Market Overview

The highest realm of life is understanding, and the highest realm of life is tranquility of the heart. Don't waste your energy on irrelevant people and matters, don't dwell too much on small gains and losses, let your heart settle, work with a tranquil mind, be consistent in your conduct, cultivate the charm of your character, enhance your own strength, and win the opportunities and respect that belong to you. Only by enduring loneliness can one regain the hustle and bustle; only by experiencing sadness to the fullest can one regain a smile; only by tasting bitterness can one naturally savor sweetness. Words are casual, but life is ultimately a long process, and every moment must be experienced firsthand, and every drop of rain must be tasted.

The actual GDP for the second quarter in the United States and the initial jobless claims from last week were both below expectations, but the market maintained resilience, awaiting the PCE inflation index. U.S. stocks rebounded from a four-month low, with the Nasdaq, S&P, and small-cap stocks all rising by 1% at one point. Chip stocks led the rebound.

The U.S. dollar, U.S. bond yields, and oil prices cooled down. By midday, U.S. bond yields joined the decline in oil prices and the U.S. dollar. The 10-year and 30-year U.S. bond yields hit their highest levels since 2007 and 2010, respectively. The U.S. dollar is set to rise for the 11th consecutive week. U.S. oil fell by over 2% after rising above $95 for the first time since August last year. Gold fell for the fourth consecutive time to its lowest level in nearly seven months, while London zinc rose by nearly 6%.

Due to the Federal Reserve's continuous interest rate hikes over the past few months, the global suction effect of the U.S. dollar has been continuously strengthened, leading to varying degrees of reduced liquidity and decreased market activity in global financial markets. When the U.S. dollar interest rate reaches 5%, speculative funds in the market no longer need to take on significant risks. Over the past month, Bitcoin has experienced an extreme contraction in volatility. The overall trend has been slow, with only single-day fluctuations of over 1,000 points occurring on September 11, September 12, and yesterday, September 28. Intraday movements have been mostly characterized by sideways oscillations.

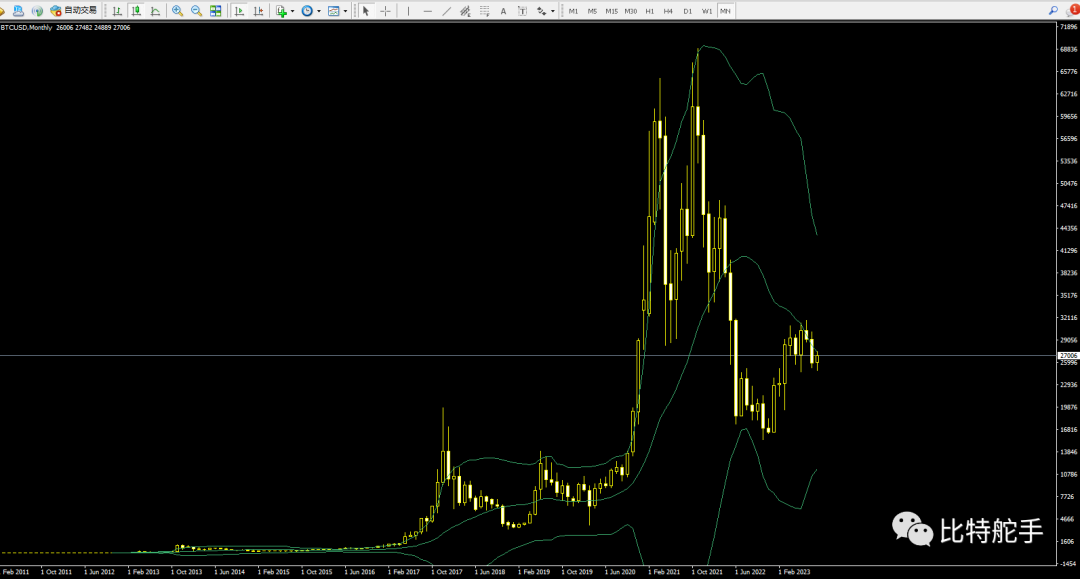

The above chart shows the monthly chart of Bitcoin, observing the sideways oscillation after a recent high in the past six months. Over the past five months, the monthly closing prices have all shown upper and lower shadows, with no strong trend-guided closing patterns. The gray line, which is near the current price of 27100, is particularly important. As we have mentioned before, 27100 happens to be the lowest opening and closing price in April, May, and June. This is not a coincidence. Last month, in August, the end-of-month price was also above 27100, and the last two trading days directly broke through this level. Today, September 29, is the end of September. We need to pay attention to whether the closing price tomorrow can directly rise above this key price of 27100. If the closing price tomorrow is above 27100, then October can be anticipated!

The above chart shows the weekly chart, with prices trading sideways around the upper and lower bands of the Bollinger Bands for nearly six months. From the perspective of the weekly and monthly charts, one thing is clear: the rebound that started from 15555 has not ended. Although the short-term market is entangled due to liquidity issues, everyone's perspective has also narrowed. A 300-point fluctuation during the day can be surprisingly exclaimed as a big rise or fall. When did 300 points become a big rise or fall? The onlooker sees clearly, have you already entered the market? In the speculative market, being diligent in trading will not increase your chances of winning. Instead, it will make you more deeply entrenched in the market, limit your thinking, and narrow your path.

The above chart shows the daily chart of Bitcoin. In the current environment of reduced liquidity, can the price break out of this short-term W-shaped pattern at the end of this sideways movement? We wait and see. Tomorrow is the last trading day of September, and we need to pay attention to whether the monthly closing price can be above the price of 27100, which has a certain guiding significance for the trend in October!

Although the volatility has decreased and the fluctuations have become smaller, the trend has not changed. The price is just slow and small, but the trend remains unchanged.

For friends holding spot positions, below 28000, around 26000, and around 27000, we have repeatedly suggested that you can buy spot positions at will, and the future is still promising. The 3000-point entry range has provided a month's time to enter the market. Don't complain and make excuses when the market surges later. The market only rewards those who are brave and foresighted. Just continue to hold patiently. Small fluctuations and slow movements do not affect the trend. The price has not deteriorated. There is no need to constantly send private messages to ask me every day.

For friends trading futures, every strategy must be accompanied by a stop-loss. In fact, this kind of volatility is not particularly friendly for speculative trading in futures, as the opportunities for speculation and arbitrage are extremely limited. It is always wiser to wait and see. For friends who cannot endure loneliness and cannot control themselves, light trading is recommended. The risks are not as great as they used to be, and of course, the profits are relative.

Today is the Mid-Autumn Festival, I wish everyone a happy Mid-Autumn Festival and a happy and healthy family!

If there are any changes in the prices during trading hours, the helmsman will provide real-time updates to everyone!

All analysis and judgments are probabilistic predictions. The market carries risks, and speculation should be approached with caution!

All analysis and judgments are probabilistic predictions. The market carries risks, and speculation should be approached with caution!

All analysis and judgments are probabilistic predictions. The market carries risks, and speculation should be approached with caution!

September 29, 2023

Please click "Read" in the lower right corner to protect the investors, starting with me!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。