在 Aptos 生态沉寂数月后,一项名为 AIP-119 的社区提案为这条 Layer 1 公链注入了新的争议与生机。

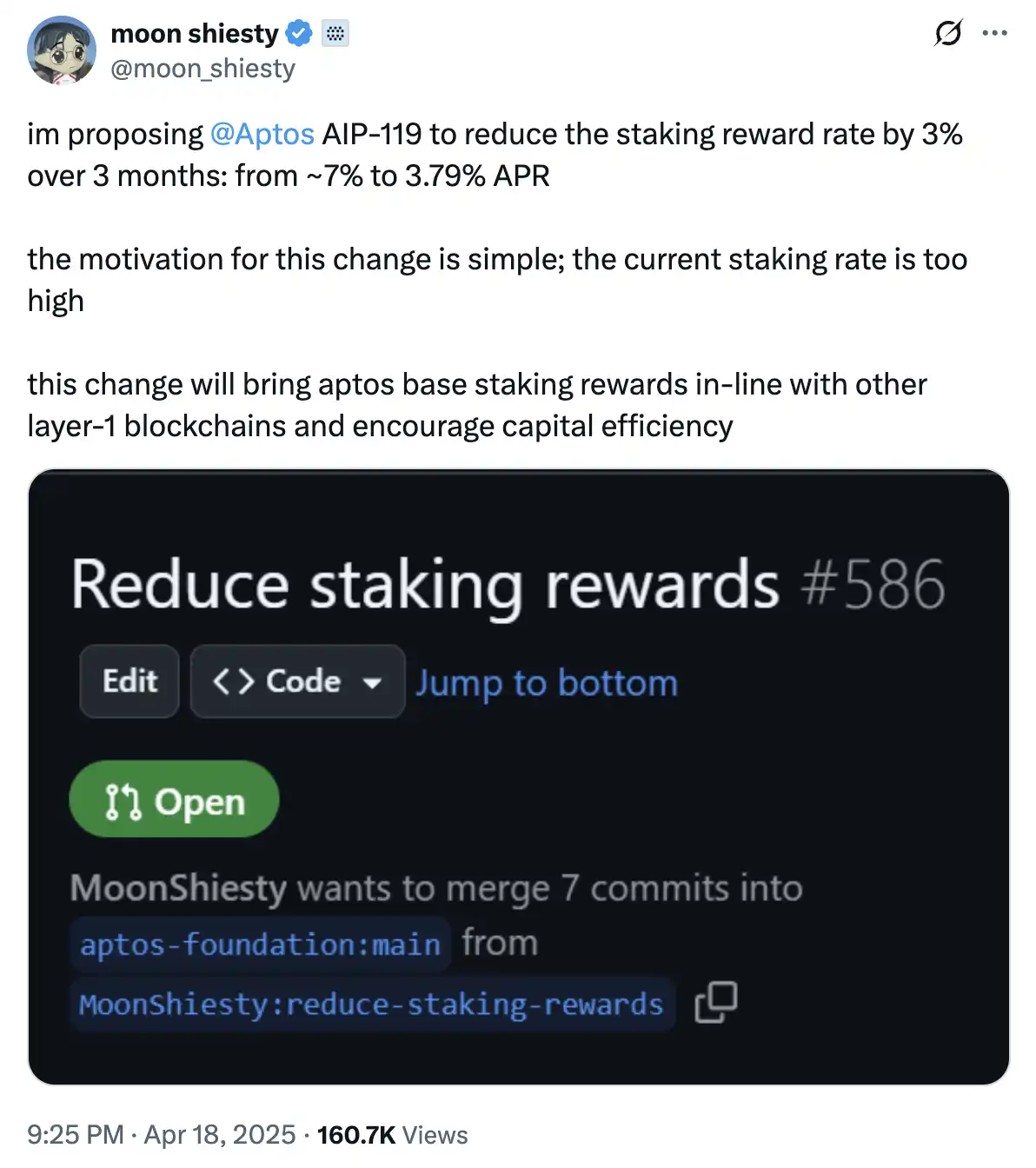

4 月 18 日,Aptos 社区成员 moon shiesty 发起「分阶段降低质押奖励率」提案「AIP-119」,建议将质押奖励率从目前的约 7%,在未来 3 个月内每月递减 1%,最终年化收益率降至 3.79%。

