Writing: Will Wang, Master of International Business Law in the United States, with ten years of legal practice experience, a serial entrepreneur in the technology industry, and an investment and financing lawyer; Diane Cheung, Master of Accounting from the University of Sydney and MEM from Peking University, with ten years of experience as a FinTech product manager and a Web3 practitioner.

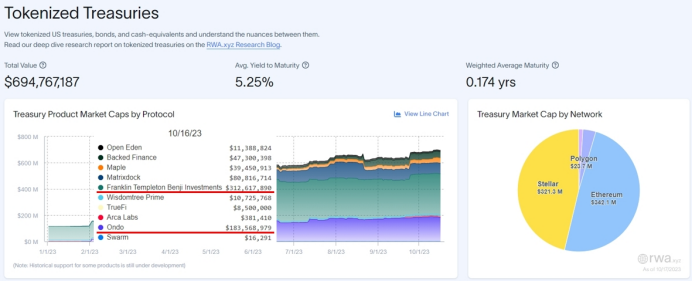

When we talk about RWA, we tend to focus more on underlying assets such as U.S. Treasury bonds, fixed income, securities, and others. Currently, apart from stablecoins, the largest RWA projects in terms of asset size are money market funds. The top three projects by asset size are: Franklin Templeton: $312 million (government bonds); followed by Centrifuge: $247 million (asset collateral); Ondo Finance: $183 million (government bonds).

Franklin Templeton is a completely tokenized fund, and Ondo Finance also has two tokenized funds, while Centrifuge, in its RWA project in collaboration with Aave, has also established tokenized funds. This illustrates the importance of tokenized funds in connecting TradFi and DeFi. We believe that funds, as an asset form, are the best vehicle for RWA assets due to (1) their regulation and (2) their relatively standardized digital representation.

Currently, when we discuss RWA, we are more focused on the one-sided value capture demand of Crypto (or DeFi) for the real world. However, from the perspective of traditional finance (TradFi), after funds are tokenized through blockchain and distributed ledger technology, they can unlock even greater value.

Therefore, this article will gradually analyze the value of fund tokenization and the active exploration and practice of market participants through observed cases in the current market.

I. Fund Tokenization

Tokenization usually refers to the digital representation of assets on the blockchain and the use of the advantages of distributed ledger technology for accounting and settlement. The assets that can be tokenized include not only financial instruments such as stocks, bonds, and funds, but also tangible assets such as real estate, as well as intangible assets such as music streaming copyrights. The tokens generated after the tokenization of assets serve as the carriers of asset value and the certificates of asset ownership.

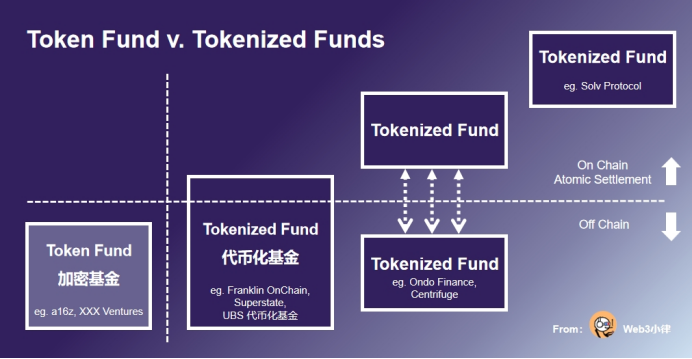

This innovation and disruption also apply to funds. After funds are tokenized, they form tokenized funds, which refer to fund shares recorded in digital token form on the blockchain distributed ledger, and the tokens are tradable on the secondary market. This type of tokenized fund differs from encrypted funds that only invest in primary and secondary markets (Token Fund).

The global asset management industry is facing many challenges. Although the overall asset management scale of the industry is growing with the market, fund management fees are being compressed due to peer competition and the industry's shift towards passive investment strategies. In addition to investment pressure, the market also has higher requirements for the digital capabilities of funds to meet the increasing online distribution, asset reporting, regulatory compliance, and personalized needs of investors. The growth rate of fund management costs is faster than income, and fund profit margins are being squeezed.

For private equity funds, due to their poor liquidity and high investment thresholds, their investors have long been limited to a small number of institutional investors. The private equity fund market urgently needs to lower the investment threshold and introduce alternative products that can meet the investment needs of non-institutional clients such as small and medium-sized institutions, family offices, and high-net-worth individuals through appropriate product design.

The tokenization of funds can solve many problems in the global asset management industry. Advocates of tokenized funds firmly believe that in the future, funds based on blockchain and distributed ledger technology can not only increase the assets under management (AuM) of funds, invest in a wider range of asset categories (diversity of RWA tokenized assets); they can also attract new categories of investors (investors from unbanked regions in Asia and Africa investing through encrypted assets), improve user investment experience (KYC embedded in smart contracts), help funds win in the competition of industrial digitalization upgrades (digital upgrades), and greatly reduce their operating and marketing costs (advantages of blockchain and distributed ledger).

