ICP tokens were clearly manipulated before and after listing. Is SBF behind this?

By: Crypto Leaks

This article is sourced from Crypto Leaks, an investigative company that exposes scandals in the crypto industry. The first two cases they exposed were about ICP being manipulated by capital and malicious shorting. This article focuses on the downfall of the "white knight" SBF. Crypto Leaks, through investigating the market's doubts and conditions at the time, believes that ICP tokens were clearly manipulated before and after listing. As the "spokesperson" for the highly popular Solana in 2021, SBF had the motive and capability to destroy its biggest competitor, the IC network (however, there is no substantial evidence, and there won't be in the future). The article was published on June 9, 2022, and FTX's scandal was exposed in November 2022. The translator has made slight modifications.

On April 7, 2023, Crypto Leaks updated the case:

After conducting extensive news investigations and publishing this case analysis, it can be said that this is the industry's first article raising questions about Sam Bankman-Fried (hereinafter referred to as SBF), including:

- The improper bundling between his hedge fund and market maker Alameda Research and his cryptocurrency exchange FTX.

- His potential involvement in criminal activities manipulating popular cryptocurrency prices, and their motives.

- He was previously sued for price manipulation and settled the matter with money.

- He has extensively promoted his charitable acts and intentions through effective altruism, which may be a strategy to deflect critical scrutiny of his criminal behavior.

- He has lobbied to influence the US media, politics, and regulatory system.

Summary of this article:

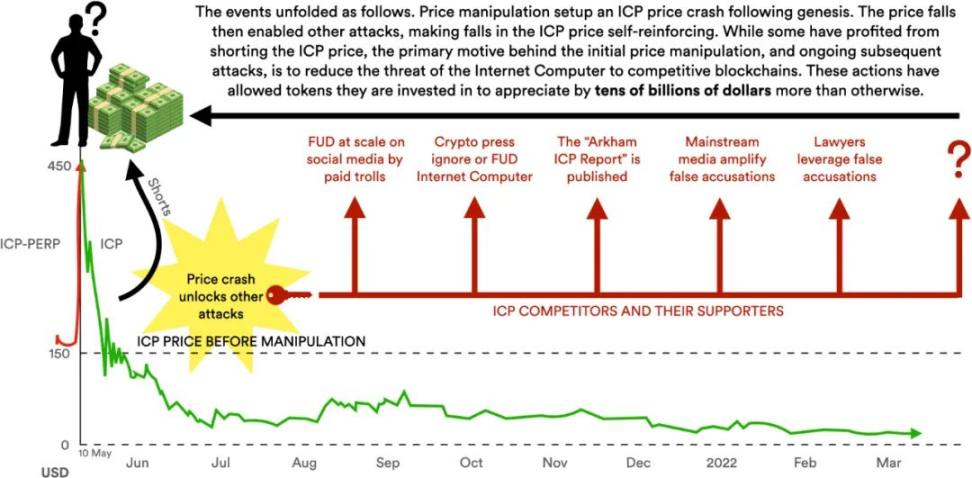

• On May 10, 2021, when the Internet Computer (IC) mainnet went live, its native token ICP was severely manipulated in the spot market.

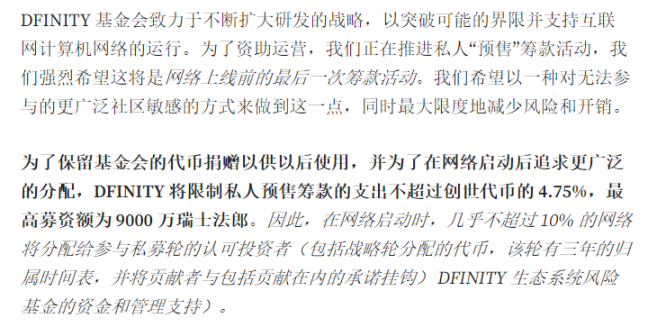

• At the time of listing, the fully circulating market value of ICP tokens was $230 billion, and its price almost immediately began to plummet, leading to a significant backlash from the crypto community against the DFINITY Foundation, further driving down the price of ICP tokens.

• Four days before the spot listing, FTX exchange, owned by SBF, introduced a perpetual futures tool called ICP-PERP and manipulated the price to rise fivefold through enormous trading volume, thus manipulating the initial spot price of ICP.

• SBF's manipulation of the ICP price began on FTX four hours before the spot listing. The initial price of ICP matched the price of ICP-PERP.

• Only major hedge funds and market makers active on FTX could carry out such large-scale price manipulation. SBF also owns and controls Alameda Research.

• We believe the primary purpose of manipulating the ICP price was to cause IC to collapse at the launch of the mainnet, creating a scandal and driving people away from projects on the IC network to protect the encrypted assets of unknown individuals. Because the advanced technology behind the IC network could disrupt the position of other blockchains and the current state of the crypto market.

• The underlying technology of the IC network is advanced (widely known before its launch), and it can serve as a Web3 alternative for traditional IT businesses such as cloud services, making Web3 more powerful.

• The main vision of the Solana blockchain is to provide the most advanced platform for Web3, and it can be said that it is facing a challenge from IC.

• We believe that SBF's possible price manipulation of ICP was aimed at defending the Solana blockchain and ecosystem, and we believe he holds a significant amount of Solana assets, which is crucial for his net worth (after the targeted killing of ICP prices, the native token SOL appreciated significantly, bringing SBF billions of dollars in capital gains).

