Despite various economic challenges, the US stock market continues to demonstrate its resilience. As the economic situation further stabilizes, there is still potential for further price increases in Bitcoin.

Written by: @Christine, PSE Trading Trader

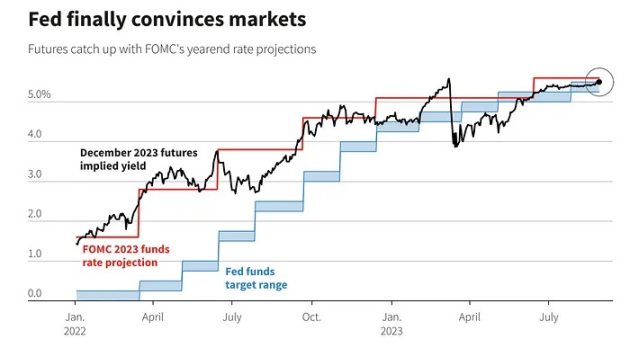

The core reason is quite straightforward: despite various economic challenges, the US stock market continues to demonstrate its resilience. The earnings performance of S&P 500 companies is robust and exceeds market expectations, undoubtedly giving the market a positive signal. We have not yet observed the expected economic recession or significant slowdown on a large scale. The market has already made pre-adjustments for the unknown inflation situation that may occur in the coming months. In addition, the Federal Reserve has clearly expressed its policy direction to pause interest rate hikes after November, which will undoubtedly inject a strong boost into the stock market before the end of this year.

Despite macroeconomic conditions still being volatile, major stock indices have successfully broken through the trading range, undoubtedly indicating that investors' risk appetite is gradually recovering. Thanks to the support of Three Arrows and FTX, the heat in the cryptocurrency market is also increasing.

As the macroeconomic outlook gradually becomes clearer, the price of Bitcoin has rebounded by 40% from the bottom. As discussions on inflation gradually fade from the market's view, investors' attention is once again turning to growth stocks and the field of artificial intelligence. With the economic situation further stabilizing, I firmly believe that there is still potential for further price increases in Bitcoin.

US Stocks: Continuously Rising

Since September, the price of Bitcoin has fluctuated within a certain range, while the US stock market has shown a steady upward trend. Despite no major new economic data released last week, existing data shows that the economy continues to demonstrate strong resilience in the current high interest rate environment. We have not observed astonishing economic growth, but we have also not seen any warning signals of severe recession or large-scale retreat. The estimated growth rate of GDP in the third quarter exceeds 3%, surpassing the forecast of the Atlanta Fed.

Against the backdrop of economic recovery, the recovery of productivity in 2022 is undoubtedly the biggest highlight. This will help offset the impact of slowing hiring, after all, although job growth has slowed, we have not yet received any negative employment reports.

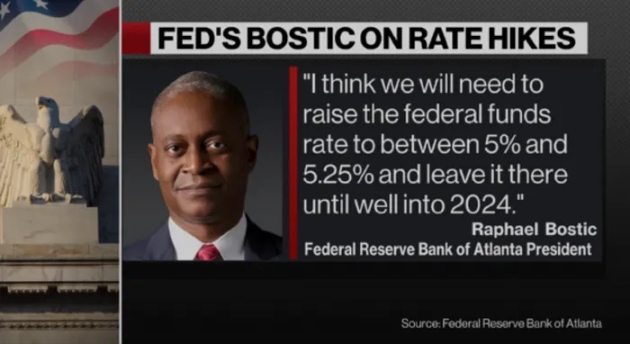

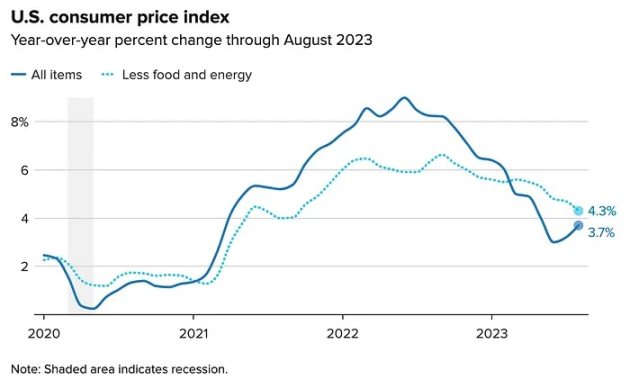

In my personal opinion, the high interest rate environment may persist for a while, but I do not understand why the Federal Reserve needs to continue raising interest rates at this time. Economic growth in September was already very difficult, and although the market predicts that the Fed may raise interest rates again in November, I have not seen any reason to support this estimate. Last week's inflation report showed slightly higher inflation pressure, but this was mainly due to the rise in oil and energy prices. The core inflation index is expected to gradually improve, and the downward trend in the annualized inflation rate will continue.

