Author: Fidelity Digital Assets

Translation: WEEX Exchange

As users access various applications within the ecosystem to obtain technical utility from the Ethereum network, some may wonder, "How does utility translate into the value of the ETH token?" In other words, why should investors buy and hold ETH instead of just using it to interact with the Ethereum network? This article will delve into this question, including some technical aspects related to various investment themes.

This article mainly discusses:

- The best way to understand Ethereum is as a technical platform that uses ETH as a means of payment.

- The perceived value of Ethereum is related to network use cases and supply-demand dynamics, which has changed since The Merge.

- The overall platform usage of Ethereum may transfer value to token holders, leading to the appreciation of the ETH token.

- One investment theme of holding ETH is to use it as an emerging form of currency, similar to Bitcoin.

- However, it seems unlikely for any other digital asset to surpass Bitcoin as a monetary good, as Bitcoin has its own characteristics and network effects.

- In other words, value is subjective and does not mean that other competing forms of currency (such as ETH) cannot exist, especially in specific markets, use cases, and communities.

- We have studied the ability of ETH to function as a store of value and a means of payment.

- Ethereum is not yet perfect and is expected to undergo upgrades every year, bringing recurring technical risks and unknown factors, which diminish its prospects as a store of value asset.

- Although ETH is used for various payment purposes, unstable fees remain a significant obstacle to widespread adoption.

- We have studied the demand-side model of ETH and found that the correlation between address growth and price is not significant compared to BTC.

- Ethereum is now transitioning to PoS, allowing token holders to earn rewards, some of which are driven by increased network use cases; we have studied where these rewards come from, as well as the various driving factors and risks.

- As an income-generating asset, the value of ETH can be examined through a discounted cash flow model; we have built a simple model to illustrate the assumptions driving this model.

Ethereum vs. Ether

There is a certain relationship between digital asset networks and their native tokens, but the "success" of the two is not always entirely correlated. In some cases, a network can provide utility to users, settling a significant number of complex transactions daily, but may not bring much value to its native token holders. Other networks may have a stronger connection between network usage and token value.

A commonly used term to describe the relationship between network design and token value is "Tokenomics." Tokenomics is short for Token Economics and is used to explain how the design of a network or application creates economic value for token holders.

The Ethereum network has undergone significant changes in the past few years, affecting its token economics. The introduction of burning a portion of transaction fees (base fees) was implemented in August 2021 through Ethereum Improvement Proposal 1559 (EIP 1559). Burning ETH is equivalent to destroying it; therefore, executing transactions on Ethereum will result in a portion of ETH being taken out of circulation.

Additionally, the transition from PoW to PoS in September 2022 reduced the issuance rate of ETH and introduced staking, allowing entities to earn income in the form of tips, issuance, and maximum extractable value (MEV). Previous upgrades to Ethereum fundamentally changed the token economics of ETH and altered people's perceptions of the relationship between the Ethereum network and the ETH token.

Token Economics: How ETH Accumulates Value

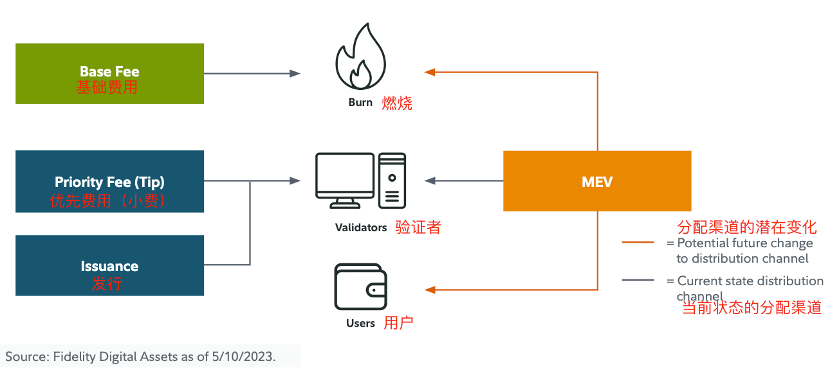

The token economics of ETH consist of three functions, where use cases are translated into value. When transacting on Ethereum, all users pay base fees, priority fees, and may generate additional value for other participants through MEV, which refers to the maximum value validators can obtain from user transactions by adding/removing transactions or changing the order of transactions in a block during the block creation process.