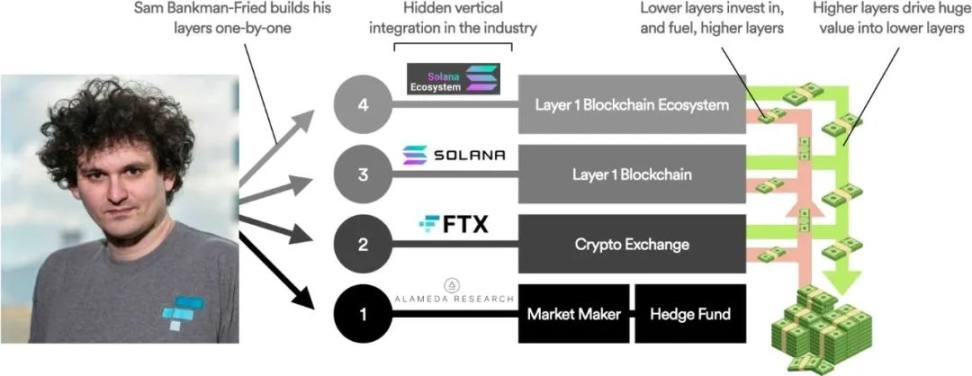

• Note the vertical relationship between Alameda Research, FTX, and Solana, which is impossible in traditional finance.

• Note SBF's lobbying activities, through which he gained support and recognition from organizations such as The New York Times, including his commitment to provide over $1 billion in presidential campaign donations to Biden.

The Mystery of ICP Price Manipulation

The Internet Computer (IC) blockchain went live with the "Genesis Mainnet" on May 10, 2021. After years of development, the blockchain was led by a large and high-quality team from the Swiss non-profit organization DFINITY Foundation (mostly composed of cryptography, academic, and leadership talents). They claimed that the underlying technology of IC could enable it to act as a "global computer," capable of fully hosting and running social media, large games, and enterprise systems on the blockchain without relying on traditional centralized technologies, such as cloud computing services from big tech companies. After the mainnet launch, the native token ICP could be transferred on its network, and cryptocurrency exchanges around the world began creating spot markets for users to trade ICP.

At the time of the mainnet release and ICP token listing, the price was over $450, bringing a fully circulating market value of $230 billion, which was undoubtedly very high. Subsequently, the price began to decline. This ultimately led to a series of attacks on the IC ecosystem by the crypto community, causing the price to spiral down far below normal levels and inflicting significant damage on ICP holders and the community building on the network.

Spot markets typically determine the price of a token through a price discovery process. However, it seems that the initial price of the ICP token at listing may not have been set through a normal price discovery process. Just four days before the mainnet went live, the FTX cryptocurrency exchange introduced ICP-PERP, a perpetual futures contract.

We analyzed the trading of ICP-PERP before and after the IC mainnet launch and found suspicious activity. ICP-PERP surged significantly before the spot listing, indicating that it was used to manipulate the initial price of the ICP token. This manipulation occurred within a few hours before and after the mainnet launch. Once the price manipulation activity ceased, the price of ICP began to fall back to natural market levels.

The rapid price decline greatly damaged the reputation of the IC ecosystem, and some in the crypto community began to attack the project, claiming that the price drop was due to improper behavior by the DFINITY Foundation and internal personnel (our investigation indicates that these attacks were carried out by parties investing in or shorting the project). These attacks further drove down the price of ICP.

In the absence of clarity on whether ICP was subject to price manipulation, innocent parties may be suspected. For example, Sam Bankman-Fried is a major supporter of the Solana blockchain ecosystem, and it can be said that due to the ICP crash, the market value of Solana increased by billions of dollars. At the same time, he is the owner of FTX exchange, which introduced ICP-PERP before the IC mainnet, evidently facilitating price manipulation, and he is also the owner of Alameda Research, a large-scale crypto hedge fund and market maker combination with the full capability to organize and execute price manipulation attacks. It should be noted that, apart from creating the ICP-PERP tool on FTX, this does not necessarily imply SBF personally participated in the price manipulation activities.

However, at present, SBF and FTX hold the logs of every ICP-PERP trade that occurred during the suspected price manipulation period, as well as the corresponding user account information. We need them to share this information to identify the mastermind behind the price manipulation. This will enable the ICP holder community to seek redress and help prevent further attacks. (Translator's note: Please note that this article was written in June 2022, before FTX's scandal was exposed)

Reasons for Price Manipulation

Cryptocurrency investors should understand that manipulating the price of ICP at the beginning of the mainnet launch caused obvious and significant damage to the IC ecosystem, and it was the greatest. Therefore, we believe that the ICP price was manipulated by those who wanted to disrupt the IC ecosystem.

We do not believe that the high listing price of ICP was intended to allow the DFINITY Foundation and insiders to sell at higher prices, as this would typically make them "poorer" (seriously damaging their reputation). We also do not believe that the purpose was to allow cryptocurrency traders to short ICP, as at the outset, due to limited liquidity of ICP, it was not possible to borrow enough ICP to create a large number of short positions, and it would involve high risk (the hype was too high). We believe that the manipulation of the ICP price was to protect the current state of the crypto market.

It is easy to understand the threat IC poses to the current state of the crypto market. It is the result of a large team developed by the DFINITY Foundation over several years, including renowned engineers, computer scientists, and cryptographers, whose technical capabilities were very strong at the time (and still are). For example, IC can achieve unlimited on-chain scalability, handle HTTP requests, and create interactive web experiences with smart contracts, trade efficiency several orders of magnitude higher than any other blockchain, and run smart contracts in parallel, and so on.

ICP's "Peak at Opening" can be said to provide freedom for some other blockchains to attract token investors' attention during the bull market in 2021. If the media and community were focused not on the price drop of ICP, but on the capabilities of the IC network and its growing community, it could immediately disrupt the current state of the crypto market. We believe that individual large investors of IC's competitors likely gained billions of dollars in capital gains due to the attacks on the IC ecosystem. This is what we believe to be the ultimate reason behind the price manipulation.

How Were ICP-PERP Futures Contracts "Weaponized"?

Four days before the IC mainnet went live, FTX exchange introduced ICP-PERP, which is a perpetual futures contract. Initially, traders could bet on the spot price of ICP after the mainnet went live to be only $114.40 through ICP-PERP. The price slowly and naturally increased until the day of the mainnet launch. At 10:00 AM Pacific Time on May 10, 8 hours before the IC mainnet went live, the price had risen to $176.89. At this point, everything seemed normal.

