Authors: Brandon Bailey, Gabe Parker, Gui / Source: https://www.galaxy.com/insights/research/bitcoin-inscription

Translation: HuoHuo / Blockchain in Plain Language

TLDR:

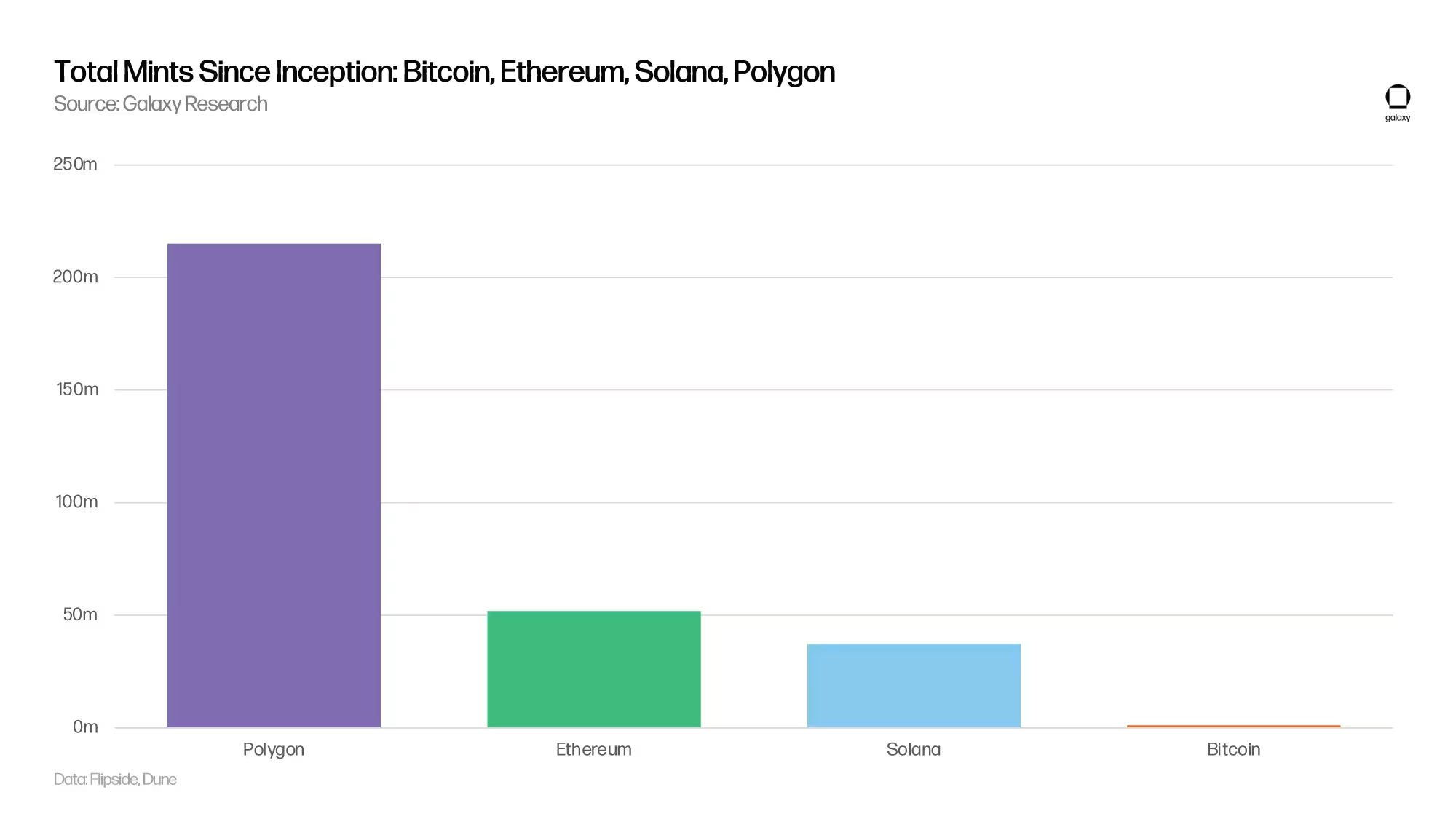

In the first 200 days since the first Bitcoin inscription, a total of 1.14 million image-based inscriptions were created, exceeding the total number of NFTs minted in the first 200 days since the first NFT was minted on the Ethereum, Solana, and Polygon networks.

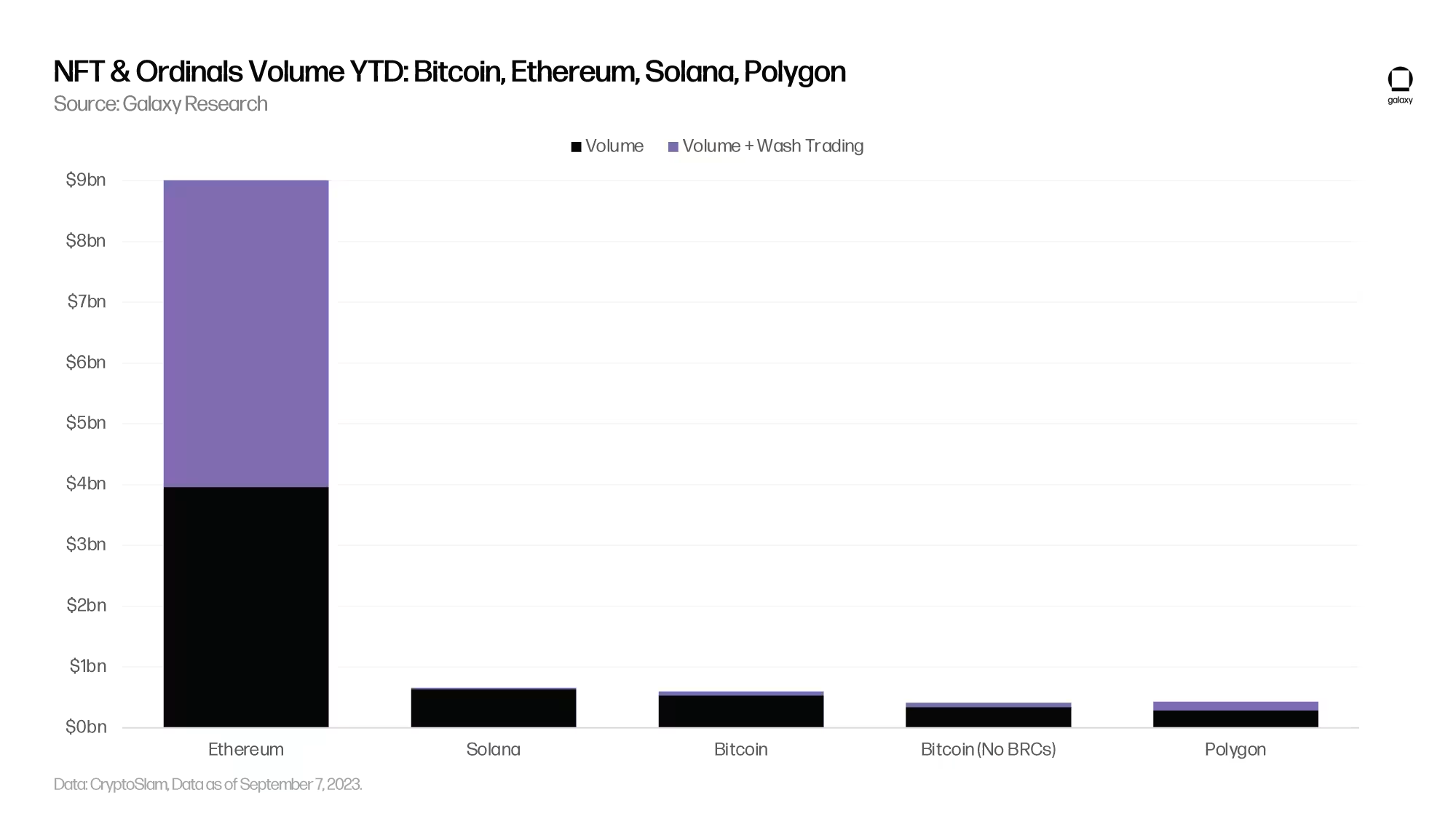

From January 1 to September 1, the cumulative trading volume of Bitcoin Ordinals was $596.4 million, making Bitcoin the third largest NFT network by trading volume, only behind Ethereum and Solana.

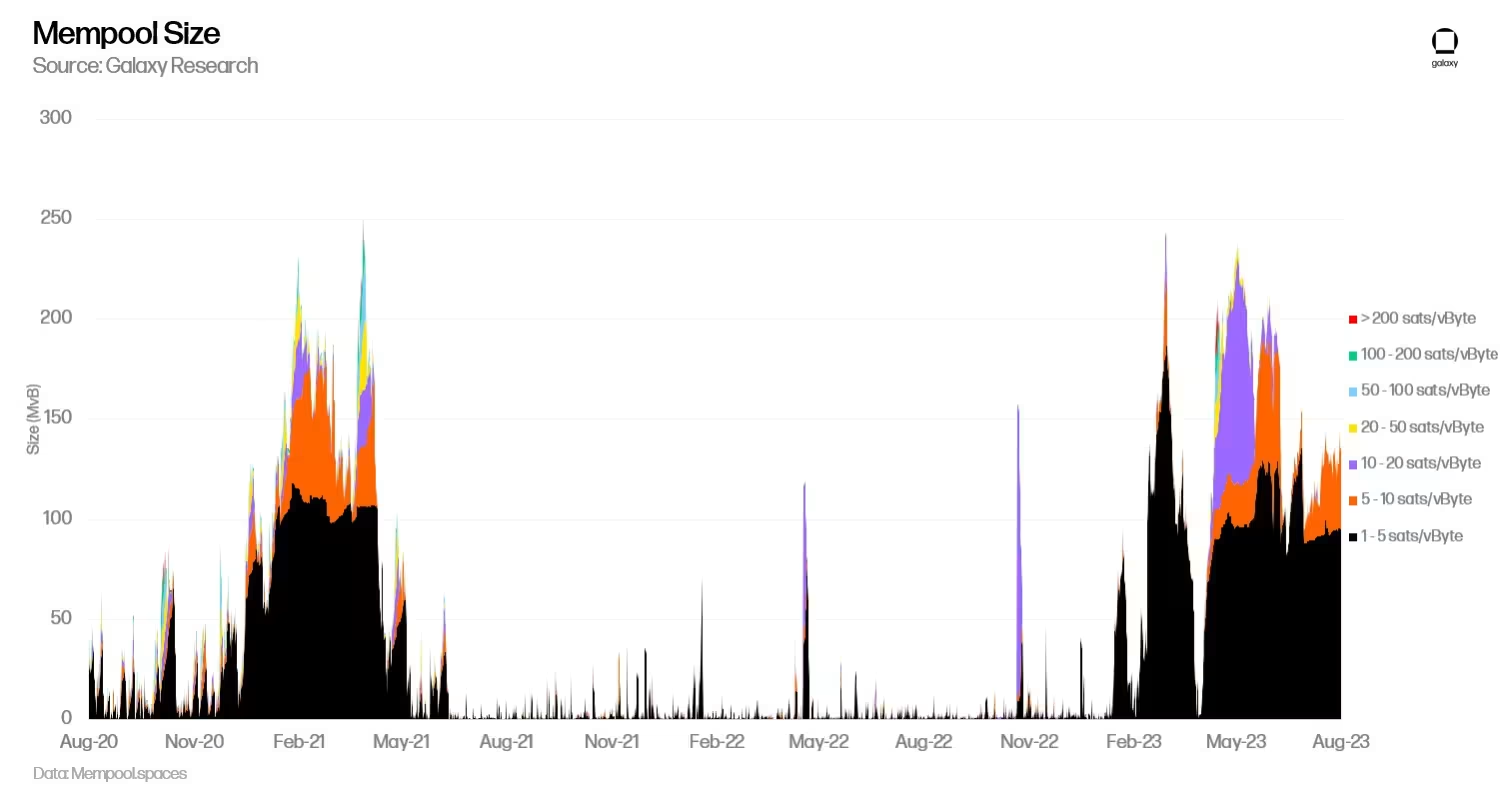

Ordinals activity led to the longest period of uncleared pending transactions in Bitcoin since 2021.

