Organization: Mint Ventures

Author: Lawrence Lee, Researcher at Mint Ventures

Introduction

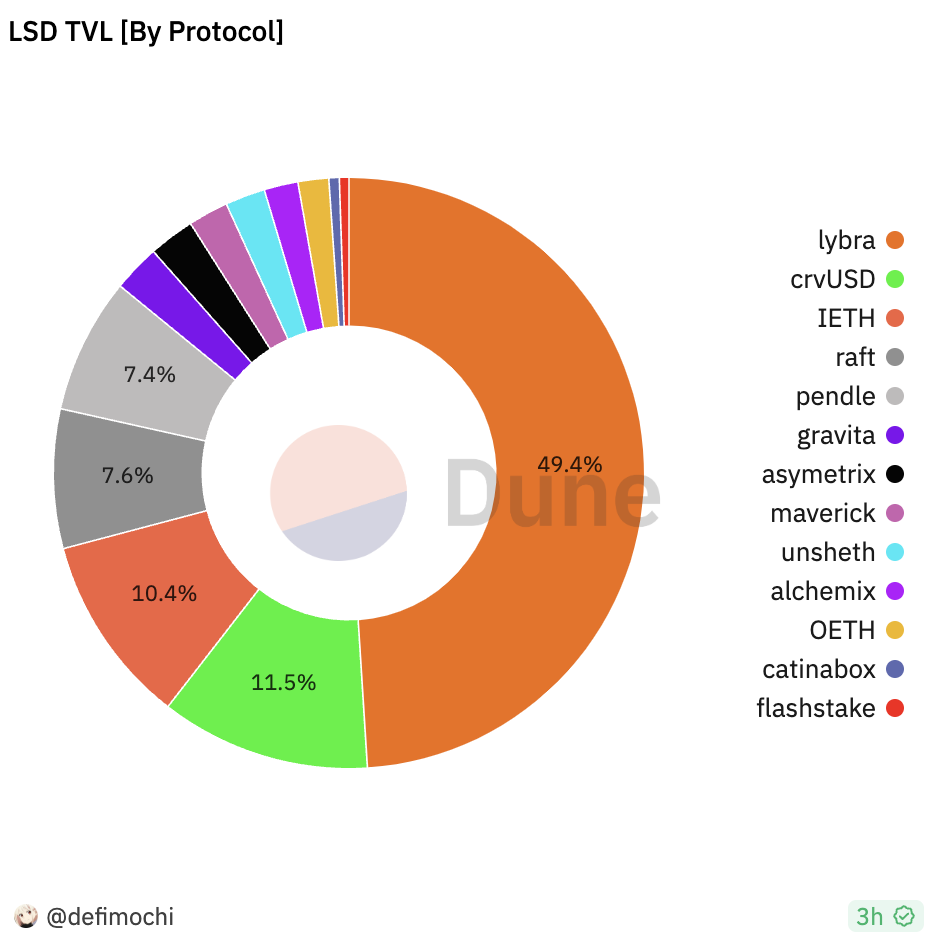

Lybra Finance is a new project of LSDFi that was born in April this year. Since its inception, it has been plagued by controversies, including issues with IDO funding sources and contracts, as well as implications on social media about its relationship with Lido. The lack of anchoring ability in its stablecoin design has also been widely criticized by DeFi players.

However, despite this, Lybra's TVL has occupied a dominant position in the so-called LSDFi summer.

Source: https://dune.com/defimochi/LSDFi-summer

Source: https://dune.com/defimochi/LSDFi-summer

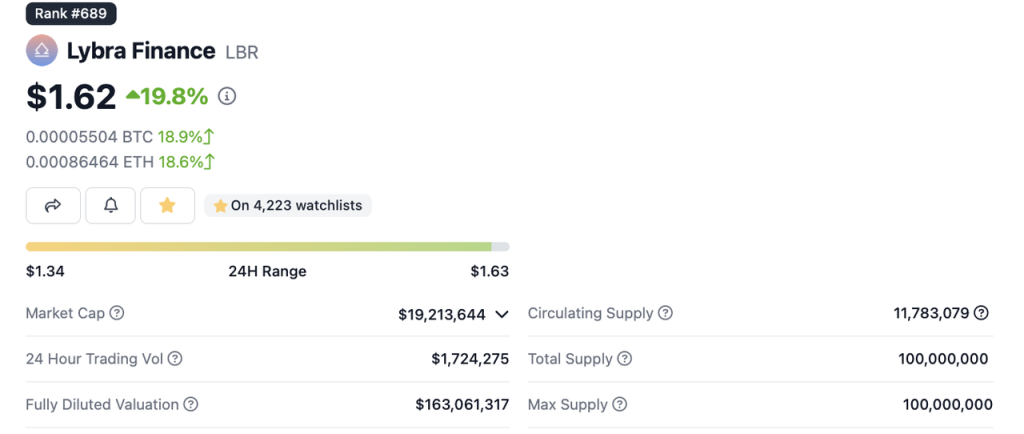

The price of its governance token LBR has also increased nearly 20 times in just over 20 days in May, with a current fully diluted market value of over $150 million.