The base fees paid in ETH are destroyed when adding a block (transaction packaging), reducing the supply of ETH. Priority fees are paid to validators, individuals, or entities responsible for updating the public ledger and maintaining consensus. When creating a new block, validators are incentivized to include transactions with the highest priority, as this may be their primary way of directly earning income. Finally, potential MEV opportunities (often arbitrage) are provided by different users and transfer most of the value to validators through a competitive MEV market in the current state.

The value accumulation mechanism can be seen as different uses of network "revenue." Firstly, the destruction of base fees leads to a contraction of the total supply, benefiting existing token holders. Secondly, priority fees and MEV come from users and are allocated to validators providing services. Although their relationship is nonlinear, increasing platform use cases equates to increased destruction and increased validator income.

Investment Theme One: Aspiring Currency

A common narrative suggests that the best way to understand Bitcoin is as an emerging monetary good, sparking discussions about whether the ETH token can also be considered a currency. The short answer is yes, some may think so; however, ETH as a currency seeking widespread acceptance may face more resistance than BTC.

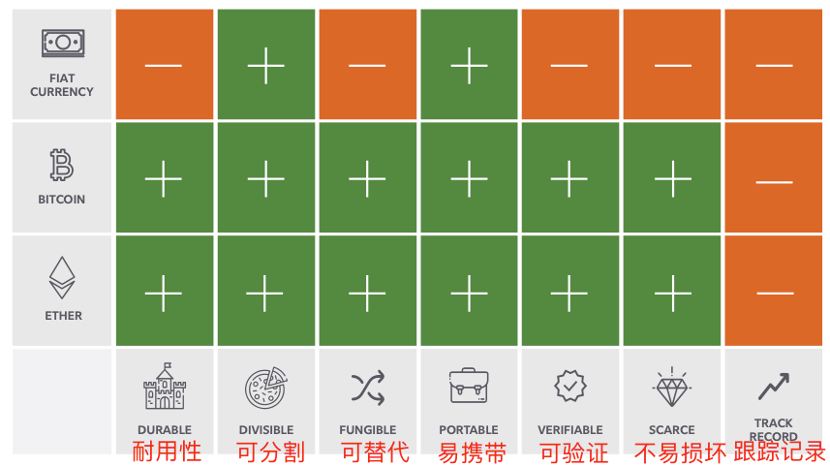

ETH shares many monetary attributes with Bitcoin and other tokens; however, its differences from Bitcoin lie in scarcity and historical records. ETH technically has infinite supply parameters, which are kept within certain ranges based on validators and destruction quantities. While these parameters are strictly enforced by the network, they do not equate to a fixed supply schedule and may fluctuate in unexpected directions.

As Ethereum undergoes network upgrades approximately every year, new code takes time to update and review, and more importantly, requires developer attention to rebuild its performance history.

It seems unlikely for any other digital asset to surpass Bitcoin as a monetary good, as some consider Bitcoin to be the safest, most decentralized, and most robust digital currency to date, requiring careful consideration for anything to "surpass" it. While network effects are crucial in the blockchain ecosystem, Bitcoin is in the best position as a monetary good in this regard, but this does not mean that other competing forms of currency cannot exist, especially for different markets, use cases, and communities.

More specifically, Ethereum has alternative uses that Bitcoin does not possess, such as facilitating more complex transactions, prompting people to consider whether ETH has a unique use similar to Bitcoin. While ETH, like Bitcoin, is typically transferred between addresses to transmit value, its additional role as a currency for executing smart contract logic is its true differentiator.

Transactions for everyday goods have not yet significantly occurred on Ethereum, but the physical and digital worlds seem to be converging. As seen from leading tech companies, applications that provide unique services to users drive network effects and demand. By default, mainstream applications used on Ethereum will lead to demand for ETH, making this long-term trend one of the most notable reasons for ETH as an aspiring alternative currency.

In fact, Ethereum has already seen some notable integration with the physical world and traditional finance:

- MakerDAO purchased $500 million in government bonds.