提案认为,降低质押奖励率将有助于 Aptos 生态的长期增长,特别是推动在 DeFi 领域更积极地参与竞争,同时也有利于增强 APT 的代币经济学,以支持其长期可持续发展。作为 Aptos 经济模型改革的第一步,提案将接受社区反馈,若提案通过将设置 6 个月观察期评估影响。

在许多观察者眼中,这不仅是一项技术治理上的调整,更是一次对 Aptos 经济模型底层逻辑的重构尝试。

高收益的隐患与结构性通胀

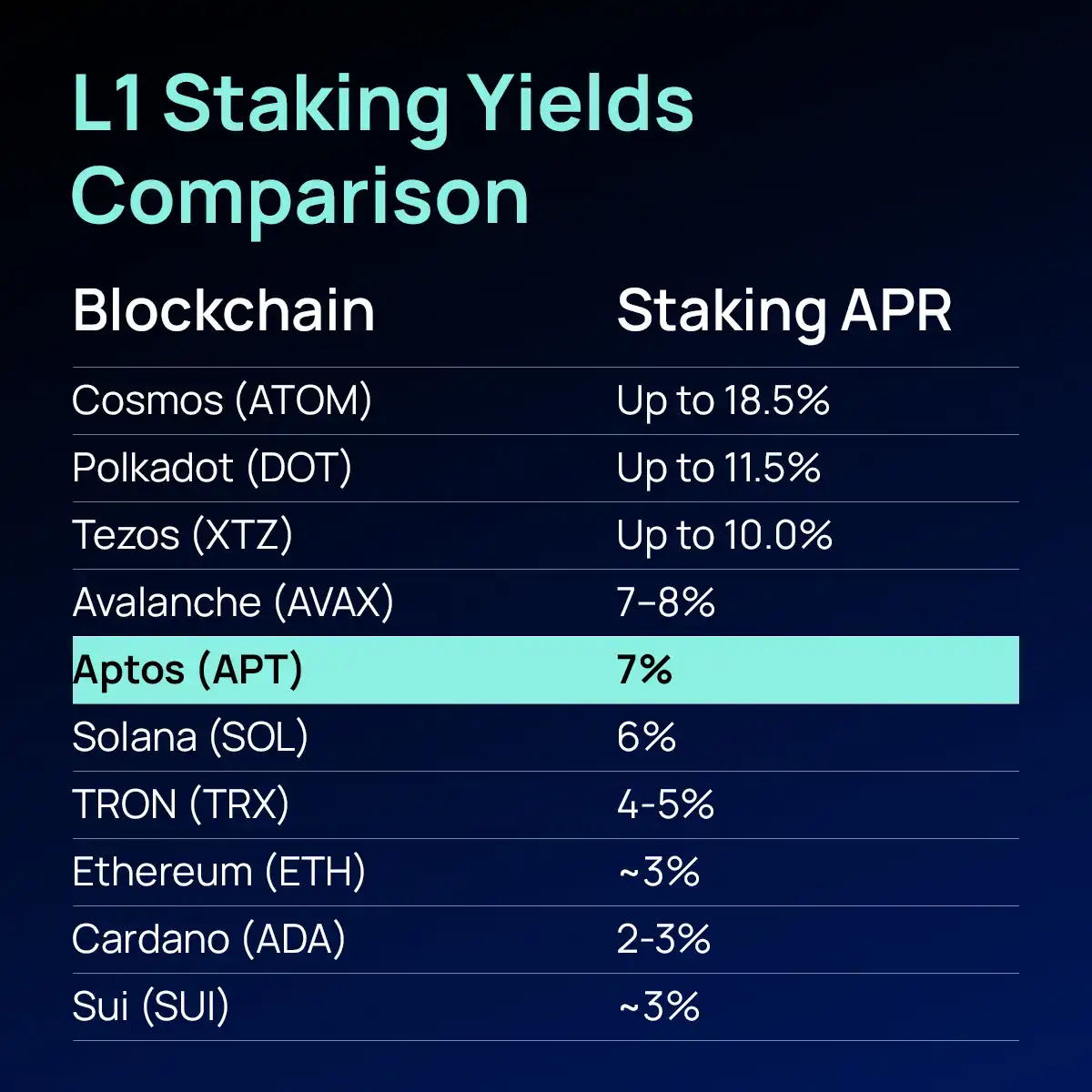

Aptos 当前的质押收益率在 L1 公链中名列前茅,但其带来的问题也日益凸显。7% 的无风险年化回报虽吸引了大量用户将 APT 锁定参与质押,却同时造成了严重的通胀压力与资金使用效率低下。