Then at 11:00 AM, the trading volume of ICP-PERP suddenly surged, increasing by 30 to 40 times compared to the previous days. From 11:00 AM to 6:00 PM, 7 hours before the mainnet went live and ICP spot listing, the trading volume of ICP-PERP reached an incredible $241 million. The average hourly trading value of ICP-PERP on FTX exceeded $34.48 million. In the 7 hours before the mainnet launch, the prices of ICP-PERP reached $275.67, $344.21, $329.09, $388.16, $466.22, $432.89, and $358.34, respectively.

To artificially increase the price of an asset in the trading market, manipulators typically use various techniques to create the illusion of demand. Sometimes, they engage in "wash trading," which means they try to sell assets to themselves (left hand to right hand) to increase trading volume. They often use fake accounts to create the illusion of different parties participating in trading. Additionally, market manipulators can increase prices by buying a large amount of assets within a limited time.

A key signal of market manipulation activity is a sudden increase in trading volume. This makes the trading volume of ICP-PERP highly suspicious. From the graph below, it is clear that the trading volume of ICP-PERP surged after 11:00 AM, and the price entered an almost vertical upward trend, reaching its peak after the mainnet went live. Subsequently, the price suddenly plummeted, eventually leading to a long-term decline. This data chart is from the FTX exchange itself.

The mainnet went live on the evening of May 10, 2021. Subsequently, popular cryptocurrency exchanges such as Coinbase and Binance were the first to launch the ICP spot market, allowing the public to buy and sell ICP tokens.

ICP-PERP and ICP prices are related. If the price of ICP-PERP is higher than the price of ICP, financial traders can profit from the price difference through special arbitrage trading, inevitably driving up the price of ICP in the spot market.

From 6:00 PM to 7:00 PM, shortly after the mainnet went live, the trading volume of ICP-PERP skyrocketed. In that hour, the trading volume of ICP-PERP reached $127.206 million, more than 250 times higher than a few days earlier. The price of ICP soared to a record high of $494.29. Since the mainnet was live at this time, ICP-PERP would have a real-time impact on the price of ICP tokens in the spot market. By setting the initial ICP price at this high level and maintaining it for some time, the manipulators led ICP holders and potential buyers to believe that this opening price was a reasonable market price.

However, the public was unaware that the price of ICP had already been influenced by FTX's ICP-PERP even before it was listed on the spot market. The last high trading volume of ICP-PERP occurred at 5:00 AM on May 11, reaching $55.914 million. At this time, the price of ICP reached $476.75 in the spot market. Around 7:00 AM, the trading volume of ICP-PERP suddenly returned to normal, and the price of ICP plummeted.

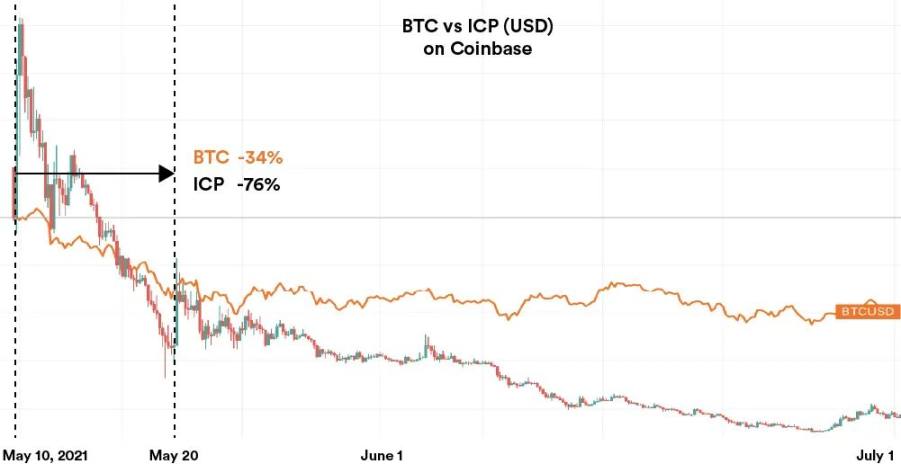

Bitcoin Crash Leads to Continued Decline in ICP Price

The price movements of most tokens are highly correlated with changes in the price of Bitcoin. In the 10 days after the IC mainnet went live, the price of Bitcoin (BTC) sharply declined by 34%. From the price chart, it is evident that this led to downward pressure on the prices of most tokens, which obviously also affected the price of ICP. However, because the initial price of ICP was clearly inflated threefold through the manipulation of the price of ICP-PERP, it would have declined regardless, so the impact of the Bitcoin crash amplified the decline.

Therefore, this timing was fortunate for the mastermind behind the price manipulation, but unfortunate for ICP holders. In the 10 days after the mainnet went live, the price of ICP declined by 76%. This helped the mastermind unlock a wave of attacks from other members of the crypto community against the IC network, ultimately maintaining the downward trend of the ICP price.

Attacks After Price Manipulation

The crypto industry has long been plagued by "pump and dump" schemes. Therefore, participants in the crypto industry, including investors, developers, and the media, have become accustomed to interpreting "sharp price increases followed by rapid crashes" as clear evidence of insiders initially inflating prices and then selling off.

Labeling a significant price drop for a project's token with this explanation is highly destructive because it implies that the project is actually a puzzle game, and the technology behind it may not be important, but rather a scheme to empty investors' pockets. Manipulating the price of ICP at the beginning of the mainnet launch and inflating it threefold likely involved major participants in the crypto industry, who were fully aware that when the price of ICP began to decline, resentment from investors would inevitably spread throughout the IC ecosystem, thereby diverting the disruption of the IC network's market position.

The crypto industry contains many "tribes" incentivized by tokens. Members of these "tribes" use social media to alternately promote (deceive) the networks they have invested in and attack competitors that threaten their networks. As part of their marketing activities, many members of these "tribes" are guided and incentivized by the organizations behind the blockchain networks.

When the "tribes" took action against the IC network, those who lost money in ICP trading also joined their ranks. They were convinced by widely circulated claims that the price of ICP had dropped due to insiders "pumping and dumping."