- The first real estate sale on Ethereum was completed in the form of an NFT.

- A European investment bank issued bonds on-chain.

- Franklin Templeton's money market fund uses the Ethereum and Polygon networks to process transactions and record ownership.

The integration of the Ethereum ecosystem with real-world assets has already begun. However, it may take several years of improvement, clear regulation, education, and time testing before the general public begins transacting on Ethereum or competitive platforms. Until then, ETH may still be a niche form of currency.

Among the many challenges, regulation is the most controversial topic when it comes to shaping Ethereum's future. Although Ethereum is a global permissionless blockchain, many of the largest centralized exchanges, which hold and stake Ethereum funds, are located in the United States. This means that any guidance issued by the United States for validators or investors could have a significant impact on the valuation and network health of Ethereum. With recent regulatory enforcement actions in the United States and the shutdown of crypto-related banking and Kraken's staking services, regulatory risk becomes one of the biggest obstacles Ethereum may face in the near future.

Next, we will explore ETH from the perspective of the two main functions of currency:

ETH as a Store of Value

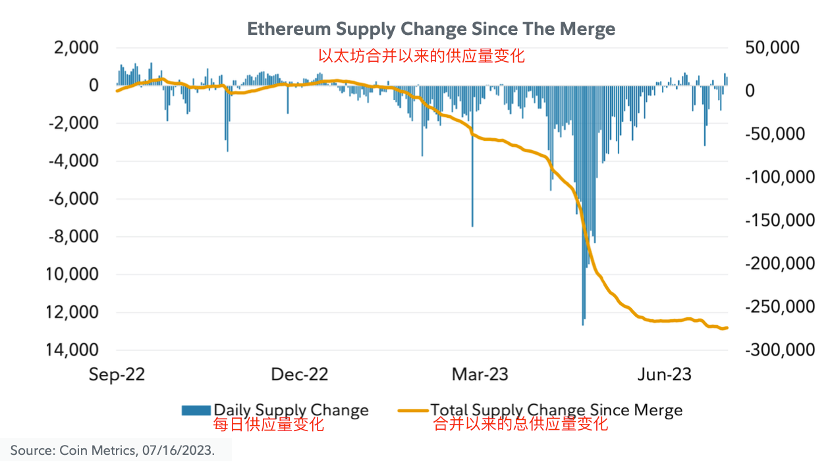

For something to be a good store of value, it must be scarce or have a high stock-to-flow ratio. As of July 2023, ETH's stock-to-flow ratio is higher than Bitcoin's. This dynamic has sparked attention since The Merge, significantly reducing the issuance of ETH, as shown below.

One of Bitcoin's core value propositions is its maximum fixed supply of 21 million coins, with no supply plan and unlikely changes. Bitcoin's supply plan is programmed into the code and executed through social consensus and network participant incentives. However, what supports the scarcity and supply plan of ETH? From the above image, it can be seen that the issuance of ETH is not like a strict schedule, but more like a balancing act between a set of predetermined parameters. In fact, two variables determine the total supply of ETH, making it difficult to assess future supply:

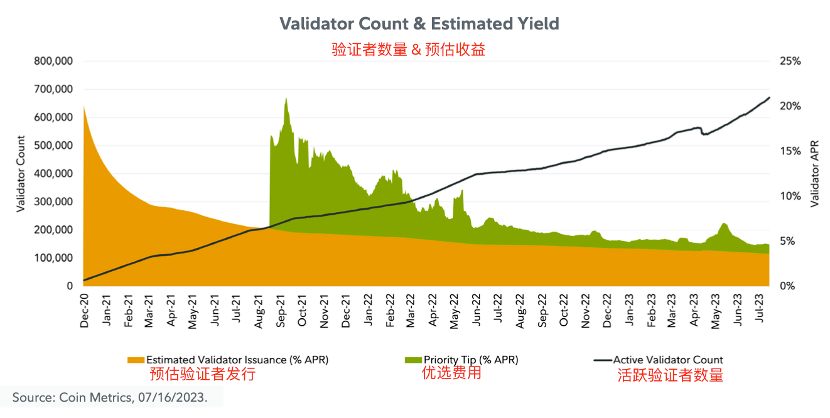

One is issuance: The issuance is determined by the number of active validators and their performance. An important trend in this model is that as the total ETH staked increases, the total issuance of ETH also increases, but the issuance rate decreases. Because the issuance of ETH is related to the number of staked ETH, a part of the formula is not prone to drastic fluctuations. The Ethereum protocol imposes limits on the number of validators that can enter and exit staking, aiming to support the security of the protocol and maintain a stable issuance rate over time.

