Original | Odaily Planet Daily

Author | How is the husband

Editor | Hao Fangzhou

While a few industry insiders are still discussing how Intent-centric promotes the large-scale application of Web3, the Bot track close to the general public is developing at full speed. In a sense, Bot projects satisfy the application design concept centered on intent and rely on Telegram's huge user base to attract newcomers to Web3. Especially for trading bots, their almost traceless trading mode helps new users quickly enter Web3.

Trading bots provide functions that traditional DEXs do not have, such as sniper for new coins, anti-MEV attacks, and anti-Rug functions. These functions were familiar only to "scientists" in the circle before the emergence of Bot track. Now, the use of trading bots is almost leveling the operational gap between ordinary users and professional users.

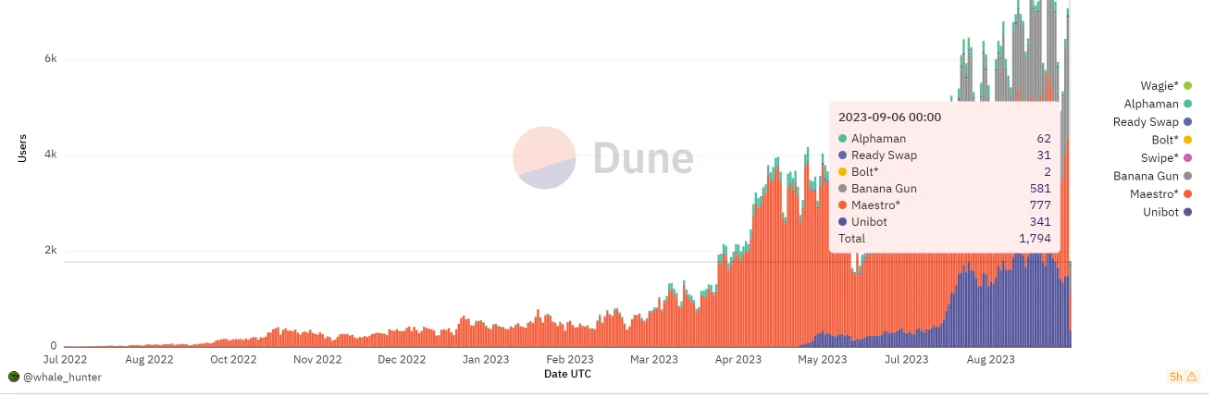

Since May of this year, Unibot has been soaring. If you have ever regretted not entering the market or discovering Alpha early, Odaily Planet Daily needs to remind you that the current user base of BananaGun and MaestroBot has exceeded that of Unibot. Especially BananaGun, which has seen a significant increase in popularity since the announcement of the token presale yesterday.

How did BananaGun manage to attract new users in the fiercely competitive Bot track?

As one of the trading bots, BananaGun has similar general functions to other trading bots, helping users trade tokens in various ways through Telegram. Its main feature is sniper for new coins, allowing some users who like to rush for new projects to benefit greatly.

Just imagine, when a new coin is launched, if you are still trading through traditional DEX, all you can do is increase GasFee to gain priority, while the BananaGun bot has already completed the transaction.

Introduction to the new coin interception gameplay

1) First, enter /start in @BananaGunSniper_bot, and it will pop up the main panel.

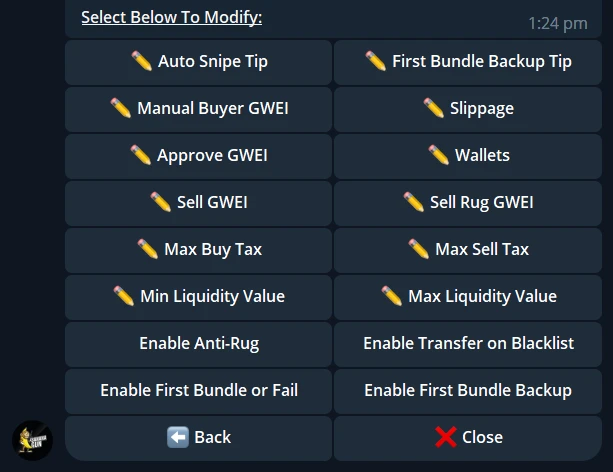

2) Click "Settings" to configure different functions according to personal needs and add a wallet.

3) Set the sniper fee: the fee determines the order of interception, set GWEI, and set the acceptable slippage.

The above is the basic setup for starting BananaGun, and users can also configure it as required according to the official documentation.

