Source: The Things About the Internet

Image Source: Generated by Wujie AI tool

The trend of membership fees has finally reached the smart speaker field.

Recently, many users have reported that their smart speakers have suddenly started to charge fees. Previously, they could play music and other content for free just by speaking, but now they must subscribe to the speaker's exclusive membership to do so.

What's even more classic is that even with a membership, not all functions can be used.

In terms of specific prices, the annual membership fees for various brands generally range from 109 to 159 yuan, including a choice of music library from QQ Music/Kugou Music/Kuwo Music and some story readings and other content.

Of course, if you want to enjoy playing APP member songs without subscribing to a smart speaker membership, you can also do so by connecting via Bluetooth.

But this also raises another question: what is the difference between a smart speaker that costs several hundred yuan and a Bluetooth speaker that could be bought for tens of yuan in the early years? Does today's smart speaker still have any intelligence?

Starting with intelligence, ending with nested dolls

In fact, before officially "harvesting the leeks," major smart speaker manufacturers had already bound them with large models. The reason is that the smart speaker is one of the terminal application scenarios where AI large models are most easily landed, and smart speakers are also in urgent need of breaking through.

As a result, Xiaodu, Tmall Genie, Xiaoai, Xiaoyi, and other smart speakers successively integrated their own large models.

Perhaps from the user's perspective, the integration of large models into smart speakers may seem a bit redundant. After all, under normal circumstances, users can only give it extremely simple commands, such as listening to music, checking the weather, controlling lights, or telling bedtime stories to children, which are relatively basic functions.

But if we set aside the user's demand for smart speakers and look at the advantages of large models combined with the technology needed for smart speakers, we will find that this is a "complementary" process.

First, it is necessary to understand that the main technologies of smart speakers are automatic speech recognition (ASR), natural language processing (NLP), and text-to-speech (TTS). The key technology that can push smart speakers towards intelligence is natural language processing, and large models happen to serve as a supplement, while large models can also be landed in terminal application scenarios.

However, at present, the demand for smart speakers integrated with large models has not yet broken through.

According to the "China Smart Speakers Retail Market Monthly Tracker" data released by RUNTO Technology, in the first half of 2023, the total channel sales volume of smart speakers in China was 11.48 million units, a year-on-year decrease of 19%; and the sales revenue was 3.37 billion yuan, a year-on-year decrease of 20%.

The reason is that user demand in the consumer market is still the primary indicator. Regardless of the continued demand for storytelling, music playback, or question searches, when these conditions can be met by mobile phones, the substitutability of smart speakers will weaken.

Moreover, unlike the smartphone market, which is saturated, the smart speaker market has a "limited" audience.

On the other hand, according to public information, the prices of various hardware devices are not high at present. For 89 yuan, or 119 yuan, 134 yuan, and other prices around 100 yuan, a smart speaker can be purchased. If you want one with a screen, the price is slightly higher, around 500 to 600 yuan.

Although the demand for those with screens is higher, under the current trend of not breaking through as a true entry point for smart homes and declining sales, smart speakers currently seem more like one-time consumer goods.

To put it more bluntly, the current low sales volume of speakers not only makes it difficult to cover every production link, but also makes speaker memberships the fundamental means for manufacturers to recoup costs.

Rather than being a pricing issue, the "play" of smart speakers and many Internet products is "not relying on hardware to make money." Even if the hardware profit is high, it ultimately comes down to "content fees."

Moreover, due to the cooperation between platforms and hardware manufacturers, hardware memberships have already been defined.

As the official customer service said, "Other music memberships from platforms such as QQ Music's Green Diamond membership and Netease Cloud Music membership currently do not support use on speakers. Our cooperation with QQ Music, Kugou, and Kuwo provides music resources. If you want to listen to member music on devices like speakers, you need to have a speaker membership with music rights."

From being a medium to becoming a necessity, the distance is like a mountain

To some extent, the "content payment" of smart speakers, which is considered as the entry point for smart homes, has become an unchangeable fact, but users' resistance is also difficult to dispel for a while.

The most obvious sign is that many users have filed complaints on the "Black Cat" platform. For example, a search for "Tmall Genie" yields 1207 complaints, with recent complaints focusing on words such as "irregular charges," "mandatory membership activation," "deceiving consumers," and "secondary charges."

From the user's perspective, what users may be more concerned about at present is the manufacturers' silent nesting behavior.

For example, when purchasing a smart speaker initially, the merchants did not mention the issue of paying for playing music, but now they require a paid membership to enjoy music, resulting in the smart speaker's function being limited to basic and non-essential functions.

A more direct feeling is that, without a membership, when you make a request to your smart speaker at home, will it always execute it for you promptly?

Not necessarily. Even with the support of large models, it may have understood your request and fully grasped the key words, but it may face the problem of you not having the right to enjoy a certain song, or not having the permission to listen to a certain bedtime story.