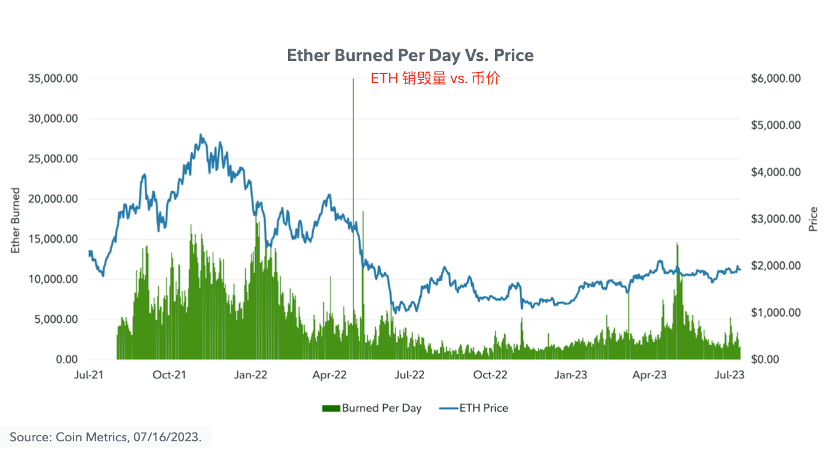

Two is burning: Burning is determined by the demand for block space, as block space computational resources are limited, with a new block produced every 12 seconds. Burning exhibits extreme volatility, making it difficult to predict the exact future supply of ETH.

Burning is like an incentive pendulum, rarely the same between blocks. The protocol specifies the target gas fee that each block should contain, and if a block's gas fee is higher or lower than the target, it will lead to a corresponding adjustment in the base fee of the next block. This adjustment is non-linear and can result in sharp increases in transaction fees when the on-chain activity is high. It also serves as a security mechanism, making it uneconomical for bad actors to periodically spam the network.

Ultimately, the supply of ETH is not based on a fixed schedule. The two components of ETH monetary policy may continue to change. The current mechanism ensures that the total supply of ETH inflates by a maximum of about 1.5% per year. This assumes that the current supply is 100% staked and no burning occurs, meaning no transactions occur on Ethereum. As shown, maintaining a low issuance or inflation of ETH does not require an increase in burning. In fact, an increase in burning often leads to net deflation or a decrease in total supply.

It has been pointed out that the future supply of ETH is related to the number of active validators (issuance) and transaction execution demand (burning), with the latter being relatively unpredictable in the long term. Upgrades to Ethereum may directly impact the burning or issuance at the base layer, adding uncertainty to the supply dynamics. For example, the Shanghai/Capella upgrade reduced staking risks and may increase the total issuance due to higher staking participation. On the other hand, data availability expansion (increased transaction throughput) and the maturity of Layer 2 platforms may unpredictably alter the supply-demand dynamics of burning and further disrupt the future supply of ETH.

Additionally, competitive L1 networks are independent blockchains with native tokens responsible for completing transactions, but do not have the same iteration and development time as Ethereum. As dApps and other blockchains develop and integrate, investors should be aware that this may drive user growth. For certain use cases, such as NFTs or gaming, users may not require the decentralization and security provided by the Ethereum base layer.

If users are willing to sacrifice the decentralization or security of the blockchain trilemma for the scalability of the L1 layer, some user value may be generated outside of Ethereum. As the smart contract platform economy is likely to be multi-chain in any case, investors should consider which use cases Ethereum will retain in the long term and which use cases will occur elsewhere.

Another significant difference between ETH and other store of value assets, and the most crucial distinction, is the possibility of future upgrades to the supply schedule. In the latest versions, developers have noted the Endgame EIP 1559 and MEV Burn. These off-chain components clearly indicate that the way burning affects supply is about to change, but it is uncertain how. Regardless of the outcome of these changes, it contrasts sharply with Bitcoin's value proposition, which claims that its fixed supply schedule will not change for a long time.

