Geoffrey Kendrick, head of digital assets research at Standard Chartered, is doubling down on his prediction of a $200,000 bitcoin ( BTC) price by the end of 2025. Kendrick and his team published their forecasts in a research report circulated to clients on Monday.

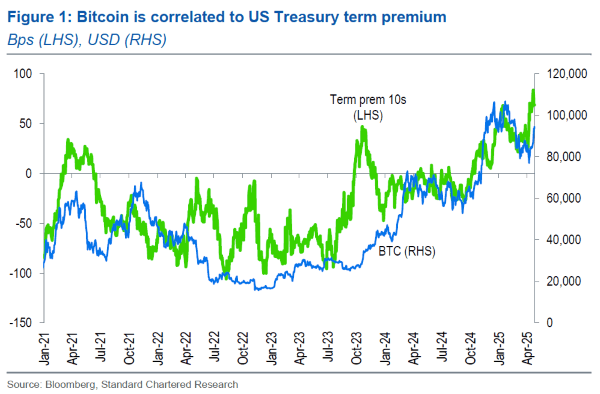

Kendrick says investors are squirreling away money into non-U.S. assets such as bitcoin because of President Donald Trump’s unprecedented tariff policies. The report points to the fact that the U.S. treasury term premium is at a 12-year high, evidence that investors currently see treasuries as riskier investments and are either ditching them or demanding juicier premiums.

(The U.S. treasury premium is correlated to the bitcoin price and is currently at a 12-year high / Standard Chartered)

The report also provides other factors that Kendrick and his team believe will buoy the cryptocurrency’s price: wealthy investors who hold 1,000 BTC or more, colloquially dubbed “whales,” are continuing to accumulate more bitcoin, and gold exchange-traded funds (ETFs) are losing ground to bitcoin ETFs. All of these factors combined, will see the cryptocurrency soar to an all-time high of roughly $120K in the second quarter of 2025, ultimately topping $200K by the end of the year, according to the report.

“We expect these supportive factors to push BTC to a fresh all-time high around USD 120,000 in Q2,” the report says. “We see gains continuing through the summer, taking BTC-USD towards our year-end forecast of 200,000.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。