Source: https://www.coingecko.com/en/coins/lybra-finance

Source: https://www.coingecko.com/en/coins/lybra-finance

In this article, we hope to answer the following questions by examining the mechanism of Lybra Finance:

- How did Lybra achieve the above results?

- What problems is Lybra currently facing?

- How will Lybra's V2 solve these problems?

In order for readers to have a more comprehensive understanding of Lybra Finance and its stablecoin eUSD.

The following content of the article represents the author's phased views at the time of publication, and may contain factual errors and biases, and is for discussion purposes only, not as investment advice, and we also look forward to corrections from other investment research peers.

1. Basic Information and Business Data

Lybra Finance is a stablecoin protocol, with its stablecoin being eUSD and its governance token being LBR.

Lybra Finance has a relatively short history. They launched the testnet on April 11 and the product officially launched on April 24, with just over 3 months of operation.

Lybra Finance is an anonymous team and has not conducted private fundraising. Its fundraising was only through a public IDO on April 20, 2023, when 5,000,000 LBR (5% of the total supply) was sold at a valuation of 1 ETH = 20000 LBR, with a valuation of 5000 ETH. Calculated at a price of ETH 2000U, Lybra Finance was valued at $10 million, raising a total of $500,000.

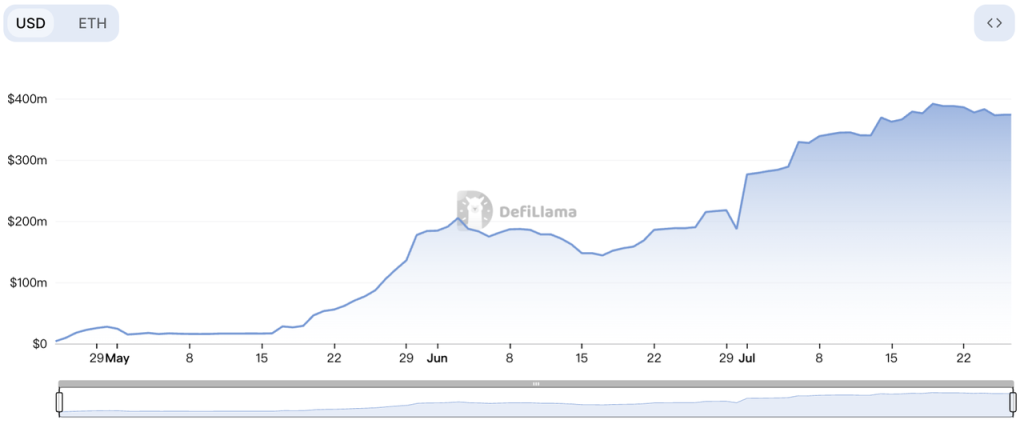

Since its launch, Lybra's TVL has grown rapidly, reaching $100 million in TVL in just one month, and currently the TVL is close to $400 million, making it the 18th ranked protocol in terms of TVL on the Ethereum network.

Source: https://defillama.com/protocol/lybra-finance

Source: https://defillama.com/protocol/lybra-finance

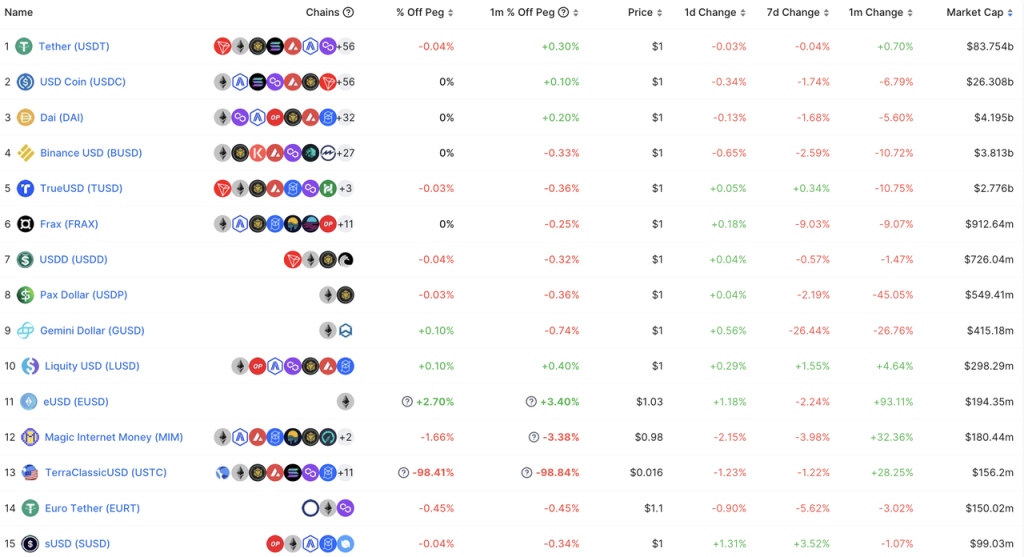

In terms of stablecoin issuance, the nearly 200 million circulating supply of eUSD ranks 11th among stablecoins. Especially within the category of decentralized stablecoins, the circulation of eUSD is only second to DAI, FRAX, and LUSD. Behind it are well-established decentralized stablecoins such as MIM and alUSD, making eUSD an undeniable new force in decentralized stablecoins.