Even excluding BRC-20 from the total ordinals, Bitcoin remains the third most popular chain in digital collectibles activity. The cumulative trading volume of the top 50 BRC-20 Tokens accounts for only 30% of all Ordinals trading volume.

In terms of daily trading volume, the most significant markets for Ordinals trading activity are Magic Eden, Unisat, and OKX, with market shares of 20%, 34%, and 44% respectively.

The demand for ordinals inscribed on rare satoshis continues to grow. There is now a robust framework for measuring the rarity of satoshis and some rare satellite markets, allowing users to easily acquire and trade rare satellites.

Recursion is a novel innovative technology that allows inscribers to build ordinals beyond the 4MB block size limit and create high-resolution artwork at a fraction of the cost of minting inscriptions.

I. Introduction

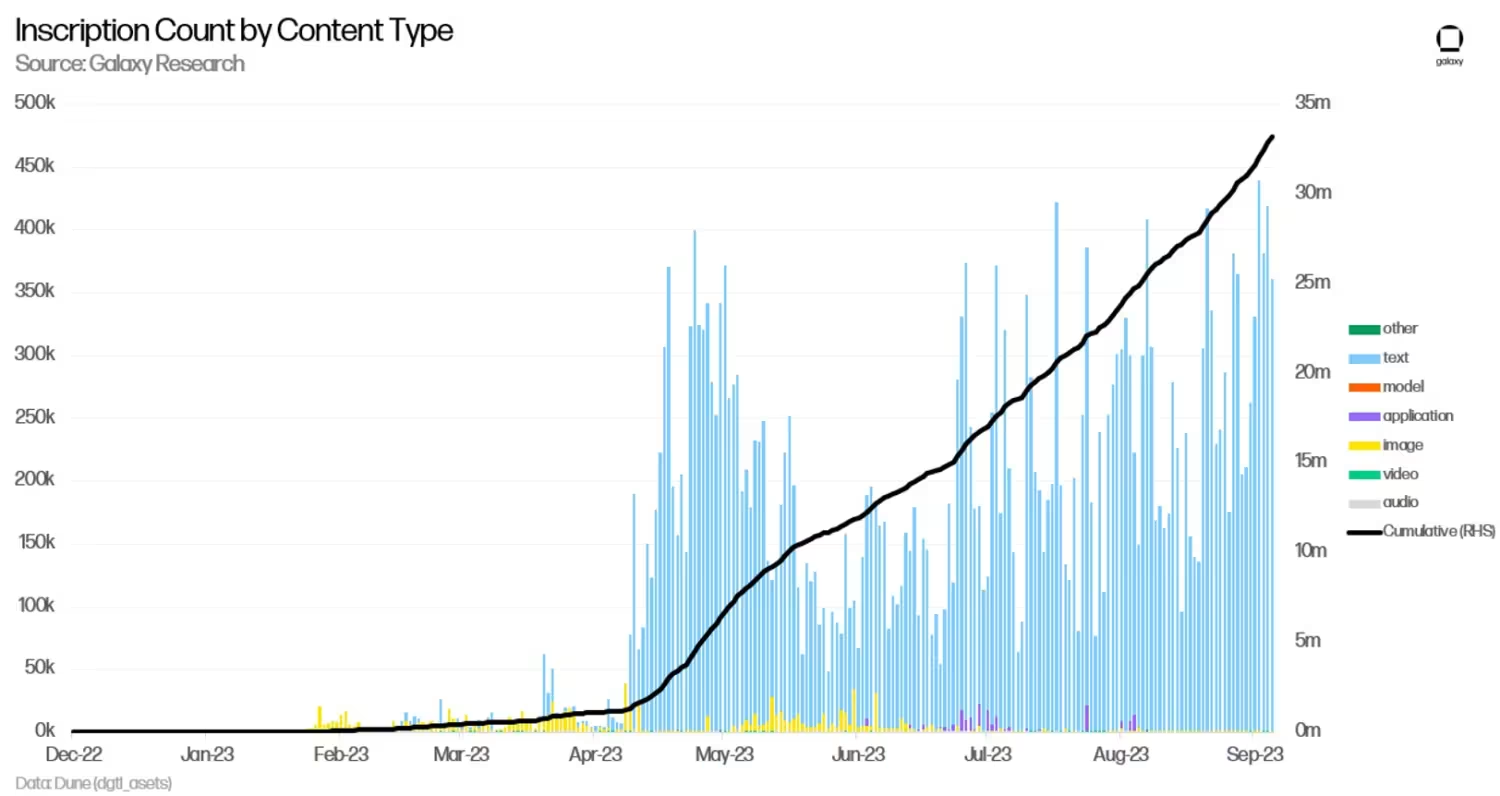

In March 2023, Galaxy Research and Mining released a report discussing Ordinals, a new area of Bitcoin digital collectibles. At that time, Galaxy Research and Mining predicted that by 2025, the market value of Ordinals would reach $5 billion, with only 260,000 registrations at that time. Fast forward to now, the ecosystem has surged to over 33 million inscriptions, exploding approximately 126 times from March 2023 to September. The significant growth of Ordinals not only demonstrates the intrinsic appeal of Bitcoin digital collectibles but also reflects the rapid maturation of its ecosystem. The Ordinals landscape is continually evolving through improved wallet and market infrastructure, new inscription use cases, and scalability improvements.

This report is an update on the Ordinals ecosystem since our last writing in March 2023. The report provides a comprehensive overview of significant developments in Ordinals infrastructure and compares Ordinals activity on Ethereum, Solana, and Polygon. The report also investigates the impact of Ordinals on Bitcoin fees and explains that most fee spikes over the past 6 months were not caused by Ordinals-related transactions. The data provided in the report indicates that Bitcoin users typically overpay for transactions, whether or not these transactions are related to ordinals.

II. Current Status of Ordinals Infrastructure

Since the public release of the software for writing arbitrary data to satoshis (called the Ord client) in January 2023, the growth of the Ordinals ecosystem and the development of critical infrastructure have achieved incredible numbers. There are currently over 33 million inscriptions, with text files being the most common file type, primarily due to the BRC-20 Token standard.

The BRC-20 Token standard remains an inefficient way to mint and transfer inscriptions, as it requires users to execute multiple transactions to complete a single operation. There are several proposed Ordinals Token standards that are relatively more efficient and robust protocols for creating tokens on Bitcoin, such as ORC-Cash and ORC-69.

While text-based inscriptions supported by the BRC-20 Token standard dominate the total number of inscriptions, most of the excitement and key technological developments in the Ordinals field are focused on collectible digital artifacts. Tools supporting image-based inscriptions have made significant progress. Three major wallet options have emerged to store image-based inscriptions: Xverse, Hiro Wallet, and Unisat Wallet. These wallets act as browser extension wallets, allowing users to connect to trading platforms, send and receive Bitcoin or inscriptions, and view Ordinals collections, providing a user experience equivalent to Ethereum's Metamask. The Xverse wallet also offers a mobile app solution.

There are various inscription-as-a-service products, such as Ordinalsbot and Unisat. Binance's mining department, Binance Pool, also launched inscription-as-a-service on August 31, 2023. From a market perspective, Magic Eden has always been the most popular trading platform for inscriptions. However, Ordinals Wallet, Gamma, and BN are also becoming competitors in this field.

Ordinals infrastructure now supports inscription gating on platforms like Discord (i.e., exclusive access to digital communities by verifying inscription ownership). It also leverages Discreet Log Contracts (DLC), a native transaction programmable feature of Bitcoin, allowing collectors to use inscriptions as collateral to obtain Bitcoin-denominated loans.

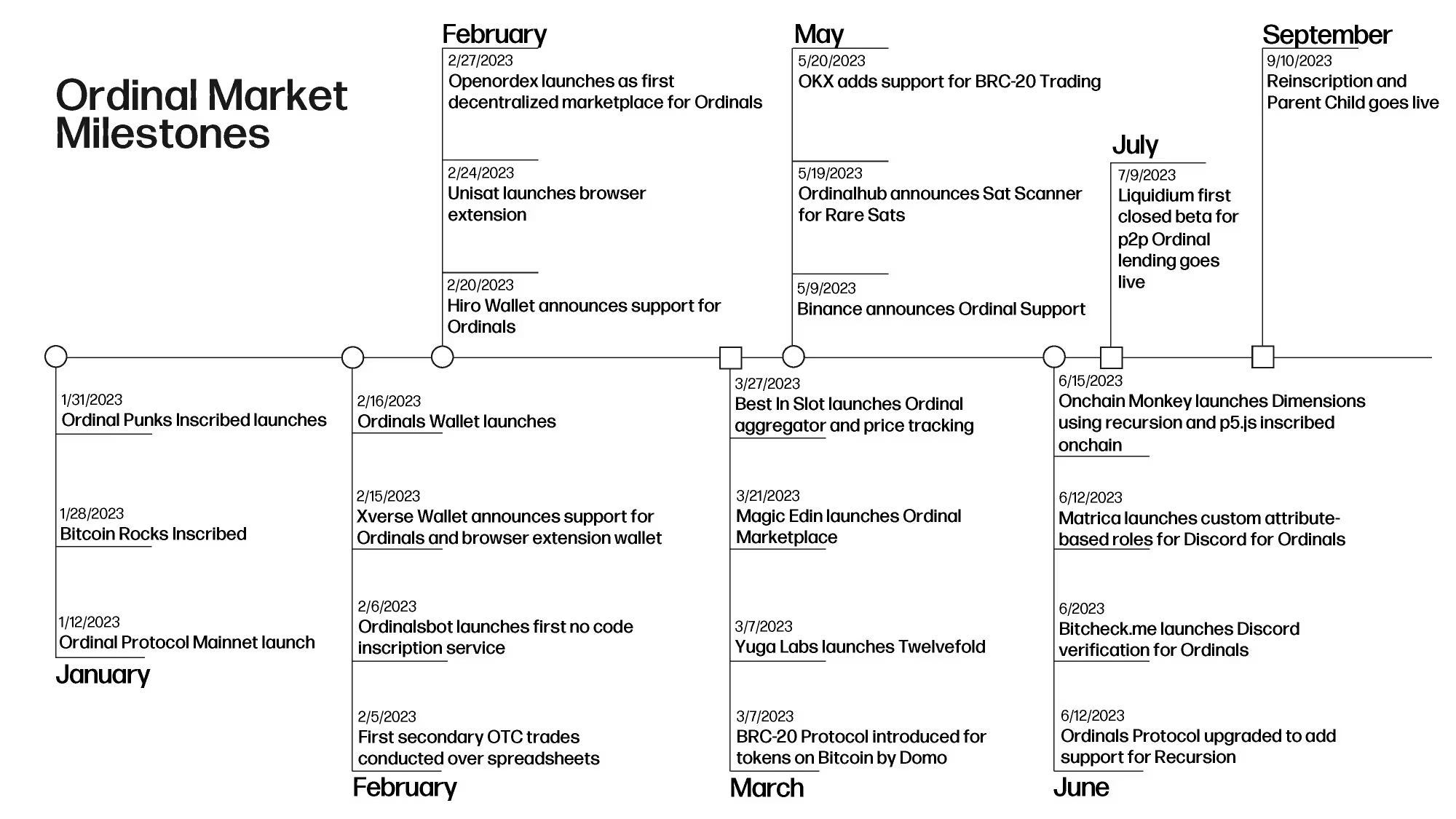

After about 8 months of Ordinals development, Bitcoin developers have built NFT tools comparable to those on other major Layer-1 blockchains such as Ethereum, Polygon, and Solana. Several companies are actively working on secretly building and improving Ordinals infrastructure. The following is a timeline that integrates many market milestones in the Ordinals field over the past 9 months:

Despite the general decline in the market volume of Ordinals and NFTs since the beginning of 2023, the development of Ordinals infrastructure continues to grow rapidly, indicating that Ordinals is not just a fad.