Attacks from amateur members of some "tribes" quickly emerged. For example:

• #Rumor One: DFINITY Foundation Team is Fake A Reddit user posted a report claiming that the team displayed on the DFINITY Foundation website is fake. When DFINITY Foundation founder Dom noticed this, he offered a reward to find the author of the report, and the report was subsequently deleted. This absurd and unfounded conspiracy theory is still being spread, indicating the damage such rumors can cause.

• #Rumor Two: Repeated Creation of False Facts Nazi propaganda minister Goebbels once said, "If you tell a lie big enough and keep repeating it, people will eventually come to believe it." Social media users also employed the same strategy. For example, Max Keiser claimed on his Twitter account to his 500,000 followers that DFINITY and ICP are a "pump and dump" scam. As false facts increased, the rumors became more convincing.

• #Rumor Three: Fabricated Victim Stories A user claimed to be a participant in the 2018 pre-sale financing of the DFINITY Foundation, alleging that the foundation "confiscated" his ICP tokens and profited from selling them on the market, leaving him physically and mentally exhausted. Unfortunately, most crypto enthusiasts may not know that this pre-sale financing was targeted at professional investors and institutions, and they had agreed at the time of investment that the ICP they purchased after the token issuance would be distributed in installments of 12 months each.

Soon, attacks from professional teams also emerged. For example:

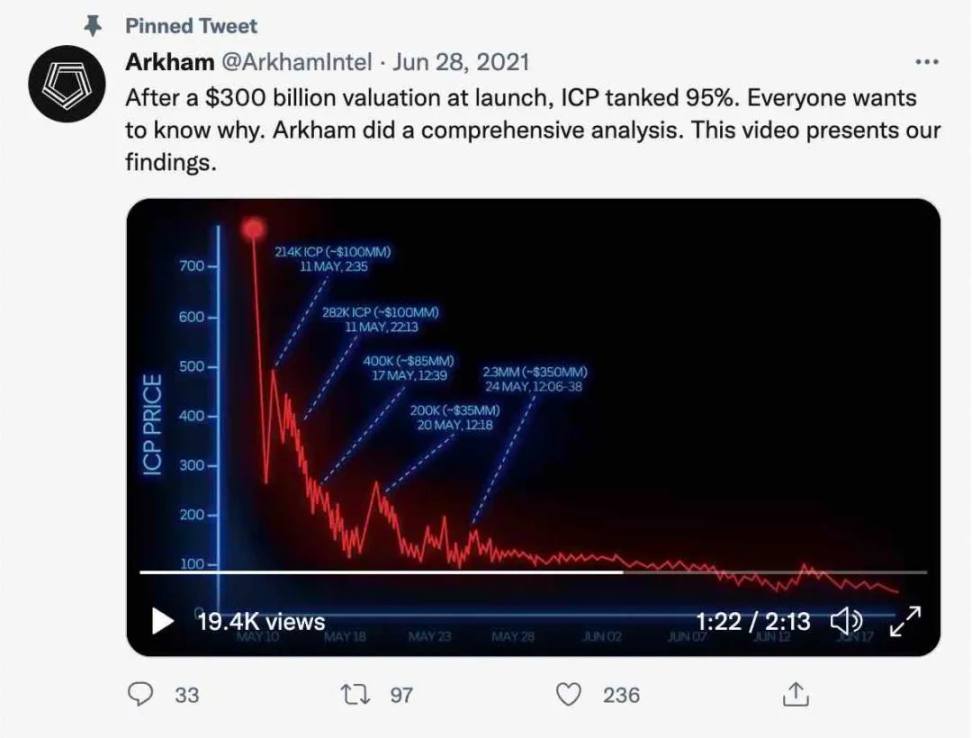

1. Arkham Intelligence

On June 28, 2021, a "mysterious organization" called Arkham Intelligence appeared (the same Arkham that was recently popular), with the unknown founder and CEO Miguel Morel claiming to focus on research in the crypto industry. They released a report claiming to prove that the decline in the price of ICP was due to the project being a "pump and dump" scam, and they used a carefully crafted video to promote this report. Miguel claimed, "I was not paid to release this report, I made it for the crypto community," portraying himself as a "white knight" defending ICP holders. However, the video began with an incorrect chart showing the price of ICP dropping from about $800, greatly exaggerating the extent of the price drop (some trading market sources did indeed show a price of $800, but $800 only existed for one second when the spot market was just listed).

In the video, Miguel claimed that the market value of the IC network is "as massive as financial companies like PayPal, MasterCard, or Bank of America." However, a high market value cannot be the conclusion that the price of ICP will inevitably fall. He continued to present a viewpoint that the price drop was due to insiders selling off, saying, "This seems not to be a coincidence or accident, but rather the misconduct of some individuals closely related to the ICP token, who sold billions of dollars' worth of ICP, leaving smaller investors in the dark as they watched their investments shrink significantly." He promised to "provide ICP holders with the clear answers they deserve," once again portraying Arkham as a "white knight."

At the end of the video, Miguel Morel stated, "We should question whether this is one of the most extreme cases of investor harm in the history of the crypto and financial markets." However, the DFINITY Foundation did not sell any ICP token shares in the weeks following the mainnet launch, and founder Dom only sold less than 5% of his token shares. Therefore, Arkham's report seems to be "professional defamation."

Crypto Leaks has exposed that Arkham was paid to produce this report and the forces behind it through a spy video from informants. Interested readers can refer to the "Arkham Chapter."

2. The New York Times Considers Arkham's Report Highly Credible

The New York Times raised the credibility of Arkham's suspicious report, mentioning it in an article published on the same day and in their DealBook newsletter, treating it as a credible source. This seems to have been pre-coordinated. The New York Times repeatedly and erroneously referred to the issuance of ICP tokens as illegal 1C0, creating the false impression that DFINITY is a lawbreaker. The New York Times, with its outstanding history and reputation, has caused significant damage to the global reputation of the IC network by lending credibility to the Arkham report. There is no doubt that their irresponsible actions have resulted in an additional devaluation of the ICP token market value by billions of dollars, harming thousands of ICP holders.

