Author: VIKTOR DEFI

Translation: Deep Tide TechFlow

The internet we use today is different from the internet in the 90s. Back then, finding online content was difficult until Google solved the content discovery problem through its aggregator.

Now, we are witnessing the rise of aggregator platforms worth billions of dollars solving important problems on the internet. For example, Amazon is used to find items, Facebook is used to find people, Google is used to find content, and so on.

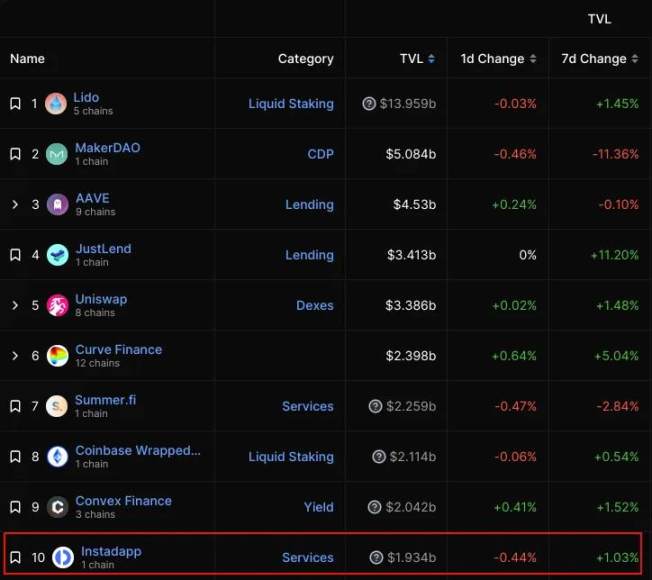

To drive the development of the blockchain industry, there is a need for key aggregation platforms to solve the user discovery problem. This is where Instadapp comes in. Instadapp aims to become the ultimate aggregation layer in DeFi by aggregating various DeFi protocols.

Instadapp is one of the leading protocols in DeFi, easily surpassing other protocols by timely launching products needed by the industry. Want to learn more? Let's delve into it.

What is Instadapp

Instadapp is a middleware protocol that simplifies and unifies the frontend of DeFi. Similar to the Web2 aggregator mentioned earlier, Instadapp consolidates the best DeFi platforms onto one platform for users to easily access and have a unified experience. The platform currently integrates eight protocols: MakerDAO, Liquity, Morpho, Aave, Compound, Lido, Uniswap, and Hop Protocol.

Users do not need to switch between different protocols; they can complete all operations with just a few clicks. The best part is that Instadapp is already live on Ethereum, Polygon, Arbitrum, Avalanche, Optimism, Fantom, and Base, helping users maximize their time and fees on-chain.