In conclusion, while the narrative of Ethereum as ultra-sound money has gained increasing attention among community members, there are many obstacles to proving that the supply of ETH is as stable as that of other store of value assets. The overall platform use cases of Ethereum can transfer value to token holders. However, value is subjective, and any description of an asset may be purely semantic, especially in the early stages of its lifecycle.

ETH as a Means of Payment

ETH is used as a means of payment, but these payments are limited to digital native assets. For most transactions, Ethereum typically achieves final confirmation within 13 minutes, making it faster for settlement than Bitcoin's 6 blocks (1 hour) probability guarantee. Final confirmation means the transaction has been included in a block, and the block cannot be altered without a significant amount of ETH being slashed. This mechanism makes Ethereum an attractive payment asset in terms of final settlement time, but there are still many obstacles to overcome to realize the takeoff of payment applications, most of which are related to user experience and high gas fees.

Since the merge, NFT payments have consumed the second largest amount of gas fees, second only to DeFi-related transactions. NFTs are priced in ETH and inherently experience price fluctuations. For merchants selling NFTs at a price of 1 ETH, the purchasing power represented by this amount varies greatly with changes in the market price of ETH. This difference reduces the experience (primarily for the seller) and is a common issue in many digital asset claims payment cases.

Although the Ethereum network offers a wide range of transaction options, direct value transfer accounts for a significant portion of network use cases; since the merge, peer-to-peer transfers have consumed the third largest amount of ETH.

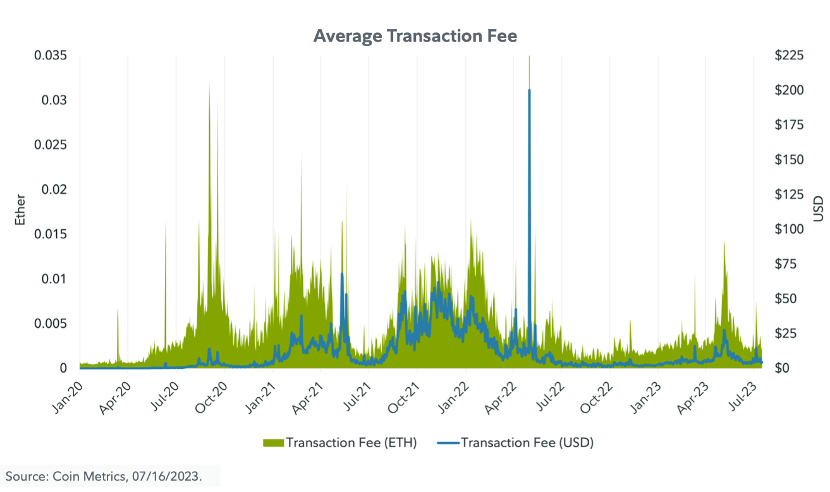

The biggest issue affecting Ethereum payment use cases is fee volatility. Ethereum's dynamic fee model leads to rapid and occasional increases in fees. The variable cost of transactions may limit payment use cases and reduce the user experience by making Ethereum an unreliable and expensive value transfer network. Users often need to make decisions such as whether to transact now at a high cost or wait until network activity decreases. This quantity forces developers to be creative in hopes of maximizing the speed and efficiency of meeting user preferences.

Furthermore, if more real-world assets enter the blockchain, payments for these assets may use ETH, stablecoins, or other tokens. Combining these innovations with the lower fees provided by Layer 2 platforms can lead to expectations for the payment prospects of the Ethereum network.

Network data shows that when ETH is used as a means of payment, it is primarily used for payments of digital native assets. However, due to poor user experience, the potential of Ethereum as a payment network has not yet reached its peak. Whether Ethereum can become a mainstream payment method largely depends on whether the community can quickly overcome various obstacles such as ease of use, real-world transactions, security, and low-cost transactions.

Assessing ETH Based on Demand

As applications on the Ethereum network require ETH, an increase in Ethereum network use cases may lead to an increase in the price of ETH and, due to the supply-demand mechanism, an increase in value for ETH token holders.