Source: https://defillama.com/stablecoins

Source: https://defillama.com/stablecoins

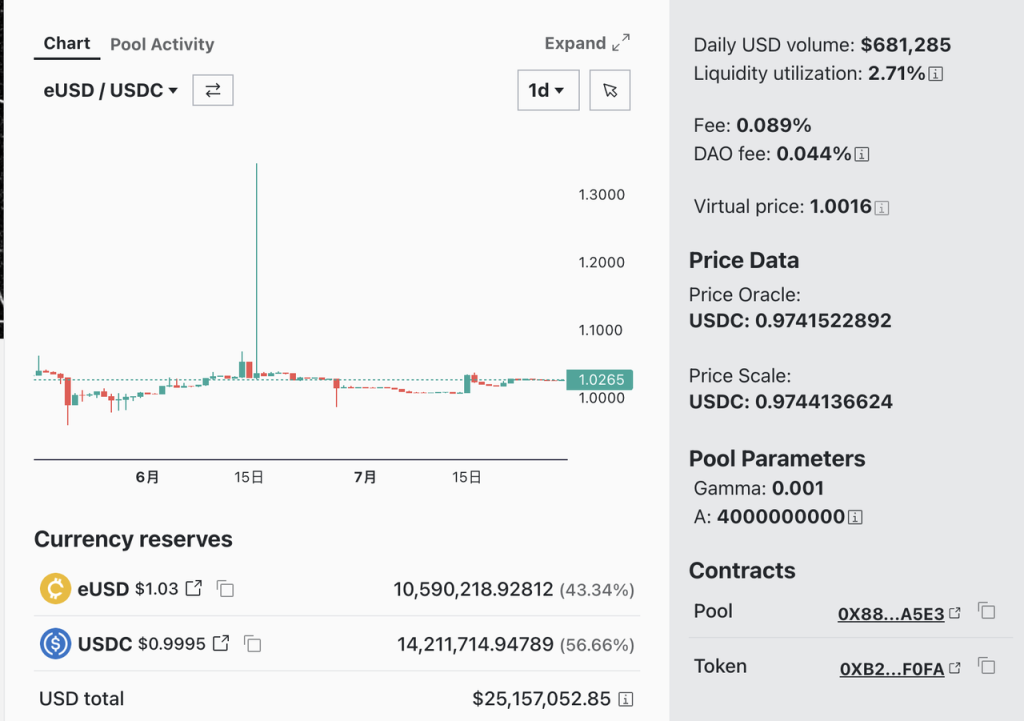

Currently, eUSD has a total liquidity of $25.5 million in Curve's liquidity pool. However, the price of eUSD is not stable and has been in a long-term premium state. On June 16, the price of eUSD briefly rose to $1.36 due to a whale buying $900,000 worth of eUSD. Although arbitrageurs quickly brought the price of eUSD back to $1, the issue of eUSD's premium is indeed a major problem at present, which we will detail in the following sections.

Source: https://curve.fi/#/ethereum/pools/factory-crypto-246/deposit

Source: https://curve.fi/#/ethereum/pools/factory-crypto-246/deposit

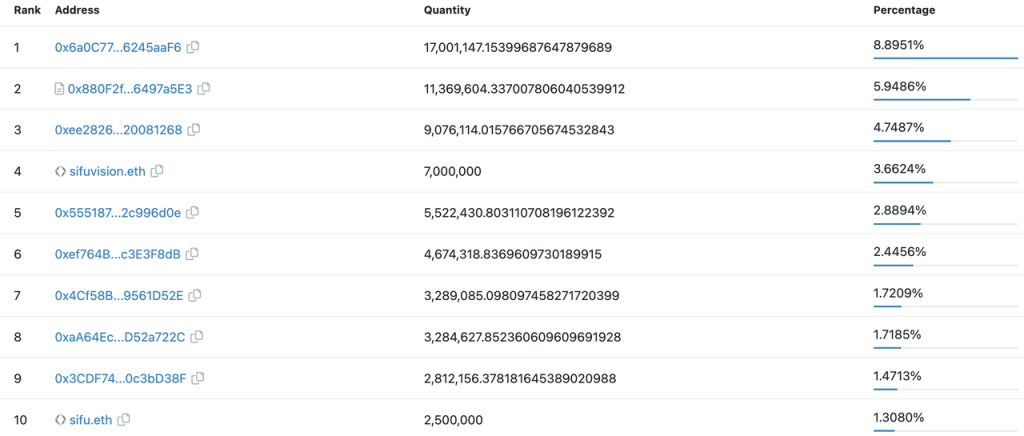

However, the number of eUSD holding addresses is still relatively small, with only 829 addresses. In addition to Curve's liquidity pool, the other top ten eUSD holding addresses are all individual addresses, and the overall holding addresses are relatively dispersed. The use cases of eUSD on-chain are also very rare, with the majority of holders holding it in their accounts for interest, which is also related to the poor composability of eUSD's current design (which will be detailed later).