II. Tokenization Will Bring Profound Impact to the Fund Market

2.1 Tokenization Facilitates the Digitization of the Fund Market

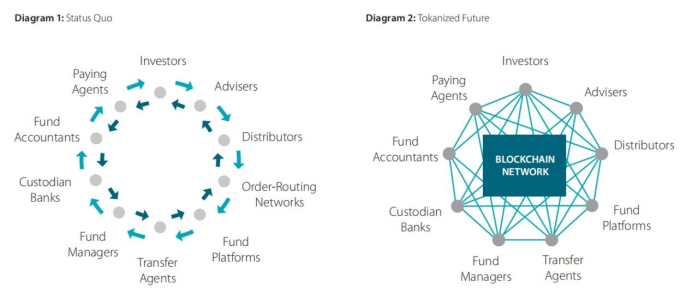

Currently, funds and investors are separated by a large number of intermediaries. Fund distribution includes: financial advisors, fund platforms, and order-routing networks; fund services include: paying agents, custodian banks, and fund accountants.

Transfer agents assist funds by coordinating both ends, responsible for customer (KYC), anti-money laundering (AML), combating the financing of terrorism (CFT), and economic sanctions screening verification, settlement of fund subscriptions and redemptions, reporting to managers, and maintaining investor registration records.

(Source: SS&C, Tokenization of Funds - Mapping a Way Forward)

(Source: SS&C, Tokenization of Funds - Mapping a Way Forward)

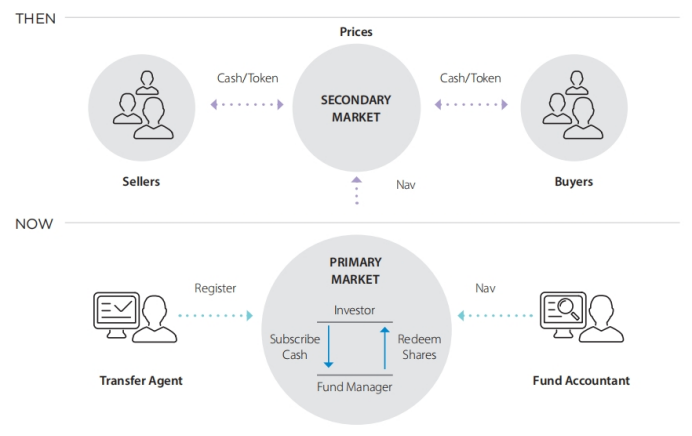

The operational process of traditional funds is fundamentally inefficient: (1) Fund shares are established to meet subscriptions and canceled to meet redemptions; (2) Fund pricing is not based on buying and selling, but on the net asset value set by fund accountants; (3) Transfer agents settle orders based on the net asset value by receiving and consolidating orders, then settle orders through entry in a centralized register, and reconcile orders with investor and fund cash positions; (4) Three days before the release of fund shares and cash settlement, funds and investors face market fluctuations and counterparty risks; (5) Fund liquidity also forces fund managers to retain cash positions to bear the cost of rebalancing the fund's net asset value.

In contrast, tokenization can greatly simplify the above complex processes: (1) When tokenized funds are issued and traded on the blockchain, the subscription and redemption process will settle directly into investors' accounts (e-wallets) through fund tokens and payment-type tokens, with finality of settlement, thereby eliminating market and counterparty risks; (2) Because all transactions are recorded on the blockchain's distributed ledger, any change in ownership will be automatically recorded, eliminating the need for centralized registration; (3) Since all intermediaries can access and view data on the blockchain, there is no need for multiple reports and reconciliations.

At the same time, tokenization will help fund managers and investors achieve digital interaction: (1) With integrated KYC, AML, CFT, and economic sanctions screening verification, the speed of investor account opening will increase; (2) Real-time pricing and settlement will be achieved through more efficient atomic settlement based on the blockchain; (3) Access to a unified ledger by multiple parties will enable real-time data sharing, allowing investors to directly access fund data and trade; (4) Fund managers will gain richer investor information and transaction information.

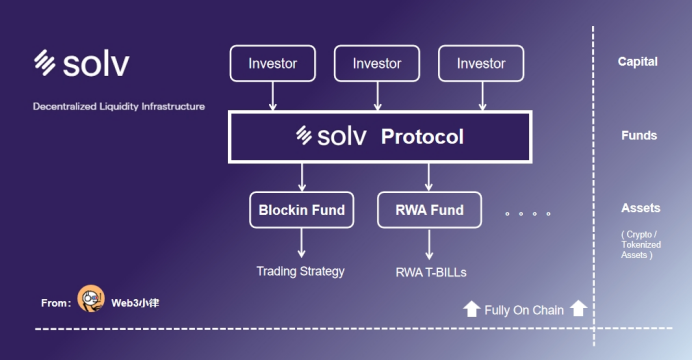

2.2 Solv Protocol's On-Chain Fund Issuance and Fundraising Platform

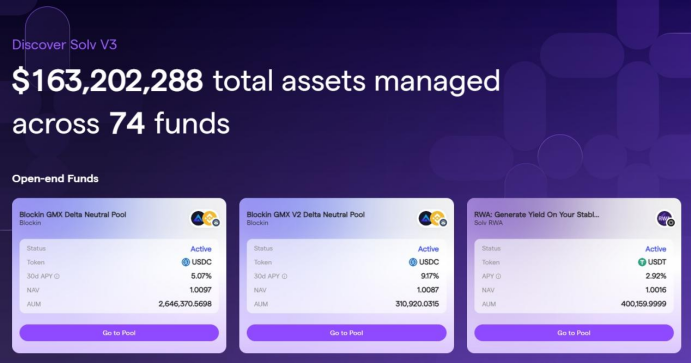

Established in 2020, Solv Protocol is committed to providing blockchain-based financial tools and diversified asset management infrastructure for the crypto industry. The company recently completed a $6 million financing round. Solv Protocol's latest product, Solv V3, sets a new standard for on-chain fund issuance. Tokenized funds created through Solv Protocol enable efficient fund raising, issuance, subscription, redemption, trading, and settlement, facilitating seamless fund capital circulation.