3. ICP Reboot - A False Community Uprising

A new project called ICP Reboot, composed of anonymous individuals, emerged suddenly in July 2021, claiming that "ICP Reboot is a community-driven project aimed at correcting the mistakes made by the DFINITY Foundation. The new ICPR token is established through forking the project to democratically control this new blockchain protocol." In other words, ICP Reboot claims that they will replicate the underlying technology of the IC network and launch a new blockchain called ICPR, which will be the IC network 2.0 version. Although the team behind ICP Reboot claims to be able to replicate the technology involved in the IC network, the talk of an upcoming fork has instilled fear in the ICP community and added further pressure to the IC network, which was already under attack.

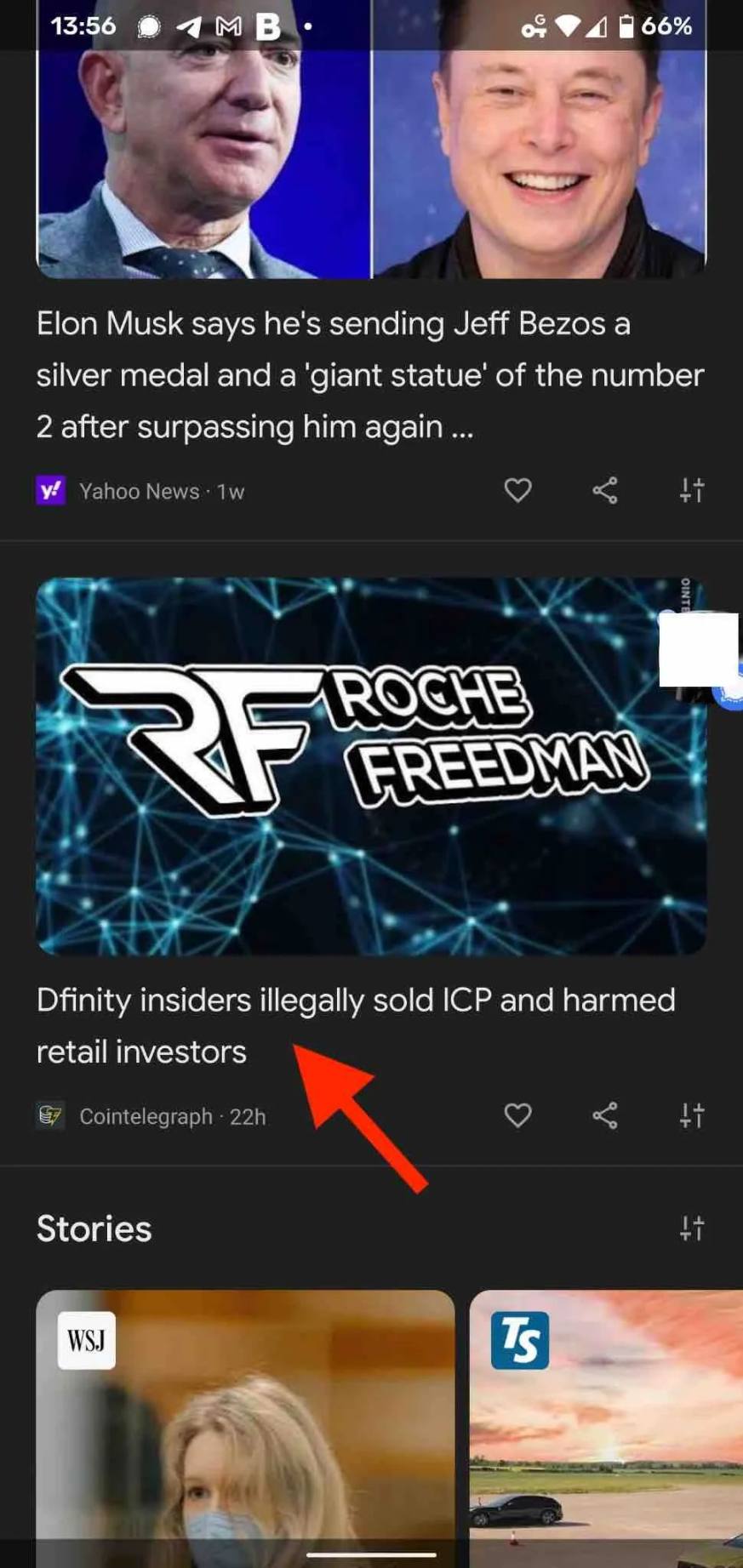

4. Class Action Lawsuits Exploiting the Arkham Report

In July and August 2021, two class action lawsuits were filed in the United States, claiming that ICP is an illegal security and that the price drop was due to "insider selling," and therefore, insiders should compensate the ICP traders who suffered losses. Both lawsuits cited the Arkham report as evidence of the misconduct of insiders.

The first lawsuit was filed by the law firm Scott & Scott from San Diego, California, and the second lawsuit came from the controversial law firm Roche Freedman in Miami. These two lawsuits have caused serious additional reputational damage to DFINITY and the IC ecosystem.

Unfortunately, outside the United States, many people may not be aware that the U.S. legal system allows lawsuits to be filed with false and unverified allegations without the risk of facing defamation charges, as the content of the lawsuit itself is protected as freedom of speech. Additionally, plaintiffs can subject defendants to invasive and costly procedures, such as discovery, allowing plaintiffs to obtain confidential information from defendants and disrupt them in various ways, even if the defendants are innocent. Even if the plaintiffs lose, they do not have to pay the defendants' legal fees.

In contrast, in Europe, a losing plaintiff must pay the defendants' full legal fees, and making false accusations in a lawsuit without sufficient evidence could lead to imprisonment. This naturally misleads European investors into thinking that class action lawsuits against ICP must have substantial evidence and content.

Therefore, the U.S. legal system provides a perfect platform for defaming competitors. These two class action lawsuits should be viewed in this context.

