Macroeconomic Interpretation: The cryptocurrency market is currently exhibiting a certain resilience driven by multiple factors, including expectations of interest rate cuts from the Federal Reserve, regulatory policy breakthroughs, and geopolitical dynamics. Bitcoin has risen for five consecutive days since April 17, breaking the $94,900 mark and briefly surpassing Google's parent company Alphabet to become the fifth largest asset globally, with a market capitalization exceeding $1.3 trillion. Behind this rally, continuous inflow of institutional funds, breakthrough technical indicators, and a shift in macroeconomic expectations form a threefold support, suggesting that the market may be accumulating momentum for a breakthrough of the psychological barrier at $100,000.

Expectations of a shift in Federal Reserve policy have become the core driving factor for the market. With the "Federal Reserve's megaphone" revealing details of Trump's pressure on Powell, and several Fed officials publicly supporting a rate cut in June, the consensus on a turning point in monetary policy is gradually strengthening. According to CME FedWatch data, traders' bets on the probability of a rate cut in June have risen to 58%, directly driving the three major U.S. stock indices to collectively rise, with the Nasdaq achieving its first three-day gain of over 2% since 2001. The interconnected effect of risk assets is significant, with Bitcoin spot ETFs seeing a net inflow of $2.759 billion over five days, setting a record for capital inflow during this phase. Institutional products from Fidelity, Bitwise, and others have each attracted over $300 million in a single day, indicating that traditional capital is accelerating its layout in cryptocurrency through compliant channels.

The substantial advancement of the regulatory framework has injected a strong dose of confidence into the market. The U.S. SEC held its third cryptocurrency policy roundtable on April 25, with new chairman Paul S. Atkins and three commissioners discussing custody rules and investment advisor access with representatives from Fireblocks, Fidelity Digital Assets, and other institutions. This marks a recognition by regulators of the positioning of cryptocurrency assets within the mainstream financial system. Notably, the meeting invited licensed institutions like Anchorage Digital Bank to participate in discussions for the first time, suggesting that the SEC may adjust its regulatory approach to unify cryptocurrencies as securities. Under the expectation of policy breakthroughs, the Bitcoin options market has become unusually active, with the open interest of $95,000 call options increasing by 47% week-on-week, and some institutions even starting to position for deeply out-of-the-money contracts at $120,000, indicating that the derivatives market has begun pricing in a breakout.

Geopolitical dynamics and the demand for asset diversification provide long-term support. Although the Chinese Foreign Ministry has explicitly denied that the U.S. and China are engaged in tariff negotiations, Trump's recent suspension of the commitment to impose a 145% tariff on Chinese goods has sparked market speculation. Some institutions analyze that global dollar asset holders are accelerating the restructuring of their investment portfolios, with gold's 18% increase this year resonating with Bitcoin's strong rebound, reflecting a migration to safe-haven assets amid a shaky sovereign currency credit system. Data shows that Bitcoin has surpassed the 23.6% Fibonacci key resistance level at $87,045, and the 21-week moving average has completed a bullish-to-bearish conversion, presenting typical bull market characteristics. In terms of capital flow, Grayscale's GBTC has ended a three-month streak of outflows, with a net purchase of $120 million in a single week, indicating that even long-term holders are regaining confidence in the current valuation level.

In the short term, the market needs to be cautious of a technical correction triggered by overheated sentiment. The greed index has risen to around 75, and the funding rates in the derivatives market have reached a three-month high, with some profit-taking occurring around $94,500. However, three positive signals remain at the macro level: first, the Federal Reserve is likely to maintain the current interest rate in its May meeting, and the policy vacuum period is conducive to the continuation of risk appetite; second, the supply contraction effect post-Bitcoin halving has not yet fully manifested, with miner selling pressure dropping to a year-to-date low; third, a virtual asset ETF in Hong Kong is set to be listed, which is expected to strengthen liquidity during Asian trading hours. Historical data shows that when Bitcoin's market capitalization surpasses traditional giants like Meta and Berkshire, it often accompanies a shift in market perception, and this rally may become a key turning point for institutional allocation from "optional" to "essential."