The Federal Reserve seems to be beginning to realize the economic risks that may arise from continuing to raise interest rates — such as a decrease in the number of bank loans, an increase in delinquency rates for car loans, troubles in the commercial real estate market, and consumer pain caused by the resumption of student loan interest, among others. However, so far, these risks have not caused substantial damage to the economy, and the data still shows that our economy is in a healthy state.

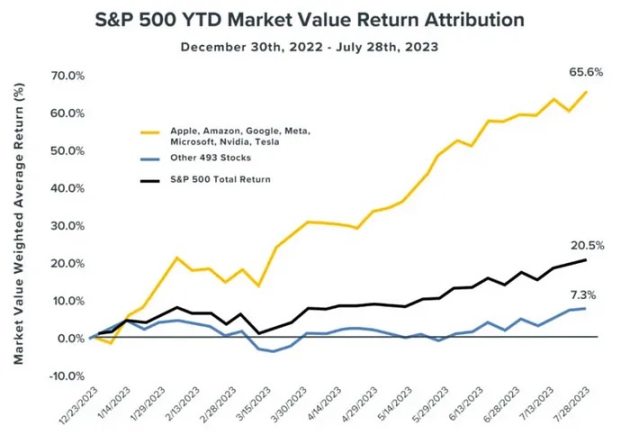

S&P 500: Growing Preference for Growth Stocks

Recently, we have observed a growing preference for growth stocks in the S&P 500 index. In the current high interest rate environment, growth stocks such as the "Big Seven" may enjoy higher valuations compared to defensive and cyclical stocks. These seven tech giants include Apple, Alphabet (Google's parent company), Amazon, Microsoft, Meta, Nvidia, and Tesla. Since 1990, the total interest payments made by the S&P 500 have been basically inversely related to the returns of investment-grade bonds, so an increase in investment-grade returns may lead to an increase in interest payments.

It is worth noting that before interest rates began to rise, growth companies had already extended the maturity of their debts in advance, thus locking in historically low interest rates. In addition, the cash-to-total-debt ratio of the S&P 500 is still relatively high, with a ratio of 53% for growth companies, 28% for cyclical companies, and 14% for defensive companies. This means that if interest rates remain high for a period of time, growth companies may receive more interest income.

Looking back at 2022, the surge in interest rates led to a contraction in price-earnings ratios, especially for growth stocks. However, this year, we have seen an expansion in price-earnings ratios despite high interest rates. A closer look at the fundamentals indicates that compared to cyclical and defensive stocks, the price-earnings ratios of growth stocks may expand.

Looking ahead, the average interest rate is expected to be higher than the level after the financial crisis. This may increase interest expenses and damage the earnings of S&P 500 companies. However, the postponement of debt maturity dates by growth companies in 2020 should help limit losses at the new normal level of stable interest rates. Given the huge difference in leverage, defensive and cyclical stocks may feel more pain due to relatively high debt. Therefore, the relationship between the valuation of growth stocks and interest rates may be more complex than many people assume.

Macro Perspective: August CPI and Future Outlook

After several months of slowing down, the core CPI in August accelerated again, partly due to a significant increase in airfare prices. Core service prices, excluding rent, rose, and prices excluding housing also increased. Although some expected the core PCE inflation rate to rise slightly, the details of the PPI indicate that commodity prices may accelerate again. However, the Federal Reserve may stick to its plan — I expect them to raise interest rates by 25 basis points in November. This is in line with our continued stable growth and slightly higher-than-target inflation. Sticky inflation may mean high interest rates for a period of time. The Atlanta Fed's wage tracker has slipped, but still supports 2% price inflation. Risks include labor cost increases due to union negotiations and potential government shutdown if Congress fails to act.

The economy seems to be growing in a diversified manner, shifting from service spending to more consumer goods, business investment, and residential investment. Manufacturing output has slightly declined, but low jobless claims and moderate industrial production growth indicate a strong economic performance.

The upcoming Federal Open Market Committee meeting and real estate data will be the focus of attention. Given the recent stable inflation and weak signs in the labor market, the Federal Reserve may maintain policy interest rates. Their forecasts may show a decrease in GDP growth and unemployment expectations for 2023. Core PCE forecasts may also decrease. Housing starts should increase due to supply constraints, but high interest rates and high prices may limit this growth.

There are signs of relaxation in the labor market — such as a slight decrease in the ratio of job vacancies to unemployed persons, and a slight increase in the unemployment rate. But labor demand remains strong, so it seems more like achieving normalization in maintaining wage growth levels above 4%. The Atlanta Fed's wage tracker confirms a slowdown in wage growth. Sticky inflation and sticky labor costs seem to be related. The upcoming negotiations with the auto union are crucial for future price inflation. In addition, the surge in the ISM services sector may reflect the rise in energy costs. However, strong consumer spending and broad-based growth are expected to lead to strong GDP in the third quarter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。