According to the official website, Solv Protocol has already issued and raised funds for 74 tokenized funds (including open-end funds and closed-end funds), serving over 25,000 investors and managing over $160 million in assets.

(Source: app.solv.finance/earn)

(Source: app.solv.finance/earn)

The core mechanism of Solv Protocol allows fund managers to create on-chain funds, deposit raised funds (stablecoins, BTC, ETH, etc.) into Solv Protocol's smart contracts, and generate NFT/SFT certificates representing fund shares for investors. This enables fund managers to invest according to their own strategies based on the raised funds.

For example, the Blockin GMX Delta Neutral Pool is an open-end fund managing approximately $2.6 million in assets, based on the investment strategy of fund manager Blockin. Another open-end fund, RWA: Generate Yield On Your Stable Coins, initiated by fund manager Solv RWA, raises USDT stablecoins and invests in U.S. Treasury RWA assets to provide interest income for stablecoin holders.

Open-end funds refer to funds where the total scale of fund units or shares is not fixed at the establishment of the fund. These funds can issue shares at any time and allow investors to redeem them regularly. Fund managers with high liquidity investment portfolios typically use an open-end company structure to establish funds.

The fully on-chain tokenized funds issued through Solv Protocol raise funds in the form of BTC/ETH/stablecoins and invest in native encrypted assets or tokenized assets (such as U.S. Treasury RWA). This on-chain tokenized fund architecture maximizes the value brought by tokenization. For example, Solv Protocol's tokenized funds (1) allow fund managers to directly interact with investors and obtain more investor data and trading information; (2) eliminate many frictions of fund service intermediaries, reducing costs; (3) achieve fund raising, issuance, trading, and settlement through blockchain and record them in a distributed ledger, ensuring efficiency and transparency; (4) update the fund's net asset value (NAV) in real-time, and allow fund share subscriptions/redemptions 24/7, and many other advantages.

Solv Protocol states that currently, most crypto asset management services come from CeFi institutions, and the opaque asset creation and fund management processes of these institutions have led to trust issues. Providing a transparent and secure investment experience through better decentralized solutions, while helping asset management companies gain trust and liquidity. Solv is building infrastructure and an ecosystem, providing comprehensive services including creation, issuance, marketing, and risk management. This reduces barriers to entry into Web3 and promotes the maturity of the crypto market.

Olivier Deng, an investor from Nomura Securities, stated, "Solv has built a trustless institutional-grade DeFi platform, integrating brokers, underwriters, market makers, and custodians, creating the first liquidity financial infrastructure bridging DeFi, CeFi, and TradFi on the blockchain."

III. Settlement of Tokenized Funds

Tokenized funds can to some extent replace some intermediaries (such as fund distributors) and enhance the digitalization level of the fund market, but the market is not built in a day. For fund managers and investors, the most realistic change brought about by tokenization is the settlement of fund subscriptions and redemptions.

3.1 Settlement of Tokenized Funds

Currently, funds are generally priced based on net asset value, and fund managers settle subscriptions and redemptions through the banking system by paying or receiving cash three days later (T+3). However, tokenized funds calculate prices multiple times a day, and since subscriptions and redemptions are settled "automatically" on the blockchain, the settlement method based on the banking system (T+3) will be replaced. We can see from the case of Solv Protocol that fully on-chain tokenized funds can achieve real-time pricing and settlement in a 24/7 market.

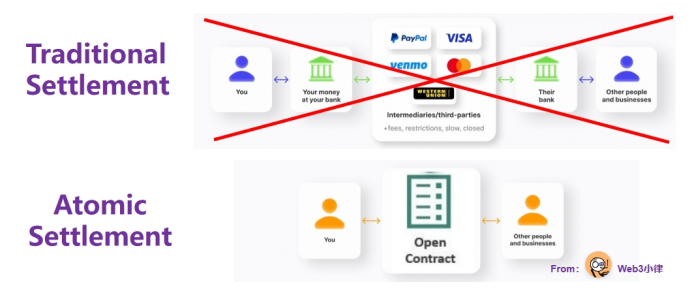

This settlement method using blockchain and distributed ledger technology is called atomic settlement, which means that the transfer of cash equivalents and fund shares is directly linked. When one asset transfer occurs, the transfer of the other asset occurs simultaneously. In other words, the settlement is based on the simultaneous exchange of cash and fund shares in the buyer's and seller's e-wallets. If cash or shares are not delivered, the transaction will not occur. This settlement method not only eliminates counterparty risk but also enables real-time settlement, greatly improving transaction efficiency.

Bitcoin was designed to achieve a decentralized peer-to-peer electronic cash payment system. Bitcoin payments allow direct transfers between users without the need for third-party institutions such as banks, clearinghouses, and electronic payment platforms, avoiding high fees and cumbersome transfer processes. This atomic settlement method applied to cross-border payments can solve problems such as high fees, low efficiency of cross-border transfers, and high costs in traditional cross-border payments.

Another interesting use case is the more effective settlement of exchange-traded funds (ETFs) through tokenization. Since ETFs are redeemed and subscribed through physical means, tokenizing the underlying securities (a basket of securities in an ETF) can greatly simplify the settlement process of the underlying securities of ETFs and achieve real-time settlement.

