Author: 0xFat

From July 12th to August 17th, Bitcoin fluctuated slightly within the range of $31,000 to $29,000. On August 17th, it broke through the support level of the past half month, reaching a low of $24,300. The panic and greed index on the 18th was 37, changing from neutral to fear, hitting a new low since March 19th.

Since June 2022, the narrative of Web3 innovation has sharply decreased, and the L2 track centered on Ethereum and the craze for Bitcoin inscriptions have not become the driving force for the overall market growth. Now, the only activity that can attract incremental funds, "lumaobao" (a Chinese term for speculative activities), has also encountered a cold wave. At the macro level, the Federal Reserve's interest rate hike is still ongoing, and overall, the outlook is not optimistic.

Alex Thorn, research director at the cryptocurrency financial services company Galaxy Digital, also pointed out that this rapid decline has cleared a large amount of leverage. The Bitcoin market has completed the most thorough market reset since the collapse of FTX. In the absence of strong positive catalysts, short-term risks still prevail. $24,000 and $25,000 are seen as key support levels. If there is no quick rebound in the short term, nearly 90% of short-term holders will be in a loss position, leading to further downward pressure. However, long-term holders and small holders are continuing to accumulate.

Although this leverage clearing is quite thorough, and macro policies continue to tighten, compared to the previous bear market, the infrastructure of the cryptocurrency industry is already very sound, and some technological innovations are still ongoing. Many practitioners believe that the US Treasury's RWA (Risk-Weighted Assets) may drive new funds into the market. The launch of Bitcoin ETFs is a clear positive, just requiring patience. In addition, the international payment giant PayPal's foray into the stablecoin market and the gradual implementation of new cryptocurrency regulations in Hong Kong still offer huge development potential for the market.

Therefore, for investors, the most important thing at present is to reasonably control risks, seize the tail of the bear market, scientifically improve the efficiency of fund utilization (increase the number of chips), and then wait for opportunities to arise.

Below is a guide to improving fund efficiency for reference.

I. For Those Stuck in Positions, Earning More Coins is the Best Option

Small investor Xiao Mei, who entered the market in 2017, heavily invested in a project she had always believed in during the first half of the year. "I thought it was the bottom at the time! Now my position has shrunk by more than 40%," she said, feeling really uncomfortable being stuck. However, because she has long been optimistic about the founding team, she really can't bear to cut her losses.

Investors like Xiao Mei are not few, especially newcomers attracted by meme coins like Pepe in May, most of whom are hopeful stuck holders. In their perception, there is simply no concept of cutting losses. In that case, it is better to choose a platform with a high safety factor and use financial tools for earning coins from holding coins. The more coins you have, the faster the speed of getting out of the stuck position and the acceleration of profit expectations when the market warms up.

OKX's Simple Earn, On-chain Earn, and Staking are all good choices.

Simple Earn is a product that helps holders of idle digital assets to earn coins with low thresholds. It is easy to get started, with different terms to choose from. The current Simple Earn corresponds to the idle treasure, which earns income by lending to leveraged trading users in the lending market, and the regular Simple Earn earns PoS income or project rewards by locking coins. It supports 24-hour anytime subscription and redemption, with immediate redemption for the idle treasure and redemption within 30 minutes for the regular Simple Earn.

Link: https://www.okx.com/cn/earn/simple-earn

On-chain Earn mainly provides holders with the opportunity to earn on-chain income, including Proof-of-Stake (PoS) and DeFi protocol. Investors can participate in PoS staking or DeFi projects on OKX at any time without paying network fees.

