Since the launch of Bitcoin perpetual contracts in 2016, the perpetual contract market has been growing uncontrollably in the entire cryptocurrency field. By 2023, the market potential of perpetual contracts has gradually expanded, completely overshadowing the cryptocurrency spot market.

From the launch of the first cryptocurrency perpetual contract trading platform to the present, the development of perpetual contract trading platforms has also undergone a qualitative change. Initially, perpetual trading platforms could only be built using centralized technology due to technical limitations. However, with the rise of DeFi and the improvement of blockchain performance, decentralized perpetual contracts have become a new direction.

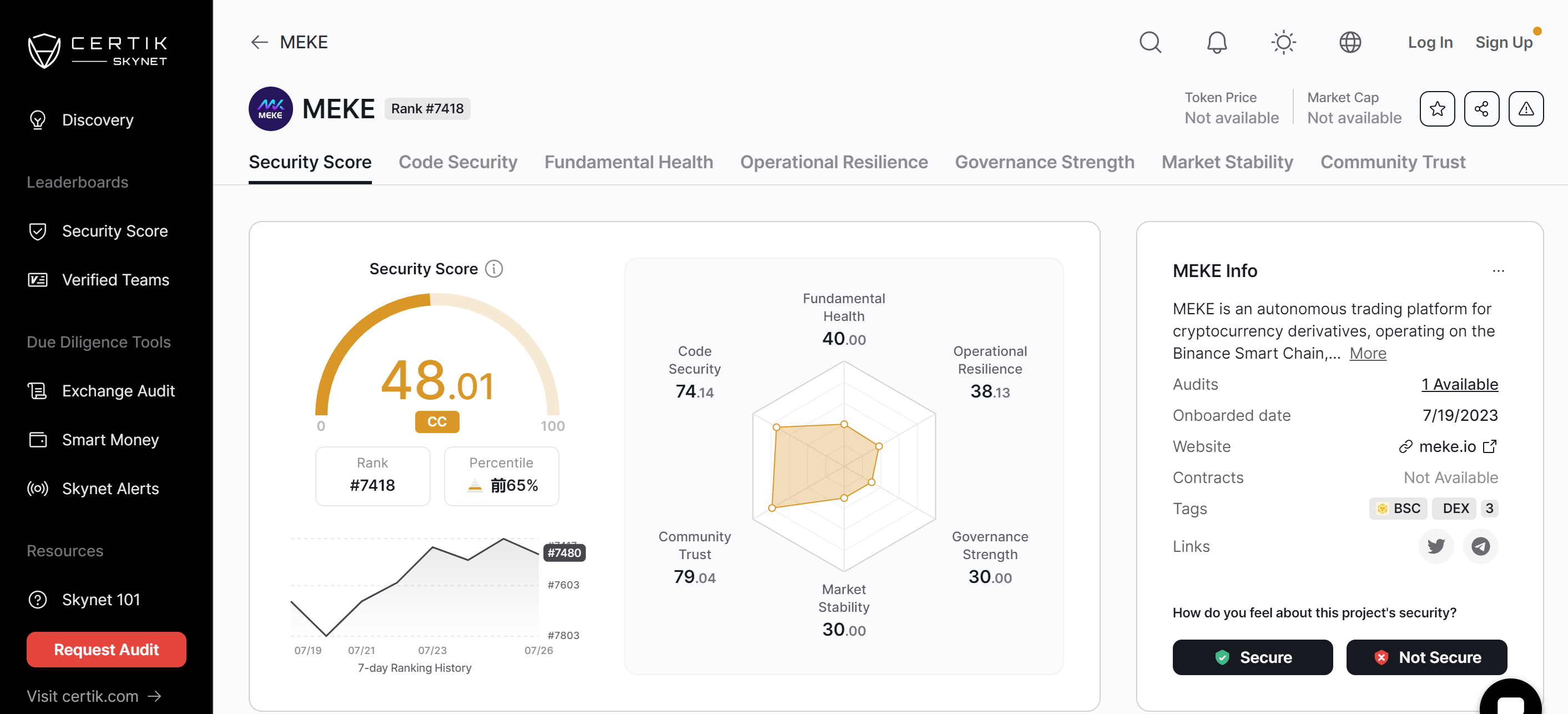

In July 2023, a chain-based derivative trading platform called MEKE, developed by a US technology team, emerged. MEKE's main functions are deployed on the blockchain and can be used for perpetual contract trading of various mainstream cryptocurrencies such as BTC, ETH, and in the future, MEKE will also involve perpetual contract trading of various physical assets such as gold, foreign exchange, and US bonds.

