Recently, Telegram trading bots have become the hottest new narrative, with various trading bots emerging one after another. Based on this, the new project we are introducing today is RobinHood Bot.

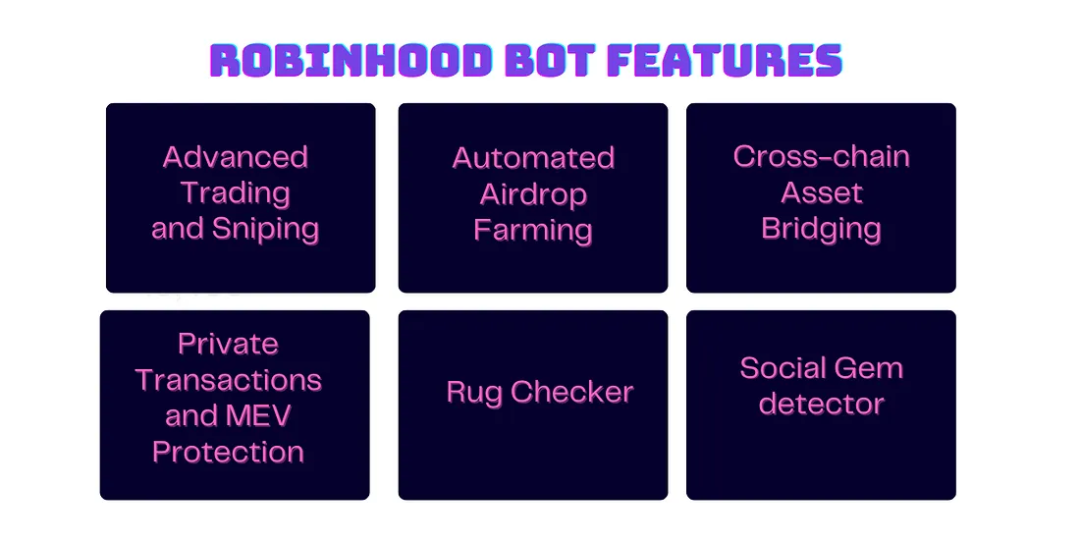

RobinHood Bot is a comprehensive, multi-functional cryptocurrency bot designed to provide a seamless trading experience and serve as an all-in-one solution to meet all cryptocurrency trading needs. It combines the best features of various bots, providing cryptocurrency enthusiasts with unique and powerful tools. Whether users are experienced traders or beginners, RobinHood Bot offers tools to maximize trading potential. It supports advanced trading and sniping, automatic airdrop harvesting, cross-chain asset bridging, private trading, MEV protection, and other features. RobinHood Bot aims to execute trades at lightning speed, making it a powerful tool for traders. It can execute trades faster than traditional platforms, ensuring users do not miss any opportunities.

Mechanism Analysis

RobinHood Bot employs various mechanisms to provide its services. For advanced trading and sniping, it uses advanced algorithms to execute trades at lightning speed and snatch up new tokens. This allows users to take advantage of price fluctuations and acquire new tokens ahead of others in the market.

- Automated Airdrop Mining

RobinHood Bot uses smart contracts to interact with various protocols on multiple EVM-compatible chains. This enables the bot to perform various automated tasks such as bridging, swapping, adding liquidity, token staking, and interacting with DeFi protocols, all without the need for manual user intervention.

- Cross-Chain Asset Bridging

RobinHood Bot utilizes interoperability protocols like Bungee and Layer0 to bridge assets between different networks. This allows users to quickly transfer their assets from one network to another, enabling them to take advantage of different opportunities on various EVM blockchains.

- Private Trading and MEV Protection

RobinHood Bot employs privacy-enhancing technology and MEV mitigation strategies. This allows users to execute trades with enhanced privacy, protecting them from front-running trades and other MEV attacks.

Features

Advanced Trading and Sniping

Access to on-chain smart wallets (profit wallets).

The bot provides advanced trading features, including liquidity sniping, call channel sniping, direct contract pasting, support for instant contracts and LP acquisition, as well as advanced trading terminal functions, wallet replication, multi-wallet emulation, and emotion detection.

Automated Airdrop Mining

Automated on-chain interactions for airdrop mining.