3.2 Use Cases of Settlement for Tokenized Funds

This atomic settlement trading method has been approved by the U.S. SEC and is being applied to the Franklin OnChain U.S. Government Money Fund, which has reached an asset scale of $310 million. Additionally, we see similar pilot projects for tokenized funds from UBS in Singapore. Although these funds are not purely on-chain tokenized funds, they leverage the advantages of blockchain and distributed ledger technology for accounting and settlement, creating a tokenized fund model.

3.2.1 Franklin OnChain U.S. Government Money Fund

We have seen that Franklin Templeton launched the Franklin OnChain U.S. Government Money Fund (FOBXX) in 2021, which is the first fund in the United States approved by the SEC to use Stellar blockchain technology to process transactions and record ownership of tokenized funds. In April of this year, it expanded to Polygon and may also be issued on the Avalanche and Aptos blockchains, as well as the Ethereum Layer 2 solution Arbitrum.

As of now, the fund's assets under management have exceeded $310 million, and investors can enjoy an annualized return of 5.19%. Each share of the fund is represented by one BENJI token, and currently, BENJI tokens have not been seen to interact with DeFi protocols on the blockchain. Investors need to undergo compliance verification through Franklin Templeton's app or website to enter its whitelist and meet the compliance requirements of KYC/AML/CTF.

The digital asset manager at Franklin Templeton stated, "We believe that blockchain technology has the potential to reshape the asset management industry, providing greater transparency and lower operational costs for traditional financial products. Blockchains like Stellar are crucial for the future of asset management, and tokenized assets built on blockchains will ultimately interoperate with other parts of the crypto asset ecosystem." It is reported that the overall cost of Franklin's tokenized fund is only 1/10 of traditional fund costs.

3.2.2 Superstate Fund by Compound Founder

Fund managers with extensive DeFi experience will fully leverage the advantages of blockchain and distributed ledger technology. For example, Compound founder Robert Leshner announced the establishment of a new company, Superstate, on June 28, 2023, dedicated to bringing regulated financial products from traditional financial markets to the blockchain.

According to the documents submitted by Superstate to the U.S. Securities and Exchange Commission (SEC), Superstate will use Ethereum as an auxiliary accounting and settlement tool and create a fund invested in short-term government bonds, including U.S. Treasury bonds and government agency securities. In short, Superstate will establish an SEC-compliant fund off-chain to invest in short-term U.S. government bonds and use the Ethereum blockchain to handle the fund's accounting, settlement, and track ownership shares. Superstate will implement an investor whitelist system, so fund tokens cannot be used in DeFi platforms like Uniswap or Compound.

In a statement to Blockworks, Superstate stated, "We are creating an SEC-compliant investment product that will allow investors to obtain a record of ownership of this mutual fund, just like holding stablecoins and other crypto assets."

Although Superstate did not mention composability with DeFi, it is conceivable that Superstate fund tokens could be pledged in Compound's lending pools to borrow stablecoins and build DeFi Lego.

3.2.3 UBS Tokenized Fund Pilot

(Source: UBS Asset Management launches first blockchain-native tokenized VCC fund pilot in Singapore)

(Source: UBS Asset Management launches first blockchain-native tokenized VCC fund pilot in Singapore)

On October 2, 2023, UBS Asset Management announced the launch of a tokenized fund pilot project. Through UBS's internal tokenization service (UBS Tokenize), fund tokens appear on the Ethereum blockchain in the form of smart contracts, representing ownership of underlying money market funds. Tokenization can help improve the fund issuance, distribution, subscription, and redemption processes.

The project is part of a broader Variable Capital Company (VCC) umbrella initiative led by the Monetary Authority of Singapore -- "Project Guardian," aimed at tokenizing various real-world assets. For UBS, the project is part of its global distributed ledger technology strategy, focusing on using public and private blockchain networks to enhance fund issuance and distribution. In November 2022, UBS launched the world's first publicly traded tokenized bond. In December 2022, UBS issued $50 million in tokenized fixed-rate notes, and in June 2023, it issued $200 million in tokenized structured notes for third-party issuers.

The project lead stated, "This is a key milestone in understanding fund tokenization, based on UBS's expertise in tokenizing bonds and structured products. Through this exploratory initiative, we will collaborate with traditional financial institutions and fintech providers to help understand how to improve market liquidity and customer market access."

3.3 Technical Challenges of Tokenized Fund Settlement

Tokenization represents a significant change in the settlement method of funds, replacing the current method of relying on transfer agents to record subscriptions and redemptions in the fund holder register for settlement. This atomic settlement method, similar to cash transactions, eliminates any intermediaries, and if cash and tokens are not delivered, the transaction will not occur. In other words, tokenized transactions exist only in a settleable form, cannot be pre-agreed and recorded, and then canceled. The biggest advantage here is that it eliminates counterparty risk, as the transaction will not occur if the buyer fails to deliver cash equivalents or the seller fails to deliver shares.

However, the atomic settlement method also presents a technical challenge: in most cases, the e-wallets on the blockchain must have sufficient funds before settlement, otherwise the transaction will not occur. Unlike failed deliveries in traditional transactions, the party that fails to deliver does not have a grace period to purchase or borrow the missing assets, and the transaction does not enter a pending state awaiting repair, but stops directly. This can bring additional costs to issuers and investors, as they must maintain excess balances in their wallets. Pre-financing comes with a cost. The accompanying risk is that the cost of maintaining the fund wallet exceeds the cost saved by the transaction.