MEKE was loved by cryptocurrency traders worldwide as soon as it was launched. Since the introduction of perpetual contracts, some decentralized perpetual trading platforms have also appeared in the market, but most of them have discouraged users due to their cumbersome operation steps and laggy user experience. MEKE, on the other hand, has excelled in this aspect. MEKE not only achieves characteristics such as on-chain trading, tamper-proof transactions, public transparency, and traceability, but also provides a smooth experience similar to centralized user contracts.

In the entire decentralized perpetual contract trading market, dydx and GMX can be considered the leaders and runners-up of the entire industry. However, MEKE is not inferior to them in terms of technology and user experience.

Taking dydx as an example, MEKE is deployed on opBNB, the layer2 solution under the world's largest exchange Binance, which is not inferior in performance to all current L2 solutions. The network has a block time of 1 second, transfer gas fees as low as $0.005, and can process over 4000 transactions per second. In terms of user experience, MEKE started its first round of public testing on July 31, and the testing experience is just as good as dydx's. Currently, dydx has chosen to launch its own trading chain through Cosmos Stack, and perhaps in the future, MEKE and dydx will be tough competitors.

Compared to GMX, MEKE differs in that it uses a classic order book model, making trading data more clear and visible, more in line with the trading habits and experience of the majority of traders, and more conducive to market makers. On the other hand, MEKE uses an average weighted price of the oracle price and the platform's real-time transaction price as the implementation guidance price for assets, which is more stable and can largely avoid oracle attacks. GMX uses pool trading and simply the oracle price for pricing.

Compared to spot contracts, perpetual contracts have the allure of leveraging small bets for big gains; compared to traditional fixed-term contracts, perpetual contracts offer the flexibility of trading at any time, making them more adaptable to the ever-changing cryptocurrency market. Therefore, perpetual contracts have gained favor among many cryptocurrency traders. Until now, perpetual contracts have become the main source of income for many centralized exchanges such as Binance and OKEX.

According to data from Binance, the cryptocurrency derivatives market currently accounts for 74.2% of the total trading volume. The monthly trading volume of cryptocurrency derivatives has reached $19 trillion, tripling in the past three years. With the vigorous development of the cryptocurrency derivatives market, it is expected that by 2030, the market revenue will grow to $231.2 billion. In recent years, with the increasing regulatory pressure and people's desire for transparent trading, decentralized perpetual contract trading has become the trend of the entire industry. It can be imagined that in the future, the on-chain cryptocurrency derivatives market will produce leading products similar to the current Binance and Coinbase. MEKE may be one of them.

In addition to MEKE's strong technical advantages and broad market potential, MEKE's token model is also noteworthy. The total supply of MEKE tokens is 60 billion, distributed as follows:

10% is used for distribution to early investment advisors and technical advisors, with a large portion of it being airdropped to early participants in MEKE's public testing.

50% is used to incentivize market makers and users. Users can obtain MEKE through trading mining and providing liquidity to the exchange. This mining period lasts at least ten years.

20% is reserved for investment institutions, and the tokens held by investment institutions must be locked for one year before being released. After one year, they will be released linearly over ten years, with a release every two months.

10% is owned by the project team for market maintenance and various promotional activities.

The remaining 10% will be reserved as an insurance fund, and if a major event occurs, the handling of this fund will be decided by community vote.

MEKE tokens can be used for 1) platform DAO governance, 2) holding MEKE to reduce transaction fees, 3) periodic repurchase of MEKE by the platform, 4) staking MEKE to share MEKE platform transaction fees, and 5) in the future, when MEKE opens its public chain, MEKE can be directly used for gas fees on the public chain.

From the above, it can be seen that over 90% of MEKE tokens will be gradually released over ten years, with less than 10% being airdropped to early participants in MEKE's public testing. The first phase of MEKE's public testing started on July 31 and will end on August 10, with only about a day left until the end. Currently, MEKE's public testing is extremely popular, with a large number of users joining the testing every day, and the total number of users participating in the testing has exceeded 20,000.

For users participating in MEKE's public testing, MEKE will airdrop platform tokens based on the amount of USDT traded by users and their contribution to the platform's traffic. There are three phases of public testing, and the earlier the participation, the more cost-effective the airdrop will be. After the testing period, if there are remaining MEKE tokens planned for airdrop, they will be directly destroyed.

It is worth mentioning that the underlying L2 opBNB deployed by MEKE has not yet issued tokens, and the opBNB mainnet will also go live at the end of August. This means that participating in MEKE's public testing not only allows for MEKE airdrops, but also may provide an opportunity to receive opBNB airdrops. The first phase of MEKE's public testing is about to end. For more details, please long-press to copy and click to enter the MEKE community.

Official Website:

Telegram:

Discord:

Twitter:

https://twitter.com/MEKE_PROTOCOL

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。