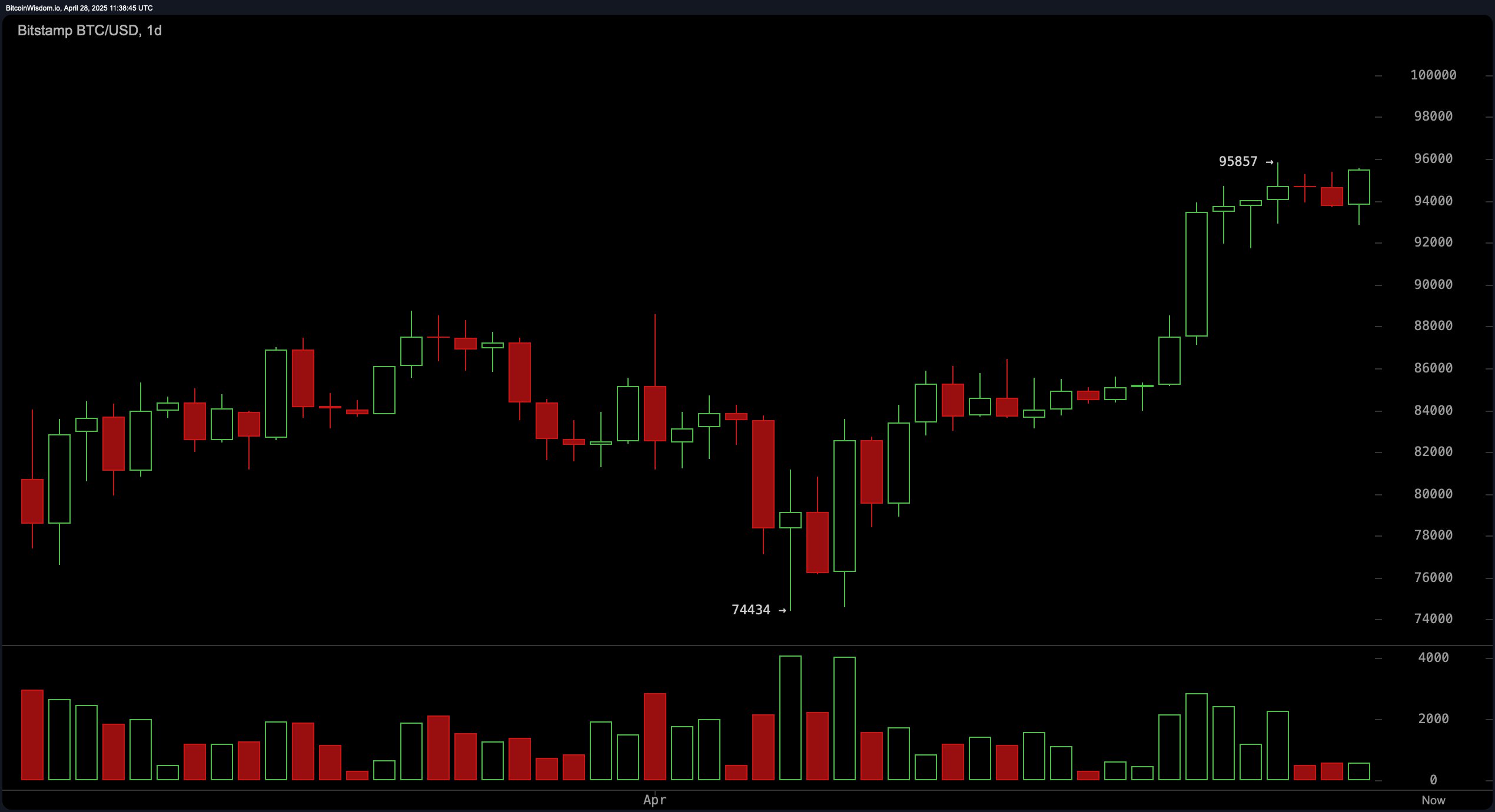

比特币在日线图上展现出稳定的看涨结构,btc/usd从$74,434的显著低点上涨至最近接近$95,857的高点。成交量分析确认了在上涨过程中真实的买入压力,尽管最近的交易时段成交量略有减少。蜡烛图结构反映出在高点出现小红蜡烛,暗示可能的暂停或整合阶段。日线支撑位设定在$84,000到$86,000之间,而阻力位则稳固在$95,000到$96,000之间。建议交易者关注回调至$88,000–$90,000的机会,以便在更广泛的看涨趋势保持不变时进行战略性入场。

2025年4月28日Bitstamp上的BTC/USD 1D图。

在4小时图上,比特币从$83,974强劲上涨至$95,857,随后进入横盘整合阶段。随着价格横向移动,成交量逐渐减少,表明可能正在形成分发阶段。高点之后开始形成微妙的低高点,暗示动能减弱,但尚未确认完全的趋势反转。若价格突破$96,000并伴随成交量支持,可能会启动继续上涨的行情,而回调至$93,000可能提供有利的重新入场点。然而,若跌破$92,000,可能会触发更深的修正。

2025年4月28日Bitstamp上的BTC/USD 4H图。

在1小时图上,短期动态显示比特币从$92,846反弹至$95,477,形成的高低点表明在更广泛的横盘区间内存在迷你上升趋势。绿色成交量的激增增强了近期反弹的合法性,为看涨交易者提供了信心。若突破$95,500,价格可能会重新测试$95,857到$96,000之间的高点。下行方面,若在此水平附近遭遇拒绝,可能会导致快速获利了结,建议将止损设置在$94,300以下,以防止虚假突破。

2025年4月28日Bitstamp上的BTC/USD 1H图。

从振荡器的角度来看,主要指标出现了混合信号。相对强弱指数(RSI)为69,保持中性,随机指标(Stochastic)为90,平均方向指数(ADX)为28,同样保持中性,而商品通道指数(CCI)为108则发出了卖出信号。与此同时,动量振荡器在10,921处反映出买入情绪,移动平均收敛发散(MACD)水平在2,963处支持看涨定位。这些读数提示谨慎,但强调了如果成交量增加,可能会重新出现看涨动能的潜力。

移动平均线(MAs)继续支持比特币的看涨论点。所有关键平均线,包括10、20、30、50、100和200周期的指数移动平均线(EMA)和简单移动平均线(SMA),均发出看涨信号。值得注意的是,10期的指数移动平均线(10)和简单移动平均线(10)分别位于$92,059和$91,753,远低于当前价格,进一步强化了强烈的看涨偏见。只要比特币维持在其主要移动平均线之上,整体趋势仍然向上,但交易者在关键阻力区域附近应保持警惕。

看涨判决:

如果比特币果断突破$96,500的阻力位并伴随强劲的成交量确认,看涨动能可能会加速,目标指向$98,000到$100,000的区间。所有主要移动平均线的坚实支撑以及关键动量指标的积极信号有利于上涨趋势的延续。

看跌判决:

如果比特币未能突破$96,000的阻力位并跌破$92,000的支撑水平,深度回调的概率将显著增加,可能将价格拖至$88,000甚至$84,000区域。振荡器的中性状态和高点附近的疲软迹象表明短期内应保持谨慎。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。