III. Ordinals Market Activity

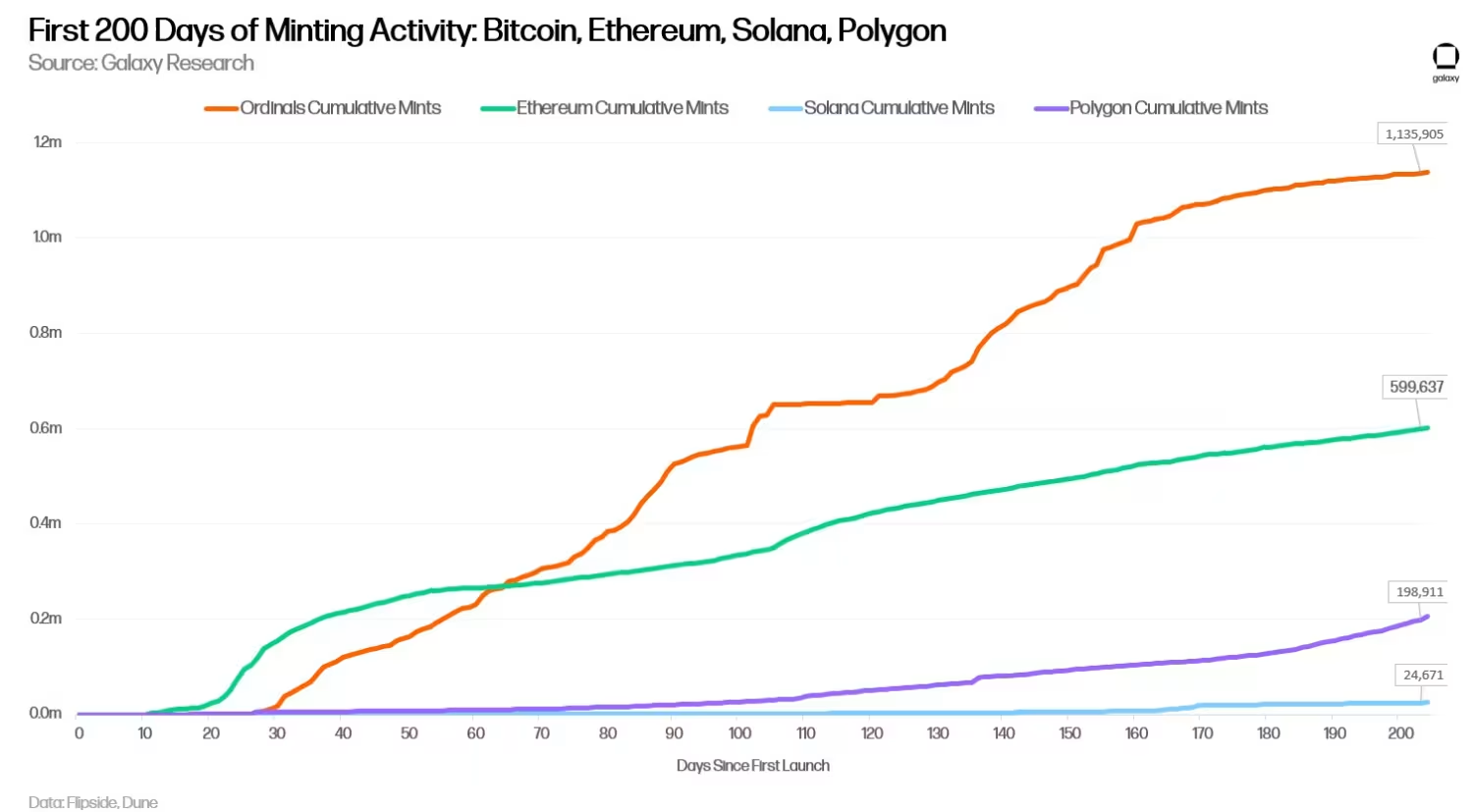

Ethereum's NFT minting activity began in August 2015 with the launch of the Terra Nullius NFT series. The first NFT minting on Polygon was recorded in May 2020, and on Solana in October 2020. NFT minting activity had already started on Ethereum, Solana, and Polygon before the summer of 2021, when NFTs gained mainstream media attention. The minting activity in the first 200 days on these networks was minimal compared to the minting activity after the NFT bull market in the summer of 2021. For reference, when NFT activity first started on Solana and Polygon in 2020, the total market value of the entire NFT ecosystem was only $41 million. In just two years, by 2022, the NFT market value on all three blockchains had grown to $32 billion.

The following chart tracks the minting activity in the first 200 days since the birth of each blockchain. The chart excludes inscriptions from the BRC-20 mint; the data below is based solely on image inscriptions.

The Ordinals ecosystem saw impressive user engagement in its initial 200 days of activity. During this period, Bitcoin users minted (inscribed) 1.14 million digital artifacts. Considering that Ordinals was launched during a crypto bear market, the rapid growth of Ordinals is noteworthy. In the first half of 2023, the number and floor price of blue-chip collectibles NFTs rapidly declined. Despite the broader NFT market struggling to recover from the bear market, Ordinals has garnered significant attention and the concept of Bitcoin digital artifacts is thriving.

While Bitcoin's minting activity in the first 200 days is substantial, it is still significantly lower than the total minting activity on other general-purpose blockchains, indicating that Ordinals still has a long way to go in adoption compared to the broader NFT ecosystem on other blockchains. One of the apparent reasons for the huge difference in total minting volume between chains is that Ethereum, Solana, and Polygon have been supporting NFT activity for many years. Additionally, with the help of the NFT bull market cycle in 2021, Ethereum, Solana, and Polygon experienced accelerated adoption. If Ordinals continues to gain momentum in the next NFT bull market cycle, we may see Bitcoin start to compete in total minting volume with Ethereum, Solana, and Polygon.

1) Trading Activity

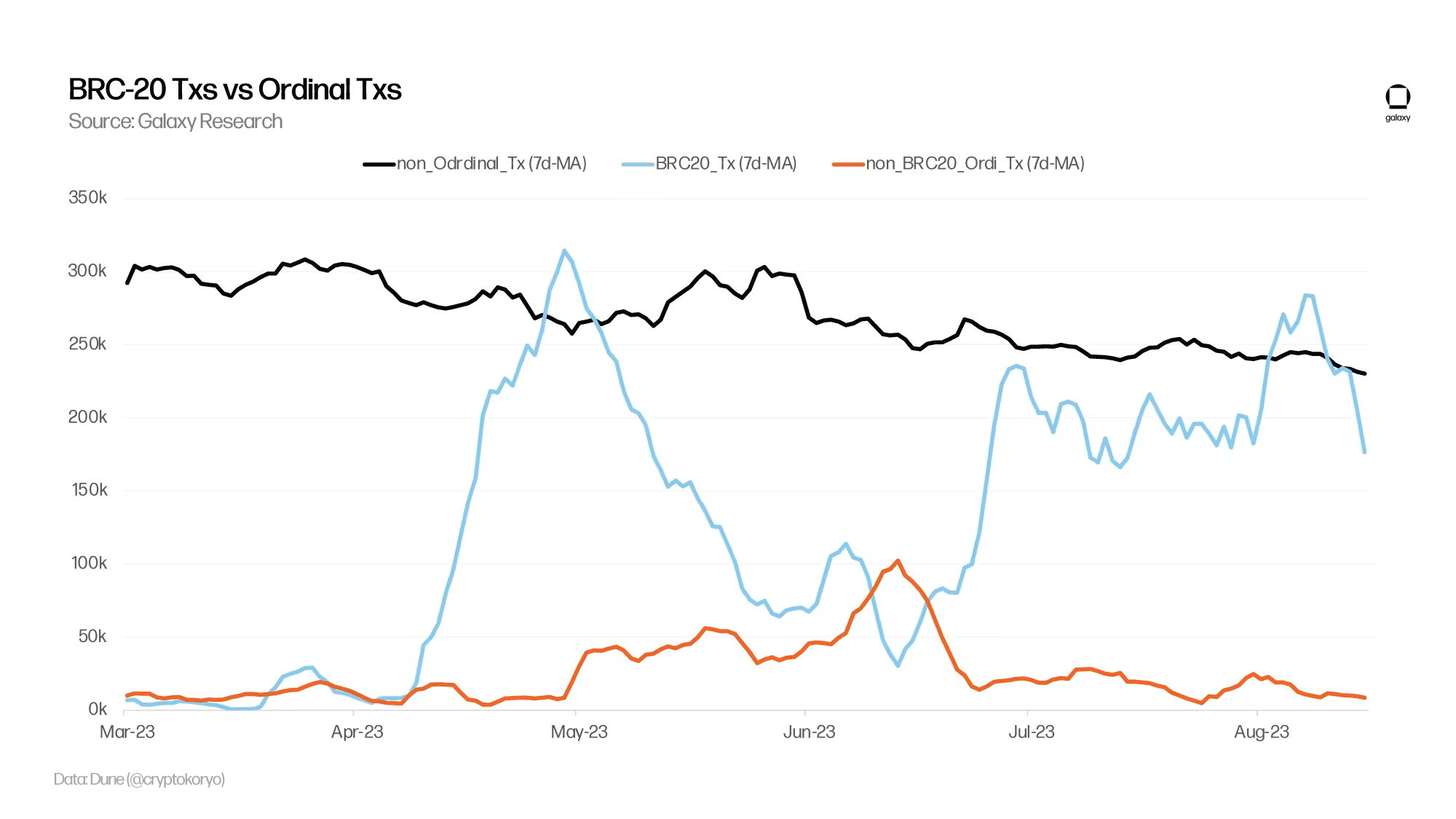

While it is necessary to exclude non-image transactions from our metrics to better compare Ordinals trading activity with the broader NFT trading activity, including all types of inscription transactions is crucial for understanding the overall impact of the emerging technology. Ordinals transactions refer to all types of inscription activity: image, text, applications, audio, and other types of digital content. The emergence of inscriptions allows for the construction of other meta-protocols, such as tokenization schemes, where BRC-20 is the most popular to date. BRC-20 transactions are entirely based on text inscriptions, and BRC-20 transactions significantly exceed non-BRC-20 Ordinals transactions. By observing the trading volume of the top 50 BRC-20 Tokens, we find that the majority of BRC-20 transactions are of low value. From January 1 to August 31,

To better compare Ordinals trading activity with the broader NFT trading activity, we attempt to exclude BRC-20 from the calculation of Ordinals trading volume, which will be detailed in the next section of this report.

2) Rollup

NFT trading volume saw a significant decline in 2023. From February to August 2023, monthly NFT trading volume declined for six consecutive months. August 2023 was the worst-performing month for NFTs this year, with trading volume dropping to $500 million, a fourfold decrease from February 2023. Despite the unfavorable market conditions for NFTs in 2023, Ordinals achieved meaningful growth. Notably, Ordinals accounted for 18% of all NFT trading volume in May.

