Crypto exchange platform tokens play a crucial role in the digital asset trading platform and are essential in the crypto industry. These platform tokens are the tokens involved in specific exchange ecosystems, implying the potential development of the exchanges and their ecosystems. This report aims to study the price trends, market capitalization changes, token burn situations, etc., to gain in-depth understanding of the market performance and potential opportunities of these platforms.

In 2023, except for $MX and $BGB, the majority of platform tokens had lower returns compared to $BTC

As of August 20th, the total market capitalization of platform tokens was approximately $43 billion, accounting for about 4% of the total crypto market capitalization. This is a 1% decrease from the 5% at the end of Q1.

The platform tokens with the highest price increases since the beginning of the year are $MX and $BGB, with increases of 234% and 134% respectively.

$BNB remains the largest platform token by market capitalization, but its price and market capitalization have been declining since it was sued by the SEC in early June. As of August 20th, the market capitalization of $BNB was $33 billion, representing a 15% decrease from the beginning of the year.

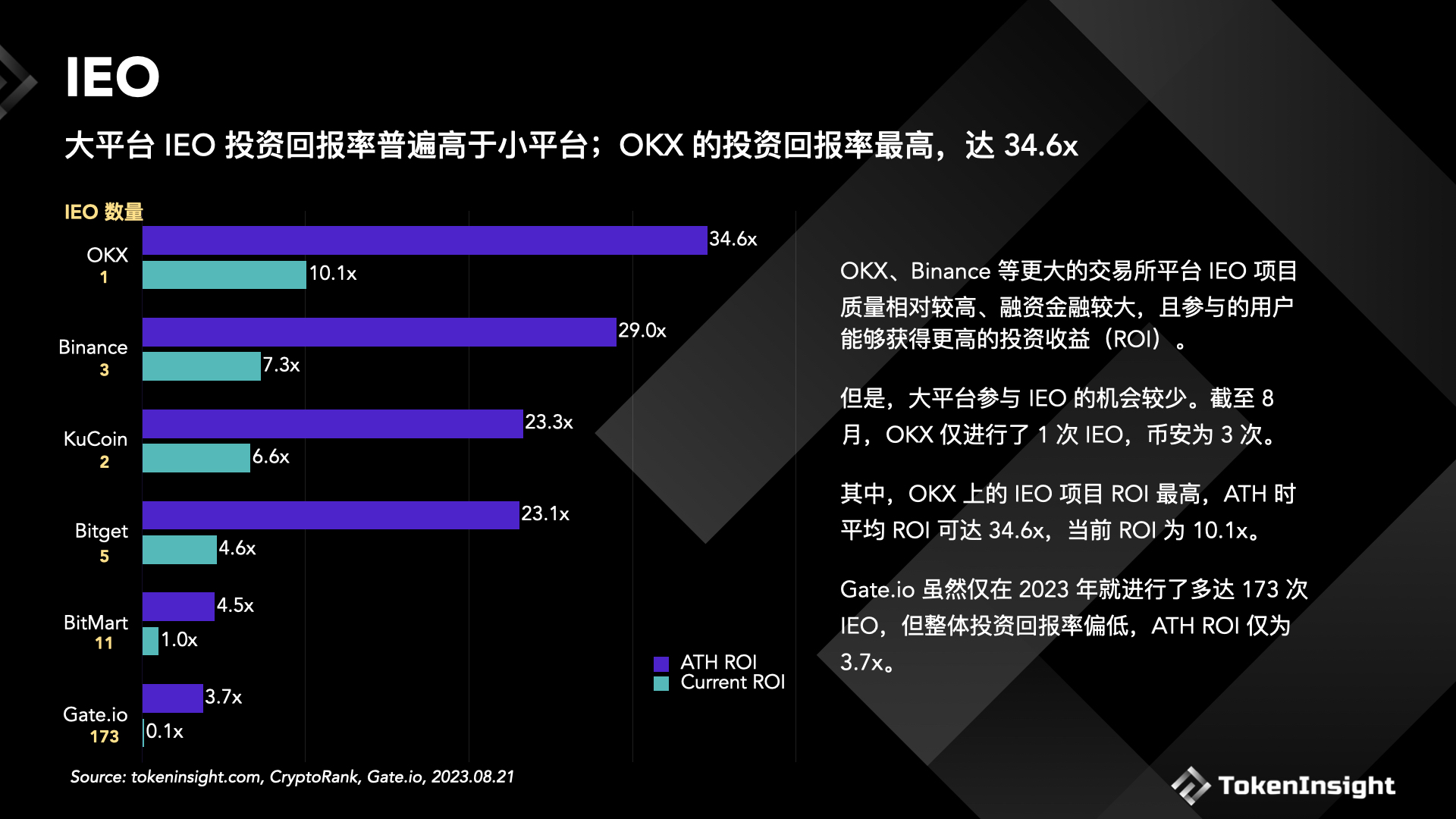

In 2023, OKX's IEO investment return rate was the highest at 34.6x

In 2023, the investment return rate (ROI) of IEO projects on OKX was the highest, reaching 34.6x based on the ATH price of IEO projects.