Especially the law firm Roche Freedman in the second lawsuit seems to have no ethical standards. The screenshot above is from the crypto news source Cointelegraph. They first published a paid article on the Cointelegraph website titled "DFINITY Insiders Allegedly Illegally Sell ICP Tokens and Harm Retail Investors." Their actions seem to be aimed at causing damage to the IC ecosystem and putting pressure on the DFINITY Foundation.

However, Roche Freedman seems to have exploited a legal loophole: they temporarily edited the title of the article, removing the word "allegedly," before including it in Google search. This allowed the completely unverified claim "DFINITY insiders allegedly illegally sell ICP tokens and harm retail investors" to be spread to millions of crypto enthusiasts. They even included destructive false information in the article, claiming that a legal judgment had been in their favor. Roche Freedman then restored the title of their paid article, adding the word "allegedly," so they would not be sued for defamation.

There are many other examples, such as media spreading FUD and encouraging holders to sell. The articles that appeared usually highlighted the Arkham ICP report, ICP Reboot, class action lawsuits, and "pump and dump" scams. All of these are providing the public and institutional investors with a false impression that DFINITY is a "stay away" scam.

Hidden Conflicts of Interest

The traditional financial system has developed over hundreds of years. In the past, stock and commodity markets were subject to serious manipulation. For these reasons, over time, layers of legal protections have been established, allowing free markets to operate normally and providing a degree of protection to participants from those who would unfairly harm them. Many regulations are aimed at ensuring that certain roles in a free market environment are performed by different parties, operating independently and without the ability to conspire. To understand why this is important and what problems arise in the centralized market of the cryptocurrency ecosystem, we can imagine a world where traditional stock financial markets lack these protections.

First, imagine a financial entrepreneur who owns a hedge fund that makes money through active trading of stocks like IBM and Microsoft, using clever strategies and automated systems to outperform retail amateur investors. This entrepreneur makes a lot of money and then diversifies into becoming a "market maker," providing liquidity to the stock market (market makers increase market depth, ensuring that traders can buy and sell reasonable quantities of assets at prices close to the prevailing market prices, which is crucial for market operation). If the hedge fund division's expansion requires the market maker to disrupt the stock market where they are short and enhance the stock market where they are long, there is now a potential conflict of interest.

Further imagine that the hedge fund and market maker, having merged and made a lot of money, decide to launch a new financial exchange for tech stocks and are located in the same office building. Now, the potential for conflicts of interest has multiplied: the hedge fund and market maker may now demand highly confidential market information from the exchange, including information about other traders in the market, such as what stop-loss orders they have placed and what leverage they are using. In the absence of regulation, the potential for the entrepreneur's "business empire" to unfairly profit is infinite.

Now, imagine that the hedge fund, market maker, and financial exchange's combination has made the entrepreneur a lot of money, and he decides to support a specific technology platform whose stocks will be traded on the same exchange. (Just like the dot-com bubble and the crypto market, the marketing "we are listed on xxx exchange" has become more important for market value than the technology behind it)

Imagine that the entrepreneur has made substantial investments in the company developing the platform and has accumulated a large number of shares in the technology platform. Imagine that his capital and control of the market have caused the platform's stock value to soar, providing returns that can be reinvested into the ecosystem, attracting new investors, tempting them with the idea that they "can invest in the next Alphabet" in this benign market.

At this stage, the already wealthy and powerful financial entrepreneur will make hundreds of billions of dollars.

SBF: You might as well report my ID card. (Translator's note)

But imagine that at this point, there is another new technology platform that has been developed for years by a non-profit foundation, which has a massive research program and has very advanced technology, leading the way. There are concerns that the launch of the new platform will ruin the entrepreneur's platform because the new platform is the fastest, most scalable, and efficient platform. In other words, the new platform has the ability to change the game.

It is clear that this is a legitimate concern, as a slight push could cause the entrepreneur's "business empire" to cause trouble for the stock of the new platform. At the same time, it convinces more people to develop on his platform.

Who knows what the entrepreneur will do, but this is why regulations in markets involving securities and traditional commodities are designed to prevent such conflicts of interest, and the cryptocurrency market also needs these regulations.

SBF's "Business Empire"

It can be said that there is a significant potential for conflicts of interest in SBF's "cryptocurrency business empire."

First, Sam founded Alameda Research, which became the largest hedge fund in the cryptocurrency industry, and then took on the role of a market maker, providing liquidity to the cryptocurrency market. Sam used the substantial profits generated from Alameda Research's trading activities to launch the cryptocurrency exchange FTX, which introduced numerous innovative products and experienced rapid growth, bringing him significant additional profits and immense power in the cryptocurrency market.

Some anonymous internet users shared scenes of SBF's meetings, where he was seen on Zoom discussing with FTX employees, raising questions about Alameda Research. In traditional finance, the separation of teams and roles reflects an increasing potential for serious conflicts of interest. Despite the risks, SBF then continued to expand his influence, taking a leading role in financing and promoting the Solana blockchain and ecosystem, with its native token SOL widely traded on cryptocurrency exchanges worldwide. He then began extensively promoting Solana through his social media accounts.

SBF's efforts attracted institutional investors, who believed that his financial strength would determine the future of "Web3 technology." At the peak on November 6, 2021, the fully circulating market value of Solana network's SOL token reached $132 billion.

Due to potential conflicts of interest, SBF and FTX must clearly demonstrate their fairness by sharing the ICP-PERP trading logs.

FTX later made significant investments in consumer-facing advertising, including Super Bowl ads, and focused on sponsoring sports events, stadiums, celebrities, and personalities, including Tom Brady, Major League Baseball, Mercedes Formula One team, Washington Wizards, Golden State Warriors, and other NBA teams.

SBF has repeatedly claimed that he will donate 99% of the enormous wealth he has earned in the cryptocurrency market to charity, often creating a halo effect that can deflect criticism.

If SBF truly cares about charity, he can start with the simplest step—by sharing FTX's trading logs to help unravel the mystery of ICP token price manipulation.