In the first three quarters of 2023, Ethereum dominated NFT trading volume, surpassing the total of Solana, Bitcoin, and Polygon. Although Bitcoin's trading volume in January 2023 was minimal, it accumulated the third-highest network NFT trading volume, reaching $596.4 million. Even excluding BRC-20 from the total number of Bitcoin ordinals, Bitcoin remains the third most popular chain in digital collectibles activity, following Ethereum and Solana.

(Note: To exclude the trading volume of BRC-20 from the calculations below, we subtracted the cumulative trading volume of the top 50 BRC-20 Tokens ($187.5 million) from the total ordinals trading volume ($596.4 million). The top 50 BRC-20 Tokens account for the vast majority of BRC-20 trading volume.)

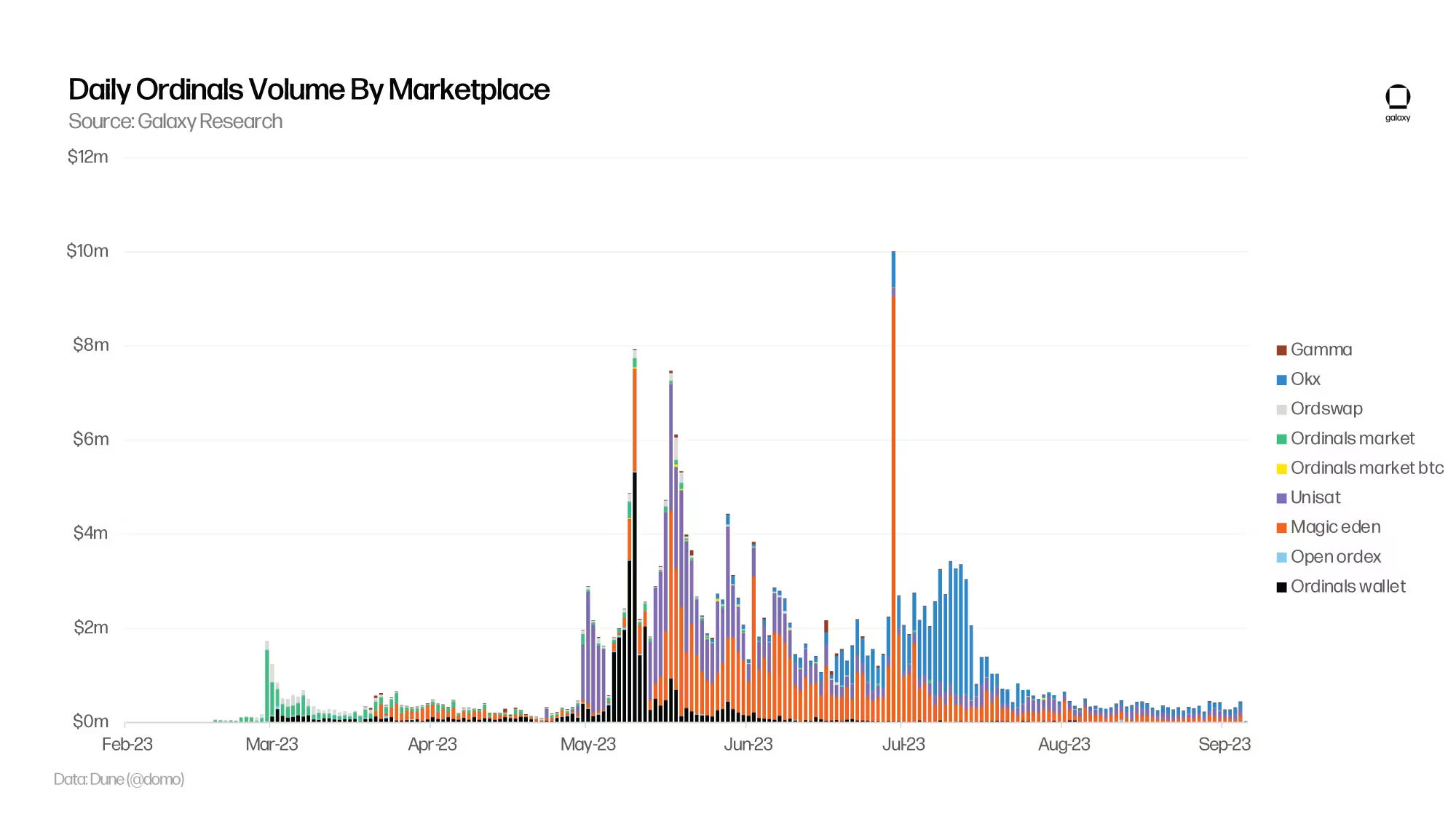

On May 11, 2023, Ordinals reached a historic high in daily trading volume, with the first wave of BRC-20 Tokens minted through Unisat and Ordinals wallets. From May 1, 2023, to July 18, 2023, daily trading volume of Ordinals generated a total trading volume of approximately $207 million, with an average daily trading volume exceeding $2.5 million.

The following chart shows the daily trading volume of Ordinals, converted to BRC-20 transactions, from February to September 2023. To convert the trading volume data of BRC-20 transactions in the chart below, we eliminated the trading volume data from Unisat between May 5, 2023, and December 12, 2023. During this period, Unisat generated sales of over $56 million solely through BRC-20. Due to the difficulty of accurately categorizing the volume of image-based inscriptions and other types of inscriptions from the market, there may be instances of BRC-20 trading volume that we cannot eliminate from various points on markets other than Unisat.

The chart also does not include over-the-counter trading data for Ordinals and Twelvefold mint, as these transactions are not included in the market trading volume data tracked by Dune Analytics. Yuga Labs' TwelveFold mint generated approximately $16.5 million in trading volume in a single day. At least 10 BTC (approximately $270,000) of over-the-counter trading is accounted for in the image-based Ordinals trading volume. The chart represents our best estimate of Ordinals daily trading volume, excluding the BRC-20 frenzy:

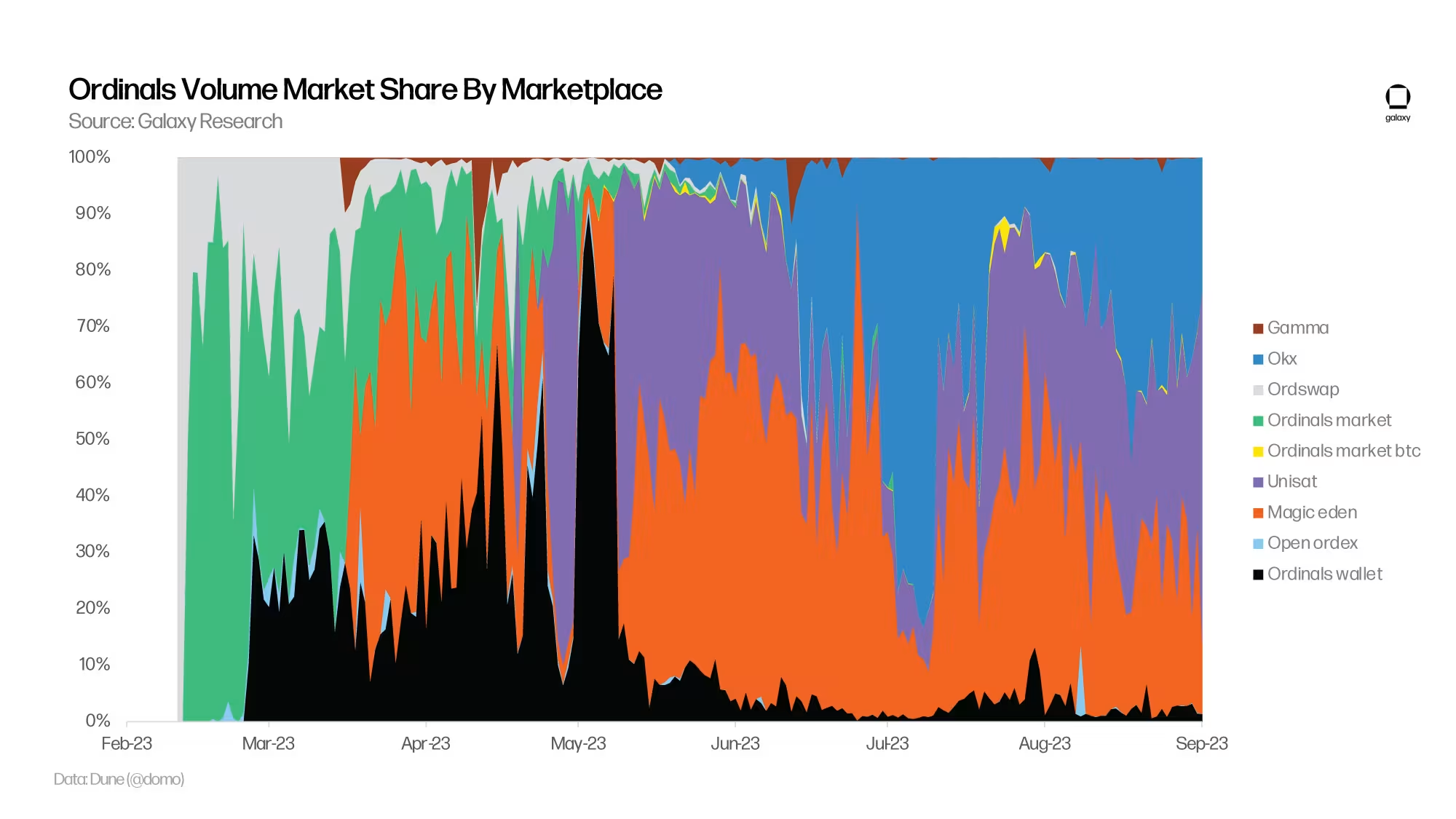

Before Ordinals gained significant support from major NFT markets, there were some early Ordinals trading markets. From February 2023 to April 2023, the Ordinals market, Ordinals wallet, and Ordswap dominated Ordinals trading volume. However, when Magic Eden launched support for Ordinals in March 2023, the dominance of market trading volume shifted from early markets. Magic Eden's entry into the Ordinals space shocked the market as they were the first major NFT market to support Ordinals adoption on other chains.