More importantly, in the early stages, in order to leverage a larger smart home market, the effect of attracting users to buy smart speakers at low prices is not satisfactory. Is the introduction of speaker memberships not adding to the trouble?

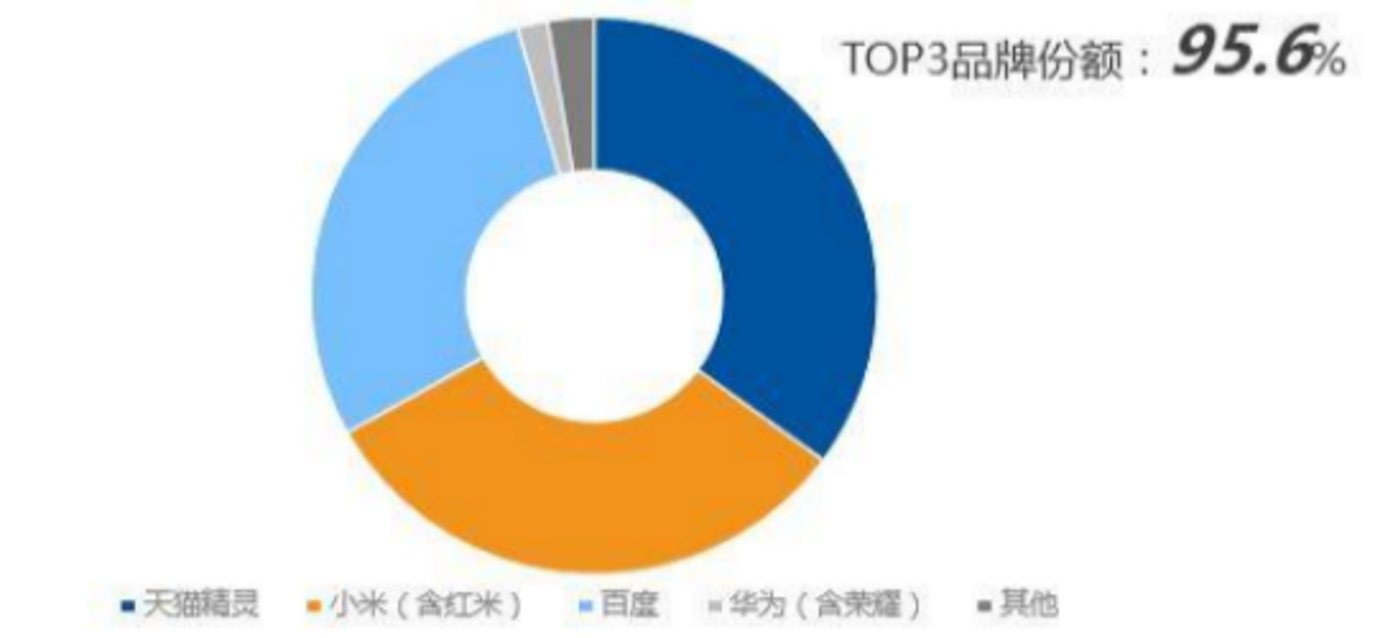

Last year, the domestic smart speaker shipment volume was only 26 million units. However, it is worth noting that the market structure has already shown a high degree of concentration, with the combined market share of Xiaodu, Xiaoai, and Tmall Genie exceeding 90%.

And the overall market share gap among these top players is not large, with Baidu at 35%, Xiaomi at 31%, and Tmall Genie at 27%. The result of the three-way split means that no one has crossed the threshold of 10 million units shipped.

As the market puts it, "This achievement, placed on the smart speaker track that was once seen as the next key entry point for the next generation of the Internet, even if it cannot be said that the bubble has completely burst, it has indeed receded."

Under the dual influence of non-essentiality and economic downturn, consumers will be more inclined to make conservative purchases. If manufacturers happen to be eager to harvest users at this time, consumers are bound to put a brake on smart speakers.