Link: https://www.okx.com/cn/earn/onchain-earn

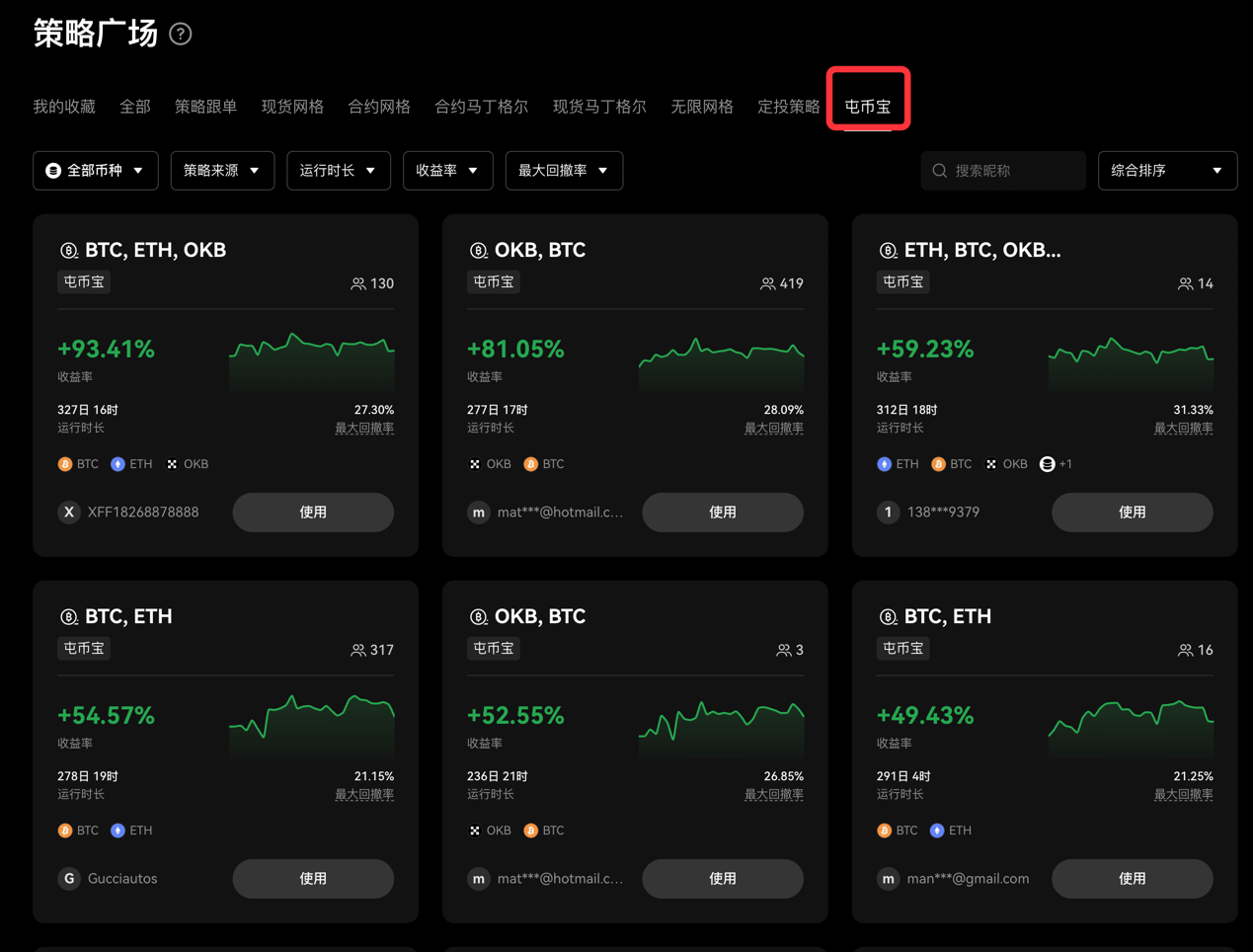

Staking is an automated strategy that can intelligently rebalance in the selected coin combination, using the exchange rate fluctuations between different coins to earn and hold coins, lock in profits, and increase the holdings of potential coins, thereby obtaining excess returns.

It should be noted that after the Staking strategy is created, the funds invested will be isolated from the trading account and used independently in the strategy. Investors need to pay attention to the risk of the overall position in the trading account after the funds are transferred out. In addition, if the coin encounters unpredictable abnormal situations such as suspension or delisting during the Staking strategy operation, the Staking strategy will automatically stop.

Link: https://www.okx.com/cn/trading-bot

II. For Experienced Traders, Consider the Miracle of Compound Interest

Einstein said that compound interest is the eighth wonder of the world, with more power than an atomic bomb. Buffett called compound interest the greatest invention in the world.

In the traditional secondary market, the most commonly used arbitrage tool for traders is the grid trading robot, which automatically executes trading strategies. Investors can achieve low buy and high sell, and repeated arbitrage in a programmatic and intelligent manner within the expected price range. It was mainly used by market-making teams with large capital in the past, who achieved arbitrage through high-frequency trading of grid trading.

Compared to the traditional financial market, grid trading in the cryptocurrency market has some innovations. Taking OKX, the platform with the most complete grid products, as an example, its grid strategies include spot grid, perpetual grid, contract grid, and universal grid.