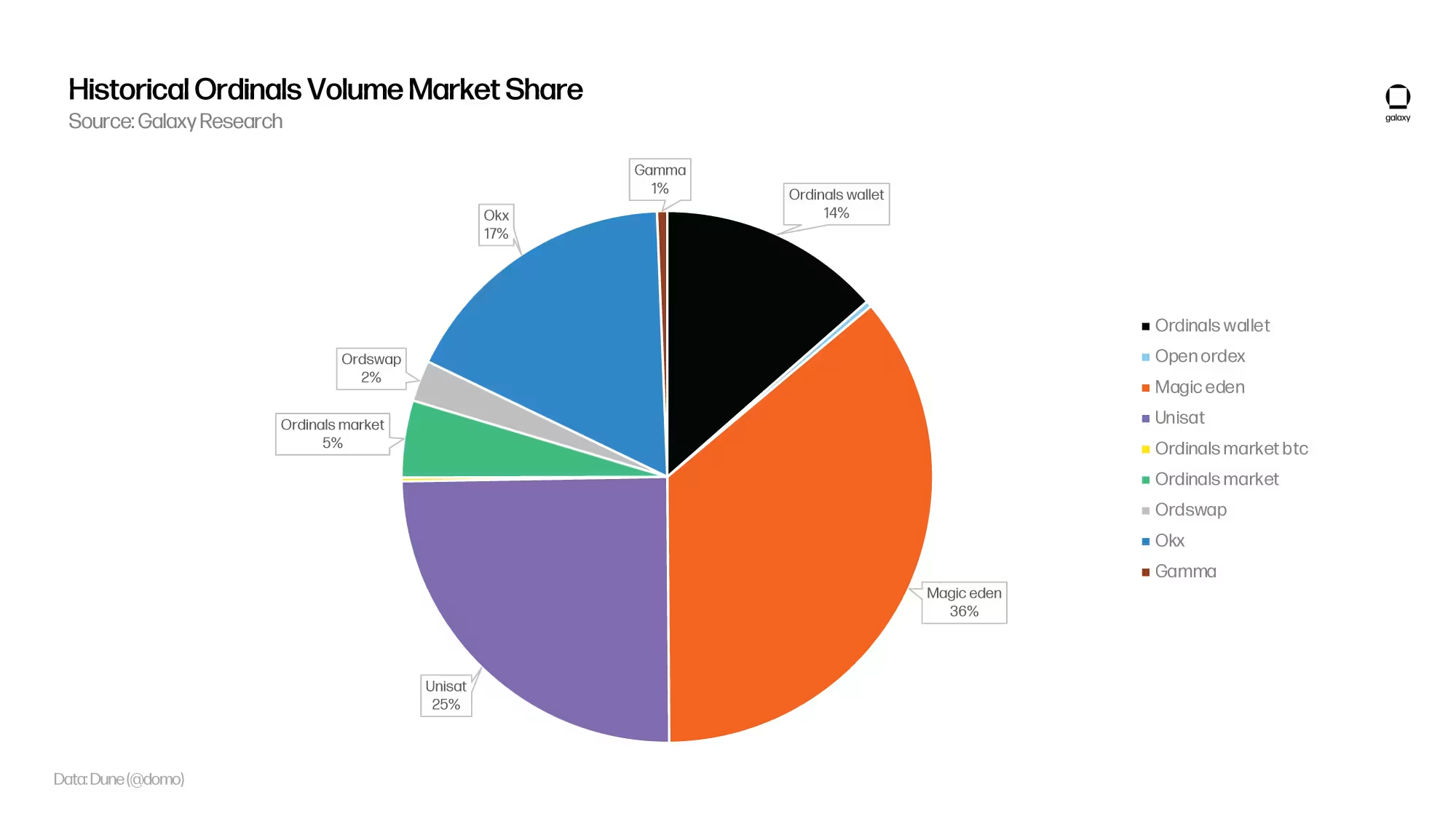

At the time of Magic Eden's support for Ordinals, Magic Eden was the fifth-largest NFT market by trading volume, with over 1.3 million users. By Ordinals trading volume, the primary markets are now Magic Eden, Unisat, and OKX, accounting for 28%, 28%, and 38% respectively.

Although Magic Eden and OKX started relatively late in the Ordinals ecosystem, they have accounted for 36% and 25% of the total Ordinals volume since their inception, respectively.

In the next section of the report, we analyze the impact of Ordinals trading activity on Bitcoin's mempool and transaction fees.

IV. Impact of Ordinals on Bitcoin Mempool and Transaction Fees

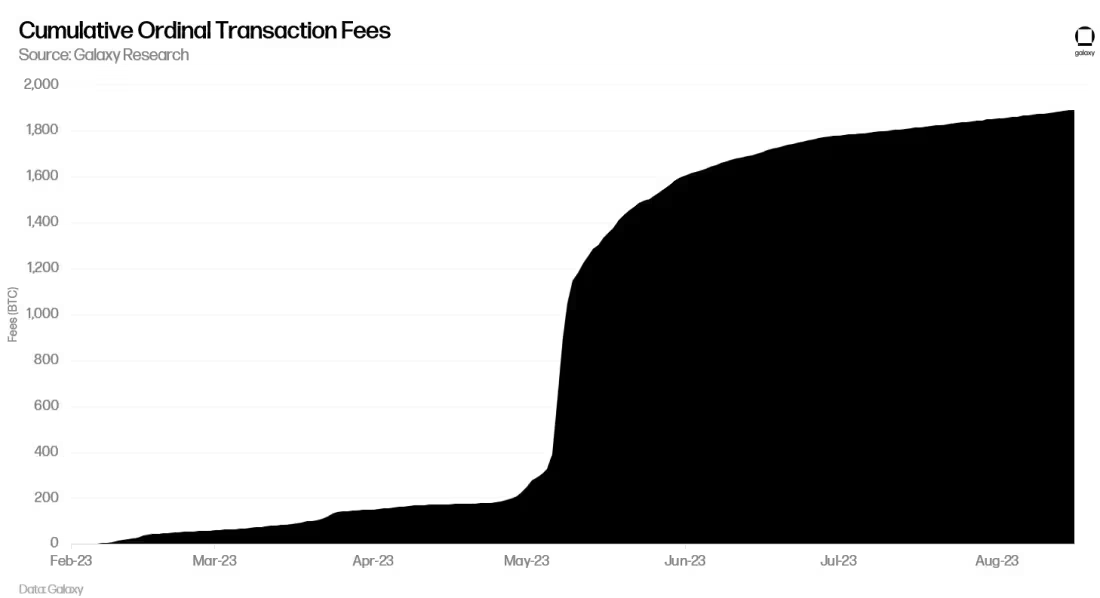

In the first half of 2023, miners accumulated a total of 8,684 BTC in transaction fees. It is noteworthy that in the first half of 2023, inscription-related transaction volume reached 1,779 BTC, accounting for 20% of the total miner revenue. In comparison, the fee was 2,325 BTC in the first half of 2022, and the total fee for the entire year of 2022 was 5,375 BTC.

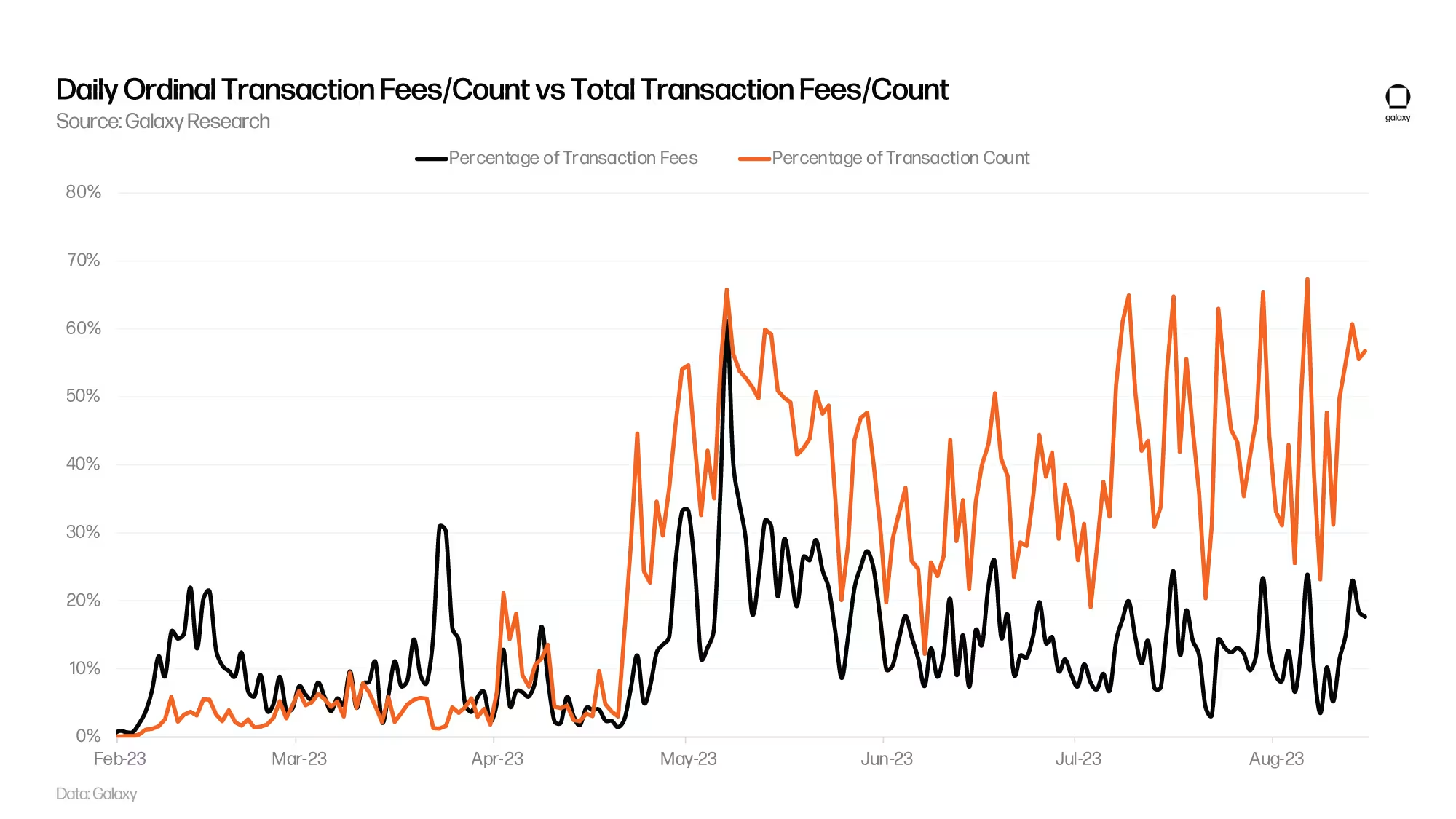

From May 2023 to July 2023, the share of Bitcoin transactions related to Ordinals relatively remained unchanged, from 47% of all Bitcoin transactions to 46%. During the same period, the share of Bitcoin transaction fees related to Ordinals decreased from 30% to 12%.

Apart from the transactions in May 2023 that led to a surge in fees, most transactions with fees higher than the median block rate were not related to Ordinals. Despite Ordinals accounting for a significant portion of the total transactions, they are not the most profitable transactions in the block.

While Ordinals transactions are not the most expensive on Bitcoin, they have caused a backlog of transactions, clogging the Bitcoin mempool (the pool of unconfirmed Bitcoin transactions). The mempool has been backlogged since April 22, 2023, for approximately four months. This is the longest active state of uncleared mempool since the surge in on-chain activity in early 2021.

Whether someone is paying inscription fees or conducting regular transactions to move Bitcoin from one address to another, Bitcoin users often end up paying excessively high fees for block space. In the next section of the report, we will analyze in detail the surge in transaction fees that occurred in the first half of 2023.

1) Factors Driving the Rise in Bitcoin Fees

The two main factors leading to the rise in Bitcoin fees are:

Time preference for block space consumption leading to voluntary overpayment. Consumers of block space exhibit different time preferences, leading to different block space consumption patterns during peak demand, driving up fees.

Overestimation of fees due to miscalculation or lack of understanding of the current fee structure.

The behavior of low time preference users can be reasonably explained and visualized on-chain. These users always bid higher than the lowest possible fee level widely accepted for mempool clearance (the mempool default size is 300 MB, so when it reaches capacity, it starts clearing or removing transactions starting from the lowest fee rate). Anything above this "clearance level" can be considered a "time preference premium" as it indicates a desire to be included in a block faster than X, where X represents the entire mempool being cleared and the "clearance level" returning to zero sat/vByte.

However, high time preference users are optimizing for different trade-offs such as opportunity cost, and analyzing their behavior requires subjective assumptions. Using this framework, we can begin to quantify and concretize the size of the "time preference premium" that users are willing to pay. In a sense, this "time preference premium" can often be thought of as the amount a user is willing to "overpay" to be included in the next block (or multiple blocks). This will be described as voluntary overpayment (e.g., BRC-20 users attempting to mint new tokens before reaching maximum supply). Some users may have paid excessive fees due to other non-economic factors (e.g., poor fee estimation by wallets and trading platforms). These types of transactions will be described as involuntary overpayment.

A case study is presented below to illustrate examples of voluntary overpayment in Bitcoin.

