TL;DR

We conducted an in-depth study of the business model of EigenLayer. After researching relevant data and information, we have reached the following conclusions:

- The number of business demand parties that EigenLayer can attract (i.e., small and medium-sized application chains) is not expected to be large, and there is a high likelihood of gradual decrease in the future.

- In the early stages, the main supplier of EigenLayer's business, AVS (i.e., node operators), is likely to be attracted due to revenue. However, considering the associated security risks, the overall entry situation of AVS is not optimistic.

- Although there are currently many users staking assets on EigenLayer, there is limited potential for an increase in the number of users in the future.

EigenLayer is overestimated overall. In the long run, EigenLayer's business model cannot sustain profitability once the novelty wears off.

What is EigenLayer

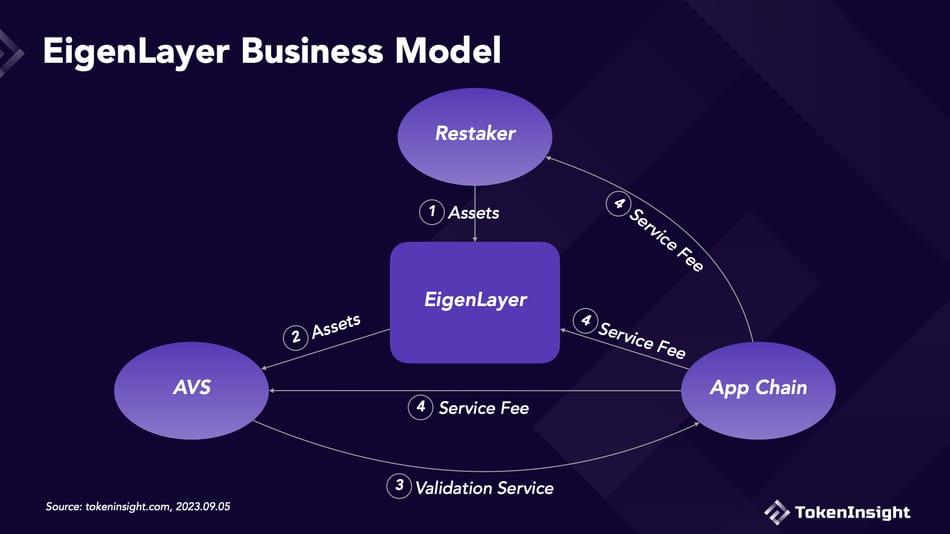

EigenLayer is a Restaking protocol based on Ethereum. It can be seen as an intermediary platform connecting stakers, AVS, and application chains.

- Stakers, also known as Restakers, are users staking assets on EigenLayer.

- AVS, Actively Validated Services, are security service protocols integrated into EigenLayer, which can be understood as node operators.

- Application chains are small and medium-sized blockchain networks with node validation requirements.

The main function of EigenLayer is to act as a platform connecting these three entities, and it can:

- Provide stakers with pathways for Restaking and obtaining additional staking rewards.

- Provide staking assets for AVS.

- Provide application chains with the opportunity to select AVS and purchase validation services.

What is EigenLayer's Business Model

EigenLayer's business model is built around stakers, AVS, and application chains. From the perspective of demand and supply:

The specific operation process of EigenLayer's business model is as follows:

- Users Restake LSD to EigenLayer.

- The staked assets are provided to AVS for protection.

- AVS provides validation services for application chains.

- Application chains pay service fees, which are divided into staking rewards, service income, and protocol income allocated to stakers, AVS, and EigenLayer, respectively.

Can EigenLayer's Business Model Be Profitable

From the perspective of the entire business model, EigenLayer's main customer base is small and medium-sized blockchain networks with node validation requirements. It mainly utilizes Ethereum's node operators to provide validation services for non-EVM compatible blockchain networks.

In the entire business chain, the income of stakers, AVS, and EigenLayer is provided by these small and medium-sized application chains. Therefore, to judge whether EigenLayer's business model can be profitable, the first question to discuss is whether there will be application chains using EigenLayer.

Will There Be Application Chains Using EigenLayer

First, the fundamental reasons why EigenLayer attracts non-EVM compatible small and medium-sized application chains as its main customer base are twofold:

Cost

Non-EVM compatible small and medium-sized application chains need to establish their own trust network and ensure network security through deploying nodes separately. However, the cost of deploying their own nodes is high, which is a burden for small and medium-sized blockchain networks. Therefore, they have a demand to seek cost-effective validation services from existing third-party node operators. The integrated AVS in EigenLayer can provide these application chains with a more cost-effective validation service market.

