

Note: All content represents the author's personal views and is not investment advice. It should not be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences.

For more content, follow: KeplerResearch on Twitter @kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。