A few days ago, MakerDAO adjusted the savings interest rate of $DAI to 8%. Today, the founder of MakerDAO proposed to lower the $DAI savings rate to 5% and expand the utilization range.

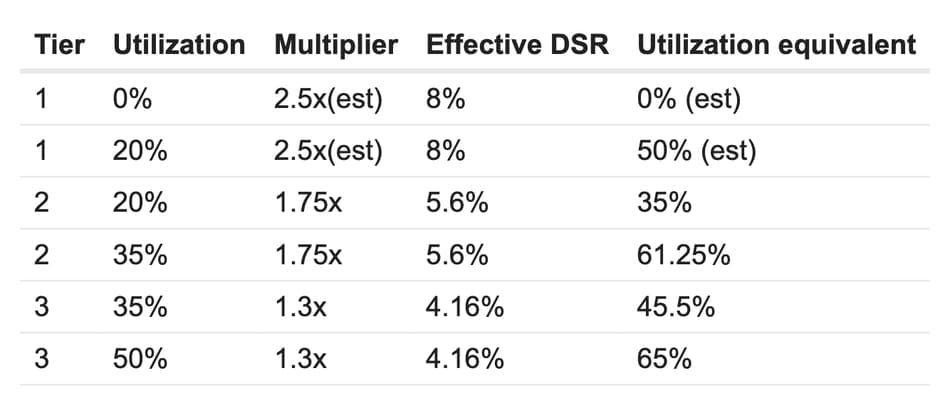

Just two days after raising the savings interest rate, MakerDAO proposed to lower the rate, as the 8% rate was actually a one-time "promotion." In discussing the increase in DSR interest rates, founder Rune explained: Enhanced Dai Savings Rate (EDSR), which is a temporary increase in the effective DSR that users can use in the early guidance stage when the DSR utilization rate is low.

EDSR will be determined based on the DSR and DSR utilization rate, and will gradually decrease as the utilization rate increases, eventually disappearing when the utilization rate is high enough. When more DAI is deposited into the DSR, the interest rate will decrease unilaterally and cannot be increased again. According to the original utilization range in the figure below, if the utilization rate is greater than 20%, the DAI savings rate will start to decrease.

Founder Rune Christensen stated that within 48 hours of the launch of EDSR, the Dai supply increased by nearly 500 million, and the DSR (deposit interest rate) utilization rate has almost reached the 20% threshold. It is evident that there is a huge demand in the market for well-known stablecoins offering high interest rates. If the 8% rate is maintained, the utilization rate may exceed 35% in the short term. Therefore, Rune proposed to uniformly use a 5% savings rate in the 0%-40% utilization range, allowing a larger user base to obtain a relatively high DAI savings rate.