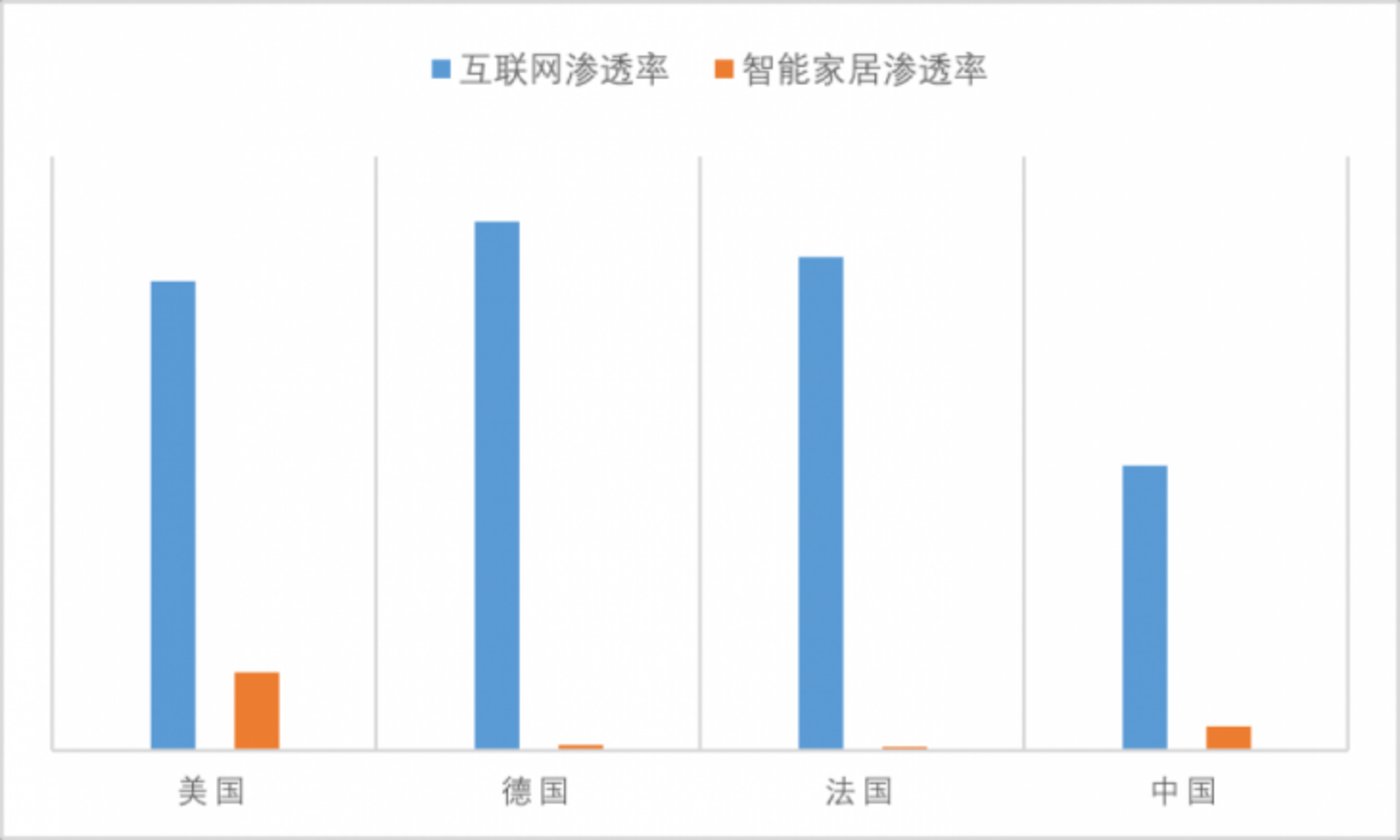

Apart from the membership issue, in a research report from April by China Securities, Statista data was cited, giving the current penetration rate of smart homes in China as only 13%.

To be more rigorous, considering the situation of some home appliances being left unused, the actual utilization level may be even lower than this data, greatly reducing the demand for the "entry" of smart homes.

Obviously, under the premise of low functional demand, blocking the hardware membership fee is undoubtedly forcing oneself onto a dead-end road.

Followers of Membership Fees, Not Just Smart Speakers

However, from the perspective of manufacturers, in the brutal price war, almost all manufacturers are losing money on smart speaker hardware. And this sustained loss is difficult for manufacturers to accept and sustain.

For example, according to internal documents, the annual operating losses of Amazon's device department, including Alexa, have exceeded $5 billion in recent years.

It can be said that this is one of the reasons why many smart speaker manufacturers have introduced content fees.

Another reason may be that the era of smart homes has too much uncertainty, and currently, there is no better profit model for such products. "Content fees" have become a necessary choice, even if users have resistance, all of these are actually commercial actions.

Similarly, the success of Apple and Android as the earliest terminal entry points has become the best example for smart speaker manufacturers.

Because for market players who have not been able to enter the mobile phone market, they all recognize the importance of the terminal entry point of smart speakers and naturally want to firmly grasp the entry point in their own hands, and are unwilling to hand over the "content platform."

It is also because of the intelligence of all market players that the plan to turn smart speakers into the central control of smart homes has faced heavy resistance from the beginning.

After all, beyond commercial actions, this kind of membership service that cannot achieve sharing across multiple platforms and copyrights is actually unsustainable.

In this regard, the market generally believes that platforms such as QQ Music, Kuwo, and Kugou, which control content resources, should also be open to more consumers.

But would the "content platforms" want to hand over the "bridal gown" to smart speakers? Everyone's goal is to charge fees, which also involves another market competition.

However, it is worth mentioning that with the precedent of TV memberships and smart speaker memberships, there will be more smart products following in the footsteps of the former in the future.

And similar "nested doll" fees can also be detached from smart products.

There is nothing wrong with hardware manufacturers charging for services, but the form actually needs to be improved, after all, consumers' money is not blown in by the wind.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。