Technology is becoming simpler, and the mindset is gradually becoming simpler as well. Now is the time to wait, to dare to pursue, to dare to stop loss, and to make a profit. The process of implementing the rules of the currency market is also a process of convincing oneself, constantly persuading oneself to become better. The cultivation of human nature begins with stop-loss and take-profit. Willing to accept losses and confidently win. Making trades is a process of solving various psychological barriers brought by investment and reshaping one's behavior.

Market Review:

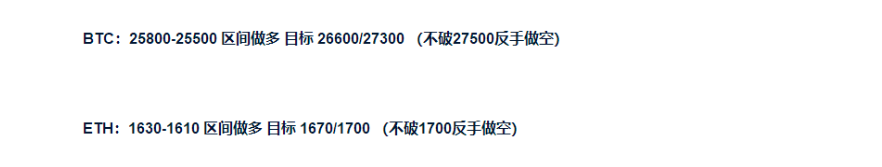

In the early morning, the price of Bitcoin showed a bottoming rebound, probing the support level at 25355 and quickly rebounding. The price did not stabilize above 26000 and the market experienced a high and then a fall. In the short term, the price did not break out of the range, and the market still maintained a volatile trend. This market movement did not reach our target for Bitcoin, but Ethereum reached the first target near 1670. Currently, the market has returned to the starting point, and we will focus on maintaining a high selling and low buying trading strategy.

Market Analysis:

Looking at the daily chart, after the last big rise and fall, Bitcoin has entered a week-long period of volatile trading. After a long period of consolidation, a large upward movement is likely to follow. When most of the retail investors have been shaken out, it will be the time for institutional investors to push the market up. Looking at the four-hour chart, the Bollinger Bands are in a state of contraction and flat movement, and the overall trend is still dominated by volatility. After a series of downward probes, the price did not continue to decline but quickly rebounded to touch the upper resistance level before falling back with long upper and lower shadows. The price is still oscillating within the lower to middle range of the Bollinger Bands. The MACD indicator shows a bullish crossover and the bullish energy column is running with volume, indicating some rebound sentiment during the trading session. Bitcoin has stabilized within an hour, forming an hour's pivot, with limited downside potential, and then retraced after a spike. Overall, it is in a low-volatility oscillation, and the next direction will depend on the pivot. On the 15-minute chart, Bitcoin moved away from the pivot downwards, immediately adjusted, and then pulled back into the oscillation within the pivot. Whether it can break through the 25900 level is worth paying attention to, and even if it breaks through the vicinity of 26150, it will form resistance. Overall, it is in a low-volatility oscillation range with little pressure. If there is a push-up behavior, it can break through all at once. The major resistance may be between 29,000 and 30,000. Therefore, I suggest that this is the time for us to layout for the medium to long term. Bitcoin is expected to reach the range of 29000-30000, and Ethereum 1800-1900. This is my personal opinion, and we do not follow the trend, but adhere to our own trading philosophy. For those who are uncertain about entry points, you can follow my updates!

Disclaimer:

The market is constantly changing, and the market fluctuates rapidly. Personal opinions and suggestions are not real-time and are for reference only. If there are no entry points, stay out of the market and wait. For those who are uncertain about entry points, you can follow the public account below to get real-time entry points based on the market situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。