社区普遍认为,这种模式正不断稀释代币价值,也阻碍了生态资金向更具风险与创新性的应用流动。正如提案发起人所比喻,质押奖励在链上扮演了「央行利率」的角色,而此刻的「利率」可能已偏离了市场实际。

在过去两年间,Aptos 虽以超高性能和 Move 语言的安全性吸引了开发者,但生态活跃度始终未能与之匹配。与此同时,与其同为「Move 双子星」的 Sui 持续走强,形成鲜明对比。

许多社区成员将此归因于 Aptos 代币模型的结构性问题——高比例代币集中在基金会与核心节点手中,叠加早期设定的高质押收益,使得生态资金过度集中于「躺赚」,反而抑制了建设性创新。

新官上任三把火

提案的提出背景,是 Aptos 近期在管理层与市场定位上的一系列变化。据社区消息,Aptos 创始人 Mo Shaikh 与早期成员有法律争议,最终结果是华裔 Avery Ching 接任 Aptos Labs CEO(原为 CTO),Mo Shaikh 退出日常管理。

在他上任后,Aptos 的战略叙事也从「可扩展 L1」转向「下一代全球交易引擎」,更明确强调性能与交易体验为核心竞争力。

更为显著的是,Aptos 重新拥抱华语市场的姿态:设立中文社区 MovemakerCN、举办多场黑客松并提供千万美元级别的生态资助,显示出其重新构建社区信任与拓展全球开发者网络的决心。

技术上,Aptos 也不断推进 Zaptos 升级与 Block-STM v2 等性能优化,希望在「低收益高性能」的新生态中吸引开发者以真实需求驱动的 PMF(产品市场契合)为核心重建繁荣。

社区怎么看?

尽管 AIP-119 的提出触碰了既得利益者的蛋糕,社区整体反馈却未陷入情绪化对抗。相反,包括最大流动质押协议 Amnis Finance 在内的多方意见表现出较为理性的审视与反馈。Amnis 在公开回应中指出,当前提案方向合理,但执行节奏过于激进,可能损害 Aptos 的竞争力。他们认为,质押收益率类似于新兴市场的利率工具,对于 Aptos 这样的公链而言,高收益是吸引资本的关键。

若降至 3.79%,Aptos 将在 L1 阵营中处于收益最低梯队,可能导致资金流向 Solana 或美国国债等更高回报的选项。此外,反对者担忧,收益骤降会削弱散户的锁仓动力,增加 APT 的市场流通量,从而加剧抛压。DeFi 生态也可能因杠杆质押策略的萎缩而面临 TVL 下滑的风险。

针对验证节点,反对者指出,收益率降低将显著影响小型节点的盈利能力。以 100 万 APT 的质押量为例,3.79% 的收益率和 7% 的佣金仅带来约 13,000 美元的年收入,而运营成本可能高达 72,000 至 96,000 美元。这可能迫使小节点退出,加剧网络的中心化风险。为此,提案中提到的社区验证者支持计划成为关注的焦点,但具体实施方案尚未明确。

支持者则强调,Aptos 要走出当前困境,必须优先解决通胀预期和代币滥发问题。高收益质押机制制造的「信用幻觉」,正悄然侵蚀生态根基。每一轮价格反弹都沦为质押用户的「出货窗口」,形成价格天花板,这不仅扭曲了市场行为,也削弱了长期持有者的信心。

更值得关注的是,提案提出了「社区质押支持计划」,试图在降息之余,扶持质押量较小的验证节点,缓解去中心化程度下滑的风险。与其他 L1 如 Solana 采取的委托支持计划类似,Aptos 也开始正视其网络安全与去中心化之间的微妙平衡。

生态进化的拐点

AIP-119 更深层的意义,是 Aptos 在面对市场周期性衰退、DeFi 流动性下降和「高 APY 陷阱」后,对其经济模型与生态机制做出的主动调整。在当前 L1 公链普遍「增发-质押-通胀」的恶性循环中,Aptos 成为罕见主动压缩基础收益、释放长期潜力的尝试者。

这也引发了更深层的讨论:是否一条链的健康发展,必须以牺牲无风险利率为代价?是否「高 APY=强吸引力」的逻辑,正在失效?真正的竞争力来自网络效用和生态持续性,而非短期激励。正如 Hashkey Capital 成员 Rui 所指出的那样,「验证节点的基础收益率不能高,通过 LST 赚 Mev 的钱增加收益率,通过 DeFi 和生态给大户更多的对网络的 ownership,其次是进入退出随意(APT 搞了 Delegators Pool)。」

AIP-119 仍处于草案阶段,但它或许已成为 Aptos 摆脱沉疴、重新定义经济模型的一个重要节点。在这个决策上,Aptos 选择的不只是数字的调整,更是一次集体治理机制的再验证,以及对「长期主义」价值的公开宣示。

当然,降低质押收益的同时,Aptos 需要提供更清晰、更具吸引力的替代激励方案,否则短期资金出逃与社区信任损失将不可避免。但至少,从「自断一臂」到「重塑生态」,这条链开始试图回答那个被反复提出却少有项目认真面对的问题:我们究竟是为了什么而设计这套系统?

