On the evening of August 15th, AICoin researchers conducted a live graphic and text sharing session on the "Grid Trading Strategy" in the AICoin PC End-Group Chat-Live. Here is a summary of the live content.

Grid Trading, a trading strategy "born for oscillation"

I. Principles of Grid Trading

1. Key Points of Grid Trading

① Buy low, sell high

② Stable returns

③ No manual operation required

④ Especially suitable for use in oscillating markets.

2. Disadvantages of Grid Trading

Not suitable for coins with extreme volatility, as extreme volatility can easily break the grid.

If the market unilaterally surges, the situation that may occur is selling at a high price, resulting in minimal profit; if the market unilaterally plunges, it is easy to get trapped.

3. Selection of Grid Trading

Carefully select trading pairs

① Exclude new coins

② Exclude coins with low trading volume

③ Exclude coins with poor liquidity

It is recommended to look for large coins with high market value on major exchanges.

II. Market Analysis

Step 1: Select large coins with high market value, choose "Market" - "Comprehensive" - "Market Value";

Step 2: How to determine the support and resistance levels of the trading pair, i.e., how to set upper and lower limits;

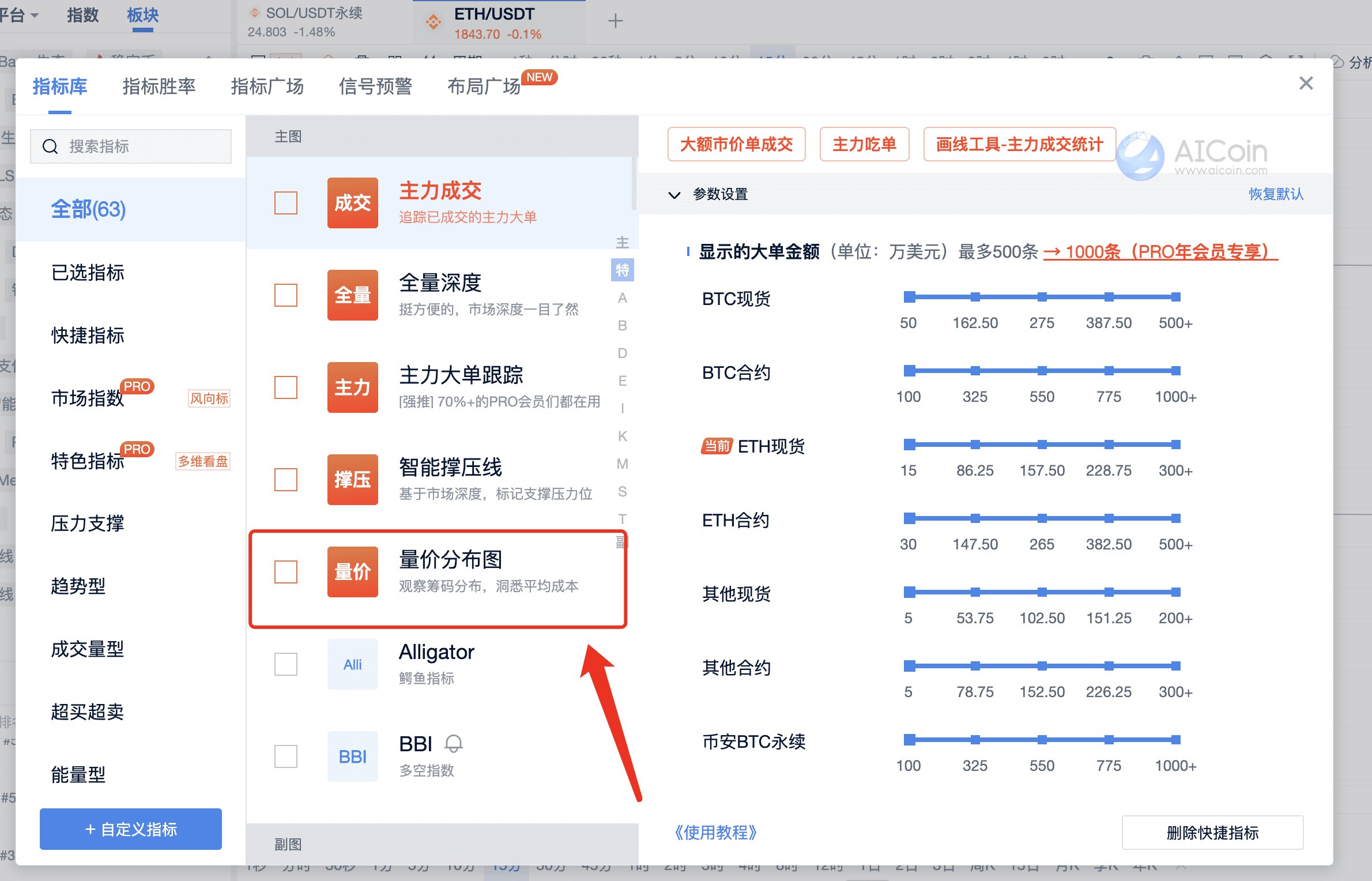

Volume-price (chip) distribution can determine the trading activities of the main force at each price level and predict the target price rise, as well as the resistance or support levels during the price rise or fall process:

