Original Author|Riyad Carey

Original Translation|Odaily Planet Daily Nan Zhi

Overview

What is Depegging? In its simplest form, depegging refers to stablecoins trading at a discount to the fiat currency they represent.

However, under the strictest and most practical conditions, this definition does not fully apply; a stablecoin trading at a tenth, a hundredth, or a thousandth of a discount to the dollar is considered depegged. If we say that TUSD priced at $0.9998 is already depegged, then this term begins to lose its meaning.

Therefore, the author proposes a metric, using the total trading volume of stablecoins to create a depegging threshold and weighting it based on the trading volume of different trading platforms.

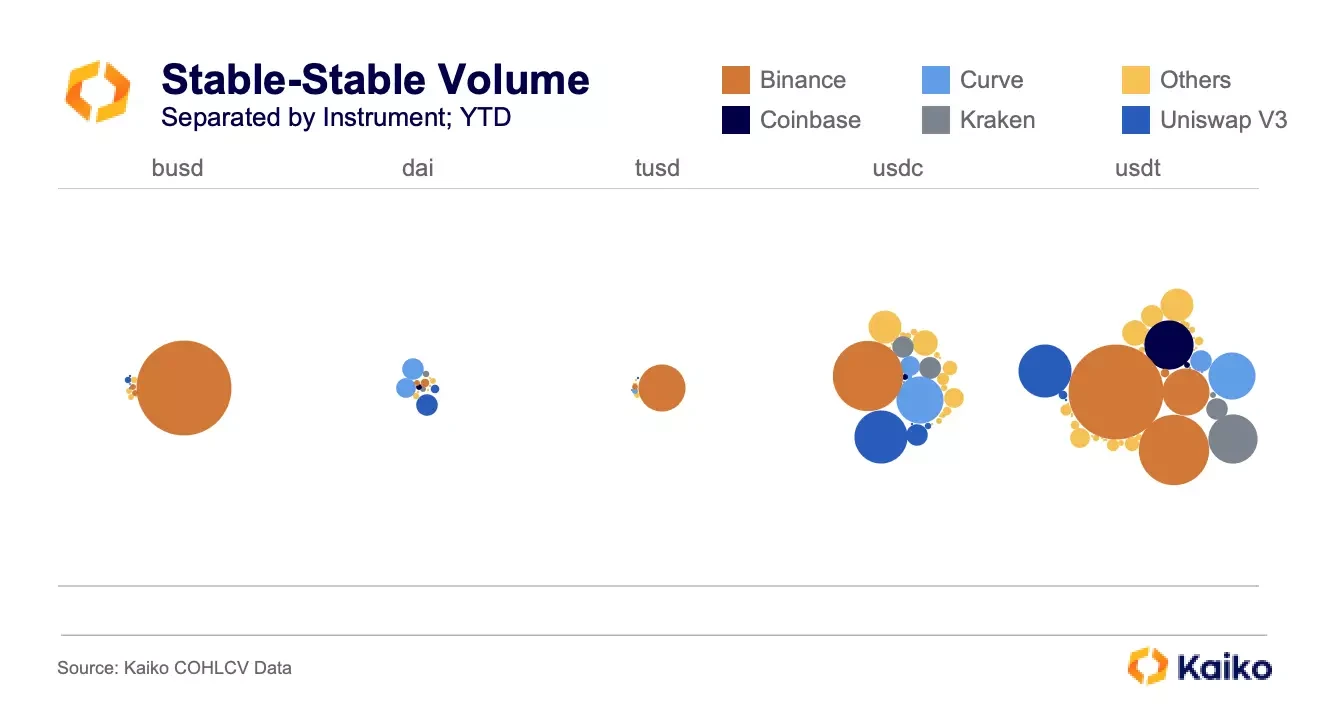

Based on this metric, the most severe depegging of the top five stablecoins this year occurred on March 12 for USDC and DAI, June 12 for TUSD, and August 7 for USDT. It is worth noting that USDT was in a slight depegged state for most of August.

Depegging Threshold

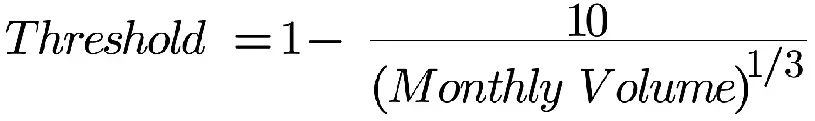

The author established a depegging threshold using the global trading volume of stablecoins, which becomes smaller as the trading volume of stablecoins increases. In short, a stablecoin with a monthly trading volume of $100 billion trading at $0.995 is far more severe than a stablecoin with a monthly trading volume of $10 million trading at the same price. The final formula is as follows:

Applied to the five stablecoins under discussion, the following results were obtained:

The depegging threshold for TUSD rapidly decreased from February to March, as Binance waived the trading fee for BTC-TUSD to promote this stablecoin.

The threshold for BUSD expanded from 0.998 to 0.9955, as its trading volume decreased.

The threshold for USDT has consistently been the lowest, at 0.998 in August.

