原文标题:《回望羊驼:当利空成为短暂的财富密码》

原文来源:深潮 TechFlow

这几天,即将下架 Binance 的「羊驼币」$ALPACA 活跃在市场舞台中央,以 3000 万美元的流通市值搅动上百亿美元的总交易量。4 月 24 日,Binance 宣布将于 5 月 2 日下架包括 Alpaca Finance($ALPACA)在内的四种代币。

「下架 Binance」的消息对项目而言,通常是巨大的利空——下架意味着流动性减少、交易量萎缩,代币价格往往应声下跌甚至一蹶不振。

但下架消息释出后,$ALPACA 短时间内产生 30% 左右跌幅(以 Binance 交易平台现货为计)后,在三天内价格迅速暴涨近 12 倍,从 0.029 美元飙升至最高 0.3477 美元。与此同时,$ALPACA 未平仓合约(OI)高远超其代币市值数倍,围绕着 $ALPACA 的多空博弈「绞肉机」行情开始了。

费率结算加速,多空博弈更甚

随后Binance调整了资金费率规则,将封顶费率周期缩短至每小时结算一次(最高 2%),进一步加剧了多空博弈的激烈程度。多头不仅通过拉盘获利,还能持续「吃」高额资金费率,多头在数天内「又吃又拿」,$ALPACA 价格在持续在高位博弈接近四天。

每小时结算一次 -2% 的费率,那么在 1 倍杠杆的前提下,做空者持仓一天空单就会至少损失 48% 的本金。而即便是扛着如此高的费率,还是有资金前赴后继选择做空。