However, there are other means to reduce costs, including: sharing data ledgers through blockchain instead of bilateral reporting and reconciliation; transfer registration without transfer agents; replacing centralized ledgers with self-maintained distributed ledgers; and using smart contracts to ensure timely access to corresponding ownership shares of fund tokens.

IV. Issuance of Tokenized Funds

Although tokenization brings many benefits such as real-time settlement, the issuance of tokenized funds is only applicable to new funds. This is because tokenizing existing funds would mean that fund shares may be recorded on the distributed ledger of the blockchain or by transfer agents in traditional registers, resulting in the cost of duplicate classification registration. Additionally, existing fund shareholders would conflict with tokenized fund shareholders.

As of mid-2021, out of the 127,913 existing funds globally (managing $68.6 trillion in assets), it is more feasible to add tokenized asset categories to existing funds (such as Fund 9, which allows funds to invest 100% of their quota in crypto assets after completing virtual asset business upgrades with the Hong Kong Securities and Futures Commission), or to provide tokenized versions of existing asset categories (i.e., tokenizing real assets, such as tokenized stocks, tokenized debt, including tokenized funds).

4.1 Tokenization of Money Market Funds - Franklin OnChain, Ondo Finance, Centrifuge

In addition to stablecoins, the largest tokenized RWA projects in terms of asset size are currently money market funds. The top three are Franklin Templeton: $312 million (government bonds); Centrifuge: $247 million (asset-backed); Ondo Finance: $183 million (government bonds).

Franklin Templeton is a fully tokenized fund, Ondo Finance also has two tokenized funds, and Centrifuge has established tokenized funds in collaboration with Aave in the RWA project. This demonstrates the importance of tokenized funds in connecting TradFi and DeFi.

(Source: RWA.xyz)

(Source: RWA.xyz)

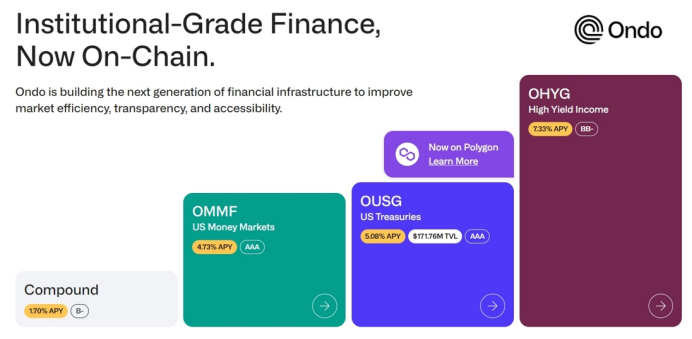

4.1.1 Ondo Finance OUSG / OMMF

(Source: Ondo.Finance)

(Source: Ondo.Finance)

In January 2023, Ondo Finance launched tokenized funds, aiming to provide institutional investment opportunities and services to professional investors on-chain. It brings risk-free/low-risk interest rate fund products to the chain, allowing stablecoin holders to invest in government bonds and U.S. Treasury bonds on-chain. The underlying assets of Ondo Finance's two tokenized funds, OUSG and OMMF, are BlackRock's short-term U.S. Treasury ETF and money market funds.

Investors need to undergo official KYC and AML verification processes with Ondo Finance before signing subscription documents. Qualified investors can then invest stablecoins in Ondo Finance's tokenized funds. Ondo Finance conducts fiat currency deposits and withdrawals through Coinbase Custody and executes U.S. Treasury ETF trades through compliant broker Clear Street.

For regulatory compliance, Ondo Finance strictly implements a whitelist system for investors, only allowing investment from Qualified Purchasers. Investors need to undergo official KYC and AML verification processes with Ondo Finance before signing subscription documents.

4.1.2 Centrifuge & Aave Treasury RWA Allocation

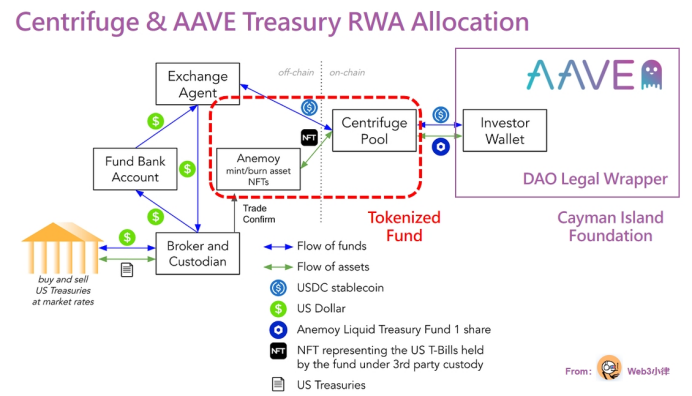

As a top player in the RWA collateralized lending model, Centrifuge has designed a tokenized RWA solution for Aave, helping Aave's treasury assets capture the yield value of U.S. bonds. Tokenized funds are also applied in this solution.

In this scheme, the Anemoy Liquid Treasury Fund is a fund registered in the BVI, which is first tokenized through the Centrifuge protocol. Aave then invests treasury funds in the corresponding Centrifuge Pool of the Anemoy tokenized fund, generating fund token certificates. The Centrifuge Pool then allocates the assets invested by Aave to the Anemoy fund. Finally, the Anemoy fund conducts fiat currency deposits and withdrawals, custody, and broker purchases of U.S. Treasury bonds to realize on-chain U.S. bond yield.

