Original Title: "A BTC ETF is a watershed moment"

Original Author: Cryptojoe

Original Translation: Odaily Planet Daily

A Bitcoin ETF is an important milestone because it can quickly meet the (traditional) market's expectations without a long waiting time. The Bitcoin ETF will attract interest from various investors, especially institutions such as family offices, private banks, and hedge funds, as it provides a compliant way to gain exposure to spot Bitcoin globally. If there is a demand of tens of billions of dollars in the market, this will have a significant impact on the price of Bitcoin. The institutions providing the ETF will also be incentivized to sell this product as much as possible. Overall, the Bitcoin ETF marks an important turning point with far-reaching implications for the entire market.

The following was posted by Cryptojoe on X (Twitter) and translated by Odaily Planet Daily.

Why a Bitcoin ETF is a watershed moment

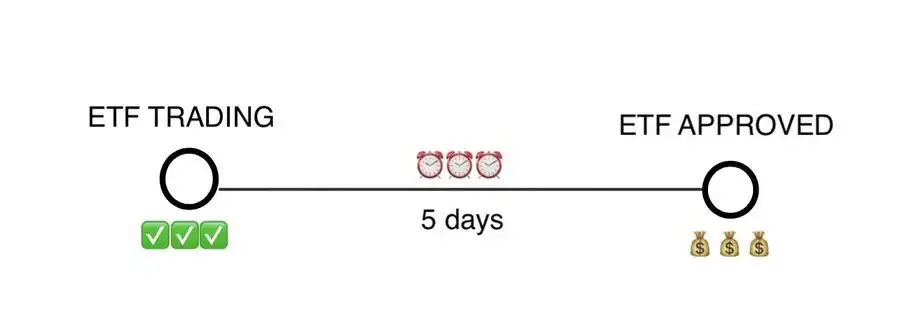

ETF approval -> ETF trading

Taking the example of the ETH futures ETF, you can see how quickly ETF instruments start trading.

In this case, it took only 5 days between approval and formal trading. Why?

Because there was not a long time between anticipated demand and actual demand. If the gap was several months, it would be more likely that the market was "selling the news."

The challenge of demand

But if no one buys the ETF, then all of this is irrelevant. So who will buy it? Why?

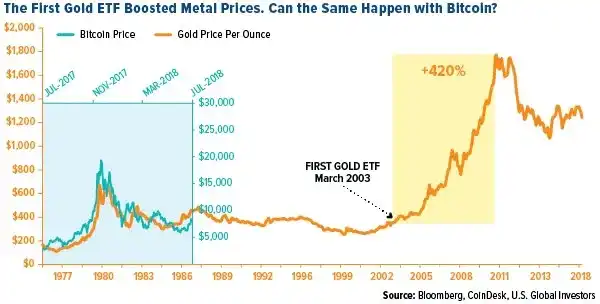

- Gold model

Historically, only two ETFs have reached a scale of $1 billion within the first 3 trading days:

Gold (2004)

Bitcoin futures (2021)

After the launch of the gold spot ETF in 2004, gold rose by 500% in the following 5 years. This data illustrates how important spot ETFs are.

- Why is a Bitcoin spot ETF a breakthrough?