Currently, the spot grid is more widely used in the current market conditions. Its trading logic is that investors set an upper and lower boundary range and decide to divide it into N segments in between. Selling a portion when it rises and buying a portion when it falls, it is suitable for oscillating markets, automatically buying low and selling high, and achieving compound interest. The advantage of the spot grid is that it is easier to hold coins and not completely miss the market. It can earn grid profits and floating spreads, and investors can also withdraw profits at any time for other trades. More importantly, it can continuously buy low and sell high through the robot without having to monitor the market all the time, saving a lot of energy. However, its disadvantage is that if the market's oscillation range is too small, it may not be tradable. In the case of a continuous one-way market, it will lead to idle assets. It should be noted that in the current market conditions, the fund efficiency of ordinary spot grids is relatively low, but OKX's spot grid supports the function of moving grids, which can effectively improve fund utilization within a reasonable range according to market conditions.

The image shows the spot grid that the author is experiencing. In a slightly oscillating market, with a principal of 20,000 USDT, the arbitrage profit over 9 days is around 250 USDT. Although the return rate is not high, the fund utilization rate of idle assets can be improved, and the overall experience is relatively good, but attention should be paid to setting the price range.

III. For the Bottom-Fishing Army, This Allocation is Safer!

In addition to compound interest, many investors with funds are waiting for the opportunity to bottom fish. However, the common anxiety is that they are afraid of buying in the middle of the mountain and afraid of not being able to buy at all.

History teaches us not to expect to buy at the lowest point. Gradually building positions and choosing suitable strategic tools may be a more rational choice. For example, OKX's Bottom-Fishing, Spot Dollar-Cost Averaging (DCA) Strategy, and Spot Martingale Strategy are all good "bottom-fishing" products. Of course, if you hold spot positions, you can also choose to hedge risks through coin-margined futures contracts.

First, the Martingale strategy is commonly used in the traditional foreign exchange market. The basic principle is to bet on one side in a market where you can buy and sell, and if you bet wrong, keep adding in the opposite direction. When the market rebounds, you can profit from buying low and selling high. OKX's spot Martingale strategy combines the basic idea of the traditional version with the characteristics of the cryptocurrency market to make a series of optimizations to balance the average cost of investors bottom fishing.

In the current market conditions, investors can choose to buy spot DCA every 1-5% drop in the market. By using the remaining funds to add positions in batches, they can reduce the overall holding cost. When the price rebounds, they can take profits and exit, capturing profits from small rebounds and continuously "realizing floating profits."

Next is the Bottom-Fishing product, which is a structured product derived from OKX's options trading function. It is very suitable for investors who want to buy a certain amount of assets at a price lower than the market price, but are worried that their limit orders at this lower price will not be executed. By using the Bottom-Fishing product to place orders, even if the strategy does not drop to the order price when it expires, the system still ensures that you can buy a certain proportion of assets at a price lower than the market price.

The Web operation path is as follows:

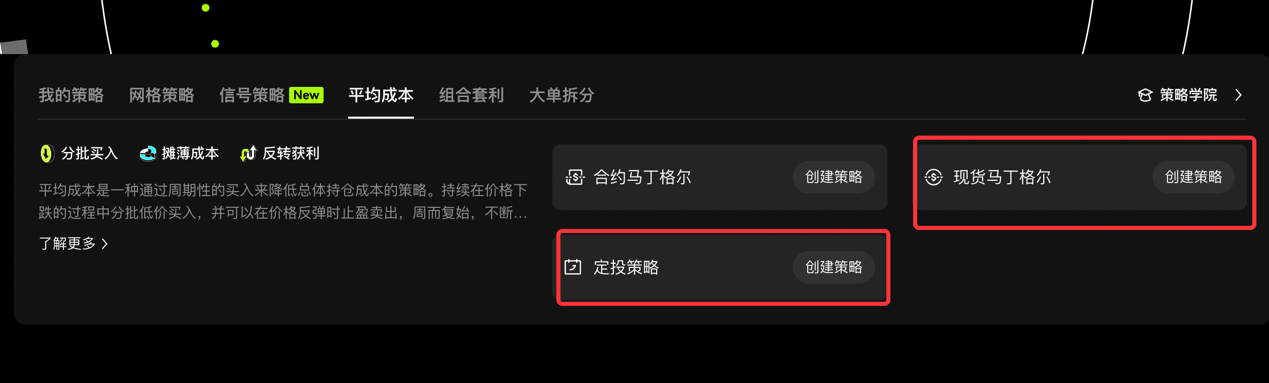

Finally, there is the Spot Dollar-Cost Averaging (DCA) strategy, which involves investing a fixed amount in a selected coin combination at a fixed time period. When the market fluctuates violently, using an appropriate DCA strategy, the same investment amount can buy more chips at the low point, helping investors to obtain more substantial returns. This strategy is suitable for everyone, especially long-term investors, and supports one-click DCA, redemption at any time, and free combination of coins.