Operates on multiple EVM-compatible chains such as ZkSync, LayerZero, Linea, Scroll, Base, Taiko, Polygon, zkEVM, and more.

Executes various automated tasks across different protocols, including bridging, swapping, adding liquidity, borrowing, lending, minting NFTs, and more.

Provides airdrop tracking and anti-Sybil detection capabilities.

Cross-Chain Asset Bridging

Enables users to bridge their assets between different networks.

Simplifies fund management and transfers.

Supports over 10 EVM chains, including Ethereum, Arbitrum, Optimism, Zksync, Binance Smart Chain, Avalanche, Polygon, and more.

Private Trading and MEV Protection

Supports private trading to enhance trading privacy.

Provides protection against Miner Extractable Value (MEV) attacks.

Protects trades, intelligently addressing sandwich attacks to provide additional security for trades.

Rug Checker

Features advanced checker and anti-rug functions.

Ensures user investment safety by checking various factors, including the credibility of project teams, deploying wallets, funding sources, code audits, verification, liquidity locking, contract renouncement, token holder count, and more.

The algorithm actively scans team-locked liquidity and/or renounced contracts. Users can evaluate team intentions and commitments by receiving real-time alerts about lock duration and information on team intentions and commitments.

The bot assigns security scores for each factor.

Social Gem Detector

Detects alerts during contract deployment.

Tracks etherscan for large purchases if it exceeds a safety threshold.

The bot has a database of Gem Hunters from social media sites that can discover projects early.

If any of these accounts discuss a project on social media, the bot adds those tokens to the Social Gem Detector channel.

If more Gem Hunters discuss the project, the bot's algorithm continues to add scores for that token.

Users can manually initiate trades or preset the bot to trade when it passes rug checks and the social gem score exceeds 50%.

Fully scans Twitter to provide data on token mentions and promotions.

Supported Chains

- Ethereum

- Arbitrum

- Base

- Optimism

- Zksync

Tokenomics

The $HOOD token is the native utility token of the RobinhoodBot ecosystem. It is an integral part of the platform and the primary means of interaction for the community and the system itself.

Total Supply

100 million

ETH Price

$1850

Initial Mcap

$37,000

FDV

$92,500

Circulating Supply

40 million

Vested Supply

60 million

TGE Circulating Supply

40%

$HOOD Allocation

Proportion

Quantity

Remarks

Initial Liquidity

40%

40 million

Unlocked

DAO Treasury

40%

40 million

Linear unlock within 24 months

Foundation

10%

10 million

2% unlocked at TGE, the rest linear unlock within one year

Team

10%

10 million

Vesting period over 12 months, with a 3-month cliff

Fee Structure

RobinHood Bot does not charge any fees in the initial stage to attract new users. After the initial launch phase, the fee for Robinhood Bot is 0.8%. The fee is deducted directly from the transaction amount and processed through the contract. This means users do not need to worry about separately paying fees or dealing with additional charges. Of the generated fees, 40% will be allocated to $HOOD holders, 30% of the fees will be allocated to referrers, and 30% of the fees will be used for the development and maintenance of the bot by the team.

Revenue Sharing

Holders can receive 30-40% of the revenue from trading $HOOD, as well as the opportunity to earn 40% of the bot fees and referral fees. This means that simply holding $HOOD can provide users with passive income. This revenue-sharing plan serves two main purposes. Firstly, it provides additional incentives for users holding $HOOD to support the token's value and stability. Secondly, it allows users to share in the success of RobinHood Bot. As the bot becomes more popular and its usage increases, the generated fees will also increase, providing greater returns for token holders.

Summary

RobinHood Bot offers advanced and comprehensive features for traders to help lower the barrier for the general public to engage in cryptocurrency trading and promote mainstream adoption. At the same time, RobinHood Bot protects users from malicious operations, identifies early-stage large transactions on the blockchain in a timely manner, and tracks social trends. As $HOOD holders, users can access the bot itself, and the held tokens are not only sustainable but also incentivized through a revenue-sharing model. Transparency and decentralization ensure that the team's interests align with the users' own interests, ensuring that RobinHood Bot evolves according to user needs and changing market trends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。