Yesterday's Review:

- Ethereum successfully took the short position at the highest point, reaching the 1800 level, with a profit of 30-40 points. Bitcoin was slightly weaker, but the overall short strategy was correct, ultimately reaching the target of 28.8k; BCH took the short-term long position and exited at the highest point, gaining over 20 points; LTC remained unchanged, and there is still room for a further decline. No rush for futures/spot trading; YGG started to decline after reaching a new high, with short-term trading volume surpassing Ethereum, and harvesting is inevitable.

Today's Blueprint:

The market has been oscillating for several weeks, with a few waves of heavy volume in the middle, but overall there has been no change. The current market focus is not on the mainstream. YGG's trading volume has been overheated in the past two days, surpassing Ethereum in the short term. The evening market decline was synchronized, and after completing the bottom test, the day session rebounded, and YGG completed the harvest.

Market sentiment has also been rising with recent news. Although the bottom has not been reached as expected, the bearish trend is nearing its end, and there is an opportunity for a market sentiment reversal. It just lacks some news as fuel. This week's CPI is a very good catalyst.

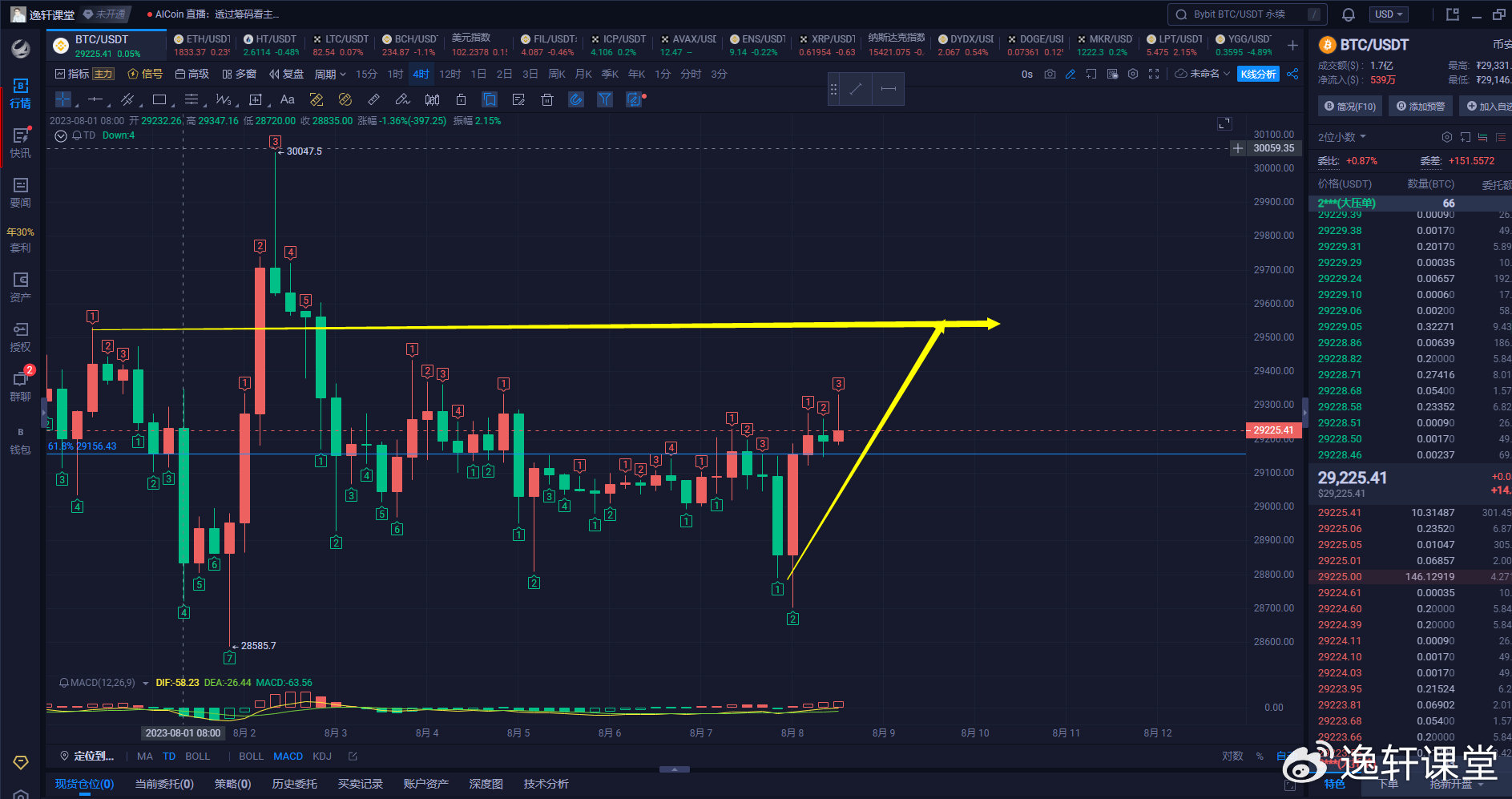

Bitcoin:

The second wave has been in a sideways trend since the decline. This round of consolidation has been accumulating for a long time, and the daily MACD has shown a trend of forming a golden cross. The short positions continue to decrease, and the daily KDJ three lines are sticking together and trending upward, showing a divergence pattern. If this round breaks through the high of the second round of decline, there will be an opportunity for a secondary reversal, and the daily K line will surge straight up. However, this week's CPI is an unknown factor. If it falls, the divergence will not form, so this round still needs more attention.

Trading suggestion: Pay attention to the watershed around 29.5k for long positions during the day. If it cannot be broken, consider opening short positions.

Ethereum:

The daily K line fell yesterday and recovered with a T9, although the weekly K line fell to the middle rail, the overall bearish trend has started to decrease, and this round is nearing its end. After the price hit a new low yesterday, it started to rebound. The 1800 support at the bottom is still effective, and the current price has returned to the oscillation range of yesterday. Short-term high selling and low buying should be canceled, and the price anchor range may break in the next few days. It is prudent to wait for the announcement of news.

Trading strategy: The short-term suppression level during the day is at 1850. Consider taking a short position in this round. The high-level suppression in this round is at 1880, and whether it can stabilize is the main point of contention for long and short positions.

BCH

Friends who continue to exit in the short term can continue to enter long positions near 230. Hold spot/futures for the medium term. This round may continue to test the 200 range, so hold patiently.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。