(Source: [ARFC] Aave Treasury RWA Allocation)

(Source: [ARFC] Aave Treasury RWA Allocation)

4.2 Tokenization of Private Equity Funds - Hamilton Lane, KKR

Historically, investing in private equity funds has been limited to large institutional investors and ultra-high-net-worth individuals, creating barriers for retail investors. One clear goal of the asset management market is to increase allocations to retail investors. The reasons for the continued under-allocation include high investment thresholds, long holding periods, limited liquidity (including a lack of developed secondary markets), a lack of price discovery mechanisms, complex manual investment processes, and a lack of investor education.

Although the tokenization market is still in its early stages, some private equity fund management companies are testing the waters by launching tokenized versions of their flagship funds. Notable private equity giants such as Hamilton Lane, KKR, and Apollo are exploring tokenized funds.

Due to limitations of existing funds, tokenizing a portion of existing fund shares would result in the same shares being recorded on the distributed ledger of the blockchain or by transfer agents in traditional centralized registers, leading to the cost of duplicate classification registration. One solution is for transfer agents to be responsible for consolidation and aggregation. Another solution is to achieve tokenization through feeder funds.

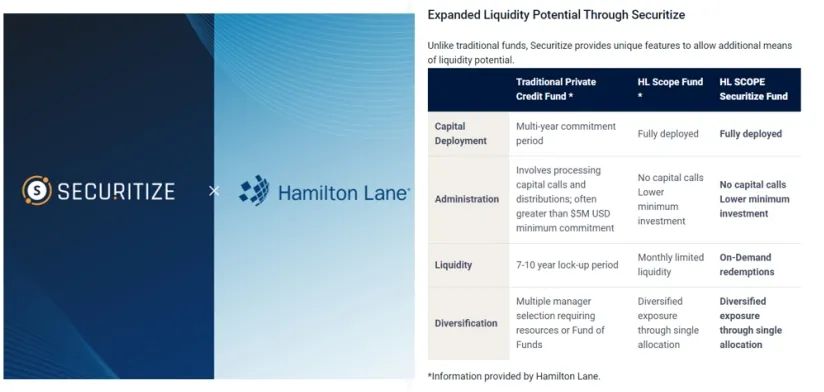

Private equity funds directly tokenize a portion of their fund shares on the Polygon network and make them available to investors on the Securitize trading platform. Through a partnership with Securitize, the fund tokenizes a portion of its fund shares in the form of a feeder fund and is managed by Securitize Capital (registered under SEC Reg D 506(c)).

Securitize's CEO stated, "Hamilton Lane offers some of the best-performing private market products, but historically, they have been limited to institutional investors. Tokenization will enable individual investors to participate in private equity investments in a digital way for the first time and create value together."

From the perspective of individual investors, although tokenized funds provide a "fair" way to access top-tier private equity funds, with the minimum investment threshold significantly reduced from an average of $5 million to just $20,000, individual investors still need to undergo qualified investor verification through the Securitize platform, presenting certain barriers.

(Source: Securitize.io)

(Source: Securitize.io)

4.2.2 KKR

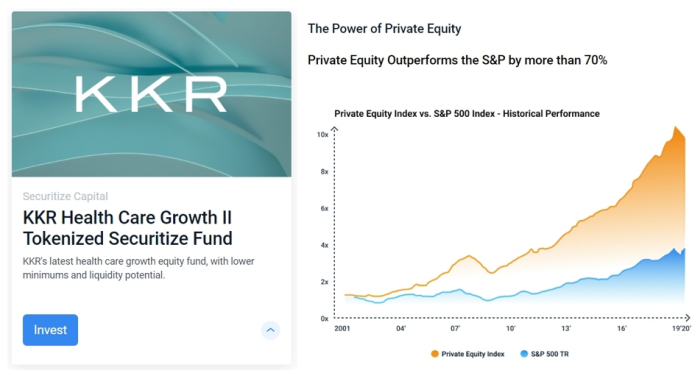

Similarly, KKR, with assets under management of nearly $500 million, partnered with the trading platform Securitize in October 2022 to tokenize a portion of its closed-end fund, Health Care Strategic Growth Fund II, in the form of a Feeder Fund on the Avalanche network.

From the perspective of private equity funds, the advantages of tokenized funds are obvious. They not only provide real-time liquidity for a portion of the fund shares (in contrast to the 7-10 year lock-up period of traditional private equity funds) but also enable LP diversification and flexible fund sourcing. This advantage may help address the current market dilemma where projects acquired during a period of loose liquidity and high valuations cannot be exited during a period of tight liquidity and reduced risk appetite.

From the investors' perspective, tokenizing private equity funds provides them with a low-threshold opportunity to invest in top-tier private equity funds (with returns far exceeding the S&P index by 70%). The threshold for large institutional investors and ultra-high-net-worth individuals to participate in KKR funds is usually in the millions of dollars, but individual investors can now invest with a minimum threshold of $100,000 through this "tokenized" Feeder Fund.

V. Trading and Investment of Tokenized Funds

5.1 Secondary Market Trading of Tokenized Funds

(Source: SS&C, Tokenization of Funds - Mapping a Way Forward)

(Source: SS&C, Tokenization of Funds - Mapping a Way Forward)

The most exciting aspect of tokenization may not be the blockchain-based settlement and issuance, but rather the secondary market trading of fund tokens.