Technology behind Instadapp

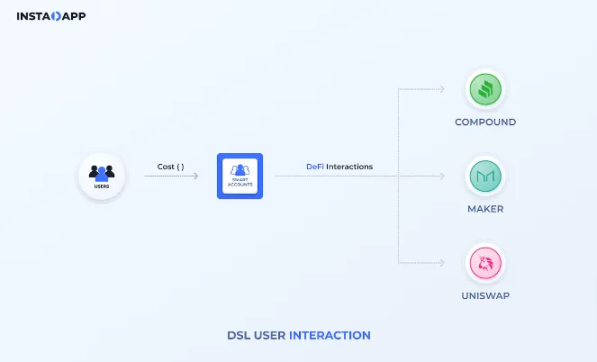

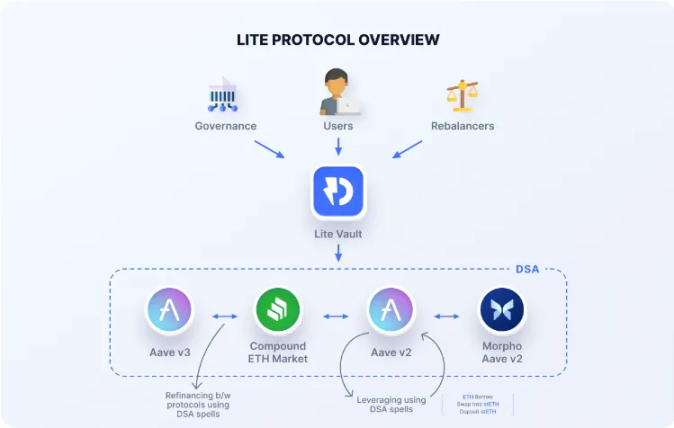

Instadapp utilizes a new technology called DeFi Smart Accounts (DSA) to provide users with greater flexibility and accessibility. DSA is a user-controlled smart contract that allows them to execute multiple operations in a single blockchain transaction. DSAs can be seen as sub-accounts for users on Instadapp, allowing them to manage positions and interact with DeFi protocols in a trustless manner.

These DSAs are generated using regular Ethereum accounts. By connecting your Ethereum wallet to Instadapp Pro, you can create your DSA account instantly, entering the multi-verse of DeFi. Interestingly, it allows users to create an unlimited number of accounts in a trustless manner. Additionally, users can withdraw funds back to their Ethereum wallet at any time with zero restrictions.

Another incredible aspect of DSAs is that connectors can extend them. Connectors enable developers to build more features, operations, and use cases on DSAs. For example, connectors can take the form of protocol-to-identity verification connectors, among various forms.

Through the unified experience provided by Instadapp, users can perform the following operations:

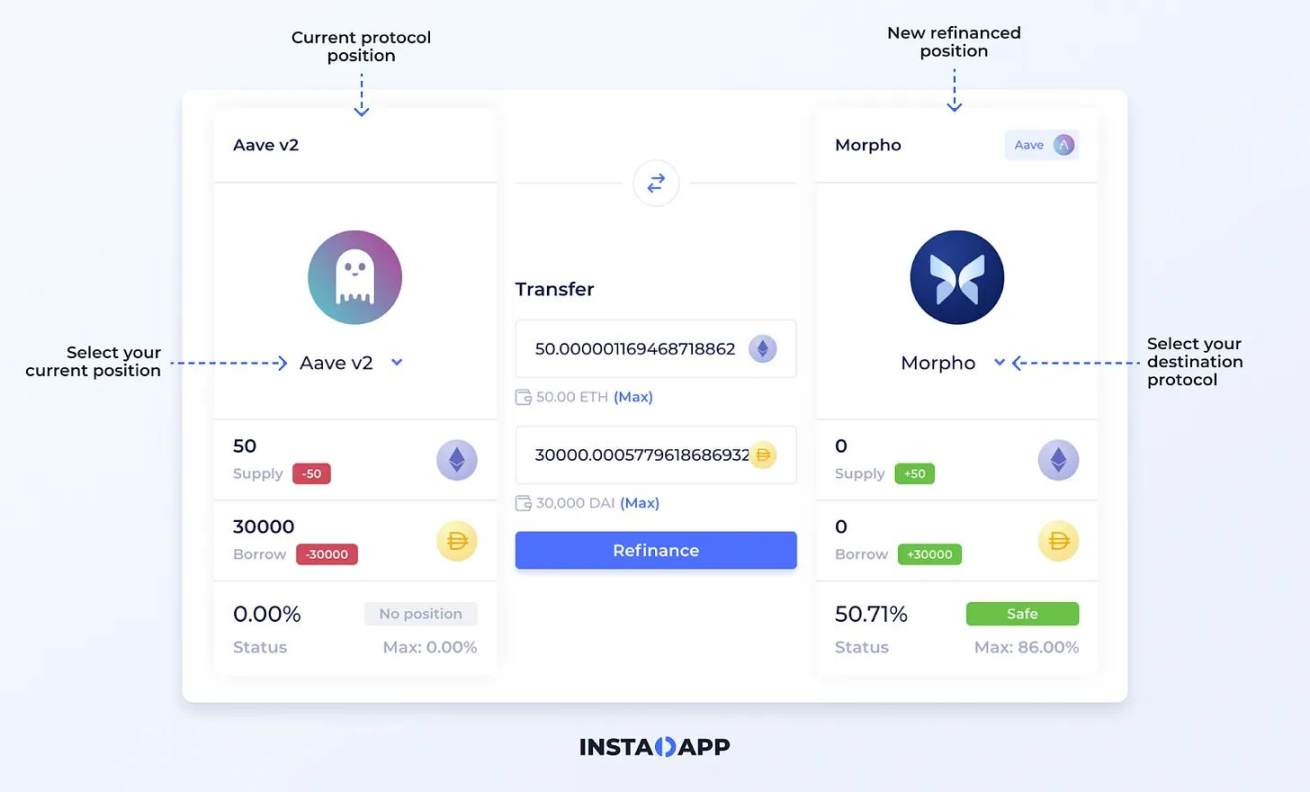

Multi-Protocol Refinancing

Lending is one of the primary use cases of decentralized finance. Users use multiple lending protocols that suit their strategies to open and refinance debt positions. Instadapp's multi-protocol refinancing feature allows users to migrate positions and refinance among top lending protocols with just a few clicks.

Cross-Chain Bridge

The existence of blockchain bridges is to transfer crypto assets from one network to another. Through Instadapp, users can easily withdraw funds from their DSA account to another network, saving gas fees and time.

Sweep Swap

We all have these tokens in our wallets that we either don't use or are tired of holding. You can use Instadapp's sweep swap feature to exchange these tokens for a single token.

Protection Automation

Automation is disrupting every industry, and DeFi is no exception. The protection automation feature allows users to automatically repay debts in market uncertainty. Each automation event only requires a fee of 0.3% to 0.4%.

Flash Loan Aggregator

Instadapp's flash loan aggregator utilizes advanced routing mechanisms to discover the best flash loan rates among major providers such as Aave, MakerDAO, Balancer, and Compound. It launches with seven routes, providing users with broader liquidity and token choices at lower costs.

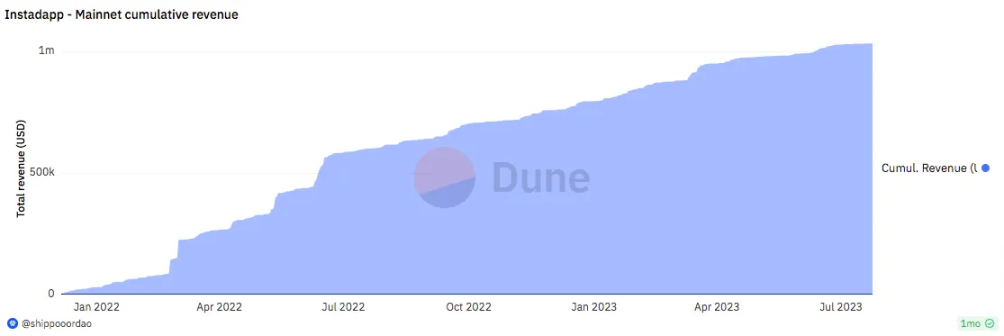

This is not all; Instadapp also manages a flash loan pool, which is used as a source of funds for the aggregator. This makes the aggregator a competitive and cost-effective flash loan platform. Since its launch, Instadapp's flash loan aggregator has maintained steady growth in revenue.

Instadapp Lite

Instadapp Lite is a powerful feature of the Instadapp platform for DeFi yield. It scans multiple lending platforms to find the best strategies and annualized returns for users, and users can access all these features with just one click. Accessibility and simplicity are the core features of Instadapp Lite.

Earlier this year, the team launched Lite v2 and introduced an insurance vault that supports only ETH. With the rise of liquidity staking, this insurance vault is strategic and timely. The insurance vault supports Aave v2, Compound's ETH market, Morpho, and Aave v3, with a cumulative locked value of over $311 million.