SBF Has Been Accused of Price Manipulation

Dealing with SBF is no easy task. With billions of dollars in cash and extensive influence, he can endlessly fund legal lawsuits and has the ability to retaliate against accusers in various ways. Extensive praise for SBF, such as an article in The New York Times mentioning his $21.2 billion wealth, his relationships with supporting celebrities, his appearance with Tony Blair and Bill Clinton at a special event, and a $10 million political donation to a Democratic congressional candidate, is intimidating!

SBF also pledged to donate $1 billion to Democratic causes to ensure their continued victory in the next presidential election, which has also earned him many high-profile friends.

However, accusations against SBF have also emerged. In recent months, many cryptocurrency enthusiasts have begun to accuse SBF and Alameda Research of manipulation, alleging that they engaged in price manipulation attacks and FUD propaganda against the Waves blockchain project, which competes with Solana.

Additionally, there have been many different accusations over the years. For example, it was claimed that in September 2019, Alameda Research conducted two market attacks on the global cryptocurrency market through the Binance exchange, but was stopped by the latter's anti-price manipulation system. There were subsequent related lawsuits, which were settled through paid withdrawals.

As the ICP token manipulation case primarily involves attacks on the IC ecosystem and ICP holders, which were launched using ICP-PERP on FTX, we hope to receive assistance from SBF and FTX to identify the mastermind behind the scenes. However, overall, we do believe that more regulations should be established for today's cryptocurrency market.

How Big Was the Threat of IC Network to Solana at the Time?

For SBF, everything is about Web3, and the future of Web3 is definitely Solana.

Web3 is the next stage of the internet, involving widespread tokenization, providing direct ownership of assets (such as media content) to people, and shared ownership and participation in the direct control and governance of the online services they choose to use. For many in the cryptocurrency industry, the key next step is to reimagine and fully rebuild systems and services, such as social media and gaming, using decentralized technology.

In Web3, online services like social media will be under the complete control of DAOs (decentralized autonomous organizations), controlled by holders of governance tokens (through voting on proposals or upgrades). In the future, governance tokens will serve as reward distributions and enable users to become partial owners of the services they use.

It can be said that the Web2 ecosystem will gradually be reshaped in the form of Web3. This provides one of the greatest opportunities for tech entrepreneurs in modern history, as it offers an attractive new way to reimagine services—tokenization helps create strong network effects, enabling them to surpass existing centralized Web2 services over time and create entirely new experiences.

Blockchains playing the role of "Web3 platforms" will become very valuable, which is why SBF promotes Solana's ability to provide functionalities for Web3 as its core marketing message.

Blockchains that can support Web3 must be particularly fast, efficient, and ultimately scalable to handle huge throughput, a unique selling point that SBF often claims for Solana. For example, at a cryptocurrency conference hosted by Yahoo Finance and Decrypt in November 2021, SBF stated:

Solana is one of the few public blockchains in existence that has a truly credible roadmap and can process millions of transactions per second, you know, for just a fraction of a penny per transaction.

Using traditional centralized IT technologies (such as cloud services, databases, and web servers) to build Web3 services is meaningless, as they cannot be placed under the control of community DAOs. Additionally, they may be vulnerable to hacking, damage, and do not have single points of failure like blockchains, and are under the complete control of individuals or organizations managing them.

SBF is very clear that Web3 blockchains will need to host mass-market social media services in the future. For example, at the Solana Summit in November 2021, SBF said:

I continue to believe that the future of social media will be built on the blockchain, able to solve many of the pain points of social media today.

SBF clearly articulates that speed, efficiency, scalability, and the ability to host social media on the blockchain are at the core of Solana.

But ideals and reality are different. How does the actual situation compare to the IC network? Would he and other Solana insiders view the IC network as a competitive threat?