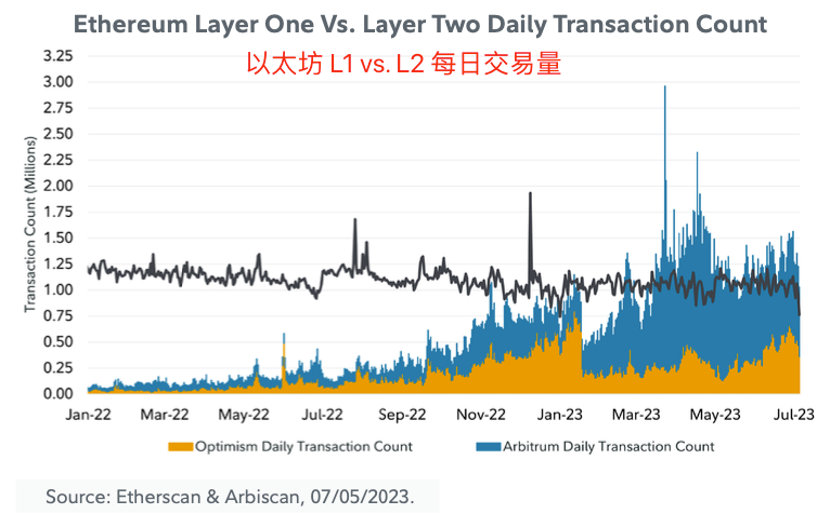

The following chart shows the prospects for value accumulation at the base layer (Optimism), ultimately translating network usage into the value of ETH. The L2 network (Arbitrum) is built on top of the base layer, processing transaction execution and relying on the base layer to provide security and transaction confirmation.

Despite being in a bear market, the transaction volume at the Ethereum layer 1 remains fairly stable at around 1 million transactions per day, while the price of ETH has cumulatively decreased by 52% since early 2022. Additionally, we see an increase in L2 transaction volume, while the transaction volume at L1 remains unchanged, which may indicate a certain degree of sticky demand at the base layer, with new demand coming from the L2 layer. This trajectory may indicate that even as L2 becomes more mainstream, the value at the base layer will continue to reliably grow.

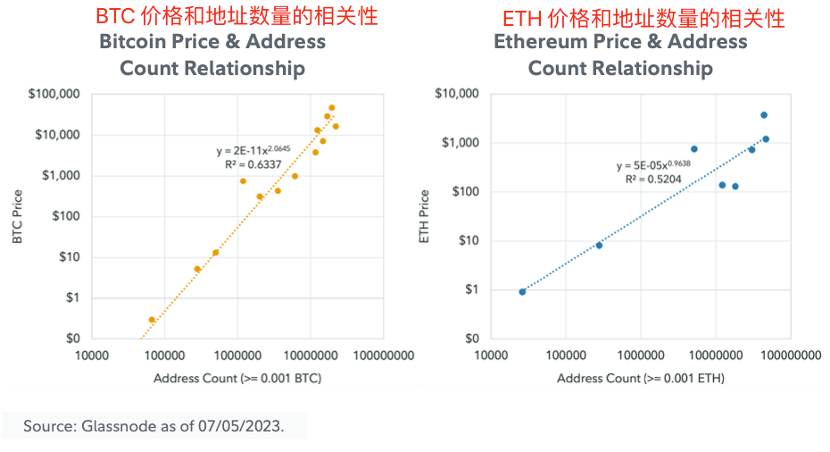

The demand for ETH as a monetary asset is difficult to measure. Metcalfe's Law is a popular economic principle that shows the relationship between address growth and the demand and price of Bitcoin. In studying Ethereum, we have found less evidence of this demand-price relationship compared to Bitcoin.

After all, if Bitcoin is primarily seen as an aspiring monetary good, then the rationality of measuring asset demand expectations against the number of addresses is stronger. For ETH, this weaker relationship may indicate that its value is derived from other sources, such as network use cases, rather than simply the demand for holding ETH itself.

Risks of the Demand-Side Model:

It can be said that the core value of Ethereum comes from the availability layer, and the model that measures use cases by the number of addresses rather than the volume, transactions, or usage cannot effectively capture this.