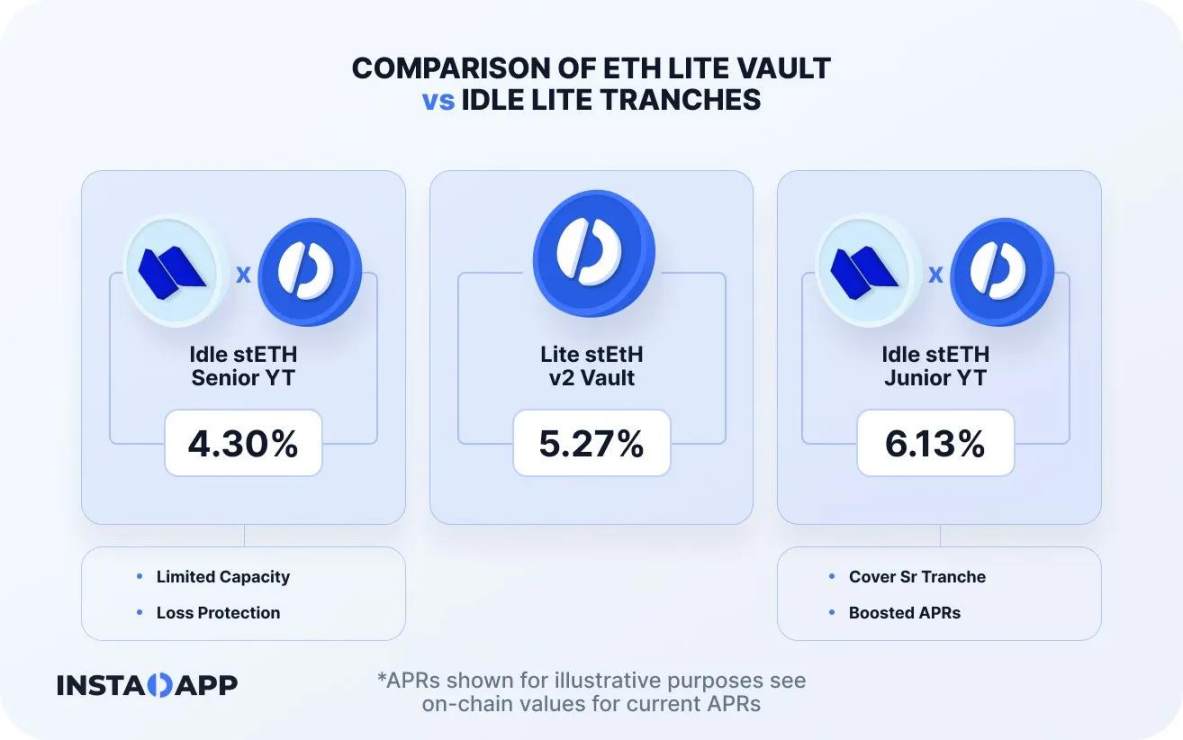

ETH Lite Vaults on Idle Finance

The yield automation protocol Idle Finance recently announced integration with Lite Vaults. Firstly, Idle Finance provides a more personalized risk strategy and choice for Lite Vault users through a layered system. Secondly, it offers two options for new and existing users based on their risk thresholds to achieve real returns.

The advanced layer is slightly lower than the standard Lite Vault and has a custom loss protection mechanism, while the basic layer covers the advanced layer by increasing the annualized return. Individuals and institutions needing additional protection for their assets may be more inclined to choose the advanced layer, while users with higher risk tolerance may prefer the basic layer.