2) DeGos Mint Case Study

In March 2023, the DeGods mint serves as an illustrative case study to conceptualize why users would voluntarily overpay for transaction fees. As background, DeGods is a collection of 10,000 NFTs initially launched on the Solana blockchain in 2021. In March 2023, the creators of DeGods launched their version of the NFT collection on Bitcoin. Prior to this, the creators of DeGods sold their collectibles through a Discord lottery. The DeGods mint on Bitcoin was sold on-chain on a first-come, first-served basis. Starting from block 781,279, inscriptions were sold at a minting price of 0.333 BTC. Users who were able to include their transactions in the first 500 confirmed transactions were lucky winners and could purchase the DeGod inscriptions at the minting price.

The DeGods inscription minting process caused a frenzy among users, as many had to wildly speculate on the appropriate fees to attach to their transactions in order to succeed in minting. DeGods minters paid fees ranging from 7 to 1,725 USD for their transactions, as shown in the table below:

[Additional simple facts about the DeGods mint are included.]

During the minting period, the highest fee rate observed in the block was 39,177 sats/vByte, with a total transaction fee of 10,000,000 sat (0.1 BTC), which is 932 times higher than the median fee rate in the block.

The median fee rate for block 781,279 is 6 times the median fee rate of the previous block.

The total fee for the block is 3.552 BTC or 9.6 million USD. The block has a total of 2,602 confirmed transactions.

Out of the 2,602 transactions, 559 are related to DeGods minting. The total fee for Bitcoin transactions related to DeGods minting is 2.969 BTC or 8 million USD (83.6% of the total fee).

The median fee rate paid by those attempting to mint DeGods is 784 sats/vByte, which is 18.6 times higher than the median fee rate for all transactions in the block.

From the minters' perspective, determining how much to pay for a transaction is essentially a calculation of opportunity cost. If the minters believe they can profit from immediately selling the item from the mint, they will attempt to optimize the transaction by determining the item's selling price in the secondary market and adding a certain fee to ensure a positive spread between the minting price and the secondary price.

After the initial minting of DeGod inscriptions, the secondary market value was 1 BTC. Minters who paid 90% or more for DeGod inscriptions are still able to profit from a secondary sale immediately after purchase, as shown in the table below:

The next section of this report will delve into the factors driving the rise in Bitcoin fees.

3) Quantifying "Overpayment" in Bitcoin Transactions

Based on these characteristics, we can quantify the on-chain "overpayment" activity of users minting and exchanging ordinals compared to users sending and receiving regular Bitcoin transactions. The following is a step-by-step breakdown of this method:

For primary inscription transactions (i.e., Ordinals transactions), they are identified by the transaction IDs listed on Ordinals.com. All other transactions during the same period are classified as regular Bitcoin transactions. It is important to note that some of these regular Bitcoin transactions may be secondary market transactions not captured on Ordinals.com. However, as shown by the NFT data aggregator CryptoSlam, the number of secondary sales has significantly decreased from the peak on May 8, indicating that even if included, their impact on fee rates may be minimal.

"Overpayment" is defined as the amount of fees for transactions in a block (in sats/vByte) that is higher than the median sats/vByte for the same block. We choose the median sats/vByte level for the block because we believe that bidding around this level provides a reasonable chance of being included in the next block if you are a high time preference user.

Based on the above method, the following graph shows the average overpayment amount per day on Bitcoin for Ordinals and non-Ordinals users from April 2023 to May 2023, when the block space market was dominated by users with higher time preference attempting to participate in block space. BRC-20 frenzy.

As demand for Bitcoin block space continues to increase over time, wallet providers will need to optimize their fee estimation schemes or provide fee alternatives (RBF) and fee selection solutions to better serve users and prevent them from overpaying for transactions. The overpayment of Bitcoin transactions can be mitigated by more sophisticated fee estimation services provided by wallets and trading platforms. Regular Bitcoin users will benefit from the fee estimation optimization and improvements pursued by wallets focused on Ordinals such as Xverse, Hiro, and Unisat. Fee estimation schemes will become a key component of the next generation of wallet technology to prevent users from overpaying for transactions, especially in the face of increased block space demand and the resulting fee volatility.

4) Additional Insights and Key Points on Bitcoin Fee Dynamics

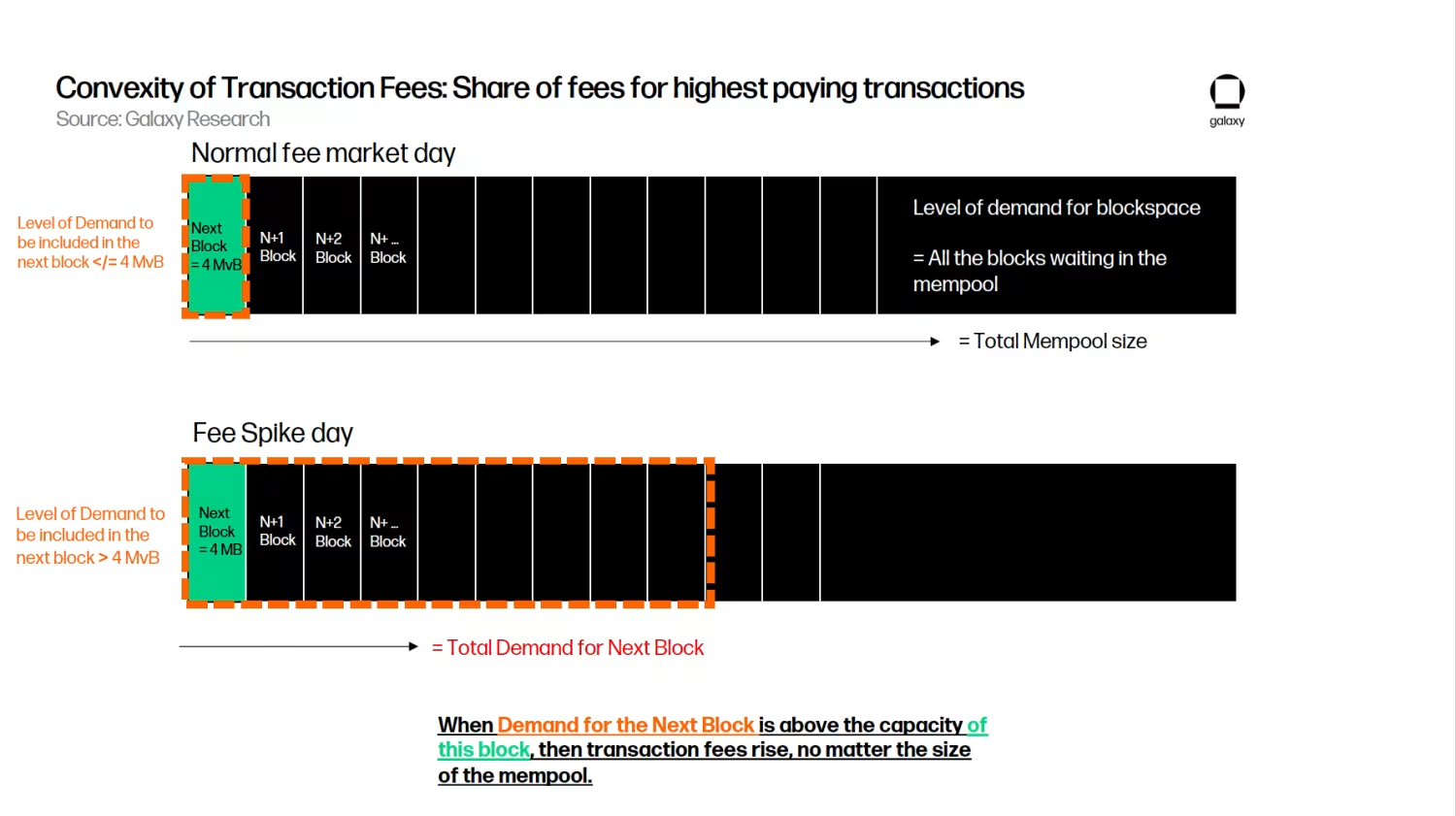

During the BRC-20 frenzy, a surprising development for market participants was how quickly fees surged in the mempool during periods of high demand. This is because the driving force behind transaction fees is not the size of the mempool (i.e., the general demand for Bitcoin block space by users with low and high time preference), but the demand from entirely high time preference users to be included in the next block.

In the graph below, we illustrate this relationship by showing that fees typically do not surge when the demand for the next block (in red) is less than or equal to the capacity of the next block. However, when the demand for the next block exceeds the capacity of the next block, fees surge. While this may seem obvious to casual mempool observers, it emphasizes an important assumption when discussing transaction fees on the network. As long as the network can maintain the demand level for the next block within its natural capacity, the overall demand for block space is (almost) irrelevant.

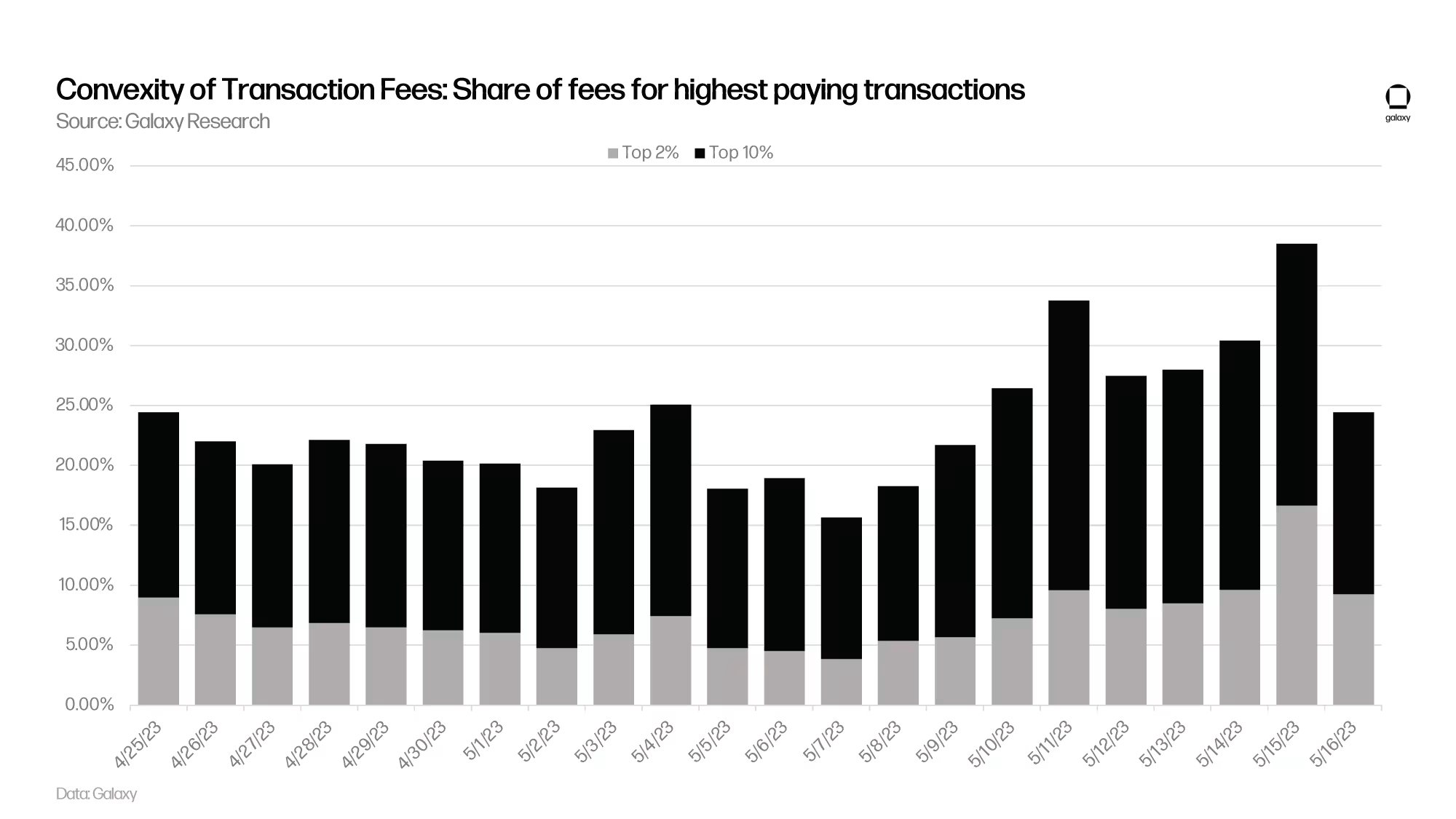

From a statistical perspective, the mean may be influenced by outliers, in this case, transactions with exorbitant fees. During periods of low volatility, the average fee and the median fee are similar, but during periods of high volatility, these two metrics show significant differences, further highlighting the impact of overpayment on fee dynamics. By measuring the convexity of Bitcoin fees, we know that few transactions are the primary cause of fee rate increases on-chain.