While data shows a relationship between address growth and the price of ETH, it cannot guarantee that this relationship will continue in the future.

This model is only a demand-side model, and as discussed earlier, the supply schedule of Ethereum may change in the future. Therefore, even if demand increases, if supply also increases, the price of ETH may not change, or even decrease.

Investment Theme Two: ETH as an Income-Generating Asset

Why and How Does ETH Provide Income?

Since the merge, ETH is a completely different asset. Not only has energy consumption significantly decreased, but it also provides income for those willing to lock ETH in the consensus layer. The shift to PoS is a turning point in the security model of Ethereum. Compared to PoW, PoS has maintained or even increased network security at a lower cost by introducing penalties for validators' improper behavior.

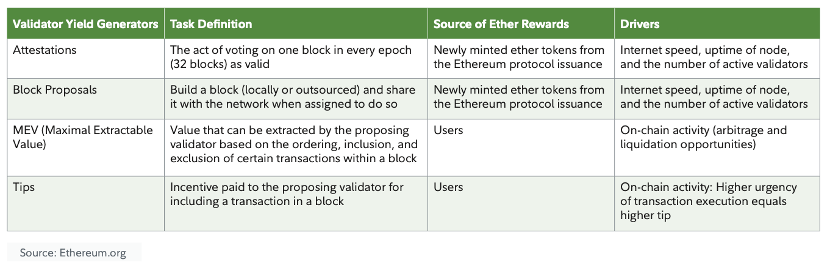

Validators contribute resources to the network and perform the responsibilities of allocation to help Ethereum achieve consensus, and therefore receive economic rewards. The various responsibilities and rewards for validators are briefly introduced below:

Since the merge on September 15, 2022, as of July 2023, 53% of validator income comes from Ethereum (referring to block rewards, WEEX note). Here are some other forms of income that are not paid by the protocol but come from users, providing an interesting link between network usage and validator income.

MEV:

It is clear that MEV comes directly from user transactions, as an increase in user activity usually brings more arbitrage opportunities. With Ethereum having multiple use cases, value can be extracted from user transactions in various ways. According to Flashbots, an organization dedicated to mitigating the centralization effects of MEV, the most common forms of MEV usually come from arbitrage and liquidations, which thrive in environments of intense volatility, such as in November 2022.

Tips:

Since the introduction of EIP-1559 in Ethereum's London upgrade in 2021, the fee market of Ethereum has undergone significant changes. Before the upgrade, PoW miners received all gas fees from the blocks they mined. After the upgrade, the network has two independent fee types: base fee and priority fee (tip). All fees are still paid by users attempting to execute transactions; after these fees are paid, EIP-1559 affects how they are allocated.

Validators only receive the priority fee, not all fees paid by users. The base fee is burned or taken out of circulation. Tips can incentivize validators to prioritize including transactions in their blocks, as otherwise validators might include empty blocks (which is more economically viable). Higher tips for transactions in the mempool than other competitive transactions can incentivize validators to prioritize including them in blocks for users who urgently need to execute transactions. As of July 2023, tips have accounted for 22% of validator total income since the switch to PoS.

Valuing ETH Based on Discounted Cash Flow Model

After the switch to PoS, the value allocated to ETH is easier to model. The demand for block space can be measured by transaction fees. These fees are either burned or rewarded to validators, accumulating value for ETH holders.

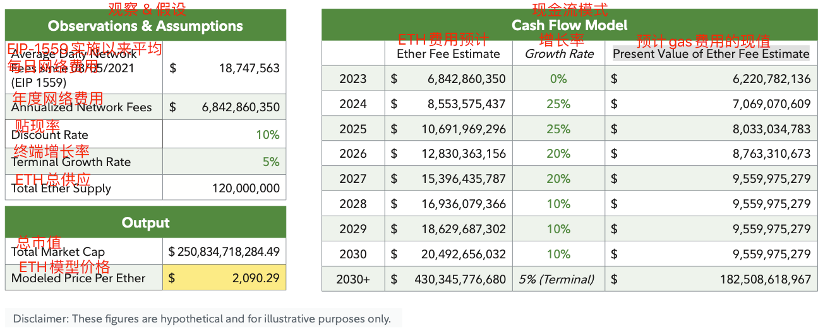

Therefore, in the long run, the growth of fees and the value of ETH should be inherently related. The following chart shows this relationship using a simple discounted cash flow model. The results of this model vary greatly based on growth assumptions and discount rates. The purpose of building such a model is not to provide a prediction of fair value for ETH, but to describe the relationship between network use cases and value accumulation.