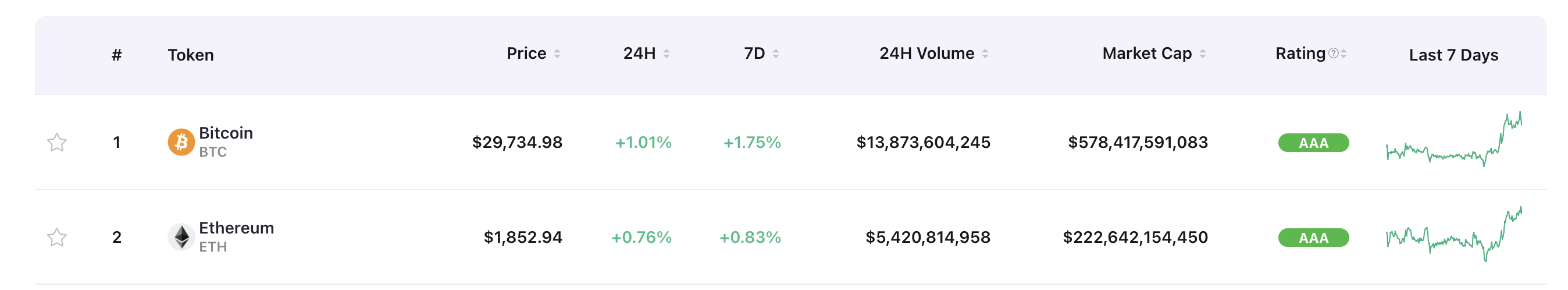

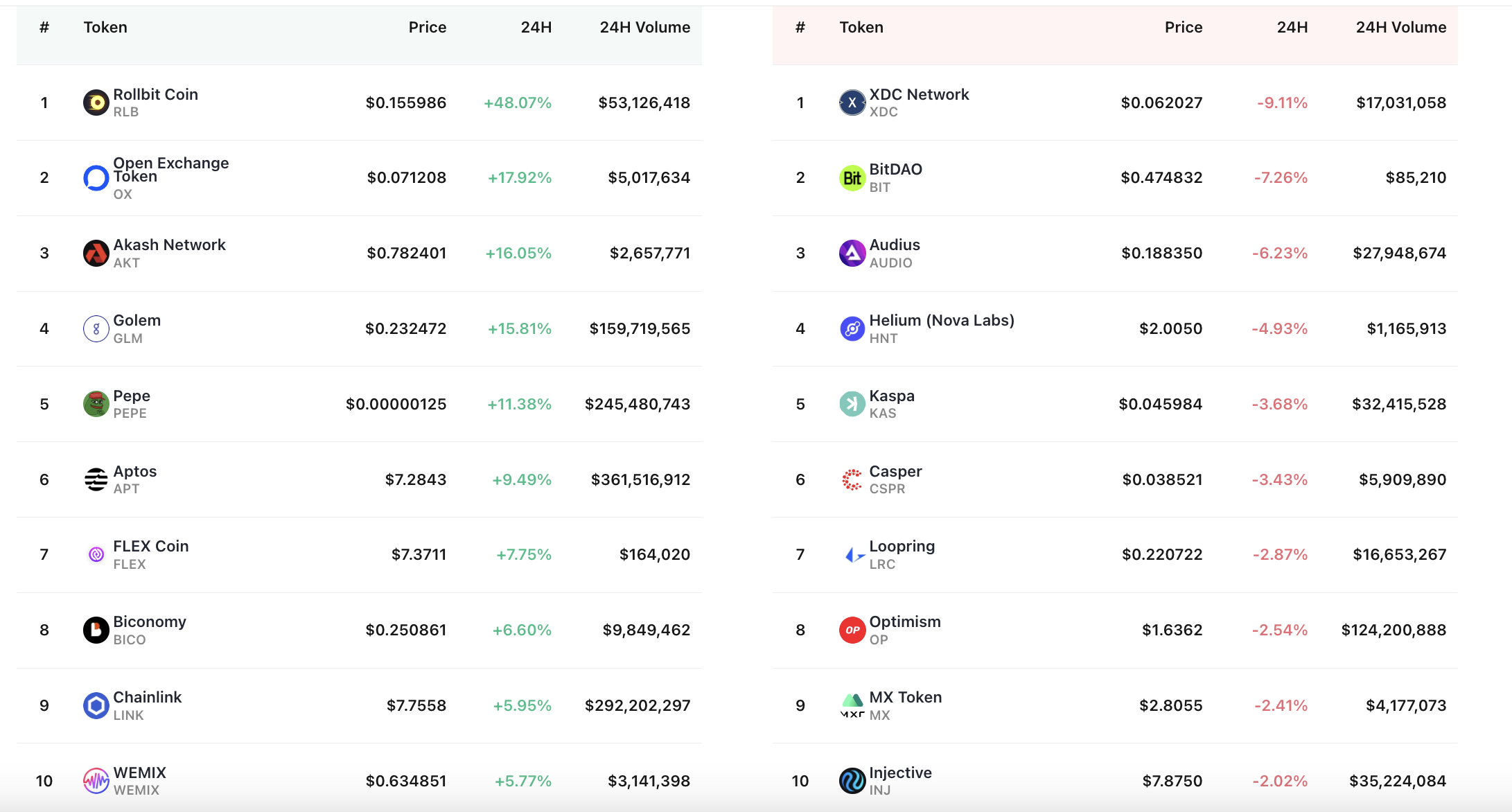

Today's Market

Source: TokenInsight Gainers and losers

Today's Highlights

Insiders say BlackRock's spot Bitcoin ETF approval is a question of when, not if

Temasek, Sequoia Capital, SoftBank, and 15 other VC firms being sued for assisting and abetting FTX

Other Notable Information

Saddle Finance plans to wind down, airdrop $ARB to $SDL and veSDL holders

Lending protocol GoldLink closes $1.4 million pre-seed round led by Polychain Capital

US Federal Reserve requires banks to obtain approval before conducting stablecoin-related activities

Founder of MakerDAO proposes to lower $DAI savings rate to 5% and expand utilization range

Decentralized perpetuals protocol Lexer Market launched on Arbitrum

Aptos Labs collaborates with Microsoft to develop AI blockchain solutions

SphereX raises $8.2 million in seed and launches its security solution for smart contracts

Web3 security startup Cube3.ai raised $8.2 million led by Blockchange Ventures

TokenInsight's Latest Reports and Courses:

Crypto Market Insights 2023Q2: After experiencing prosperity in Q1, the crypto industry did not experience significant ups and downs in Q2, but rather changes from the traditional market. So, what major events occurred in Q2? What impact did they have? Let's review together.

Mastering Market Cycles: Decoding Top Crypto Indicators: When to buy low? When to cash out? This course will definitely help you!

How to Build a "Decentralized Binance"? - The most detailed overview of trading infrastructure on the web.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。