As the tokenization market matures, the fully traded prices of fund tokens in the secondary market can more accurately reflect the value of the fund. This facilitates price discovery and provides a basis for fund pricing, as opposed to ETFs, which are traded solely based on published net asset values. This not only allows investors to view trades, portfolio valuations, and investment performance in real-time but also enables them to adjust their risk exposure. Fund tokens are also traded based on investor demand, currency trends, and arbitrage, with arbitrageurs eliminating any price differences between tokenized funds and non-tokenized versions.

Furthermore, fund tokens circulating in the secondary market can also supplement fund redemptions with liquidity. Funds can reduce low-yield cash reserves held to meet redemptions. Once investors can sell tokens instead of redeeming shares, the fund's asset size stabilizes, and the cost of rebalancing decreases. If the underlying assets of the fund are also tokenized, fund managers will no longer need to sell underlying assets or borrow from banks to address the liquidity mismatch between subscriptions and redemptions. Instead, the relevant underlying assets can be sold in tokenized form directly in the secondary market.

While tokenization may not actually increase the liquidity of some fundamentally illiquid asset classes, such as private equity and credit, infrastructure, real estate, art, and timber, it can fully leverage the advantages of interacting directly with investor communities and increasing the application scenarios of DeFi, reducing the asset's high discount due to lack of liquidity. Additionally, tokenization can fragmentize assets, allowing individual assets to be divided into smaller denominations, thereby lowering the investment threshold and enabling previously excluded investors to participate, bringing additional liquidity. The importance of these functions has already been demonstrated in the cryptocurrency and DeFi markets.

The shrinking of publicly traded stocks and the subsequent growth of the private equity industry have cut off a series of investment channels for retail investors. Tokenization can allow them to re-enter asset classes that are currently only open to institutional investors.

Unfortunately, for compliance reasons such as KYC/AML/CTF, most tokenized funds are not yet open for permissionless trading on public chains. For example, the largest asset management tokenized fund, Franklin OnChain U.S. Government Money Fund, although it processes transactions and records ownership on the Stellar blockchain, has not yet seen any operations on public chains. Tokenized private equity funds such as Hamilton Lane and KKR can only subscribe to and redeem funds through the platform's entrance (after strict KYC), with more trading operations likely taking place in the form of OTC. In the future, secondary market trading may be conducted through permissioned blockchains.

5.2 Tokenization Will Accelerate the Development of Personalized Investments

The higher investment thresholds in traditional investments reflect higher capital costs. Tokenization significantly reduces the investment threshold by reducing the costs of fund issuance, subscription and redemption, registration, and services. Tokenization solutions may also be applied to small investor funds, which can invest in assets such as commercial and residential real estate, infrastructure projects, private equity and debt, art, and collectibles, which are currently excluded from traditional investments.

In the long run, the impact of tokenization may be far more profound than just reducing trading costs, improving price discovery, increasing liquidity, and expanding the investor base of funds. Tokenization has the potential to create investment portfolios that fully meet the needs, desires, and values of individual investors.

Currently, funds are generic products that are expected to achieve returns or capital growth, or comply with a set of environmental, social, and governance (ESG) standards. Millennials have grown up with the digital economy and have never known a world without smartphones. What they need are direct, simple, and transparent fund products. For them, mutual funds are complex products that are difficult to understand, slow to purchase, and difficult to customize.

Tokenization can eliminate these barriers. Buying and selling fund tokens is cheaper, easier, and faster than traditional fund shares. Smart contracts can be embedded in fund tokens to conduct due diligence quickly and conveniently, allowing young investors to open accounts (e-wallets) in minutes rather than days, similar to owning a wallet for trading and holding cryptocurrencies.

Most importantly, tokens enable personalized investment portfolios. They can tokenize and fragmentize any asset, expanding the range of investable assets and even allowing small amounts of capital to be invested and customized based on the preferences of investors. Over time, tokenized funds may provide personalized investment portfolio packages for each investor, allowing them to manage their own bank accounts. Most importantly, personalized investment in tokenized funds has an intuitive appeal to a large number of young investors.

According to Newzoo's data, there are 2.9 billion electronic game players worldwide. The intersection between electronic game players and cryptocurrency enthusiasts means that use cases for cryptocurrency already exist, allowing electronic game players to buy and sell in-game items on the blockchain. NFTs are actually an invention of electronic game players. Technically, tokenized funds have become part of the lives of millennials and Generation Z.

(Source: www.tbd.website/)

(Source: www.tbd.website/)

V. Regulation of Tokenized Funds

Traditional funds are generally subject to strict regulation in their local jurisdictions, with clear operational guidelines and implementation paths. However, after fund tokenization, who will regulate it? This is still a new topic. One point that participants in tokenized funds need to adapt to is that after fund tokenization, the fund can be globally circulated on public blockchains (although currently only limited permissioned circulation scenarios are seen), and may therefore be subject to regulatory authorities in all major fund markets worldwide, as well as regulatory frameworks for global crypto assets.

