Author: Nancy, PANews

Recently, OpenSea announced that it will close the royalty enforcement tool "Operator Filter" on August 31 and will shift to implementing an optional creator fee model. This announcement immediately sparked protests from multiple parties, with Yuga Labs, the parent company of BAYC, leading the resistance, stating its commitment to protecting creator royalties and gradually ceasing support for all upgradable contracts and any new series on OpenSea SeaPort. So, why did OpenSea stop enforcing creator royalties? And which projects will be most affected?

OpenSea Shifts from Mandatory to Optional Royalties, Sparking Controversy

A few days ago, OpenSea officially announced that it will no longer enforce creator royalties starting from August 31, and will instead introduce an optional creator royalty mechanism to better reflect the principles of choice and ownership that drive this decentralized ecosystem.

In simple terms, starting from March 2024, sellers can decide the split percentage for secondary sales, and if they set the split percentage to 0, creators will not receive any earnings.

Specifically, the disabling of the royalty enforcement tool includes four main aspects: (1) discontinuing the OpenSea Operator Filter from August 31, 2023; (2) for collections that had the OpenSea Operator Filter enabled before August 31, 2023, as well as collections existing on blockchains other than Ethereum, OpenSea will enforce the creator's preferred fee in all secondary sales from August 31, 2023, to February 29, 2024; (3) starting from August 31, 2023, making it easier for buyers to identify secondary sales listings that include the creator's preferred fee; (4) starting from August 31, 2023, making it easier for sellers to choose the creator's preferred fee or customize their creator royalties payment method.

Although the original intention of OpenSea's Operator Filter, launched in November 2022, was to limit NFT secondary sales by creators to NFT markets with enforced royalty mechanisms, filtering out platforms like Blur that offer optional royalties and zero royalty, as mentioned in the announcement, the success of the Operator Filter depends on the participation of everyone in the ecosystem, which unfortunately did not happen. In fact, despite allowing creators to blacklist NFT markets that do not enforce royalties, platforms like Blur and LooksRare bypassed the operator filter by integrating OpenSea's NFT aggregator Seaport protocol, thus bypassing the blacklist and avoiding creator fees. Additionally, in February of this year, OpenSea had already hinted at adjustments with a limited-time 0% fee, revised optional royalties (minimum 0.5%), and updated blacklists.

Meanwhile, OpenSea Pro (formerly NFT aggregator Gem) announced that, with the adjustment of creator fees, it will start charging a 0.5% platform fee for all OpenSea listings and orders created on OpenSea Pro from August 31. The platform also stated that this adjustment is necessary to prevent market manipulation and maintain transaction data as accurate as possible.

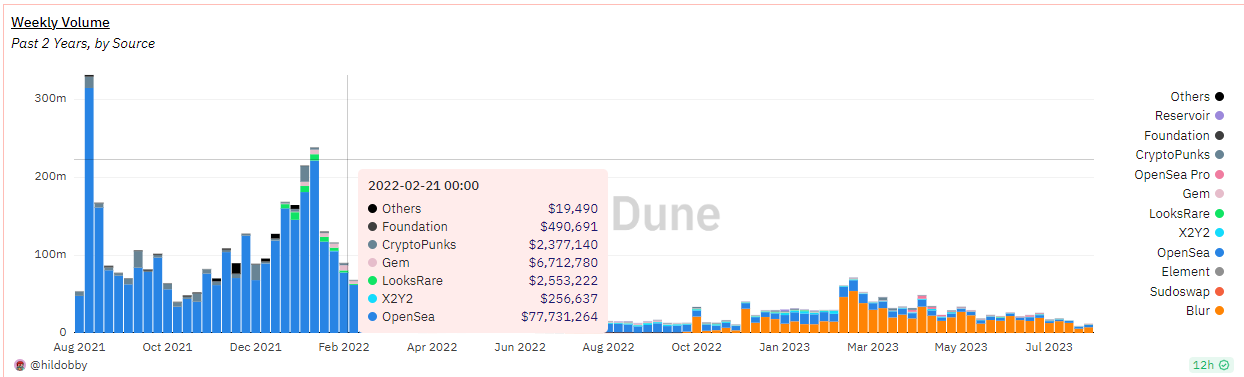

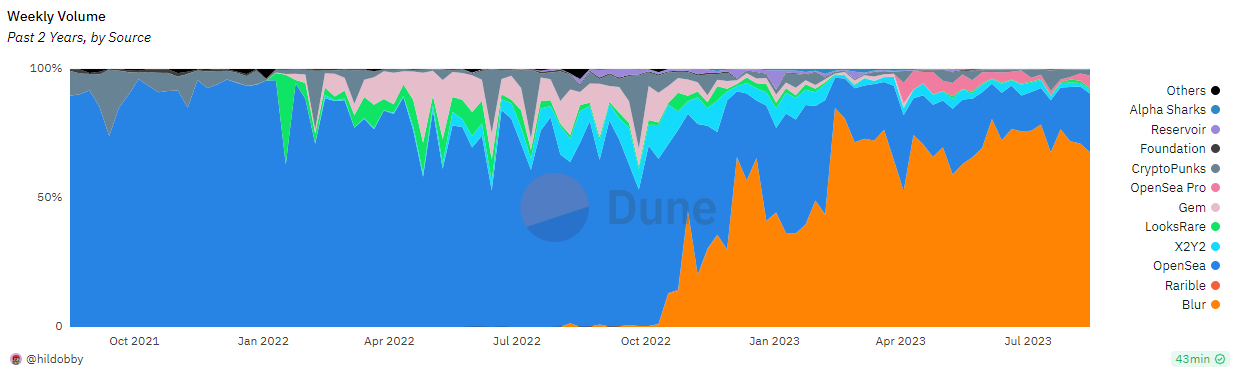

In fact, OpenSea's recent adjustment to its royalty structure is not unrelated to the market challenges it faces. On one hand, as the market trend turns bearish, NFT prices and trading volumes continue to decline, indicating a waning interest in NFT trading, affecting platform revenue. Data from Dune shows that as of August 22, the weekly trading volume of NFTs has dropped by over 96.9% from its peak of nearly $330 million in January 2021.