Larger exchanges such as OKX and Binance have relatively higher-quality IEO projects and larger financing, providing users with higher investment returns (ROI). However, opportunities for IEO projects on major platforms are limited. As of August, OKX had only conducted 1 IEO, while Binance had conducted 3.

Despite conducting as many as 173 IEOs in 2023, Gate.io had a relatively low overall investment return rate, with an ATH ROI of only 3.7x.

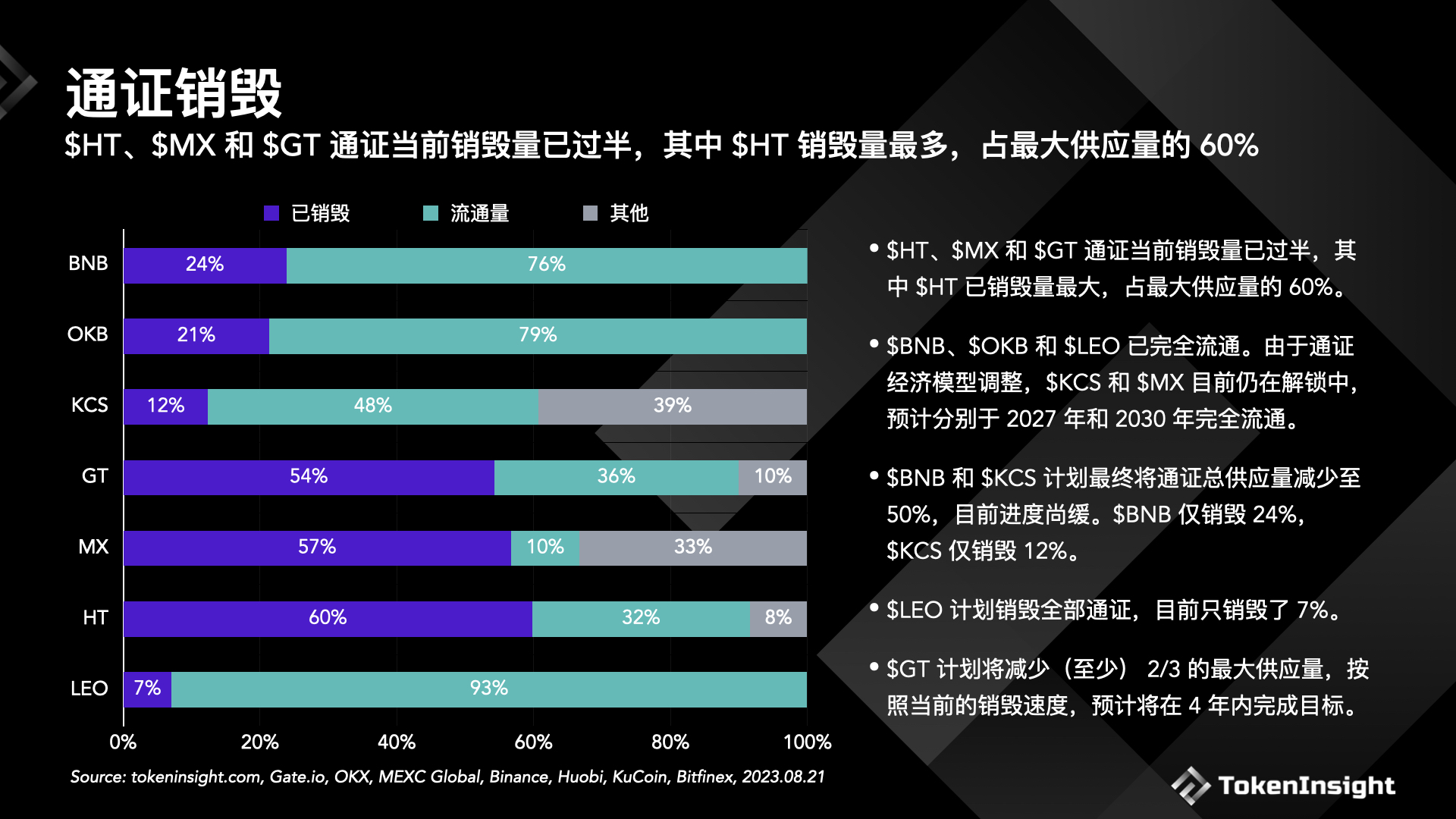

$HT, $MX, and $GT have burned over half of their tokens

$HT, $MX, and $GT have already burned over half of their current supply, with $HT having the largest amount burned, accounting for 60% of the maximum supply.

Since the beginning of the year, $GT has had the largest amount of tokens burned, accounting for 6.94% of the circulating supply, worth $24 million. $GT plans to reduce (at least) 2/3 of the maximum supply, and at the current burn rate, it is expected to achieve this goal within 4 years.

$BNB, $OKB, and $LEO have fully circulated. Due to adjustments in the token economic model, $KCS and $MX are still unlocking, and are expected to fully circulate in 2027 and 2030, respectively.