Top ten eUSD holding addresses Source: etherscan

Top ten eUSD holding addresses Source: etherscan

2. Core Mechanism of Stablecoin

In the current V1 version, eUSD can only be generated through over-collateralization with stETH (Lybra also supports users to deposit ETH, but in actual business operations, Lybra will deposit users' ETH into Lido Finance to obtain stETH for subsequent business processes, and after repaying all debts, users can only withdraw stETH, so we believe that eUSD can only be generated through over-collateralization with stETH). Lybra requires a minimum collateralization ratio of 150%, meaning that for every 1 eUSD generated, there must be at least $1.5 worth of stETH as collateral.

In terms of eUSD's price stabilization mechanism, the main mechanism at play is the Rigid Redemption mechanism. The Rigid Redemption mechanism allows any user to use 1 eUSD to rigidly redeem $1 worth of stETH from the system at any time after paying a 0.5% fee (which can be changed by the Lybra DAO). Since the protocol itself is over-collateralized, as long as the protocol mechanism functions normally, over-collateralization + the Rigid Redemption mechanism can provide a lower limit of $0.995 for the price of eUSD. Stablecoin protocols that have used this design in the past (such as Liquity) have usually been able to effectively guarantee the lower limit of the stablecoin price, making it the most critical part of eUSD's current price stabilization mechanism.

As for the upper limit of the price, in the current V1 version, Lybra Finance lacks an effective mechanism to return eUSD in a premium state back to $1, which is a significant flaw in its current product design, as we will detail later.

The design of the liquidation module for stablecoins using over-collateralization is a key factor in the security of the protocol, and a robust liquidation mechanism is also needed as a supplement to the effective price stabilization mechanism.

In terms of liquidation, Lybra has introduced two roles: Liquidator and Keeper. The Liquidator provides liquidation funds (eUSD), and the Keeper triggers the liquidation operation, with each receiving 9% and 1% rewards, respectively. In order to better protect the collateral of the pledger, Lybra has adopted a mechanism of forced partial liquidation: the maximum percentage that can be liquidated for each liquidated person is 50%.

At the same time, when the overall over-collateralization ratio of the system is below 150%, all users with over-collateralization ratios below 125% can be fully liquidated in order to quickly increase the overall collateralization ratio of the system.

We can see that Lybra Finance mainly refers to the stablecoin protocol Liquity in terms of the core mechanism of stablecoins (minting, redemption, liquidation, price stabilization), but it is not a mechanical copy of Liquity. They have retained Liquity's redemption and recovery mode, removed the stability pool (thus eliminating some token incentives), and replaced it with liquidators providing liquidation funds.

Liquity's core mechanism has been verified for more than 2 years and has good stability. We can see from LSDFi's major stablecoin projects such as Lybra, Raft, Gravita, and Prisma that they have more or less drawn on Liquity. Based on Liquity, Lybra Finance has been operating relatively well for over 3 months since its launch. However, whether it can be maintained in the future remains to be seen.

3. Stablecoin Yield Mechanism

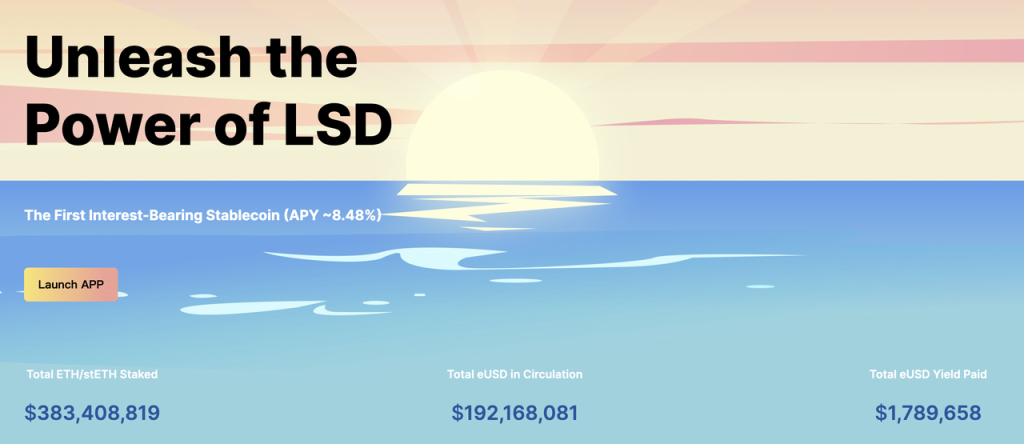

Simply holding the stablecoin eUSD can earn an APR of around 8%, which is an important selling point for Lybra Finance to attract users, and is also an innovation in stablecoin mechanisms that the author believes is rarely seen recently. We will now take a detailed look at eUSD's yield mechanism.