Security

For non-EVM compatible small and medium-sized application chains, obtaining security equivalent to Ethereum is very attractive. EigenLayer claims that it can use LSD as collateral to provide these blockchains with the same level of security as Ethereum. This undoubtedly addresses the pain points of these application chains.

From a cost perspective, EigenLayer can indeed meet the needs of small and medium-sized application chains to reduce node deployment costs. However, in terms of security, we believe that EigenLayer cannot "rent" the security of Ethereum to provide the same level of security as Ethereum for these application chains.

In terms of the staking mechanism, EigenLayer mainly uses LSD as collateral to provide protection for AVS. But this does not mean that the validation services of AVS can provide the same level of security as Ethereum. Ethereum's strong security is provided by its large number of nodes and ETH staking amount. It has over 10,000 nodes and 25 million ETH staked. Therefore, its network is highly secure. The number of nodes and staking amount purchased by application chains from EigenLayer cannot reach the same level as Ethereum. Therefore, EigenLayer cannot meet the pain points of customers in terms of security.

Furthermore, from a sustainability perspective, small and medium-sized application chains using EigenLayer will not last long. In the early stages of development, these application chains may choose to purchase AVS services from EigenLayer for cost considerations. However, in the later stages of development and after issuing their own native tokens, there is a high probability that application chains will switch to using their native tokens as staking assets and establish their own secure networks. This is inevitable for the development of blockchain networks.

Therefore, for the above reasons, the number of customers that EigenLayer can attract is not expected to be large, and there is a high likelihood of gradual decrease in the future.

Will AVS Integrate into EigenLayer

For the supply side AVS, the income obtained from application chains is an important reason to attract them to join EigenLayer.

Essentially, the AVS integrated into EigenLayer is making extra money. They are essentially taking on additional validation work on EigenLayer in addition to completing Ethereum's validation work. So how much additional income can these extra validation work bring to them?

If we refer to the data from Lido Finance, the income that AVS can earn by joining EigenLayer is estimated to be between 5% and 10% of the service fees. Lido charges a fee of 10%, of which 5% is given to the node operators. However, since EigenLayer is in the early stages of development, there is a high probability that it will implement incentive measures to allocate a larger proportion to AVS to attract their entry.

However, although EigenLayer brings additional income to these node operators, the additional validation work also increases the security risk of the validation nodes. Regarding this point, Vitalik Buterin has also expressed the same view. He believes that the behavior of EigenLayer, which uses Ethereum's node operators to validate other blockchain networks, will lead to consensus overload in the entire Ethereum network. The Restaking mechanism will add to the risk, thereby affecting the overall network security.

Therefore, we believe that in the early stages, there is a high probability that AVS will be attracted due to revenue. However, considering the associated security risks, the overall entry situation of AVS is not optimistic. In other words, the additional income they receive from application chains may not be enough to compensate for potential losses.

Will Users Stake Assets on EigenLayer

Users choose to stake assets on EigenLayer mainly due to the staking rewards from Restaking and potential future airdrop rewards.

