BTC:

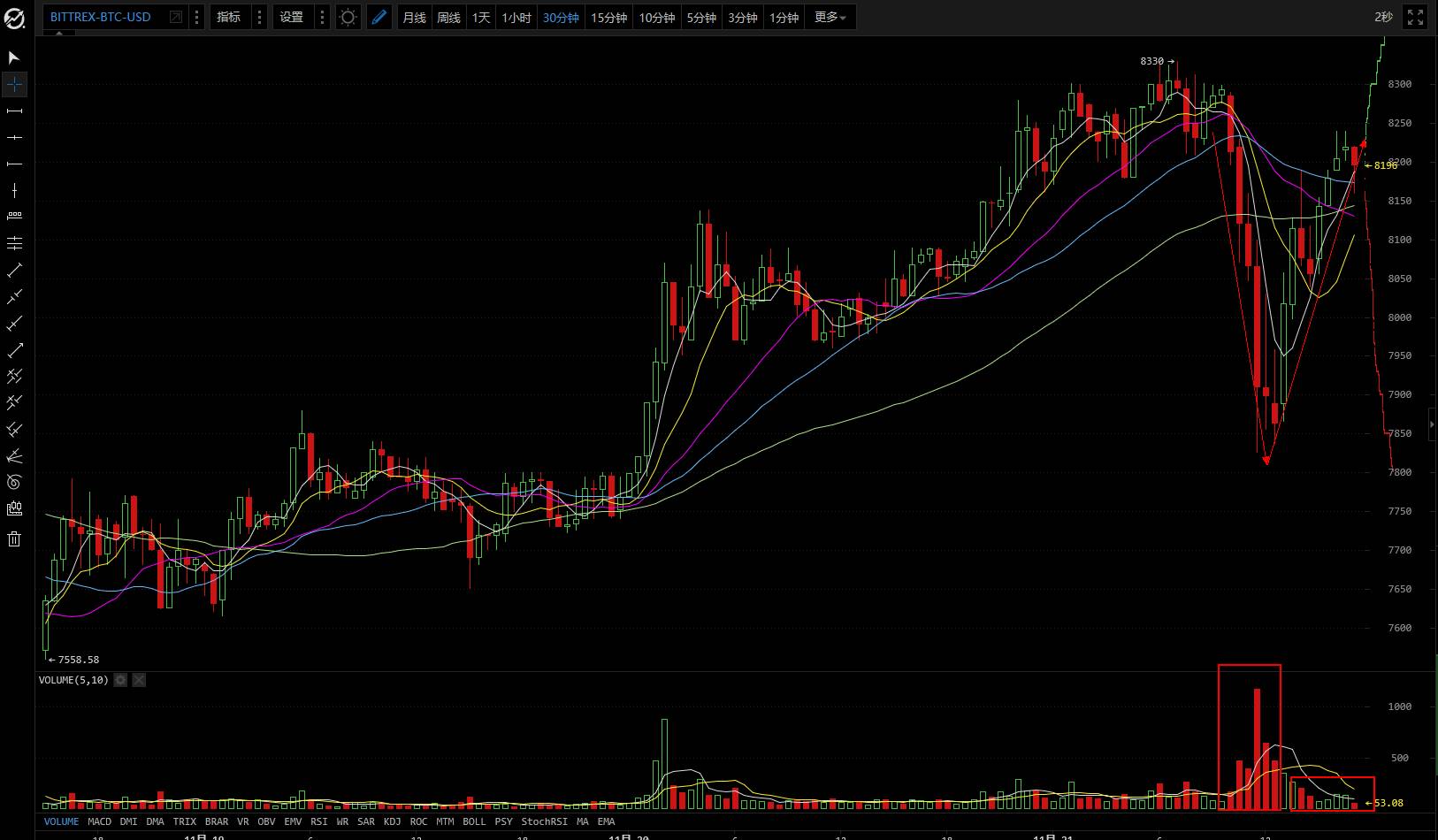

First, let’s look at the chart in 30-min intervals :

(Data fed from AICoin)

Obviously, we can see a fall in price with increasing volumes and a rally with decreasing volumes, indicating that pressure from those locked up is basically all released. The fact that volumes decreased during the rally shows that investors are reluctant to sell their positions after the release of their pressure. The “candy bonus” brought by BCD may be the reason why most investors choose to hold on to their positions for now.

(Data fed from AICoin)

As you can see, there’s been a continuous upside move with decreasing volumes since November 18. The weakening strength of this uptrend caused the dip in price today. The effectiveness of the support from 5-Day MA is fading out as price has been in an uptrend since November 18 and it has been above 5-Day MA for the past 4 days. Profit-taking should be strictly operated as long as price breaks below 5-Day MA, which should be strictly observed as “candy bonus” looming .

Judging from the momentum, price is very likely to form a lower shadow with increasing volumes, and we can be bullish about further moves.