Although regulatory authorities around the world have responded to the rise of blockchain token financing since 2017, international regulatory bodies are also trying to reach a global consensus on how to regulate crypto assets. However, the legal regulations for regulating tokenized funds are still only applicable to specific jurisdictions and are not clear or explicit. The scope of regulating crypto assets includes legislating the roles, rights, and obligations of crypto asset issuers, investors, and intermediaries (as in Liechtenstein), as well as providing guidance on which crypto assets and crypto asset activities require regulatory authorization (as in the UK). Without clear legal definitions of crypto assets and smart contracts, and subsequent precedents, tokenization still faces legal and regulatory uncertainty.

Regulatory uncertainty makes fund management companies uneasy. As regulated entities, they are unwilling to take action first and then seek approval from regulatory authorities. However, at least in the UK, the guidance of the Financial Conduct Authority (FCA) has been proven sufficient to enable the tokenization industry to develop on a certain basis, that is, crypto assets issued on private networks are subject to existing securities and cash payment rules, rather than public networks.

First, issuing crypto assets on private blockchains (rather than public blockchains) enables fund managers to fulfill their regulatory obligations, conduct KYC, AML, CTF, and economic sanctions screening and verification of investors, which are prerequisites for investment. Second, fund tokens are regulated by the FCA as securities. This particularly reassures investors that risks will be controlled; information disclosure will maintain market integrity; market manipulation and insider trading will be suppressed; and tokens will be securely held.

Although the above-mentioned fund tokens are classified as "security tokens," fund tokens issued in the UK are subject to regulation under the Collective Investment Schemes sourcebook (COLL) of the FCA, in the same manner as mutual fund shares today. In other words, the issuer of fund tokens must issue a prospectus and key investor information document (KIID), comply with detailed COLL rules regarding investment, borrowing, risk management, and valuation, and appoint a depositary to protect investors.

VI. Conclusion

If we want to realize the ultimate form of tokenized funds using the advantages of blockchain and distributed ledgers, the current situation is analogous to the need to change the engine of an airplane flying at 30,000 feet. In addition, the new engine needs to be completely rewired while remaining compatible with the old system. Of course, change will not happen overnight.

In the fund industry, the shift in strategic direction is already evident, with fund companies exploring tokenization to reposition their businesses for the future of tokenization. Fund management companies are acquiring wealth management businesses and investing in fund platforms. Fund platforms are considering the capabilities of transfer agents. Transfer agents and custodians are investing in order and execution management technology, as well as fund platform and custody services.

These developments indicate that the distribution and service ends of the fund industry have begun to restructure. The advantages touted by tokenization—lower costs, larger markets, greater liquidity, reduced counterparty risk, automation of account opening/ongoing verification, expansion of investable asset classes, changes in customer service, and customization of fund investments—are gradually being achieved with difficulty.

There is reason to believe that tokenization can simplify the intermediaries that separate fund managers from investors; accelerate the digitization of products and expand the range of investable assets under management; ultimately, the issuance and redemption of fund shares may give way to an active secondary market for fund tokens, freeing funds from the constraints of daily net asset values and enabling trading in a manner equivalent to investment trusts and ETFs.

Before realizing the value brought by tokenization, many obstacles still need to be cleared. Common standards for KYC, AML, CTF, and economic sanctions screening and verification, cross-chain channels and oracles between public and private permissioned chains, and how to build a secondary market, among others. In addition, there is regulatory uncertainty, the lack of legal tender on the blockchain is a major constraint, but the biggest obstacle to progress is time.

A global industry's transition to the future cannot happen overnight. The danger is that as the reform time lengthens, it will become a reason for inaction today, which would be a mistake. For blockchain, what is valuable today will still be valuable tomorrow, just like Bitcoin.

Reference:

[1] SS&C, Tokenization of Funds - Mapping a Way Forward

https://www.ssctech.com/resources/form/tokenization-funds-mapping-way-forward

[2] CMS, Tokenised funds series

https://cms.law/en/gbr/publication/tokenised-funds-series

[3] Open for Investing 24/7: An Introduction to Open-End Funds on Solv V3

https://medium.com/solv-blog/open-for-investing-24-7-an-introduction-to-open-end-funds-on-solv-v3-84abc4704e68

[4] Franklin Templeton Announces the Franklin OnChain U.S. Government Money Fund Surpasses $270 Million in Assets Under Management

https://investors.franklinresources.com/news-center/press-releases/press-release-details/2023/Franklin-Templeton-Announces-the-Franklin-OnChain-U.S.-Government-Money-Fund-Surpasses-270-Million-in-Assets-Under-Management/default.aspx

[5] UBS Asset Management launches first blockchain-native tokenized VCC fund pilot in Singapore

https://www.ubs.com/global/en/media/display-page-ndp/en-20230927-first-blockchain-native.html?caasID=CAAS-ActivityStream&hss_meta=eyJvcmdhbml6YXRpb25faWQiOiAxNDc3LCAiZ3JvdXBfaWQiOiAxMTA5MDA0LCAiYXNzZXRfaWQiOiAyMjUwMDA3LCAiZ3JvdXBfY29udGVudF9pZCI6IDEyMTM4NjcwOSwgImdyb3VwX25ldHdvcmtfY29udGVudF9pZCI6IDE4ODYyNTM2M30%3D

[6] Hamilton Lane and Securitize to Tokenize Funds, Expanding Access to Private Markets for a Broader Set of Investors

https://www.hamiltonlane.com/en-us/news/hamilton-lane-securitize-tokenize-funds

[7] [ARFC] Aave Treasury RWA Allocation

https://governance.aave.com/t/arfc-aave-treasury-rwa-allocation/14790/1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。