As a starting point, the chart below shows the average daily fees paid in USD by Ethereum since the implementation of EIP 1559 in August 2021. The chart is calculated using a two-stage discounted cash flow model, with an initial stage where fees continue to grow significantly, followed by a decrease in the rate of fee growth, potentially lowering the ceiling of fee growth regardless of the utility Ethereum users receive.

More than 70% of the token value associated with this model comes from terminal perpetuity growth, which is the assumed growth rate after 2030 (5% annual growth, WEEX note). This result is common when predicting the future of high-growth enterprises and is part of why using a discounted cash flow model is theoretically effective.

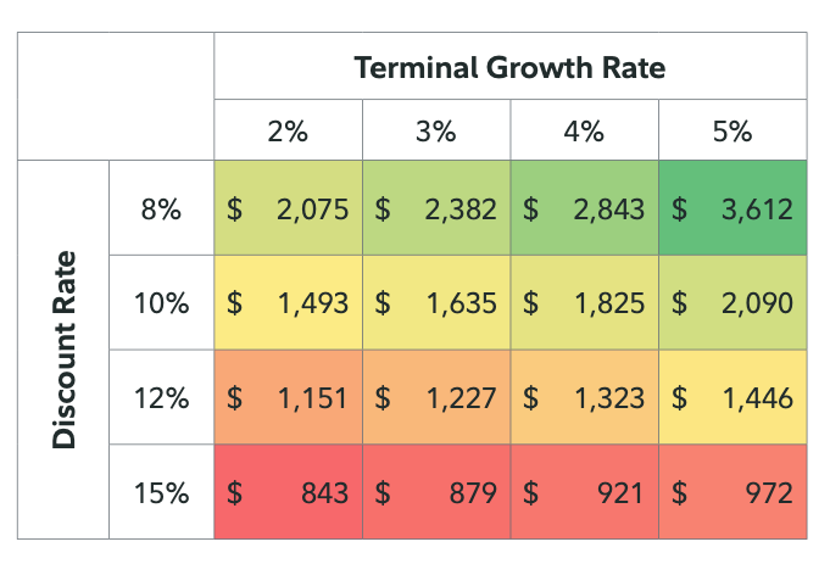

The sensitivity model shown in the chart further describes the impact of modeling prices on assumed growth rates and discount rates. Understanding the relationship between ETH and user willingness to pay is extremely important. However, a model that is highly sensitive to small changes in growth assumptions, especially for assets sensitive to growth, may not be as useful.

Risks of the Discounted Cash Flow Model:

If scaling technologies reduce gas fee revenue, the relationship between ETH and the value provided to users by the Ethereum network may weaken, unless an increase in transaction volume offsets the decrease in revenue from lower gas fees.

Modeling the future of any growth-sensitive asset and applying relevant discount rates is highly subjective, so valuation may only be theoretically useful.

Efforts currently made to minimize the negative impact of MEV will improve user experience but may reduce income. In this simple model, we have not adjusted for this issue and many other important details.

Conclusion

There is no doubt that Ethereum is a leading blockchain technology platform that enables developers to build decentralized applications, many of which can accomplish things that are not possible on the Bitcoin network due to Ethereum's exceptional programmability. This has led to some of the largest and most active applications in the digital asset ecosystem being built on Ethereum, and ETH has consistently maintained its position as the second largest market cap for many years.

However, the question posed by investors is, "Will the increase in developers and applications translate into value for ETH?" We have shown that theoretical and data to date indicate that increased activity on the Ethereum network drives demand for block space, which in turn generates cash flow that can benefit token holders. But it is equally clear that these different drivers are complex, subtle, and change over time with various protocol upgrades and developments (such as L2) and are likely to continue to change in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。