If you want to do a good job, you must first sharpen your tools. - Confucius

If you want to gain a competitive advantage in this rapidly changing market, mastering the right tools is crucial. In this article, I will combine my years of experience in the industry to share several free cryptocurrency trading software that I use. If you only know how to use exchanges to check the market, then this article is worth saving.

First, I do not recommend using only exchanges to check the market for the following reasons:

Different exchanges have different depths. If you are a novice, you may not be clear about the specific situation and strength of your exchange. After all, there are currently more than 200 exchanges in the market. Therefore, by only using one exchange to check the market, you may not be able to fully see the market liquidity and other data changes, missing the opportunity for comprehensive analysis.

Exchanges have overly simplistic data and indicators. Almost every exchange uses basic data indicators, which are used by almost everyone and belong to the consensus, making it difficult to gain a trading advantage.

Checking the market on a single exchange cannot find opportunities such as funding rates and spread arbitrage. These operations require cross-platform searching.

The current cryptocurrency market is closely related to traditional finance (TradFi), and you need to horizontally understand the changing trends of the entire financial market. For example, for macro fundamental analysis, you may need to understand the impact of foreign exchange, stock markets, and other important economic data on the market, in order to establish trading advantages based on relevance.

Without further ado, I will now analyze the advantages and disadvantages of each market-watching software.

Cryptowatch

This is a little-known cryptocurrency multi-screen market-watching software with a very simple interface. If not set up, it will display a grid of cryptocurrency observations. However, I usually set up my own observation list based on relevance, while also monitoring the market changes of different markets, and can monitor altcoin indices, DeFi indices, or ETH/BTC, while also checking various foreign exchange markets or US stock changes.

Advantages: Free, simple, can cross different markets, and data and indicators are based on tradingview.

Disadvantages: Cross-market monitoring requires some difficulty for novices, lacks other information or community content, and cannot see others' viewpoints.

Coinglass

This is a cryptocurrency market-watching data website created by a Hong Kong team. Their team operates in a distributed manner and has recently made many data improvements. They have added many effective market filters and currently provide them for free. They mainly rely on API interfaces and website advertising for monetization. The website has a daily active user base of 20,000, supporting on-chain data analysis, exchange data, and CME data. I believe that for cryptocurrency traders, the depth of this website is beyond doubt.

Advantages: Also free and supports various types of data. The candlestick charts support many cryptocurrency-specific indicator data, such as various funding rates, long/short ratios, and position situations, and can also monitor abnormal movements of different cryptocurrencies. These are not available on exchanges, and even tradingview does not have them. It also supports multi-screen. In addition, Coinglass supports a mobile app, making it convenient for users to access.

Disadvantages: Although Coinglass can also view data such as the US dollar index, grayscale, and CME, the traditional finance (TradFi) data is still insufficient and cannot achieve the goal of monitoring the global market. The website does not have an embedded community and does not provide channels for market viewpoints, which need to be accessed through third-party platforms.

Dextools

Friends who like to play in the primary market will definitely not be unfamiliar with this website. Nearly 100,000 people trade on this website every day, making it the leading website for primary market market-watching. The website has a monthly traffic of 13.5 million, surpassing most secondary exchanges.

Advantages: This is a free market-watching software focused on the DeFi market, where you can check the liquidity data of each trading pair and list the corresponding candlesticks. The website can provide a reliability score for each project and can also monitor newly listed trading pairs.

Disadvantages: Only suitable for the primary market, the indicators are basic and cannot provide TradFi information. The website does not have an embedded community. There are too many low-quality projects on the website, making it unattractive to secondary market and derivative traders.

Coinalyze

This is also a niche cryptocurrency market-watching website that supports viewing open interest contracts, funding rates, liquidation situations, and other indicators. It also supports viewing different levels of moving averages and RSI overbought/oversold data, and provides various candlestick pattern alert prompts.

Advantages: Like Coinglass, it supports cryptocurrency-specific data indicators, but provides data charts for checking RSI and moving averages, as well as candlestick combination prompts, which Coinglass does not have.

Disadvantages: No TradFi-related content, no multi-screen function, no community or market viewpoint provision, and may not be highly practical for Chinese users.