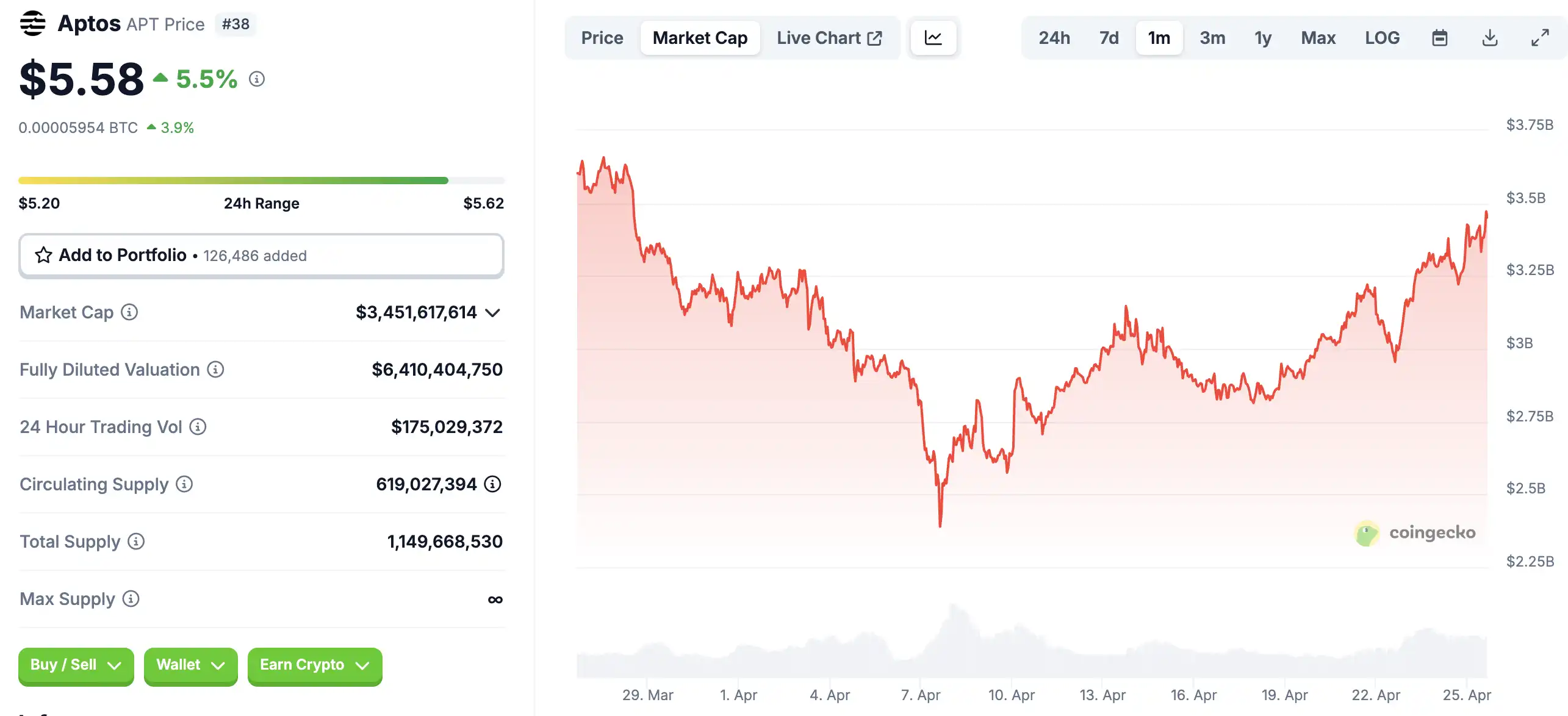

截至撰稿时,APT 代币价格为 5.58 美元,24 小时上涨 5.5%;4 月以来,较市场大跌期间币价回升明显。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。