Avocado

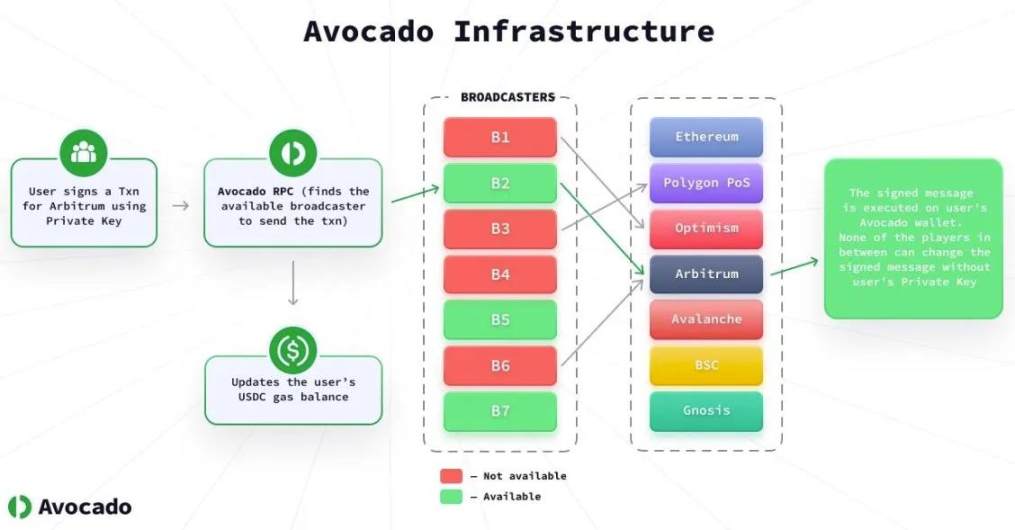

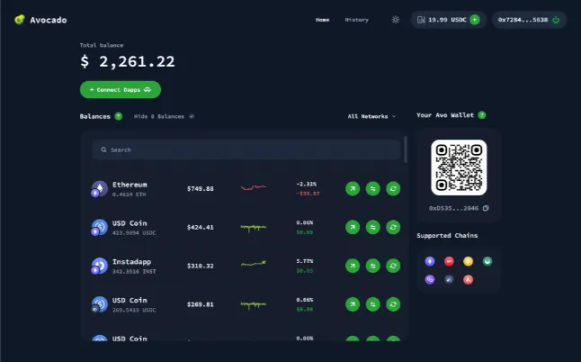

Avocado is Instadapp's latest innovative product, leading the development of account abstraction. If you have been a DeFi user for some time, you may be accustomed to connecting your wallet to dapps, switching networks, paying gas fees in the native token of the network, and adding new chains through Chainlist for interaction on new chains.

But Avocado changes all that. It is an innovative smart contract wallet that allows users to conduct multi-network transactions using the Avocado network. This eliminates the need to switch between different networks while saving gas fees.

Avocado has its own RPC (Remote Procedure Call). Nevertheless, it is not a blockchain. Avocado RPC is a network aggregator that searches for available broadcasters to process transactions on a given chain, as shown in the diagram. The best part about Avocado is its triple abstraction model: network abstraction, gas abstraction, and account abstraction.

Network abstraction ensures access to all network balances on the dashboard, gas abstraction uses USDC as the native gas fee for transactions, and account abstraction provides higher modularity in design, opening up new use cases for the platform. With these features, Instadapp can easily become a leading abstraction and aggregation layer in DeFi.

The platform creates a native Avo wallet address for you after connecting to Avocado's RPC network. With this wallet address, you can perform all operations and enjoy the same level of security as your externally owned account (EOA) such as Metamask. The team also hinted at some upcoming developments for Avocado, including 2FA security, balance unification, roles, DeFi strategies, and developer incentive programs.

Token Economics

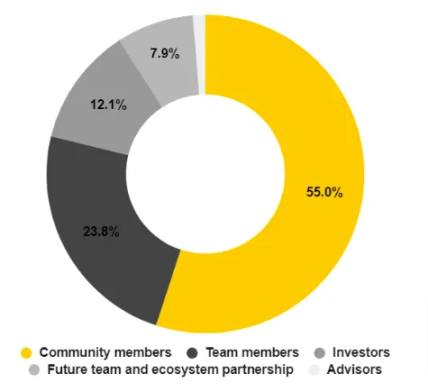

$INST is the governance and utility token of Instadapp. Its maximum supply is 100 million INST, with a market value of approximately $30 million. 55% is allocated to community members, 23.8% to team members, 12.1% to investors, and 7.9% to future team and advisors.

The current price of $INST is $1.2, which I believe is undervalued. Instadapp's TVL is $1.9 billion, and the token reached a historical high of $24.40 in the last bull market. Considering the recent and upcoming developments of Instadapp, it is easy to predict a higher increase in the next bull market.

Summary

As I mentioned earlier, we are witnessing the emergence of innovative blockchain aggregators. Like Google and Amazon, their goal is to become intermediaries between DeFi protocols and users, attracting users and driving ecosystem growth.

My research indicates that Instadapp is tirelessly establishing itself as the ultimate aggregation layer in DeFi across different verticals. At this pace, Instadapp is poised to achieve the same network effect as similar products in Web2, it's just a matter of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。