Source: Lybra Finance official website

Source: Lybra Finance official website

We know that the LSD stETH issued by Lido Finance aims to be pegged 1:1 with ETH, and the ETH that users pledge continues to generate income on the Ethereum consensus layer. This requires the mechanism of Rebase to be implemented. Lido will take a snapshot of all stETH holders and the amount held on the Ethereum mainnet every day and proportionally distribute the growth portion of stETH to all stETH holders. From a user experience perspective, the amount of stETH held by users will increase daily, and their income will also reflect the increase in stETH. Typically, users holding stETH can earn staking rewards from Lido. Most DeFi protocols that integrate stETH rebase also proportionally return the income generated by stETH rebase to users.

However, Lybra has taken a completely different approach. After users deposit stETH into Lybra, all rebase-generated stETH will not be distributed to stETH holders. Instead, the protocol will use the secondary market to exchange stETH for its stablecoin eUSD, and then proportionally distribute the income from this portion of eUSD to all current eUSD holders. In this process, Lybra will deduct an annualized 1.5% of eUSD as protocol income, distributed to the holders of $esLBR (escrowed LBR, obtained through locking LBR or mining).

Through this process, Lybra Finance achieves "asset income allocation based on liabilities." To better understand this process, consider the following example:

Assuming on Day 1, the current ETH price is 2000 eUSD, and the stETH APR is 5%:

- Adam deposits 10 stETH into Lybra and mints 7000 eUSD, with a collateral ratio (CR) of 285.7%;

- Bob deposits 10 stETH into Lybra and mints 10000 eUSD, with a CR of 200%;

- Charlie deposits 10 stETH into Lybra and mints 13000 eUSD, with a CR of 153.8% (just 3.8% away from the liquidation threshold of 150%);

- Adam, for the need to go long on ETH, sells his 7000 eUSD to David in exchange for David's ETH, so David holds 7000 eUSD;

- Eric also holds 10 stETH, but he has not deposited into Lybra.

The entire Lybra system has a total of 30 stETH, minting 30000 eUSD, with the overall system CR at 200%.

On Day 2, the 30 stETH generates 0.0041 stETH based on a 5% APR. Lybra will exchange this 0.0041 stETH for 8.219 eUSD and distribute it to Bob, Charlie, and David in proportion to their eUSD holdings:

- Adam, although he minted eUSD, does not currently hold eUSD, so he does not receive new eUSD. His APR on Day 1 is 0.

- Bob currently holds 10000 eUSD and receives 2.74 eUSD in proportion to his holdings, with an APR of 3.5% for holding 1 year, considering the annualized 1.5% Lybra deduction.

- Charlie currently holds 13000 eUSD and receives 3.56 eUSD in proportion to his holdings, with an APR of 6.5% for holding 1 year.

- David currently holds 7000 eUSD and receives 1.92 eUSD in proportion to his holdings, with an APR of 10% for holding 1 year (note that David's APR denominator is different from Bob and Charlie).

- Eric receives income from his stETH at a 5% rate.

From the above example, we can see that:

- Without considering the Lybra deduction, the APR for minting eUSD users is eUSD-based APR = stETH APR / personal CR * system CR. If we assume that the stETH APR and system CR are constant in the short term, the way to increase personal APR is to reduce personal CR. The lower the CR, the higher the income, but this also means a greater risk of liquidation due to price fluctuations. Currently, users minting eUSD can receive incentives in the form of esLBR, with an APR of around 20% (calculated based on the amount of eUSD minted), which is the main incentive for users to mint eUSD.

- The highest-earning user, David, did not participate in minting eUSD (in fact, David can also apply the income formula mentioned above, with a CR of 100%). The income David receives (stETH APR * system CR) is the highest possible income for holding eUSD, and it is also the income listed on the Lybra website for holding eUSD (currently at 8.54%). Unlike most stablecoin protocols, to receive this income, users need to mint as little eUSD as possible and hold more eUSD. For any user participating in minting eUSD, since their personal CR cannot be less than 150%, their theoretical income ceiling = stETH APR * system CR / 150%.

- Comparing Bob and Eric, if their personal CR is the same as the system CR, due to the Lybra deduction and potential liquidation risk, the strategy of minting eUSD and holding it is not as effective as simply holding stETH.

The benefits of Lybra's design are obvious: it provides a strong use case for their stablecoin eUSD—yield-generating stablecoin. Currently, the primary use case for decentralized stablecoins in the DeFi world is still as a "mining tool for earning rewards," rather than as a value scale and medium of exchange, and even MakerDAO, with its significant first-mover advantage and network effects, is offering a yield-generating stablecoin sDAI with a high APR of up to 8% in an attempt to reverse the declining TVL and stablecoin scale. The approximately 7.5% to 8% annualized yield provided by eUSD fulfills its role as a yield-generating tool quite well.

In fact, it is not uncommon for over-collateralized stablecoin protocols to find a way to generate income from the assets deposited by users and redistribute it. From the protocol's perspective, over-collateralization is mainly to ensure the overall security of the protocol, but having a large amount of high-quality collateral locked in the protocol is also a significant waste of resources. If the collateral can generate income in a safe and reasonable way, it is beneficial for users to earn additional income while obtaining stablecoins. At the same time, the protocol can deduct a portion of the "commission" as protocol income, which is relatively fair and reasonable.