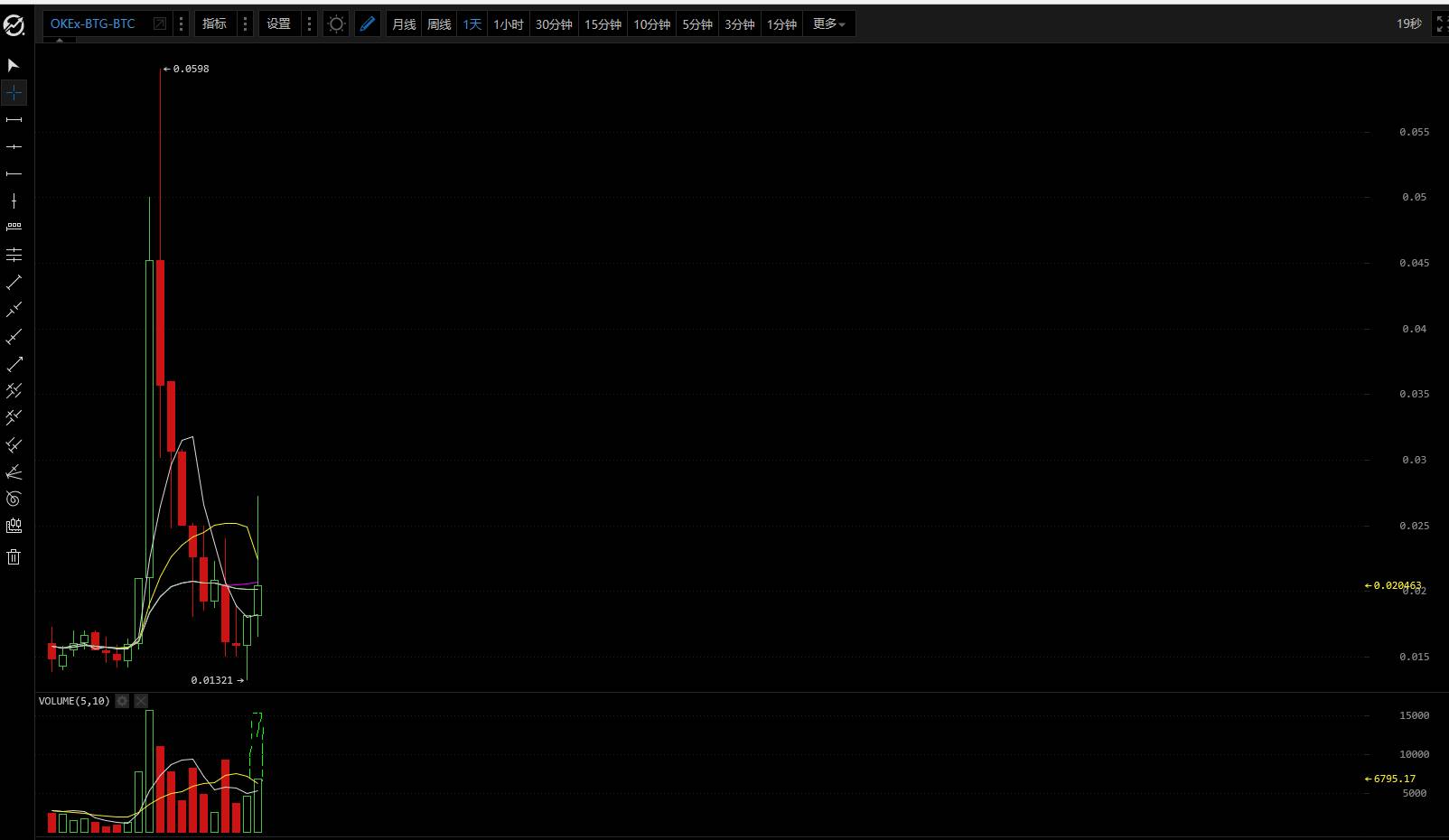

BTG & BT2:

The reason why I am negative about BTG and BT2 is because the lack of support from mining pools, exchanges and investors. It’s even difficult for them to survive, not to speak of brilliant performances. However, each of them experienced a surge today with a relatively large range as BTC dipped.

BTG:

BT2:

BT2:

ETH:

ETH remains above 5-Day MA, and shares the same uptrend with increasing volumes and lower shadow as BTC price. We’re still bullish about the short-term outlook.

LTC:

Like ETH, LTC also moves in an uptrend with increasing volumes and forms a lower shadow. Price will break below 5-Day MA and may continue the “disgusting” pattern if LTC can’t be pushed up at night.

ETC:

Even though ETC price dipped after a major bearish breakout, the momentum lost during the dip was far less than that of LTC and ETH, indicating that ETC is under a better control. Retailor investors may be “whipsawed” because of a continuous uptrend, but we remain bullish about the outlook in the medium and long term.

BCH:

BCH price has been steady in the past 4 sessions, both highest and lowest prices are within a range, indicating that main funds are still in control of the price. However, it’s less likely for price to be pushed up again as positions locked up above are too many. We can wait and see how long the move will last under the control of main funds, you may also make a fortune out of short-term trading according to the spread between the highest and lowest prices in the past 4 sessions.

Original by Kuang Ren, translated and posted by AICoin Jami.

Disclaimer: The information contained herein is not guaranteed, and is strictly for information purposes only. It does not constitute any trading proposal and will not be liable for any loss based on the information herein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。