As time goes on, as demand for Bitcoin block space continues to increase, wallet providers will need to optimize their fee estimation schemes or provide fee alternatives (RBF) and fee selection solutions to better serve users and prevent them from overpaying for transactions. The overpayment of Bitcoin transactions can be mitigated by more sophisticated fee estimation services provided by wallets and trading platforms. Regular Bitcoin users will benefit from the fee estimation optimization and improvements pursued by wallets focused on Ordinals such as Xverse, Hiro, and Unisat. Fee estimation schemes will become a key component of the next generation of wallet technology to prevent users from overpaying for transactions, especially in the face of increased block space demand and the resulting fee volatility.

The framework above for understanding block space demand is relevant to the background of Bitcoin security budget discussions. The discussion should not focus on the question of "will transaction fees rise enough to provide miners with sufficient income?" but rather on the question of "how do we ensure sustained demand for block space exceeding 4 MvB?"

When examining the peak fees during periods of high demand for the next block, we observe that a significant portion of the total fees paid in that block is driven by a small number of users paying extremely high fees, indicating strong convexity. However, this relationship becomes less apparent on days with lower fees. To illustrate the two-way dynamics of Bitcoin fees, the graph below shows that on May 15th, the top 2% of transactions accounted for over 15% of the total fees. On average, the top 10% of transactions account for 21.05% of the total fees in a block. However, the percentage from the top 2% of transactions sharply decreases during the peak fee period in May and then rebounds.

Under normal circumstances, when Bitcoin fees are not surging, most of the fee pressure is driven by outlier transactions, which we define as the top 2% of transactions in a block calculated by sats/vByte fees. This is also reflected in the difference between average sat/vBytes and median sat/vBytes, likely due to involuntary overpayment or a lack of understanding of mempool dynamics during fee volatility.

During fee peak periods, these outliers account for a smaller proportion of the overall fee pressure, indicating that while users are increasing their fees to be included in the next block, they may not necessarily be overpaying compared to other high time preference users. They are also competing to be included in the same block.

In the next section of this report, we will delve into the new developments in Ordinals infrastructure and minting technology.

V. New Developments in Ordinals

Bitcoin transactions, especially those involving ordinals, have greatly benefited from previous protocol-level upgrades (such as Segwit), which reduced the transaction weight and thus the overall fees for these transactions. However, Segwit was not initially designed for Ordinals, and neither was Taproot (a Bitcoin upgrade that made the creation of Ordinals possible). The existence and proliferation of ordinals on Bitcoin have become possible for unexpected reasons, but since their creation earlier this year, the Bitcoin development community is now working together to intentionally support such activities by building tools centered around ordinals. (For a deeper discussion of the factors leading to the creation of ordinals and their impact on Bitcoin development, see the report from March 2023.)

This section of the report will focus on the new technologies being developed on Bitcoin to facilitate the growth and maturation of the Ordinals market.

1) Recursion

In June 2023, a major Ordinals block explorer was upgraded to enable recursive inscriptions and added support for JavaScript and CSS file types. Recursion allows users to link one inscription to another in the following format: /content/. Through recursion, users can add JavaScript and CSS libraries to create rich HTML files directly on Bitcoin. One of the best examples of the benefits of recursion is provided by the OrdinalsBot team, which we will discuss below:

Example of Recursive Inscriptions

Source: OrdinalsBot

If each layer above were inscribed into a single image, the file size would be 250 kb before any compression techniques, assuming a collection size of 10,000 pieces, and an inscription cost of 10 sat/vybte, the cost would be approximately 1.8 million USD.

With recursion, HTML inscriptions can be created. By leveraging the HTML canvas element, minters can use JavaScript to create graphics, as shown in the image below:

HTML used to create graphics with JavaScript, Source: OrdinalsBot

Then, recursion can be used to reference the written JavaScript logic, significantly reducing block space usage and the associated costs of generating the final image.

This process is operated through a comprehensive script containing a single drawing function. The function takes a canvas element and a series of inscription links, coordinating the loading of all image layers.

As a result, it facilitates seamless creation of the canvas, ensuring the presentation of the complete image rather than gradually loading individual layers, providing a more streamlined and cost-effective visualization process.

Final recursive inscription, Source: OrdinalsBot

The final result is a complete image that can be resized or saved just like a regular image. Compared to 250,000 bytes, the final HTML inscription is only 621 bytes, yet the image can still be viewed at full size or at a resolution of 250,000 bytes.

Assuming a collection size of 10,000 blocks, the recursive process can save 99.7% of the total size (6.21 MB versus 2.5 GB).

Assuming a fee rate of 10 sats/vByte, the total cost of inscribing the collection using recursion is approximately 12,000 USD, compared to 1.8 million USD if inscribed separately without recursion.

In conclusion, recursion can be used as a compression technique to allow for larger collection sizes and reduce minting costs. Through recursion, collections can record the features of generating or creating PFP collections as their own separate layers and use recursion to call these individual layers to generate the file image. Three other major benefits of recursion include:

- Creators can surpass the 4 MB block size limit.

- Recursion can assemble complex digital artifacts, reflecting the process of piecing together a puzzle. Initially, individual components (similar to puzzle pieces) are inscribed separately. Subsequently, the final inscription integrates these different elements, synthesizing them into a cohesive and singular image, presenting a unified visual from segmented inscriptions.

Recursion enables composability, unlocking various use cases. One major benefit of the composability provided by recursion is the ability to conduct on-chain art display processes. Onchain Monkey (OCM) Dimensions is the first series to be displayed on-chain. Another use case unlocked by recursion is the ability to conduct open edition and limited edition prints. Gamma recently released "Prints" as their new edition. Prints are achieved through the use of recursion, where artists inscribe on a high-resolution original artwork, and Gamma creates a package for creating digital versions. By embedding print numbers directly into the digital asset, the print version number can be viewed on any screen. Other features include conducting on-chain lotteries and utilizing the ability of the on-chain inscriptions code library. The Onchain Monkey team has incorporated p5.js and Three.js libraries, allowing them to create their own Dimensions digital artifact collections. Users are also starting to join more advanced libraries, such as react.js and Animate.css.

Recursion makes it more feasible to create games directly on Bitcoin. Developers can inscribe popular game libraries and create more complex native on-chain 3D games by referencing these libraries through recursion.

In a sense, inscriptions have the ability to transform Bitcoin block space into a global hard drive, and recursion effectively optimizes storage and data, making it cheaper and more composable, thus expanding the possibilities and design space. The market and browser act as web browser clients for exploring and experiencing content on the Bitcoin blockchain. As more people write code libraries into Bitcoin, these libraries can be referenced, making it easier for all creators to build more immersive experiences and artworks. Ordinals collector Jokie88 has launched a GitHub repository to track a list of all code libraries recorded to date. The list currently includes 40 different libraries that can be referenced through recursion.

2) Reinscription

Reinscription allows users to inscribe multiple pieces of data onto the same satoshi (the smallest unit of Bitcoin). To reassign a satoshi, the user needs to own it, so artists cannot reassign the satoshi containing their artwork after it has been sold. Reinscription was launched in the Ord client version 0.9.0 released on September 11, 2023. It should be clarified that reinscription does not affect the immutability of inscriptions. Reinscription does not overwrite or delete previously inscribed data on the satoshi, but rather creates an array of data. All data reinscribed onto the satoshi appears in chronological order.

The five main benefits of reinscription are:

- All recursion elements inscribed on a single satoshi: Reinscription combined with recursion allows individuals to inscribe all recursion elements on the same satoshi to create larger, more complex digital artifacts.

- Version control technology: Reinscription can be used for upgrading or version control of code libraries or other on-chain applications.

- Reducing the risk of fungibility issues: While inscriptions have already posed minimal risk to the fungibility of Satoshi, reinscription further reduces this risk, as multiple assets can be stored on a single satoshi.

- New metadata and storytelling opportunities: Through reinscription, artists can effectively create an entire art gallery or series on a single satoshi. Artists can also use reinscription to create dynamic or lifelike artworks. For example, reinscription can be used as a better way to inscribe books, where each page can be inscribed onto a single satoshi and then viewed in chronological order through a browser.

Reinscription also provides a mechanism for proving ownership. After purchasing an inscription, collectors can re-inscribe a text file with their name and then sell it to a new owner to show the history of the artwork collector.

3) Parent-Child Inscriptions

Parent-child inscriptions are a way to strengthen the provenance guarantee of inscriptions. Provenance refers to the ownership history, creator, and creation time of the artwork. Establishing provenance is crucial for verifying the authenticity of artworks. The authenticity of NFTs on Ethereum and other general blockchains is determined through accounts and smart contracts. Provenance is determined by the wallet address that deployed the issuing smart contract. However, Bitcoin does not use an account-based model, making Ethereum-based provenance methods impractical.

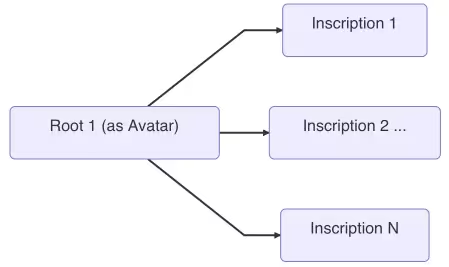

Ordinals creator Casey Roadamor did not link provenance to Bitcoin wallet addresses, citing privacy trade-offs and lack of customizability, but instead conceived the idea of root inscriptions, which would serve as avatars or logos for future works. The root inscription is the "parent," and future inscriptions, the "children," can be linked back to the parent. In practice, it works by using the satoshi of the root inscription as the input for a revealing transaction. When the output created by the submitted transaction is spent, it displays the inscription content on the chain, known as a display transaction. This origin style creates a lineage tree, as shown in the following image:

Simple Design of Parent-Child Inscriptions

Source: Medium, Cypherpork

The pull request for the parent-child inscription standard was merged into the Ordinals client in September 2023 and is currently operational.

4) Rare and Unique Satoshis

Many collectors want their artworks inscribed on satoshis with a certain degree of rarity or uniqueness. Mining pools have also noticed the interest in "rare" satoshis. The mining pools Luxor, F2Pool, and BN Pool, which collectively account for about 50% of the total hashrate, are separating rare resources from their block rewards. In the past few months, rare Bitcoin markets have also emerged, making it easier for speculators and artists to acquire and trade these bitcoins. Some notable markets include Magisat, Danny Deezy'sSat Dispenser, and Lumisat. NFT markets and Ordinals explorers (such as Magic Eden and Ord.io) also welcome the popularity of rare satoshis, allowing users to sort and filter inscriptions by rarity.