$BNB and $KCS plan to eventually reduce the total token supply by 50%, but progress has been slow. $BNB has only burned 24%, and $KCS has only burned 12%.

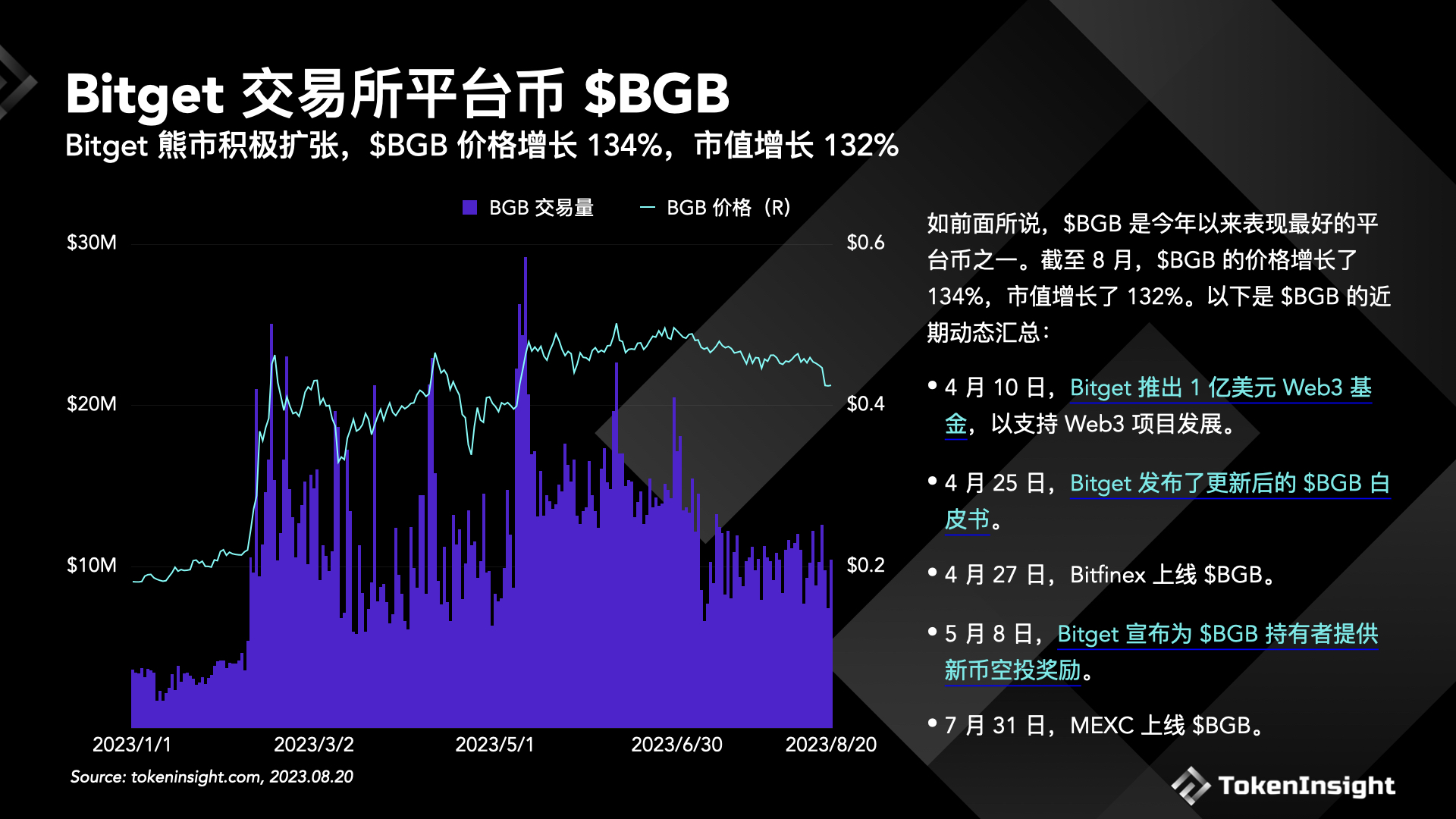

Bitget actively expanded during the bear market, with $BGB price and market cap increasing by 134% and 132% respectively

As mentioned earlier, $BGB is one of the best-performing platform tokens this year. As of August, the price of $BGB has increased by 134%, and its market cap has grown by 132%. The following are the recent developments of $BGB:

- On April 10th, Bitget launched a $100 million Web3 fund to support the development of Web3 projects.

- On April 25th, Bitget released an updated $BGB whitepaper.

- On April 27th, $BGB was listed on Bitfinex.

- On May 8th, Bitget announced a new coin airdrop reward for $BGB holders.

- On July 31st, $BGB was listed on MEXC.

New developments from TokenInsight

The new data chart Dashboard is now live!

It includes historical trading volume data, exchange market share changes, spot/derivative trading volume, top coin market capitalization, and more. Historical data can also be downloaded for free. Click to view

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。