For example, Alchemix Finance, supported by the "DeFi godfather" Andre Cronje, issued alUSD at the beginning of 2021, which has the so-called "self-repaying loan" feature. The core logic is to deposit the stablecoins users deposit into Yearn, and use the income generated by Yearn to repay the user's debt. Alchemix deducts 10% of the income as protocol income. Its subsequent alETH product logic is similar, relying on the yield from collateral to automatically repay the debt, while also meeting the demand of these yield-generating asset holders (DAI, wstETH) to release asset liquidity.

Another example is MakerDAO, which uses the USDC accumulated in the PSM (Peg Stability Module) to purchase various RWA (Real World Asset) products. The income from this part is used as protocol funds for MakerDAO, for protocol daily expenses, distribution to sDAI holders, and providing liquidity to MKR (equivalent to half of the funds being repurchased).

Lybra Finance's approach is different from Alchemix and MakerDAO. Lybra targets the yield-generating assets held by users and redistributes the interest generated by these assets. Critics may argue that all the income obtained by eUSD holders comes from the original income of stETH depositors, and depositing stETH into Lybra does not yield any additional income. Instead, depositors have to bear the 1.5% fee deducted by Lybra, resulting in a complete zero-sum game among all minters. Indeed, without considering other incentive factors, this is true. However, as we have seen in the current decentralized stablecoin market, the circulation of any stablecoin is essentially maintained by various yield mining opportunities, and the mined tokens ultimately come from the governance tokens of stablecoin projects themselves (of course, leading stablecoins like DAI may also be able to mine other tokens as rewards for promoting themselves). After adding protocol token incentives, the entire system can operate to a certain extent, as is the current situation with Lybra.

For stablecoin holders (users who simply hold stablecoins without minting and holding them), this design clearly allows them to receive income more "organically": the income is directly in the stablecoin itself, without any lock-up clauses or various complex tokens to deal with, and only requires holding eUSD daily for the income to be automatically credited.

Perhaps Lybra's idea is this: by providing stablecoin holders with a better yield-generating stablecoin, it first stimulates the demand side of stablecoins through mechanisms rather than incentives. Based on this, it combines early incentives for the supply side to stimulate stETH holders to mint and form a closed loop.

Of course, this design also brings a series of problems. For example, the rebase feature of eUSD makes it difficult to be integrated by other DeFi protocols and is not convenient for cross-chain use, significantly affecting the composability of eUSD.

And to some extent, Lybra puts all eUSD minters in a "prisoner's dilemma."

Since everyone's APR = stETH APR / personal CR * system CR, and stETH APR is an external input parameter that cannot be adjusted, the main focus for individuals to increase APR is to: 1) reduce personal CR, and 2) increase system CR.

In the example above, Charlie, with a 200% collateral ratio, achieved the average system income (i.e., without considering the Lybra deduction situation) and, since Lybra's liquidation CR is 150%, this means that Charlie needs to bear a stETH price drop risk of no more than 25% to receive stETH's basic income through Lybra. If the stETH price drop exceeds 25%, Charlie may potentially lose his stETH.

If the overall system CR is 300% at present, then for Charlie to receive the basic stETH income, he only needs to set his CR to 300%. This way, Charlie can bear a stETH price drop of 50%. Both of these methods can achieve the basic stETH income, but the latter can bear more risk, which is obviously better than the former.

On a macro level, if all minters can maintain a high CR, their yield rates can be consistent and they can bear more risk. However, on a micro level, each minter has the incentive to lower their CR to increase their yield. In this game, minters will collectively lower their CR, reducing the overall risk tolerance of all participants while keeping the total income unchanged.

However, compared to the above two issues, the problem of eUSD trading at a premium may be more serious in the short term. In the current design of Lybra V1, the daily stETH income generated by all collateral is used by the protocol to purchase eUSD in the secondary market and then distribute it to all eUSD holders, meaning there is a fixed amount of buy orders for eUSD every day. The forced redemption mechanism of eUSD mainly addresses the issue of eUSD deviating from its peg downwards. When deviating upwards, the protocol has no means to push the eUSD price back to 1, which keeps eUSD in a state of slight upward deviation in the long term. Although the degree of deviation is not very high, the risk-return ratio of purchasing a target investment project with a 3% premium for a target annualized return of 7.5% is not high, which also limits the development of eUSD from a mechanistic perspective.

eUSD historical price Source: Geckoterminal

4. Token Model

The governance token of Lybra Finance is LBR, with a total supply of 100 million. The distribution is as follows:

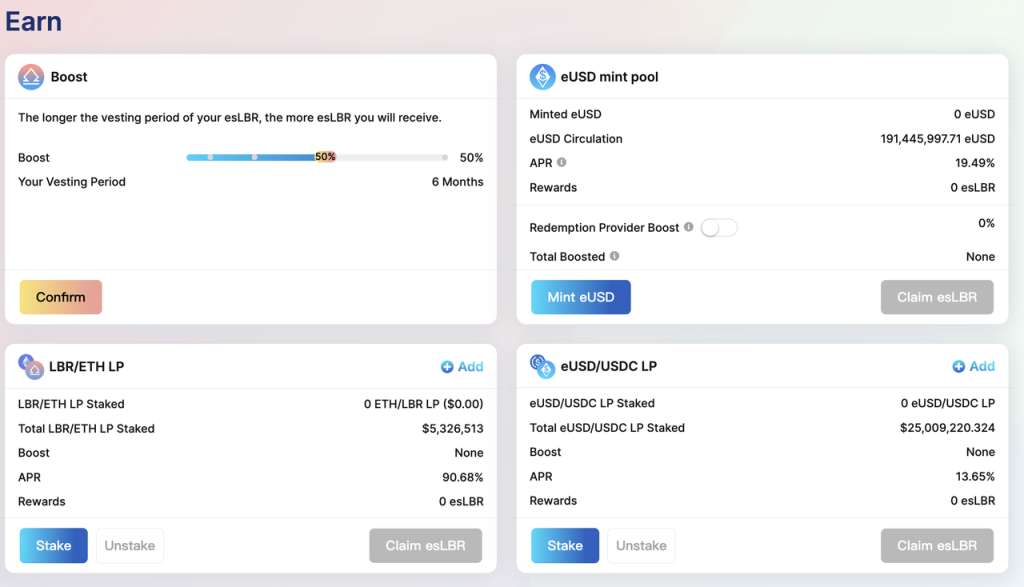

- 60% of the tokens are allocated to mining for incentives across the protocol. This includes incentives for minting eUSD, incentives for eUSD-USDC LP, and incentives for LBR-ETH LP.

LBR incentive allocation Source: https://lybra.finance/earn

- 8.5% of the tokens are allocated to the team, with this portion being released linearly over 2 years after a 6-month TGE.

- 5% of the tokens are allocated to advisors, with this portion being released linearly over 1 year after a 1-month TGE.

- 10% of the tokens are allocated as ecosystem incentives, with 2% unlocked at TGE and the remaining portion released linearly over two years.

- 10% of the tokens are allocated to the protocol treasury, released linearly over two years.

- 5% of the tokens are used for the IDO, raising a total of $500,000.

- 0.5% of the tokens are allocated to IDO whitelist rewards.

According to Coingecko data, the current circulating supply of LBR is 11.78% of the total supply, which is 11.78 million tokens.

Source: https://www.coingecko.com/en/coins/lybra-finance

The use case for LBR mainly revolves around esLBR (escrowed LBR). Rewards from protocol mining are also distributed in the form of esLBR.

esLBR cannot be traded or transferred, but it can share in protocol income (i.e., the 1.5% annualized eUSD scale deduction). Users can unlock esLBR to LBR through a 30-day linear release, or lock LBR to obtain esLBR for mining speed bonuses and sharing protocol income. In addition, esLBR also has governance participation functionality.

In V2, there are significant adjustments to the reward distribution module for Lybra, which will be detailed below.

5. Lybra V2

Lybra V2 is currently live on the testnet, and the documentation has been published. It is currently undergoing an audit by Halborn, with the expected launch date no earlier than the end of August.

Regarding the scope of V2, Lybra has a detailed comparison in a chart.

In summary, the changes in V2 include the following:

Firstly, Lybra V2 will issue a new stablecoin called peUSD, and will also support more Liquid Staking Tokens (LST).

Currently, there are two types of LST in the market. One type is rebase LST such as stETH and sETH issued by Stakewise, the characteristics of which have been previously explained. Lybra can support this type of LST well. The other type includes "value-accruing" LST such as rETH from Rocket Pool, cbETH from Coinbase, wBETH from Binance, swETH from Swell, and wstETH from Lido. The value of this type of LST increases relative to ETH exchange rates. For example, after a user holds rETH, the quantity of rETH does not change, but the amount of ETH that each rETH can be exchanged for continues to increase, making it a value-accruing LST. The entire yield mechanism of eUSD in Lybra currently only applies to rebase LST, and does not apply to value-accruing LST. To address this issue, Lybra is introducing a new stablecoin called peUSD (pegged eUSD), which can be minted directly by value-accruing LST. The main difference between peUSD and eUSD in terms of price stability, liquidation, and fees is that peUSD generated by value-accruing LST is not a yield-generating stablecoin, and holding peUSD does not automatically yield income (because the value accrued by the collateral still belongs to the user). Of course, peUSD can also be obtained by wrapping eUSD, and peUSD wrapped by eUSD can receive the income generated by eUSD rebase.