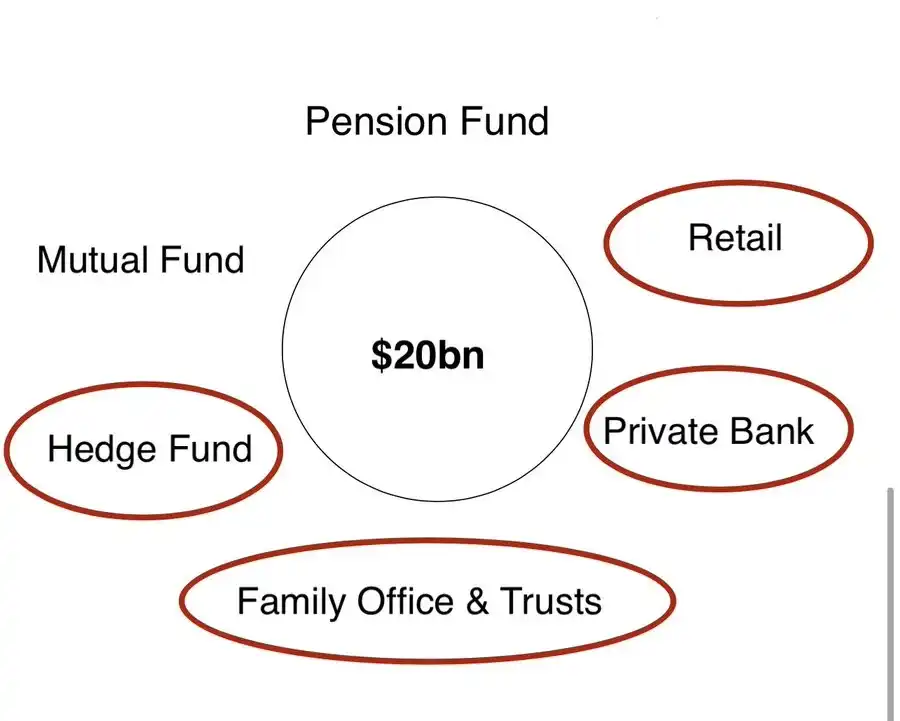

Because it provides meaningful exposure to spot Bitcoin in a compliant manner globally. From KYC to custody to regulation, there are significant barriers to entry that have prevented billions of dollars from entering. What types of investors are there?

For example, family offices, private banks, and hedge funds, their ideal product is a Bitcoin ETF.

I estimate that within the following investor circle, the market size may be between $10-20 billion.

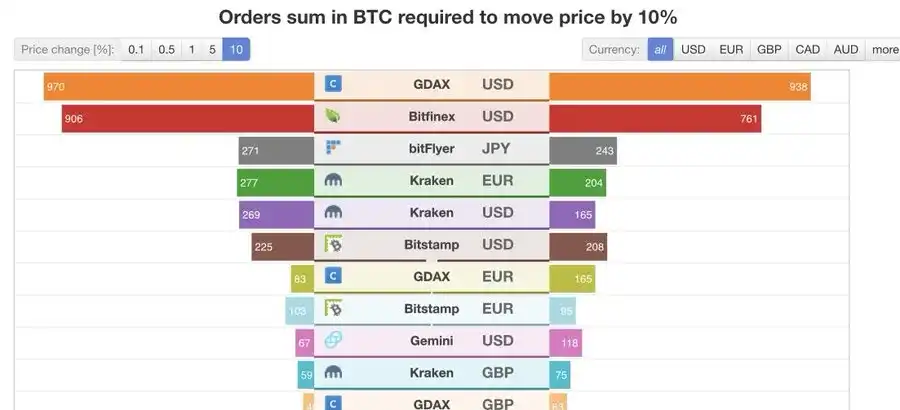

What would happen if there was a demand of $10 billion in the spot market? With the current trading depth, it would take approximately $1 billion to increase the spot Bitcoin market by 10%.

However, ETF inflows may take some time, influenced by the following factors:

Halving

Tightening credit -> Quantitative easing

Geopolitical uncertainty.

But from my personal perspective, I can clearly see the impact that ETFs may have on the price of Bitcoin.

Cost is king: Incentivizing institutions to sell ETH

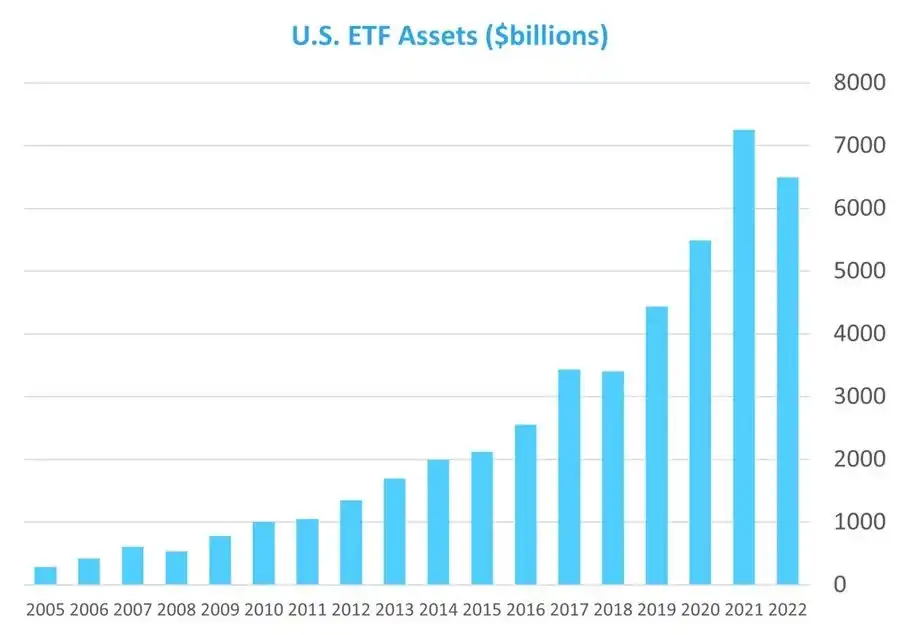

ETF providers are incentivized to sell the ETF as much as possible. In 2022, ETF fee income exceeded $100 billion, with an average fee rate of 0.37%. The total assets under management of ETFs are approximately $7 trillion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。