Are the steps simple? By entering the new coin address and purchase requirements as prompted, and finally configuring the wallet and wallet quantity for the purchase, the interception purchase of this new coin is complete.

BananaGun Token Economy

BananaGun will issue tokens (BANANA) on a dedicated DApp and divide whitelist users through early NFT activities.

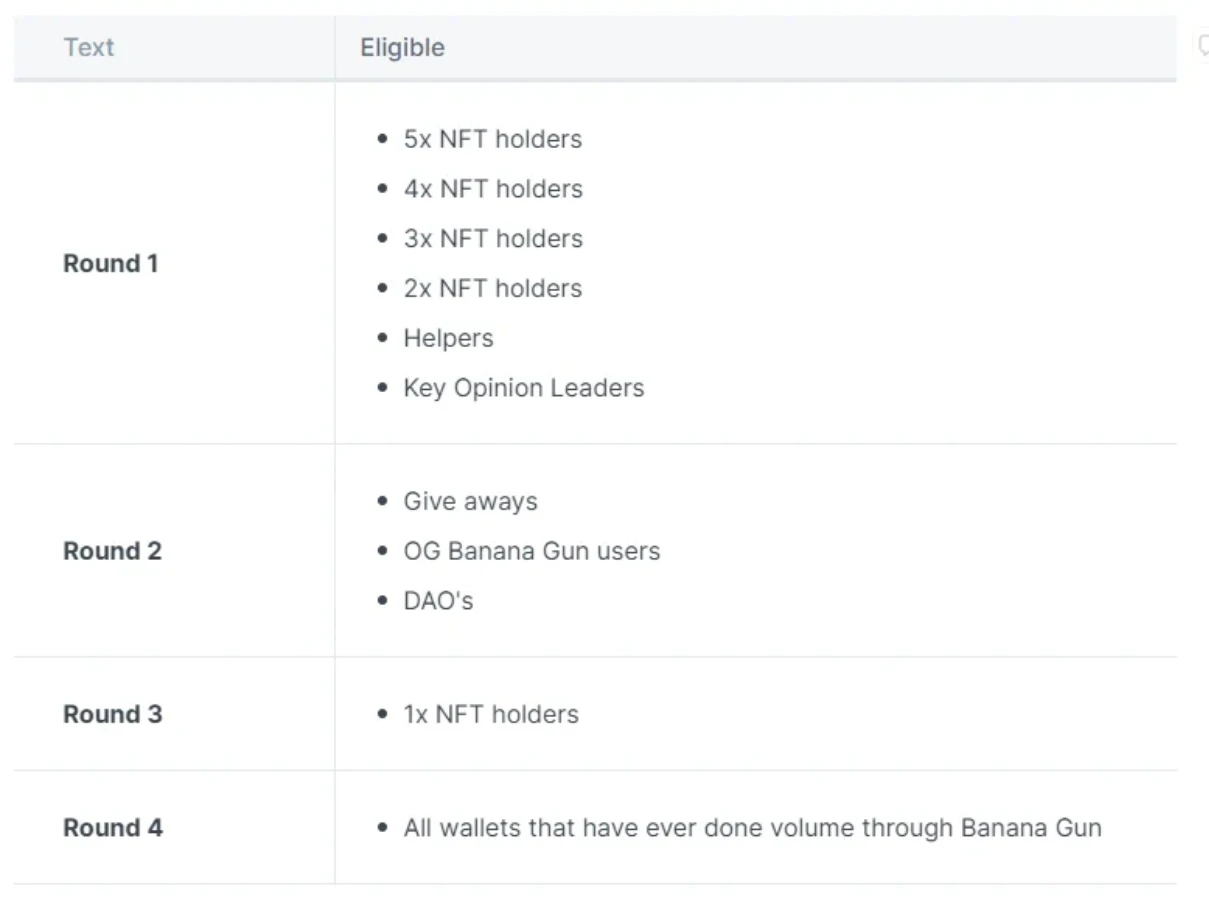

The presale will have a limit of 800ETH, with a maximum allocation of 1ETH per person, and the presale price is $0.65; a whitelist program with multiple rounds and levels will allocate quotas on a first-come, first-served basis in different rounds. The following is the specific distribution rules:

The total supply of BananaGun tokens this time is 10 million, with the team holding 10% of the total supply, divided into lock-up periods of 2 years and 8 years, with a linear unlock period of 3 years after the lock-up period, and the 8-year lock-up period can participate in the ecological income sharing plan.