The introduction of peUSD can significantly improve the composability of Lybra: on one hand, Lybra can obtain a more stable value stablecoin, peUSD, which is beneficial for its multi-chain expansion and integration by other DeFi protocols; on the other hand, through the design of peUSD, Lybra can expand the protocol collateral to value-accruing LST that it could not support before, achieving full coverage of LST. In addition, the eUSD stored in peUSD according to Lybra's plan can also provide flash loan services to generate more income for eUSD holders. However, issuing two stablecoins in a stablecoin protocol is relatively rare, and it will raise the cognitive threshold for users. Although they are related, the mechanisms of peUSD and eUSD are quite different, which to some extent affects their overall expansion in the consumer market. If Lybra's composability is achieved through peUSD rather than eUSD, it may make the positioning of eUSD somewhat awkward: the only purpose for users to hold eUSD is to obtain a high yield of 7.5% for the stablecoin (other uses such as leverage need to be achieved through holding peUSD), and the source of this income ultimately comes from the incentives of the governance token LBR, which may make eUSD become a typical Ponzi scheme that is only maintained by incentives from the governance token.

Secondly, Lybra V2 has made significant adjustments to the acquisition of esLBR token rewards, introducing two bounty programs—Advanced Vesting Bounty and DLP Bounty. These adjustments are mainly based on the V2 version of the lending project Radiant, which was born on Arbitrum.

In V2, the unlock time for esLBR will be extended from 30 days to 90 days, but users are allowed to unlock early, albeit with a cost of 25%-95% based on the length of time remaining until complete unlocking, which will become the advanced unlocking bounty.

The DLP (Dynamic Liquidity Provisioning) bounty requires minters of eUSD to maintain at least 5% of their LBR/ETH liquidity supply to receive their esLBR rewards. If minters cannot maintain more than 5% of LBR/ETH liquidity, their esLBR will become DLP bounty.

The esLBR obtained from the advanced unlocking bounty and DLP bounty allows users to purchase LBR/eUSD at a discounted price, with all received LBR being burned by the protocol, and the received eUSD entering the stability fund (which will be detailed below).

Through the advanced unlocking bounty and DLP bounty, Lybra V2 attempts to more closely tie the acquisition of protocol incentives to the long-term development of the protocol. However, from another perspective, such high friction may also affect users' willingness to enter the Lybra ecosystem for mining.

Another series of important improvements in V2 focus on the price stability of eUSD. As analyzed earlier, the current mechanism for eUSD yield involves using the daily stETH income to purchase eUSD in the secondary market and distribute it to all eUSD holders, creating continuous buying pressure for eUSD. In V2, Lybra has added two methods to address the issue of eUSD trading at a premium:

Firstly, a premium suppression mechanism has been designed: when the eUSD/USDC exchange rate exceeds 1.005 (i.e., a premium of more than 0.5%), the protocol will change the daily stETH income to purchase USDC in the secondary market and distribute it to eUSD holders. This shifts the continuous buying pressure for eUSD to USDC, resolving the long-term root cause of eUSD trading at a premium.

Secondly, a stability fund has been established. The stability fund is accumulated by users using eUSD to purchase esLBR at a discount. The eUSD reserves in the stability fund can also be used to control the price of eUSD when it is trading at a high premium. Through the premium suppression mechanism and the eUSD reserves in the stability fund, the issue of eUSD trading at a premium should be effectively resolved. Combined with the rigid redemption mechanism providing a price floor for eUSD, this may achieve stable anchoring of the eUSD price.

Overall, Lybra V2 addresses the issues exposed during the operation of V1, such as poor composability of eUSD, inability to expand the product model to value-accruing LST, and difficulty in restoring the premium of eUSD. It is more targeted and attempts to more closely link the protocol incentives of the LBR token with the long-term development of the protocol.

Of course, these changes will significantly increase the complexity of the protocol, and having two sets of stablecoins with significant design differences may also affect the expansion on the user end. At the same time, the composability advantage of peUSD may also make the positioning of eUSD somewhat awkward.

Conclusion

In the concurrent LSDFi projects, Lybra has a relatively poor investment background (no institutional investment) and the lowest funding amount of $500,000, leading to continuous FUD about Lybra. However, in the current LSDFi project, Lybra has the highest TVL and token market value, and its business progress is the fastest. Not only has V1 been successfully launched and operational, but the V2 version has also entered the testing phase on the testnet. This reflects both the operational and business development capabilities of the Lybra team, as well as the strength of their product.

Compared to other LSDFi stablecoin protocols that make minor adjustments to existing stablecoin protocols, Lybra has truly brought new ideas to the distribution of LSD income. By providing users with a stablecoin with an APR of around 8%, they have created a relatively robust demand scenario, while applying appropriate token incentives on the supply side, allowing the protocol to develop rapidly. From the perspective of stablecoin holders, this type of APR is more sustainable than stablecoin APR relying on protocol token incentives, which also forms the cornerstone of Lybra's long-term development.

However, for a stablecoin with a current scale of 200 million and aspirations for further breakthroughs, the above is far from enough. Use case expansion is currently the top priority for all decentralized stablecoins, and compared to FRAX, LUSD, and even smaller-scale stablecoins like alUSD and MIM, the use case for eUSD is clearly much more limited. If, in the future, peUSD cannot establish more diverse use cases, then Lybra will still be a mining game—although Lybra's mining game design is more sophisticated, and in V2, the game is further complicated.

Nevertheless, Lybra Finance has become a cornerstone of the current LSDFi, and we look forward to its future development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。