https://aicoin.app/vip/signal

When the chip peak is high, the pressure or support is significant, for more details:

https://aicoin.app/article/360367.html

Chip chart position

Step 4: ETH/USDT spot

For ETH's 15-minute chart, you can choose the corresponding new high and low points as the upper and lower limits for the grid.

Because a new high will experience a certain pullback, and a new low will experience a certain rebound.

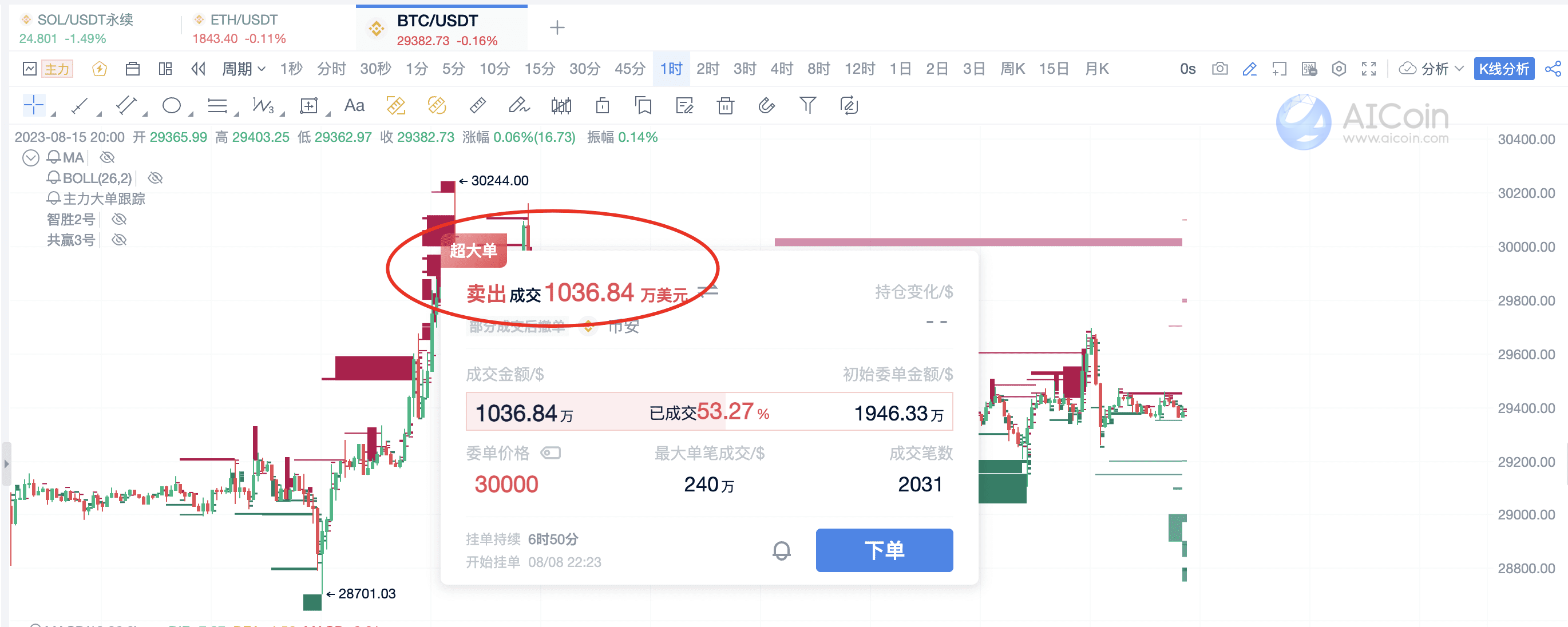

Volume-price distribution chart and large single orders are two methods to determine new high and low points.

When a large buy order appears, it serves as a support level.

When a super sell order appears, consider it as the upper limit for the grid.

III. Conclusion

Four methods to set upper and lower limits

- Utilize the peak value of chip distribution

- Utilize new highs and lows

- Utilize large single orders

- Use the method of constructing upper and lower limits in the Chande Kroll Channel

By becoming a Pro member, you can view the volume-price distribution: https://aicoin.app/vip/chartpro

Recommended Reading

- Unveiling the Market Makers from the Perspective of Chip

- Grid Trading, a trading strategy "born for oscillation"

- Customized Volume-Price Analysis System: King's Vision, Selecting Investment Opportunities

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC End.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。