For the future market, Bitcoin's breakthrough of $100,000 requires two catalytic conditions: first, U.S. inflation data must fall below expectations, reinforcing the necessity for rate cuts; second, the SEC must release a clear regulatory framework after the May meeting to eliminate compliance barriers for institutional entry. The current market has entered a "self-fulfilling expectation" phase, where any marginal positive news could trigger FOMO sentiment. It is advisable to view $87,000 as a dividing line between bulls and bears; if the weekly close is above this level, mid-term upward potential may open up to the $120,000-$130,000 range. This asset revolution driven by shifts in monetary policy, regulatory breakthroughs, and geopolitical restructuring is reshaping the value coordinates of global capital markets.

Data Analysis:

Bitcoin's price has recently achieved a key breakthrough, rising strongly from the $85,000 level to the $94,000 range, with weekly volatility expanding to 28%, setting a new high for this phase.

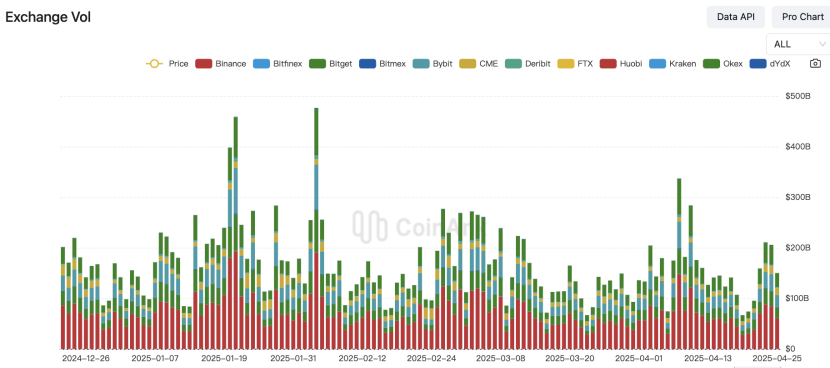

According to Coinank data, the derivatives market is showing a synchronous volume-price resonance, with the trading volume of futures on leading exchanges significantly rebounding. Binance's April contract trading volume reached $1.049 trillion, a month-on-month surge of 53.6%, forming a "stair-step volume increase" characteristic. Platforms like OKX and Bitget saw monthly trading volumes surpassing $519.9 billion and $435.4 billion, respectively, with the three major exchanges collectively experiencing a 78% month-on-month increase in liquidity, indicating that leveraged trading is becoming the core driving force of this rally.

This round of futures-spot linked trading has exposed three structural changes: first, the ratio of Bitcoin futures open interest to spot trading volume has risen to a historical extreme of 2.7, indicating that funds are accelerating their layout through leverage; second, the central funding rate of perpetual contracts has increased by 0.03%, with the cost of going long rising but not suppressing opening enthusiasm, reflecting that the market has entered the early stage of irrational exuberance; third, the borrowing rate of USDT on major exchanges has surged to an annualized 35%, suggesting that arbitrage funds are constructing long-short combination strategies. It is important to be cautious, as the current futures trading volume to market capitalization ratio stands at 1:1.8, a fragile balance; historical data shows that a breach of this threshold is usually accompanied by a technical correction of over 15%.

The cryptocurrency market is experiencing a "leverage-driven bull market," a model that often exacerbates volatility transmission effects: on one hand, it attracts traditional quantitative funds to increase their allocations, pushing the open interest of CME Bitcoin options up by 42%; on the other hand, it may trigger liquidity fragmentation across exchanges, with some smaller platforms already experiencing price deviations of over 5%. If the Federal Reserve maintains a hawkish stance in June, the excessive leverage in the derivatives market could become an amplifier of systemic risk. However, in the short term, the deep improvement in futures is accumulating momentum for a breakthrough of the psychological barrier at $100,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。