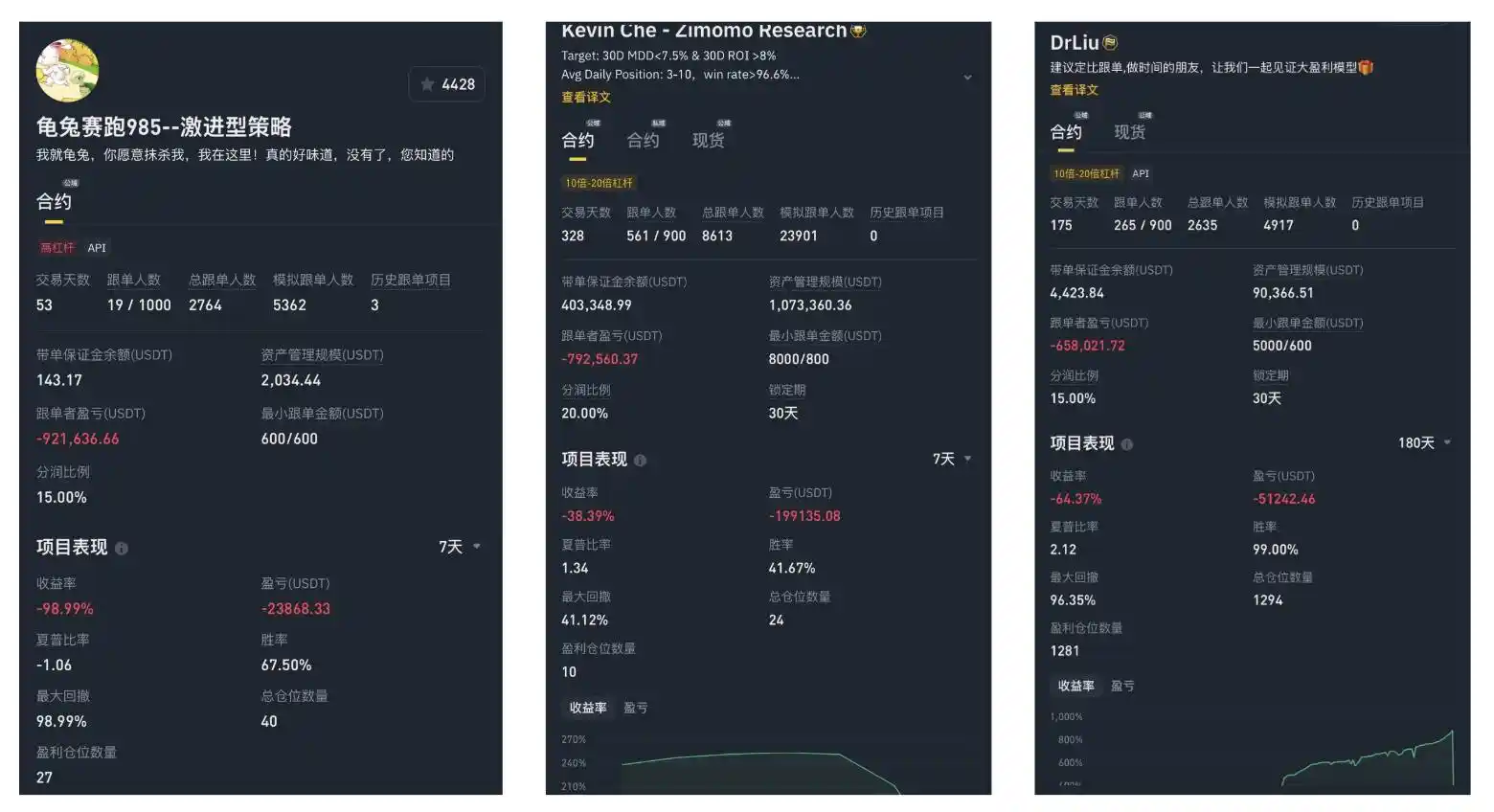

在激烈博弈下,有人发现一些有着百万美金体量跟单的带单员一直在高杠杆做空 $ALPACA,最后带着跟单用户的数百万美元资金一起爆仓。

4 月 29 日,Binance将 $ALPACA 合约费率上限提高至 ±4%。对空头而言,费率上限再次提高会让做空成本成倍增加,但本该劝退空头的规则一出,$ALPACA 币价却又「反常识」般地一泻千里,价格从 0.27 美元一路跌至 0.067 美元附近。

没有绝对的交易法则

随着交易量与注意力逐渐转移,$ALPACA 的故事也许就此告一段落。

回顾这场千亿量级的闹剧,这几天的 $ALPACA 从某些方面而言何尝不是一种 Meme——由下架利空带来大量的注意力,让「黑红也是红」这一原则在价格波动上倍发挥到极致。同时,在同级别环境(一线交易平台)内相对较低的流通市值(低点仅不到 400 万美元)、高度控盘的筹码加之不断刺激玩家神经的宽幅价格波动,甚至连「羊驼」这个形象都与 Meme 挂得上钩。

只是形象虽可爱,但对于真正参与其中博弈的用户而言,这几天也许只能用「血腥」来形容。出现利空疯狂拉盘,出现「爆空」消息反而流畅下跌,$ALPACA 这几天的复杂的走势颠覆往常的「sell the news」(卖利空)逻辑,也颠覆了许多人的仓位。

显然,「利好」与「利空」的界限已经逐渐模糊,之前单一的判断逻辑已经逐渐不适用于不断进化的市场。取而代之的是玩弄人性的暴力操盘大行其道,不断刷新的爆仓数据逐渐占据市场中心。用「野蛮生长」来形容这种进化方向也许再合适不过。

不过事物兼具两面性,有人觉得迷茫,就有人感到兴奋。此番闹剧并非对所有人来说都是一件坏事。对于许多追求价格波动刺激、能力超群的参与者来说,羊驼如此走法甚至是久违赚大钱的机会。

也有声音表示,带单员用跟单用户的钱不计成本做空的背后是一场对散户资金的围猎,正如电影名片所言:「豪绅的钱如数奉还,百姓的钱三七分成」。言论真假一时之间无从判断,不过可以确定的是,即便真实情况并非如此黑暗,这场操纵中最后的赢家也不会是普通用户。

在相应监管措施尚未完善的前提下,$ALPACA 也许不会是这个市场中最后一次疯狂的操纵。截至撰稿完毕,$ALPACA 的价格仍在剧烈波动,也许在正式下架之前,还会有更多精彩的「表演」。

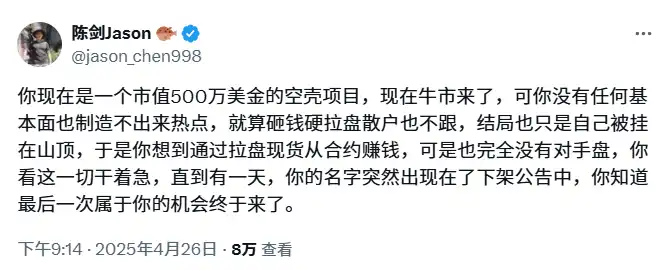

只是在风雨飘摇的价格博弈中,难有懵懂参与者的自留地。在注意力与流动性的围猎下,也许少看多动是散户最正 EV 的打法。看到大新闻与一反常态的价格走势,觉得「机会来了」的,不只是散户,还有饥渴已久的项目方。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。