On the other hand, OpenSea's market share is being steadily eroded. According to Dune data, as of August 22, OpenSea's market share of weekly trading volume is only 22.8%, one-third of Blur's, compared to a high of 95.6% in January 2022. Similarly, in terms of weekly trading volume, OpenSea's share has declined by over 63.6% from January 2022.

The implementation of the optional copyright mechanism by OpenSea has also sparked numerous criticisms. For example, Mark Cuban, owner of the NBA's Dallas Mavericks, expressed on social media that as an investor in OpenSea, not charging and paying royalties for NFT sales is a huge mistake, undermining people's trust in the platform and damaging the entire industry. Phillip Kassab, NFT and gaming growth lead at Sei Labs, stated that (reducing royalties on platforms like Blur and OpenSea) is a short-sighted strategy that overlooks the delicate balance of sustainable success in this field, which is based on empowering traders and creators.

Under the Reform of the Royalty System, Leading Projects Are the First to Bear the Brunt

In response to OpenSea's adjustment of the creator royalty mechanism, Yuga Labs took the lead in protesting. On August 19, Yuga Labs officially announced that it will gradually cease support for all upgradable contracts and any new series on OpenSea SeaPort.

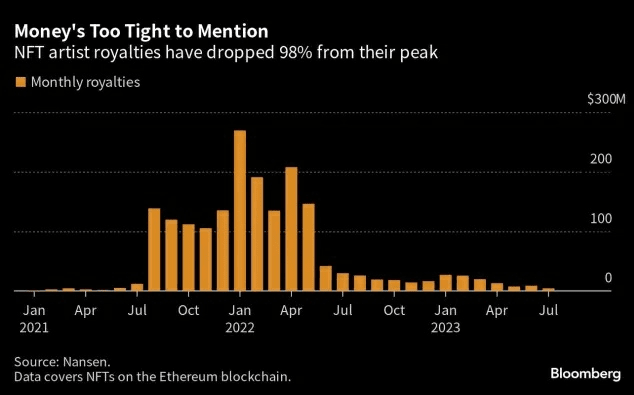

In fact, royalties are a significant source of income for project teams, so NFT trading platforms typically focus heavily on royalties. However, with the market downturn, creators' earnings are facing significant reductions. According to Nansen data, NFT market royalties had dropped to $4.3 million in July this year, a 98% decrease from the peak of $269 million in January 2022, as the transaction fee rate decreased from 5% per transaction to 0.6%.

More critically for creators, with OpenSea also shifting to an optional creator royalty model, this means that there are no longer leading trading platforms supporting mandatory royalties. For example, platforms like Blur and LooksRare use an optional royalty model, while SudoSwap adopts a zero royalty strategy, and so on.

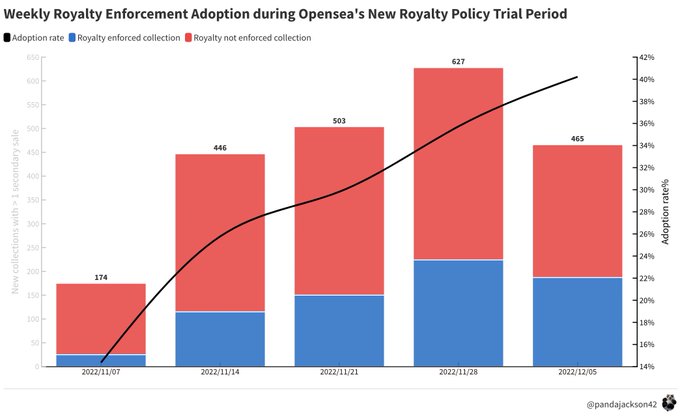

According to data analyst @Panda Jackson's previous statistics during the trial period of the Operator Filter (November 8 to December 12, 2022), out of 2,215 new collections, 31.6% used enforced royalties, with the adoption rate increasing from 14% to 40% within four weeks, and nearly 80% of the total trading volume of new collections was contributed by collections with enforced royalties. Furthermore, the data also shows that in transactions without enforced royalties, only 0.8% of transactions comply with the royalties, while in transactions with enforced royalties, this ratio is 86.6%. This data indicates that without enforcing royalties, creators can hardly receive royalties, as royalties increase the cost for buyers. Although this data is not the most recent, it does to some extent confirm the importance of enforced royalties for creators.

Faced with the situation where creators are unable to sustainably receive royalty income, which NFT projects will be most affected? According to Definitive data as of August 22, the top 10 NFTs in terms of royalty income are BAYC, Otherdeeds, Azuki, CLONE X, Moonbirds, Doodles, Parallel, RTFKT-MNLTH, and VeeFriends. Among them, BAYC ranks first with royalty income of $58.8 million, followed by Otherdeeds with $52.7 million, and Azuki with $44.1 million. CLONE X and Moonbirds follow closely with $37.7 million and $28.1 million, respectively.

In conclusion, regarding OpenSea's royalty reform, some believe that the optional or zero royalty strategy may attract NFT traders in the short term, but in the long run, it may lead to a lack of creative motivation for creators, which is not conducive to the continued innovation and development of NFTs. However, others believe that the existence of royalties is not conducive to NFT liquidity and may further expose investors facing losses to additional losses.

Related reading: Unsustainable Royalties, What Incentive Model Is More Suitable for Creators?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。