撰文:KarenZ,Foresight News

在 DeFi 的演进历程中,大多数稳定币设计长期受制于内生收益模式的枷锁。主流稳定币的收益高度依赖协议内部的经济循环 —— 无论是代币激励排放形成的「飞轮效应」,还是用户交易费用构成的价值闭环,本质上都如同「衔尾蛇」(Ouroboros)般自我消耗,难以突破协议边界实现规模化增长,更无法抵御市场周期的系统性风险。

与这种封闭循环相对的,是外生收益的探索。外生收益源自协议外部的经济活动,如套利、MEV、RWA 等。这些收益此前仅由金融机构和高净值玩家垄断,而 CAP 正以「可信金融担保的稳定币引擎」定位,通过引入外生收益源与风险转移机制,打破这一困局。本文将从 CAP 的定位、核心机制、收益逻辑及行业影响展开介绍。

CAP 是什么?

CAP(Covered Agent Protocol)是一个将稳定币收益来源从协议内部转向外部市场的创新协议,其核心目标是通过代理机制与共享安全网络,将机构级的外生收益(如 MEV、套利、RWA)转化为普通用户可获取的稳健收益。

区别于传统稳定币依赖代币激励或单一抵押品的模式,CAP 通过智能合约实现资本的自动化分配与风险管控,构建「收益生成 - 风险隔离 - 价值分配」的完整闭环。

融资方面,2024 年 10 月份,CAP Labs 完成 190 万美元 Pre-Seed 轮融资,Kraken Ventures、Robot Ventures、ANAGRAM、ABCDE Labs、SCB Limited 以及 Synthetix 创始人 Kain Warwick 等天使投资人参投。2025 年 4 月初,CAP 再获 1100 万美元融资,Franklin Templeton 与 Triton Capital 等传统资管巨头参投,标志着传统金融对其模式的认可。

团队背景方面,CAP 创始人 Benjamin 是稳定币协议 QiDao 核心团队成员。CAP 创始成员和 CTO Weso 也是 DeFi 优化协议 Beefy 的顾问和贡献者。另外,Cap 已入选 MegaETH 旗舰加速器计划「Mega Mafia」,不过将在以太坊上推出核心协议。