The airdrop plan is divided into two parts:

● NFT holders: 100,000 tokens for the first round airdrop, with different NFT levels corresponding to different points, and the corresponding number of tokens will be distributed according to the points.

● Social media promotion: 20,000 tokens for the second round airdrop, distributed based on social media dissemination and KOL.

The following is the specific distribution ratio:

The token economic model of BananaGun aims to promote the long-term development of the protocol and reduce the risk for investors by locking up excess tokens.

2% of the token sales tax revenue will be distributed to token holders, 1% to the team, and 1% will be stored in the reserve. The initial liquidity will be $390,000, with a market value of $1.56 million, and the initial price will be $0.65. The ratio of BANANA liquidity to circulating market value is 25%, which provides a good balance in terms of volatility and depth.

BananaGun Ecological Development Strategy

The ecological value of BananaGun is to use the treasury tokens as a reward mechanism to attract and retain users.

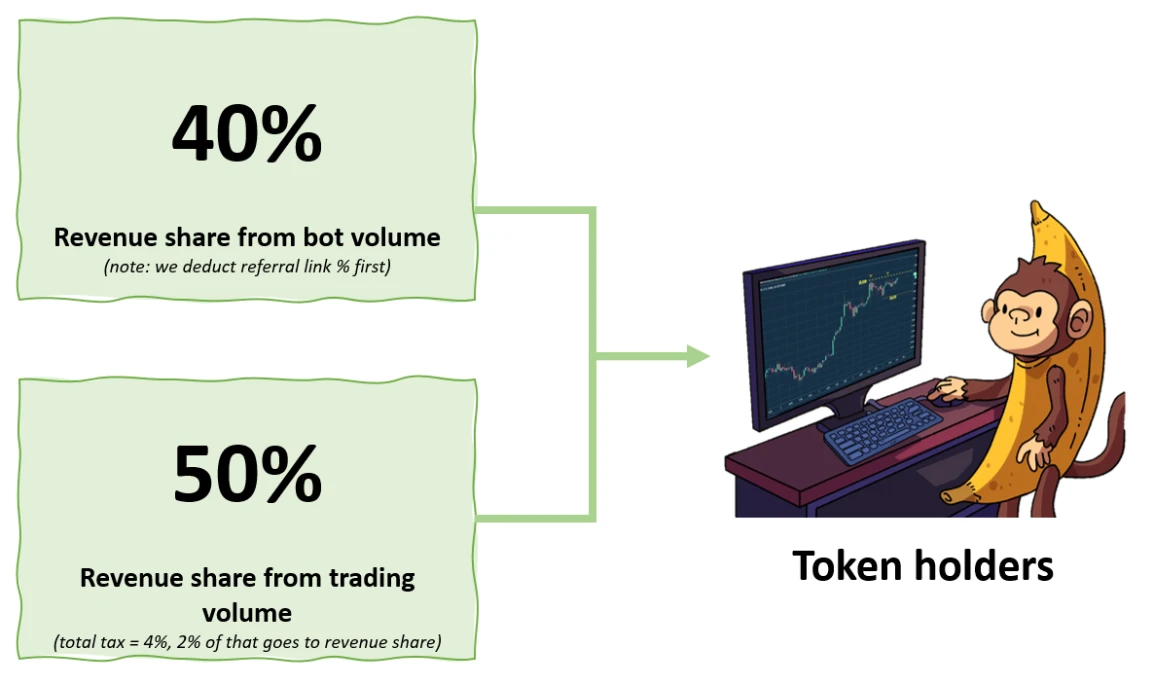

- Token holders

As shown in the above image, token holders can receive income sharing on the official DApp.

Robot income (40% recommended after referral)

50% of tax revenue

This helps stabilize token holders and achieve token dividends.

- BananaGun users

When users purchase or intercept new projects through BananaGun, they can receive a certain amount of token rewards.

The calculation formula is: Token reward = payment fee * coefficient (officially stipulated as 0.05-1)

- New features

BananaGun will introduce new features for token burning.