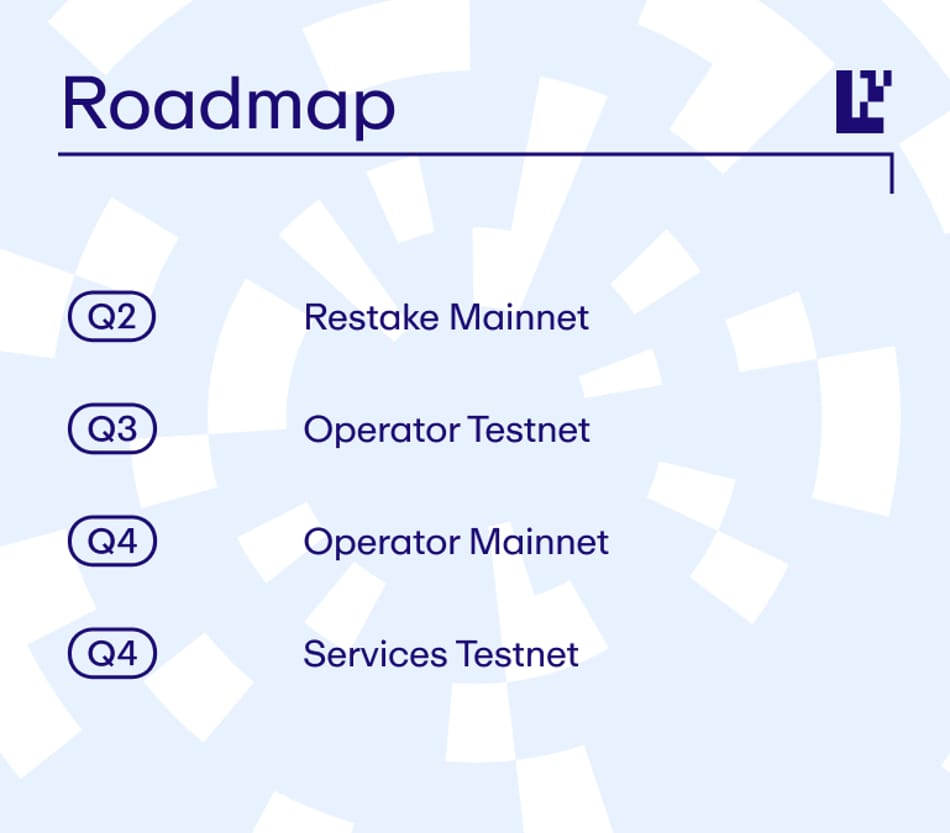

According to the roadmap released by EigenLayer, EigenLayer is currently in the first phase: Restake Mainnet, and only the platform's Restaking function is open. Staking of nodes based on LSD and AVS services have not yet been opened. This means that currently, users can only deposit assets into EigenLayer, but there are no staking rewards. Moreover, for a long time in the future, until the Service phase is opened, users will not receive substantial staking rewards.

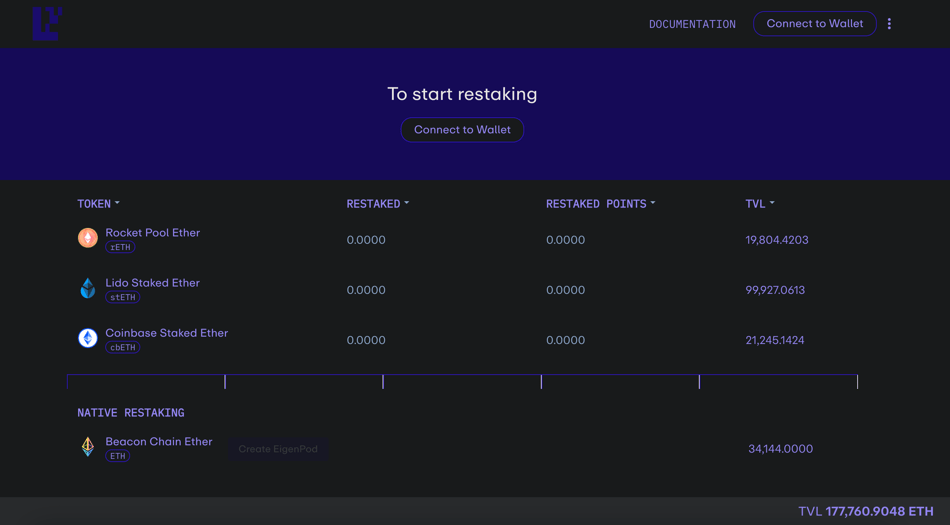

However, based on the data from EigenLayer's official website, the number of users staking assets on EigenLayer is not small. Within the first two months of the mainnet staking function being launched, the total staking amount on EigenLayer exceeded 177K ETH. This is largely due to users hoping to become early supporters of the project to receive potential future airdrop rewards. However, this pie-in-the-sky approach to attracting users, although it can attract a large number of naive users in the early stages, will start to lose effectiveness in the future. After all, users cannot receive any substantial returns in the short term. This is the most fatal problem.

Furthermore, from a long-term perspective, holders of LSD assets can completely seek node operators to stake assets on their own. There is no reason to go through EigenLayer. EigenLayer simply eliminates the step of users searching for information and provides them with a platform to connect with node operators. Therefore, unless EigenLayer provides sufficiently high staking rewards in the future, it will not be able to attract many users to continuously stake assets on its platform.

Therefore, although there are currently many users staking assets on EigenLayer, there is limited potential for an increase in the number of users in the future.

Conclusion

Overall, for EigenLayer, application chains, AVS, and users are all indispensable.

- From the perspective of the main demand side, application chains, EigenLayer can indeed meet the cost reduction needs of small and medium-sized application chains, but cannot meet their security needs. At the same time, the sustainability of application chain demand is also poor.

- From the perspective of the main supply side, AVS, in the early stages, there is a high probability that AVS will be attracted due to revenue. However, the security drawbacks of the Restaking mechanism may to some extent affect the entry situation of AVS.

- From the perspective of users, users cannot receive any substantial staking rewards in the short term, and the uncertainty of staking rewards may affect the potential increase in the number of users in the future.

Therefore, we believe that EigenLayer, as the flagship project of Restaking, has been "mythified" and overestimated. Its business model is not sufficient to achieve sustainable profitability once the novelty wears off.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。