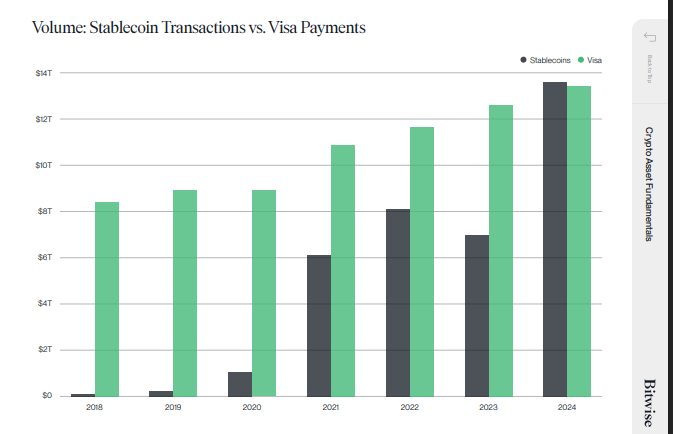

Stablecoins are experiencing exponential growth, rapidly becoming one of the most significant financial innovations of the last two decades, some experts have asserted. The experts’ sentiments are supported by a recent Bitwise report that showed stablecoin transaction volumes just surpassing that of the U.S. multinational payment card services corporation Visa in 2024.

One of the primary drivers of stablecoin use is their unparalleled efficiency for settlements. Stablecoins enable near-instantaneous money transfers, available around the clock, at a significantly lower cost compared with traditional systems like Society for Worldwide Interbank Financial Telecommunications (SWIFT). This speed and cost-effectiveness are revolutionizing how value is moved, offering a stark contrast to the often slow and expensive processes of conventional finance.

In decentralized finance (DeFi), stablecoins provide a reliable unit of account and medium of exchange, making the conduct of a wide range of financial activities possible.

Despite rapid growth, widespread stablecoin adoption poses significant systemic risks requiring proactive mitigation, warns DWF Labs Managing Partner Andrei Grachev. Building on adoption drivers, Grachev highlights emerging vulnerabilities, and redemption pressure is one such downside. According to the managing partner, this risk is particularly evident with algorithmic stablecoins.

“Imagine what happens if users try to exit en masse because they fear a depeg. This could destabilize issuers and trigger broader market volatility, especially with algorithmic or undercollateralized stablecoins,” Grachev said.

Reserve management presents another critical risk. Insufficient or opaque reserves erode trust and breed contagion upon a major issuer’s failure, exacerbated by offshore operations lacking oversight.

To overcome such risks, Grachev advocates a multi-pronged solution that prioritizes real-time, on-chain proof-of-reserves, ideally short-duration U.S. Treasuries or central bank reserves. Grachev believes robust regulation is equally crucial to ensure strict fund segregation, transparent governance, and smart contract audits. Finally, protocols should incorporate risk management features like automated circuit breakers and redemption throttling to manage outflows during stressed periods, preventing rapid destabilization.

As shown by the Bitwise study data, stablecoin transaction volume fell to $14 trillion last year, up from approximately $7 trillion seen in 2023. For context, stablecoin volumes were almost 10 times less than those of Visa in 2020, and it took just under five years for stablecoins to close this gap. This clear and growing demand for stablecoins has prompted several financial institutions and the U.S. state of Wyoming to contemplate issuing their own stablecoins.

However, some observers, including Petr Kozyakov, co-founder and CEO of Mercuryo, speculate on whether stablecoins issued by traditional financial institutions will follow the same model as USDT, USDC, and other existing stablecoins.

“One important point would be whether TradFi stablecoins will operate on a public permissionless blockchain or on a private permissioned blockchain,” Kozyakov stated.

Meanwhile, Mike Blake-Crawford, CMO of World Mobile Group, told Bitcoin.com News that his experience working with financial institutions in both developed and emerging markets suggests banks will be inclined to choose permissioned models. Yet, adopting this model is likely to create problems he has seen in some markets.

“This creates an interesting tension we observe directly in markets like Pakistan and Zanzibar versus the USA – traditional institutions want the efficiency benefits of stablecoins without the decentralisation that makes them so powerful for financial inclusion. Finding this balance will be critical as banks enter a space where World Mobile and other blockchain-native companies have already established robust use cases driven by genuine market needs rather than theoretical benefits,” Blake-Crawford stated.

Still, the exact makeup or shape of stablecoins issued by traditional financial institutions will likely be determined by the stablecoin legislation before the U.S. Congress and those passed by the European Union (EU). Until recently, issuance of stablecoins was largely unregulated, but incidents of stablecoins depegging or collapsing prompted global financial regulators to respond by proposing or passing laws governing these.

While the debate on what assets should back stablecoins is ongoing both inside and outside Congress, Blake-Crawford told Bitcoin.com News that regulatory certainty is exactly what the mobile money industry needs.

“The STABLE Act represents a potentially crucial milestone that could unlock significant growth in our American operations. When I speak with our U.S. customers about payment preferences, the conversation inevitably turns to regulatory concerns – they want the same frictionless payment options our African subscribers enjoy, but with clear legal frameworks that protect their assets,” Blake-Crawford said.

In addition to the STABLE and GENIUS Acts, the trajectory of stablecoins will also be shaped by international coordination on cross-border payment standards. According to Grachev, the Bank for International Settlements (BIS) and International Monetary Fund (IMF) “will probably lead this charge.”

Grachev also believes that finding frameworks that strike the right balance between privacy needs and compliance will also determine if stablecoin usage will indeed become widespread.

“The other big challenge regulators need to tackle is balancing privacy with compliance. How do you establish norms for programmable identity verification and transaction tracing without trampling on user rights? Getting this balance right will be crucial for widespread adoption,” Grachev explained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。