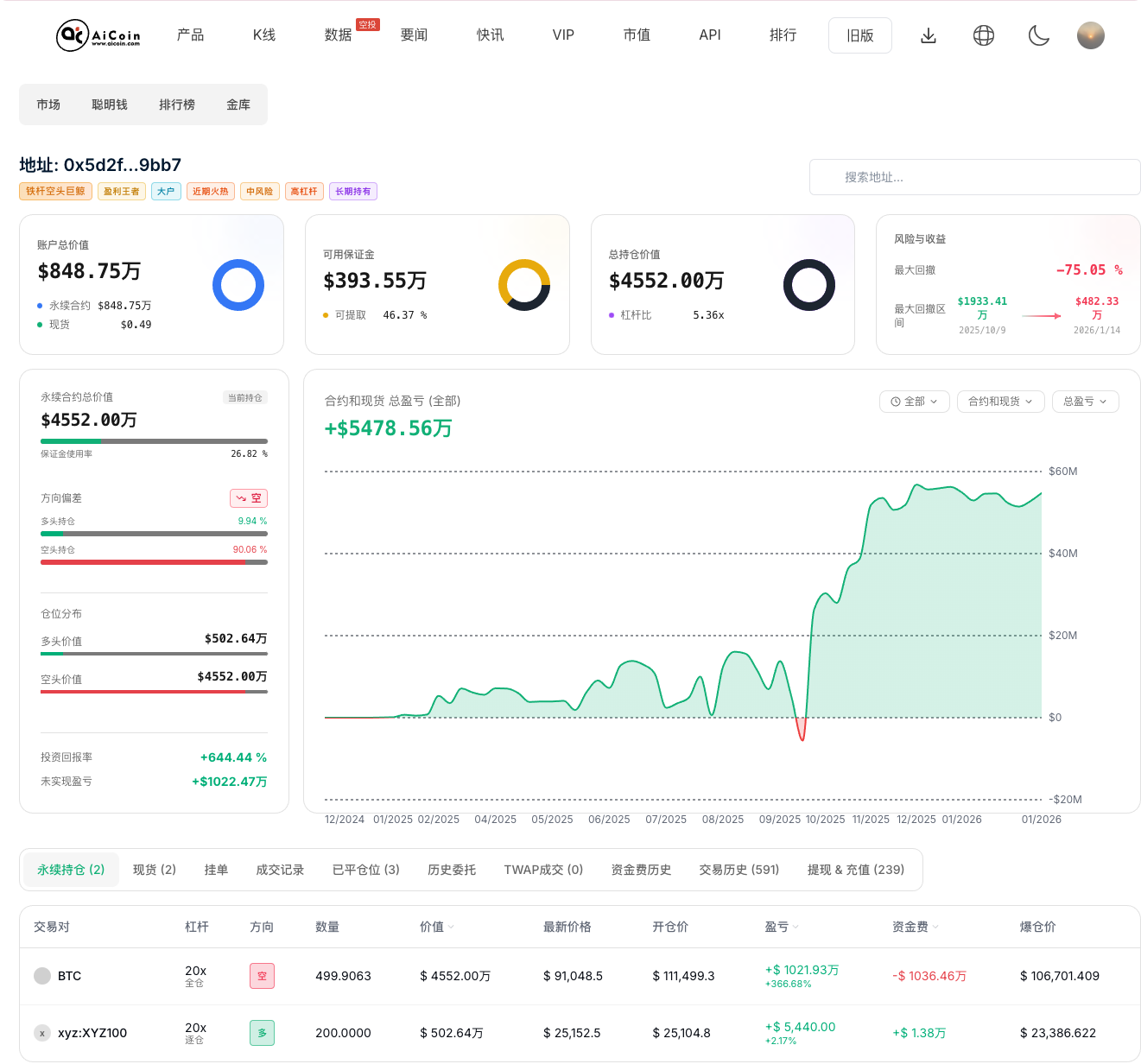

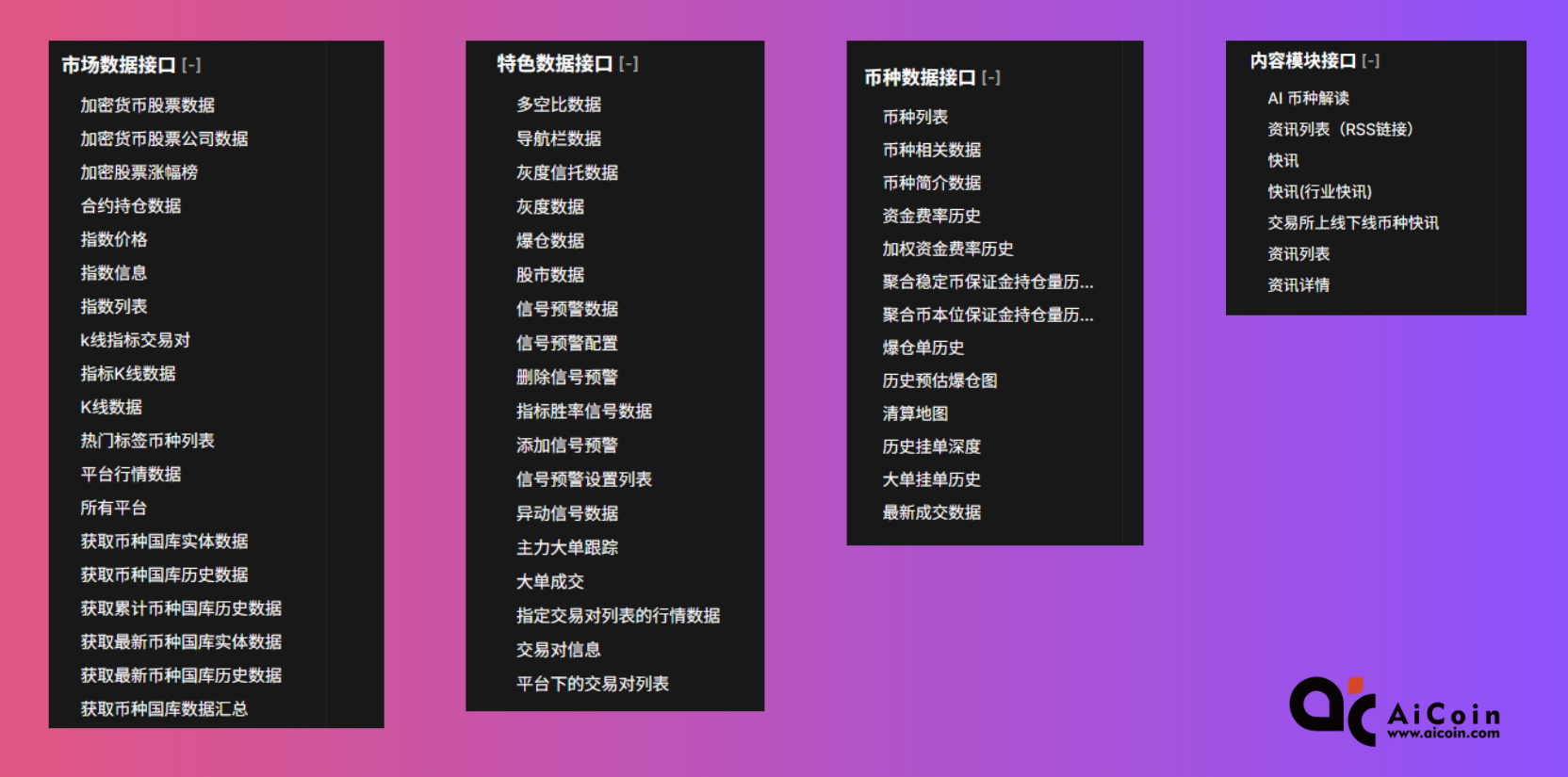

Aicoin

Aicoin is a cryptocurrency trading software that has been developed for many years, supporting on-chain data, market data, US stock indices, precious metal prices, grayscale data, options, etc. This is also a market analysis software commonly used by most cryptocurrency KOLs, but the free version only supports basic data indicators, and the advanced version requires a payment of at least 70U.

Advantages: Can directly connect to exchange KPIs for direct trading, providing real-time market information and economic data, and can view other analysts' market viewpoints and provide embedded community communication. Supports multi-screen viewing, allowing simultaneous monitoring of market changes in different markets. Supports mobile users.

Disadvantages: Can only support a few basic TradFi data (US dollar index, Nasdaq 100, etc.), but the variety is still not rich enough. For example, I cannot monitor the situation and candlesticks of related stocks and ETFs in the cryptocurrency market. Also does not support viewing funding rates and other derivative indicators.

Tradingview

This software is not unfamiliar to any trader, with 2.3 million people using it every day. TradingView provides a rich variety of chart types and technical indicators, allowing users to conduct in-depth technical analysis. It supports multiple chart types, such as candlestick charts, area charts, line charts, etc., as well as over 100 commonly used technical indicators. Supports unlocking more data indicators through payment.