The path to create a DCA strategy is to click on "Trading" on the OKX homepage, then "Strategy Trading," select "Create Strategy" and then "Average Cost" and "DCA Strategy" under it, and then enter the strategy creation interface to set the coin, DCA period, and other content, and finally click "Create Strategy."

The Spot Martingale strategy and Spot DCA strategy both belong to the average cost section. Average cost is a strategy that reduces the overall holding cost through periodic purchases. By continuously buying at low prices during a price decline and taking profits when the price rebounds, the strategy continues to cycle and profit.

IV. For Large Capital, Choose a Reliable Platform for Financial Management First

IV. For Large Capital, Choose a Reliable Platform for Financial Management First

Whether in the traditional market or the cryptocurrency market, financial products have always been the preferred choice for improving fund utilization, especially for large fund holders. However, with the low liquidity and frequent theft incidents in the DeFi financial products, they are not very favored by the market. Large funds still prefer to allocate assets to CeFi platforms. However, since the collapse of Fcoin, FTX, and AnYin, the demand for transparency and security of financial platforms by large funds has become increasingly high.

Currently, in terms of brand reputation, risk control system, high fund transparency, and product experience, OKX has been tested by the market in the past few years. They still regularly disclose the POR reserve data every month, to a certain extent, making it the first choice for large funds.

Of course, what is more commendable is that they are one of the few CeFi platforms on the market with a systematic financial product matrix. This matrix includes the simple options product "Shark Fin," which is loved by novice investors for its ultra-short-term capital preservation, the fixed-income financial product "Dual Currency Win," suitable for the current stable market conditions, and the customized strategy product "Snowball," favored by medium-sized funds with professional trading backgrounds.

These three products can basically meet the financial needs of different types of investors in different market conditions. Currently, the first two are more widely adopted, but due to the recent uniqueness of the market, it seems that the users of "Dual Currency Win" have increased. The image shows the returns from "Dual Currency Win" shared by investors, for reference only.

V. For Professional Traders, Please Continue Reading!

Seeing this, you will notice that the article introduces products from OKX.

Yes! That's right. In the past two years, whether in terms of product experience or risk control capabilities, OKX has been the most outstanding player in the cryptocurrency market. In addition to the Web3 team that has always been at the forefront of the market, OKX's CeFi innovation is also strong. In addition to the above products, the CeFi team also launched a signal strategy for professional traders last week.

In simple terms, OKX's signal strategy feature allows traders to freely customize their trading signals on the TradingView platform to meet specific needs, truly achieving freedom in trading experience, significantly improving trading efficiency and accuracy, while reducing the risk of irrational operations.

The image shows the custom signal entry.

The core concept of OKX's signal strategy is to predict future price movements based on historical market data and patterns. Traders can use market signals to find potential buying or selling opportunities for trading.

Its advantages can be explained with three key words. First, it is "signal-driven." OKX aggregates top signal providers composed of the smartest and most professional investors and institutions globally, providing traders with the highest quality trading signal services, reducing the learning costs for traders while increasing their trading accuracy to reduce trading errors caused by emotional issues. Second, it is "automatic trading." The signal strategy can help traders automatically execute trades as soon as the signal is confirmed, with stronger timeliness and efficiency compared to manual trading, helping traders avoid missing out on opportunities as much as possible. Third, it is "low latency." Compared to platforms with delays in the order of seconds, OKX's signal strategy is committed to providing millisecond-level latency, helping traders seize market opportunities in a timely manner. Overall, the signal strategy is to provide professional traders with a more rational and intelligent operating system, essentially helping them improve fund efficiency.

Currently, the signal strategy connects professional traders, nodes, and ordinary users. Ordinary users can use OKX's signal strategy to let professionals/institutions help them make money, only needing to pay a subscription fee or commission. Signal providers can apply to become signal providers for OKX, providing professional trading signals to realize the monetization of professional knowledge and cognition. For nodes, in the future, they can cooperate with signal providers to receive a share of the profits. The three parties form a closed-loop trading system. According to official sources, OKX will also launch a signal plaza for ordinary users in the future, integrating and displaying the completed trading signals from signal providers. Ordinary users can subscribe to and use these signals through the signal plaza, and create their own signal strategies based on this.

Looking back, every product from OKX carries a solid and rigorous attitude. Insiders say that this attitude comes from two forces within the CeFi team. One is the rationality and restraint of members with many years of traditional financial experience, and the other is the keenness and pragmatism of Internet experts in user operations. It's quite good. The platform pursues rigor, and users value science. The irrational cryptocurrency market is finally going to bloom "orderly" flowers.

Risk Warning: This article is for reference only and does not constitute any investment advice. The market is risky, and investment needs to be cautious!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。