Here are some common examples of rare satellite groupings and methods:

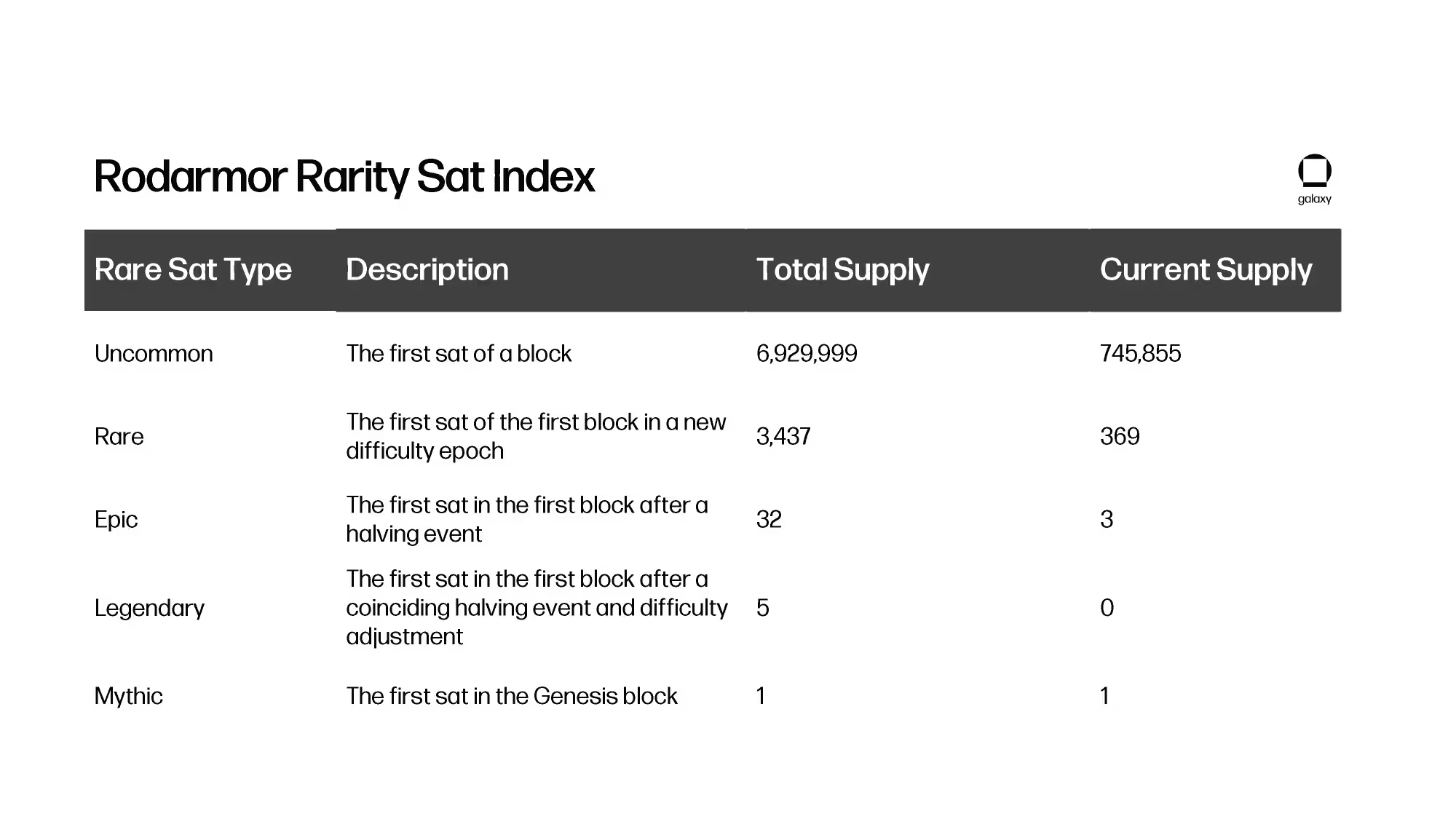

Rodamor Rarity Index. The Rodamor Rarity Index is a method of identifying rare satoshis created by Casey Rodamor, the creator of the Ordinals client.

Block 9 (Block 9 sat) - Satoshi Sats. Block 9 sat is the oldest circulating sat, mined by Satoshi Nakamoto and sent to Hal Finney in the first-ever Bitcoin transaction. From a quantity perspective, the sats from the 9th block are not necessarily rare, as the block contains 500 billion satoshis. It is currently unclear how many satoshis from this early block are still in circulation, as many complete bitcoins from these early blocks are believed to be lost or dormant, locked in wallets whose owners cannot access their private keys. Due to its historical and cultural significance, Block 9 sat is highly sought after. Some popular series inscribed on Block 9 Sats include Ordinal Maxi Biz (OMB) Green Eyes and Timechain Collectibles Series 2.

Block 78. Block 78 is the first Bitcoin block mined by someone other than Satoshi Nakamoto. It was mined by the renowned cryptographer and digital privacy advocate Hal Finney. Similar to the 9th block satoshi, from a quantity perspective, the 78th block satoshi is not necessarily rare, as the block contains 500 billion satoshis, and the circulating supply of these satoshis is still unclear. Due to their history and association with Hal Finney, these satoshis are highly sought after. Some popular series inscribed on Block 78 Sats include: OnchainMonkey (OCM) Dimensions and Ordinal Maxi Biz (OMB) Blue Eyes.

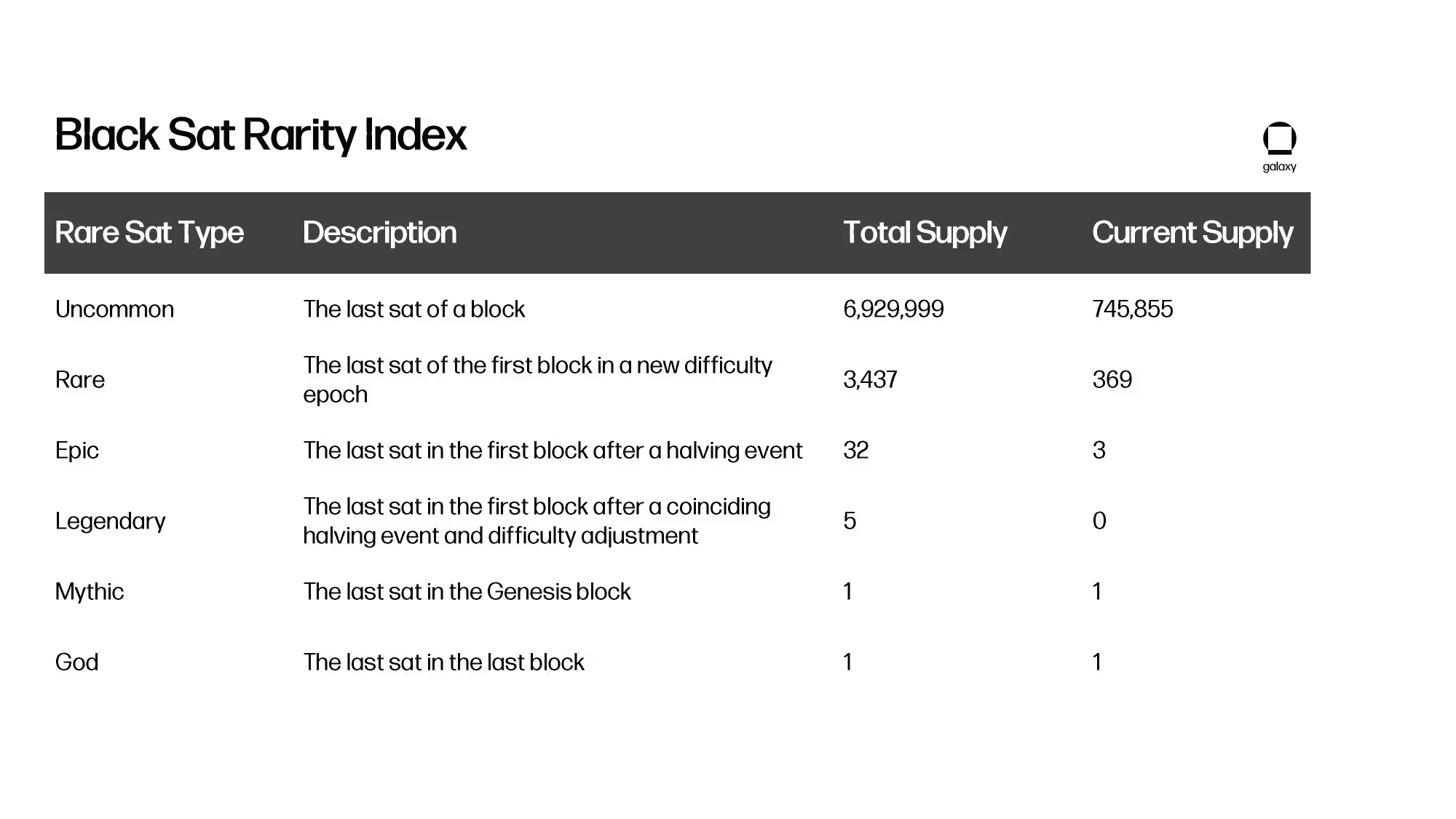

Black Sats. Black Satoshi follows the Rodamor Rarity Index, but it is not the first Satoshi in a block, rather the last Satoshi minted in a block. The concept of black satoshis was created by @blackxbtx.

Palindrome Sats. Palindrome satoshis are those that read the same forwards and backwards, with approximately 9 billion palindrome satoshis, accounting for 0.0000043% of the total supply. Some popular collections inscribed on palindrome satoshis include: Geo Ordinals and Palindromes.

Satoshi Names. Satoshis can be represented in several ways, such as integer notation, decimal notation, degree notation, percentile notation, and names. The most common notation is integer notation, which allocates satoshis based on the order of their minting. Recently, there have been attempts to explore different representations of "satoshi" names. Bitcoin developer and inscriber Danny Deezy has introduced his Satoshi Cards series, pushing the boundaries of satoshi name elements. Satoshi Cards are a collection of trading card-style artworks inscribed with human-readable words or phrases on satoshis.

The Satoshi Card inscribed with "deepdarkweb" by Satoshi Nakamoto. Source: Ordinals.com

Conclusion

Bitcoin is one of the top three blockchains for NFT minting and trading activities, following Ethereum and Solana. By the end of 2023, the trading volume of Ordinals, including BRC-20, is expected to accumulate to approximately $725 million. The adoption and value of Ordinals have continued to grow in recent months, supported by new developments and tools.

One of the most exciting innovations of Ordinals is the recursive inscriptions, which provide a new framework for NFT creators on Bitcoin to expand their digital collections in an economically efficient manner. New collections and file types on Bitcoin may emerge from recursive inscriptions. In addition to recursion, technologies such as parent-child inscriptions are redefining methods for indexing and proving the provenance of satoshis.

Part of the reason for the backlog of transactions in the mempool is the ongoing minting activities of Ordinals, which may exacerbate fluctuations in transaction fees, which could be positive for miners, especially as the Bitcoin halving approaches, and may encourage crypto wallets and exchanges to adopt more sophisticated fee estimation strategies. Miners and mining pools are also embracing satoshi collection by collecting and selling rare satoshis.

The Ordinals movement is propelling Bitcoin into an unprecedented era of innovation, harnessing the untapped potential of general-purpose computation on the blockchain, giving rise to a variety of new products. Looking ahead, the development path of Ordinals is not only hopeful, but the maturation of infrastructure and the rising adoption trend also point the way for us. This sustained momentum confirms the view that satoshis are not a passing trend, but a permanent fixture in the field of on-chain digital collections.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。