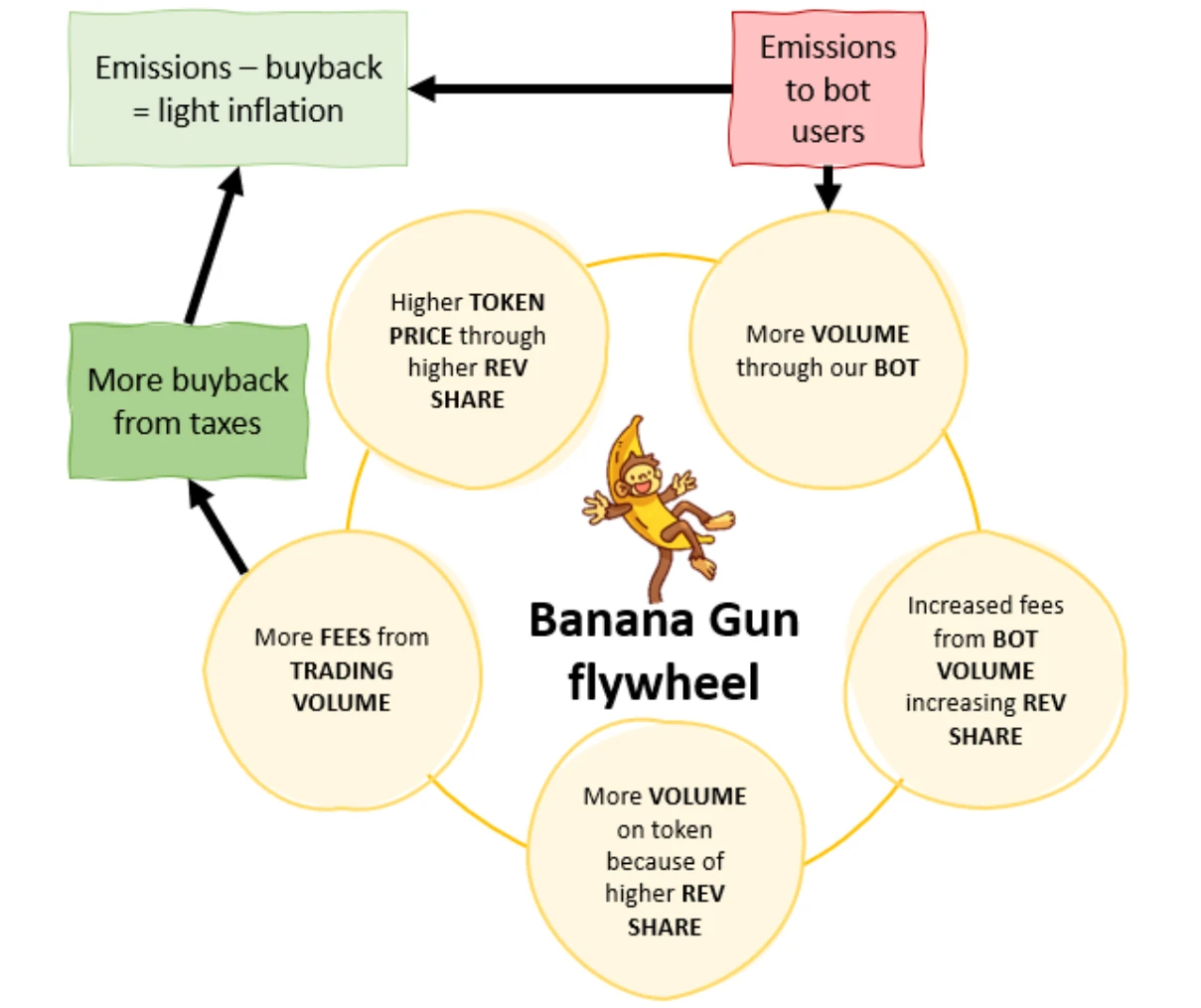

Through the above three points, it is not difficult to see that the Banana project uses a reward mechanism to attract users to use and retain token holders. However, this may lead to the possibility of inflation, and the official has measures to prevent this:

Buyback through 1% treasury tax: this can offset most inflation in all cases;

Adjustable multiplier; if necessary, this leverage can be used to carefully balance emissions;

Increasing users will lead to an increase in the number of robots, forming a flywheel;

New features will burn BANANA, completely removing it from circulation;

The token's income sharing is high, so investors will hold it.

Summary

BananaGun highlights the interception of new projects, and even before the coin was issued, its user base had already exceeded that of Unibot, ranking second, not far behind the first-place MaestroBot. After the announcement of the coin issuance, its momentum has become even more fierce, showing signs of seizing the top spot.

Image from Dune

From the perspective of its token economy, the reward and burning mechanism of the token are relatively sound, but the specific income capability and sustainability still need to be verified. Odaily Planet Daily reminds here that early projects carry huge risks, so DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。