CAP 的核心机制:三元角色

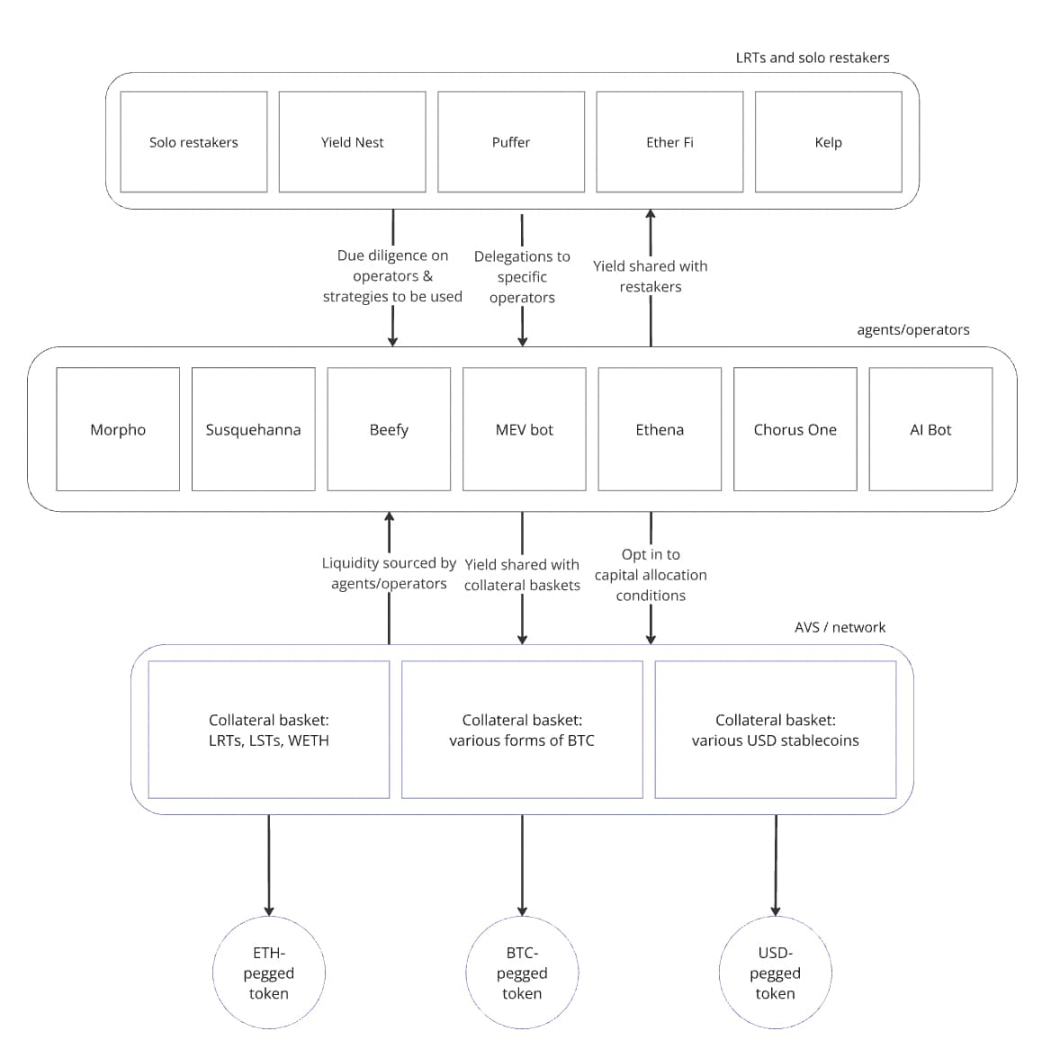

CAP 通过智能合约实现自执行的资本分配和安全保障,依托代理层和共享安全模型,将收益生成风险转移到再质押者,保护稳定币用户免受策略失败的影响。

在 CAP 中主要有 Operators、再质押者、稳定币存款人三个系统主要参与角色。

来源:CAP

稳定币存款人:低风险收益的获得者

用户存入 USDT/USDC 等主流稳定币铸造 cUSD,可获得基准贷款利率收益。CAP 官方称,「cUSD 始终可以 1:1 赎回。」cUSD 也可直接用于 DeFi 生态场景,或在 CAP 平台内进一步质押以赚取收益。

稳定币存款人无需承担代币价格波动或策略风险,即可获取由专业代理创造的外生收益,摆脱传统 DeFi「高风险挖矿」的困境。

Operators:外生收益的捕获者

Operators 是负责产生收益的代理层,这些代理包括市场做市商、银行、高频交易公司、私募股权机构、MEV 参与者、RWA 协议以及其他 DeFi 协议等,用以捕获加密原生和现实世界资产的外生收益。CAP 的收益生成不依赖于单一策略,而是通过代理的多样化策略动态适应市场变化。

初期 CAP 对 Operators 采用白名单机制,未来将逐步过渡到无需许可模式。每个 Operator 需先从再质押者处获得「经济安全背书」(即再质押者委托资产为其担保),从 CAP 池中借入相应的稳定币执行收益策略。抵押要求类似加密借贷市场(如超额抵押)。Operator 在支付稳定币用户的基准收益与质押者的分成后,保留剩余收益作为激励。

再质押者:经济风险担保者

再质押者将资产委托给特定 Operators,为 Operators 担保的同时为稳定币存款人提供经济安全。再质押者可赚取 Operators 收益分成,同时也需要承担策略失败的风险。

利率、收益如何确定?

Cap Labs 创始人 Benjamin 表示,代理支付给稳定币用户的基准利率是通过程序化确定的,是主要借贷市场的存款利率加上 Cap 的附加利用率溢价之和。该利用率溢价按借入资本的百分比计算,表明在特定市场条件下资本配置的竞争力。代理可以根据基准利率自选择进入或退出。

代理在支付给稳定币用户和再质押者利率之后,剩余收益由代理保留。这将在很大程度上激励代理制定更好的收益策略。

不过,如若代理的收益策略遭到损失,或执行恶意操作,导致借入资金发生损失,则再质押者的部分 ETH 将被罚没,用于填补 CAP 池的损失,确保 cUSD 持有者不蒙受损失。

在规则上,考虑到再质押者承担全部经济风险,因此 CAP 给予了再质押者比较大的权利和选择权。比如,再质押者可以对哪些第三方可以加入协议并产生收益拥有最终决定权;再质押者的收益率(也称保费 Premium)由再质押者和 Operator 协商确定。另外,保费将以 ETH 和 USD 等蓝筹资产支付,而非通胀型治理代币或链下积分计划。

交互策略

目前 CAP 支持在 MegaETH 测试网铸造 cUSD。用户一次可以铸造 1000 个 testnet-cUSD。CAP 已发布以太坊主网用 USDC 铸造 cUSD 的页面,但尚不可交互。

小结

CAP 的出现标志着稳定币从「内生循环」向「外生价值捕获」的跃迁。CAP 通过外生收益和共享安全模型,不仅提升了 DeFi 的收益可持续性,还通过风险隔离增强了用户保护。随着 RWA 和机构参与者的接入,CAP 或将成为连接传统金融与 DeFi 的关键基础设施。

需要注意的是,CAP 的运行高度依赖智能合约的可靠性,因此智能合约风险是其核心潜在挑战。根据官方披露,协议当前正由 Zellic、Trail of Bits 等安全机构进行审计,Pre-Mainnet 版本已通过 Electisec 审计。此外,由于 CAP 建立在 EigenLayer 等共享安全网络之上,因此也需持续关注相关生态的风险传导可能。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。