Advantages: The platform has built-in social features, allowing users to share viewpoints, charts, and analyses with other traders. This social interaction helps with learning, sharing insights, and benefiting from the experiences of other users. TradingView provides real-time market data, including stocks, cryptocurrencies, forex, and more. Users can instantly access the latest prices, trading volumes, market depth, as well as real-time updates on news and events. The platform offers flexible personalization settings and customization options. I can adjust chart styles, indicator settings, timeframes, watchlists, etc., according to my needs to adapt to specific trading strategies and preferences.

Disadvantages: Compared to Coinglass, it provides fewer derivative product data and not as much specific cryptocurrency market data.

Summary

In fact, there are many software tools that can display cryptocurrency market data, including Coinmarketcap, CoinGecko, Feixiaohao, Mytoken, Coinpaprika, which are specifically for the cryptocurrency market, as well as websites like Investing.com, Bloomberg, which are combined with traditional finance (TradFi) charts, and even more unconventional tools like MT5. However, these are not the tools I am accustomed to, and may not be very appealing to pure traders and data analysts. I believe the above software can meet the needs of anyone watching the cryptocurrency market.

Note: All content represents the author's personal views and is not investment advice. It should not be interpreted in any way as tax, accounting, legal, business, financial, or regulatory advice. Before making any investment decisions, you should seek independent legal and financial advice, including advice on tax consequences.

For more content, follow: Public Account KeplerResearch, Twitter @kepler008

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。