撰文:岳小鱼

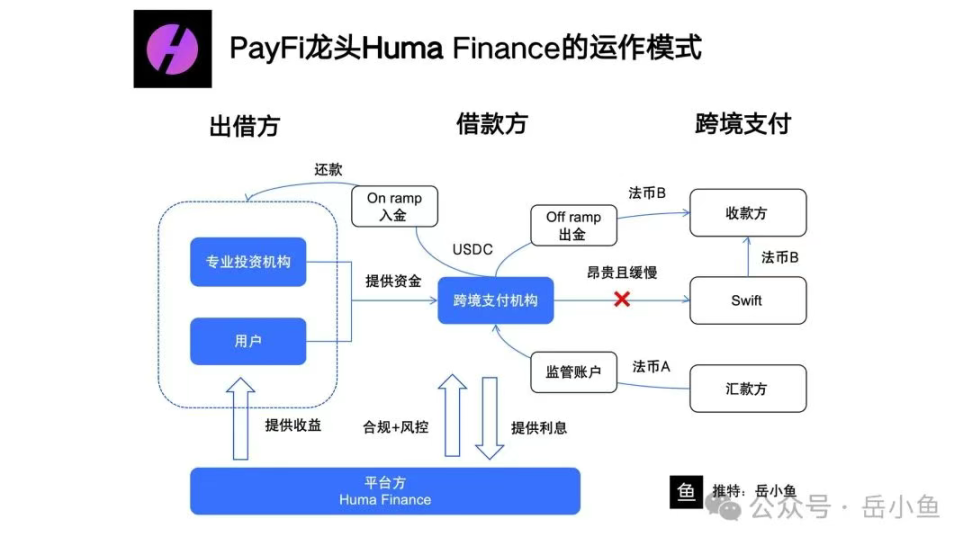

我们可以直接看下 Huma 平台的整体业务流程,有一个整体感知:

1、用户出借资金:

(1)普通用户(链上出借方)通过 Huma 的去中心化平台存入稳定币(USDC)

(2)无需 KYC,通过智能合约锁定资金,获得固定收益

(3)资金进入 Huma 的借贷池,供借款方使用。

2、跨境支付机构提出借款需求:

(1)合规的跨境支付机构(如持有金融牌照的支付服务商)在 Huma 平台注册,提交借款申请;

(2)借款用途:为汇款方(客户)提供快速跨境支付服务。

(3)借款金额:通常为短期垫资(3-5 天),金额与汇款规模匹配。

3、抵押物托管:

(1)支付机构需提供等值法币抵押物,即汇款方支付的法币 A(如欧元);

(2)将法币托管至 Huma 指定的监管账户(由 Huma 并购的持牌机构 Arf 管理)。

4、借入 USDC 并执行支付:

(1)Huma 通过智能合约向支付机构发放 USDC 贷款;

(2)支付机构使用 USDC 作为中介货币,通过区块链(Solana)将资金转移至国家 B。

(3)在国家 B,支付机构通过本地合作伙伴(交易所或 OTC 服务商)将 USDC 兑换为法币 B(如美元),并支付给收款方。

5、偿还借款:

(1)支付机构在 3-5 天内(账期)使用托管的法币 A(抵押物)或汇款方的后续资金,兑换为 USDC,偿还 Huma 的借款本金和利息。

(2)Huma 将本金和收益返还给出借方,扣除平台费用(息差,即借款利率与出借收益的差额)。

6、收益分配:

(1)出借方获得稳定收益(假设 10% 年化)。

(2)Huma 赚取息差(如借款利率 15% - 出借收益 10% = 5%)。

(3)支付机构通过快速支付服务赚取客户手续费(低于 Swift 的 1%-3%),并覆盖借款利息成本。

整个业务流程中各方的角色与定位:

我们可以看到,Huma 构建了一个借贷平台,普通用户作为出借方,提供资金来源,而跨境支付机构作为借款方,借入资金;

在跨境支付场景中,汇款方支付了国家 A 的法币 A,如果走传统的 Swift 结算体系,需要 3-6 个工作日,且非常高额的手续费,会涉及汇率差和货币转换费,通常是 1%-3%。

那么跨境支付机构收到汇款方的支付款项后不直接走 Swift,而是将 USDC 这种稳定币作为中介货币,在 Huma 平台借入稳定币,然后直接在目标国 B,将 USDC 出金为本地货币 B,这个支付流程即可在当日完成。

在整个过程中,Huma 通过 USDC 的形式为跨境支付机构提供了跨境汇款结算中的短期垫资,跨境支付机构则需要经过一次出金和一次入金。

Huma 的借款端是合规的跨境支付机构,需提供等值法币抵押物(如汇款方的本地货币),并将资金托管至监管账户,确保风险可控。

出借端通过链上智能合约参与,无需 KYC,直接存入稳定币。

平台方则是要把控借款端企业的资质、借款申请等,然后赚取息差(借款利率高于出借收益)。

这里重点提一下 Huma Finance 并购的公司 Arf:

Arf 是一家注册在瑞士的金融机构,可以为全球范围内的持牌支付机构提供基于稳定币的结算服务。

所以 Huma 并购 Arf 之后,就直接解决了牌照和合规问题,使用这一主体开展业务。

要知道,做金融业务最麻烦的同时也是最大的门槛就是合规。

Huma 很巧妙地通过并购一家有牌照的机构直接就解决了合规问题,同时建立了自己的竞争壁垒。

总结一下:

Huma 整个运作流程和商业模式还是比较清晰的,但是,链下部分毕竟是黑盒,依旧有很多操作空间。

那么,Huma 获取社区信任的核心是未来可以将这部分信息上链,或者直接披露借款人的部分信息,确保资金的全流程可控。

还需要关注的是,Huma 其实要做的不只是跨境支付垫资,这个业务只是一个很重要的切入点,未来还会扩展到更多业务:

跨境支付是 4 万亿的市场,而信用卡是 16 万亿的市场,以及还可以扩展到更广阔的 Trade Finance(贸易融资)。

总的来说,Huma 正在构建一个 PayFi 平台和 PayFi 生态,这项目可以说是实用型项目和叙事型项目的结合体,值得长期关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。