The Gulf Between Ideals and Reality

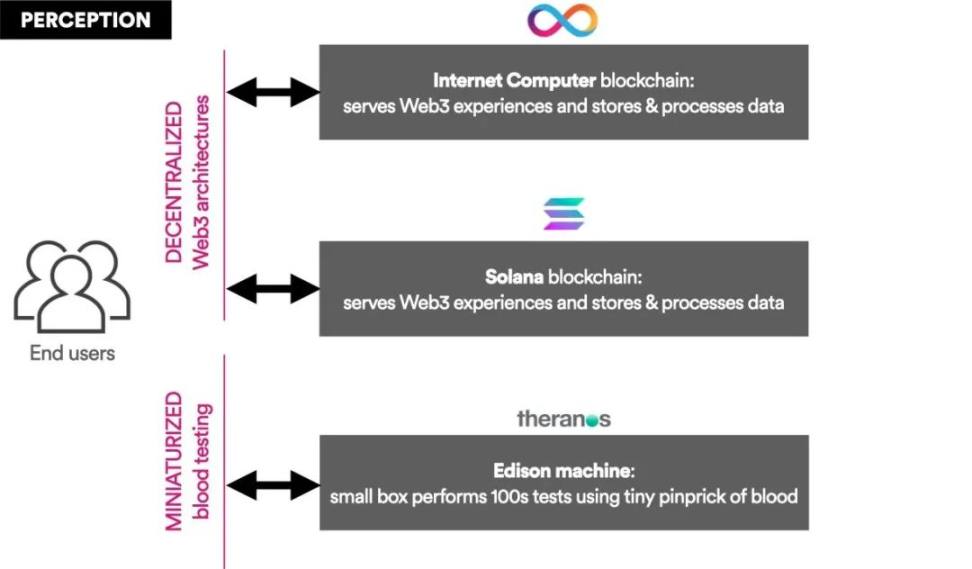

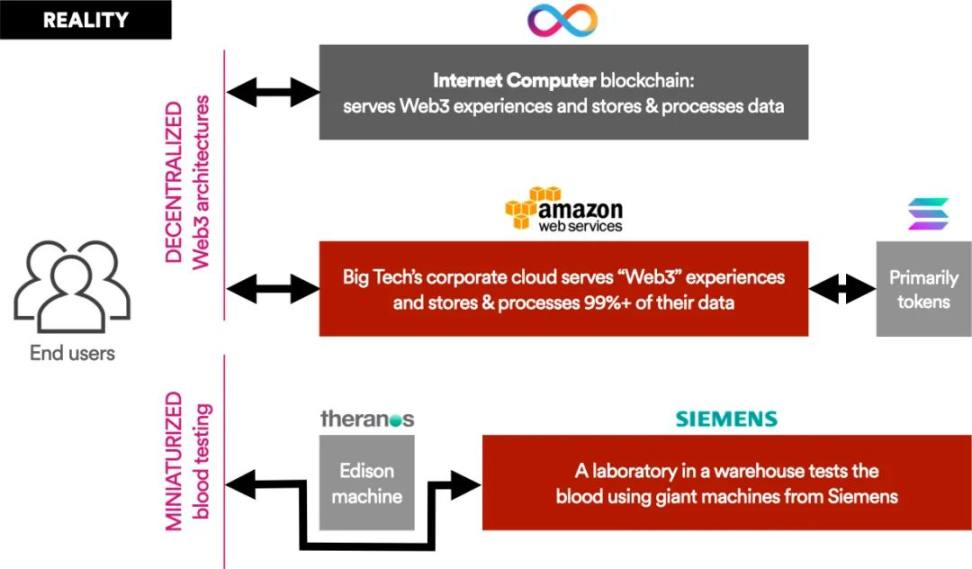

At a higher level, it is easy to understand the threat that Internet computers pose to Solana. We conducted a simple survey of some cryptocurrency enthusiasts (including journalists and investors), and when they heard that Web3 services or decentralized applications were "built on Solana," everyone understood this statement to mean that Web3 services or decentralized applications were actually running entirely on the Solana blockchain, and that Solana is an end-to-end Web3 decentralized technology platform:

However, this carefully cultivated view of users through marketing is starkly different from reality. Web3 services and decentralized applications "built on Solana" are actually mostly running on centralized servers in enterprise cloud services (such as Amazon Web Services) or data centers, which run databases, while Solana is only used to support tokens and smaller transaction information:

You might expect developers to describe projects as "built on Solana," only to find issues when they are actually built using traditional IT in practice. But they accept the status quo because they know there is no difference. They have brought the promises, public relations, and marketing of Web2 directly into the Solana ecosystem, leading them to believe they are doing the right thing. Most of them have not investigated other blockchain networks or understood the differences between Solana and other blockchains, and have started development directly after receiving generous funding, with these projects continuously updated with subsequent funding, making them loyal and integral members striving for Solana's success.

Solana insiders cannot simply accept this disconnect between ideals and reality. With the launch of the IC network's mainnet approaching, they must be concerned that the IC network's ability to host social media services on-chain (which they desire) could hinder their rise in the cryptocurrency market rankings.

The IC Network Has Realized Their Ideals in Reality

The Huge Technological Differences Between Blockchains

The vast majority of investors in the Solana blockchain are unaware of the significant technological differences between blockchains. Most people believe in the potential of blockchain and Web3, and find comfort in supporting Solana due to the success and reputation of Sam Bankman-Fried and other investors doing the same. Many would argue that the technological differences between blockchains are not important in Web3 and would cite the classic example of how the VHS videotape format used by JVC defeated the more advanced Betamax format used by Sony in the 1970s.

The theory is that SBF and his network's capital and influence can easily beat superior technology in the short to medium term, while buying time to catch up with their own technology. For example, Kevin O'Leary once said about Solana:

"Who's researching this? SBF and his team! Why wouldn't you bet on this horse?"

However, comparing the differences between IC and Solana to the differences in videotape formats has limited significance.

Compared to Solana, IC has a completely different set of technological capabilities, which can be said to be crucial for realizing the Web3 revolution, as they allow Web3 services to run 100% on-chain under the control of community DAOs. For example, smart contracts hosted on IC can handle HTTP requests and provide interactive web experiences directly to users without cloud computing.

Even if technological capabilities can be compared, Solana's statistics perform poorly. For example, storing 1GB of data on Solana costs 3480 SOL per year, assuming the price of 1 SOL token is $100, which is equivalent to $348,000 per year. In contrast, storing 1GB of data on IC has a stable cost of about $5 per year.

The developer community of IC has already begun to use this lower cost to build 100% on-chain Web3 social media services. For example, a Web3 chat called OpenChat allows users to chat with each other using a web browser, running entirely on the IC blockchain. The service involves IC smart contracts, which are fast enough to handle instant messages and can also store messages. It can be said that IC's performance is an example of what Solana wants to become. Despite facing various attacks, the IC network has a large developer community, reportedly developing hundreds of Web3 projects.

Imagine how the current situation of the IC network would be without price manipulation?

Because Solana is steadfastly committed to the Web3 competition, there is no doubt that if the ICP price manipulation had not occurred, IC would have severely disrupted its promotional vision and market positioning.

Investigation Summary

The preceding chapters clearly demonstrate that IC poses a potential existential threat to Solana.

The DFINITY Foundation team conspiracy theory sounds absurd. DFINITY has an extraordinary team, consisting of many leading cryptographers, computer scientists, and engineers, many of whom have personal papers cited thousands of times. In contrast, Solana has not even publicly shared detailed information about its technical team.

A simple investigation quickly reveals that IC's technology is vastly superior to Solana's, and its vision for Web3 is also more ambitious. Despite facing various attacks and a lack of substantial funding, the growth of the developer ecosystem indicates that the IC network has genuine product-market fit.

If it weren't for the devastating blow of the market manipulation on May 10, 2021, and the subsequent price crash, IC would almost certainly have severely disrupted Solana's core claim to be the "future of Web3" during the bull market in 2021. Therefore, supporters of the Solana ecosystem benefited the most from the ICP market manipulation event.

In this investigation, we have only provided speculative evidence indicating that SBF benefited from the attack through his assets in the Solana ecosystem. We have also speculated about the motive and believe he has the capability to execute it. Of course, this does not mean that he actually carried out the attack.

Translator's Note: Crypto Leaks repeatedly requests SBF and FTX to share ICP-PERP trading records in the article for further investigation. However, with the downfall of FTX and SBF in 2023, we may never get to see it again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。