Trading Volume Measurement

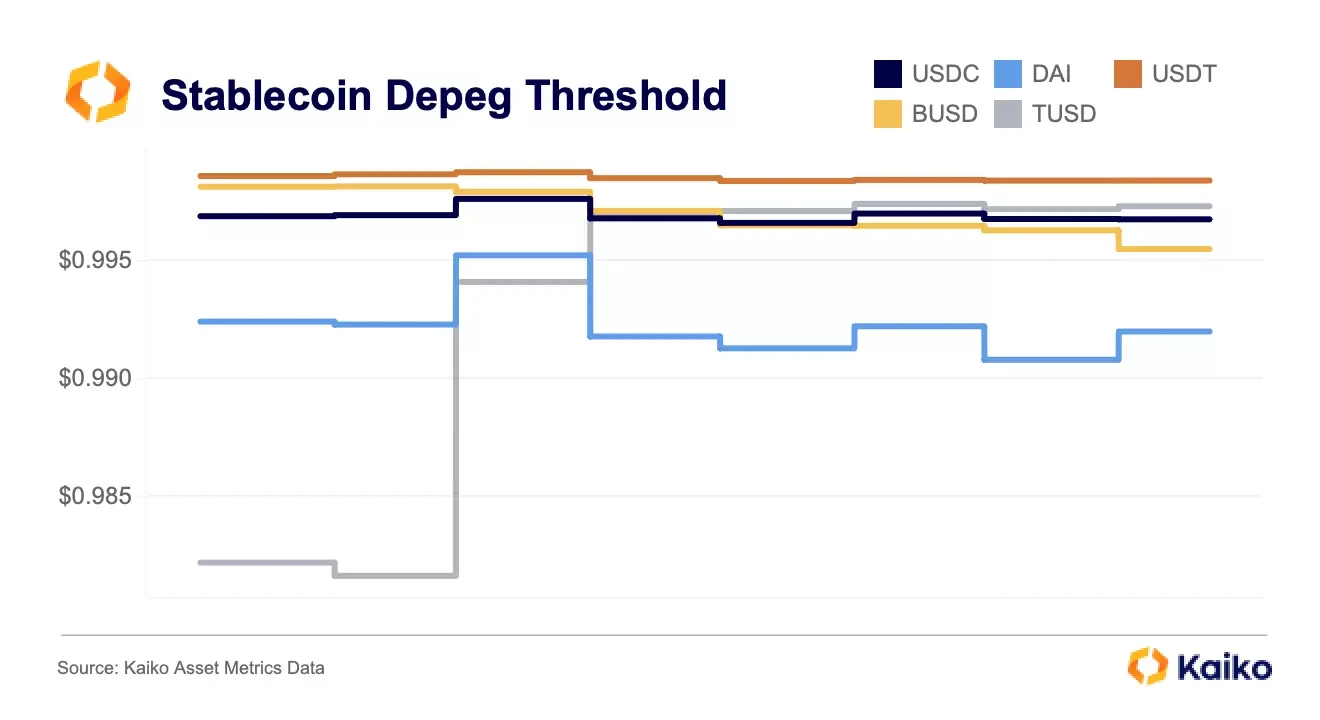

The following figure shows the trading volume of stablecoins against stablecoins as of this year, with different colors representing different exchanges. DAI has the lowest trading volume, at only $17 billion, with nearly $13 billion coming from UniswapV3 and Curve. TUSD follows, with a trading volume of only $24.5 billion, of which $23.5 billion comes from a single trading pair: TUSD-USDT on Binance.

BUSD has a trading volume of $97.5 billion, and is similarly highly concentrated, with $93 billion coming from the BUSD-USDT trading pair on Binance. USDC and USDT differ significantly from other stablecoins, with a trading volume of $150 billion for USDC, spread across 48 trading platforms, and a trading volume of $320 billion for USDT, spread across 75 trading platforms.

Conclusion

Observing the situation at the beginning of August on an hourly basis, USDT experienced a major depegging of 98% on August 7, meaning that USDT was traded at a discount on almost every trading platform. A total of $500 million USDT was sold on Binance, Huobi, and Uniswap, which the author believes is due to the inflexibility caused by Tether's redemption fee and minimum limit.

On a daily basis, the most severe depegging since May occurred on June 7 for TUSD, reaching nearly 60%, with most of the time being discounted on Binance.

TUSD, DAI, and BUSD are relatively stable, with TUSD benefiting from its liquidity being almost entirely concentrated on the same trading platform;

USDC experienced over 10% depegging in March, but has not exceeded 1% since then, showing increasing stability;

USDT has stability issues. Its redemption fee and minimum limit mean that for USDT holders, selling the token on the market is preferable to exchanging it for dollars through Tether. With reduced liquidity, the market cannot absorb large-scale USDT sales. Although the degree of depegging is low in terms of price, the continued discount phenomenon is worrisome. The most direct solution is for Tether to remove its redemption fee and minimum limit. In the second quarter report, Tether's profit reached $850 million, and removing the fee has almost no significant impact on profit, unless the company believes that reducing redemption costs will significantly reduce the supply of USDT.

Related Reading

Why Tether's Continued Issuance of USDT Loans Is a Dangerous Signal?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。