In 2025, the stablecoin market has risen at an astonishing speed, becoming the brightest star in the global fintech sector. From trading volumes surpassing Visa to a market size exceeding $230 billion, stablecoins not only occupy a core position in the cryptocurrency ecosystem but also demonstrate disruptive potential in real economic scenarios such as cross-border payments, remittances, and corporate settlements.

Market Size and Trading Volume: The "Super Moment" of Stablecoins

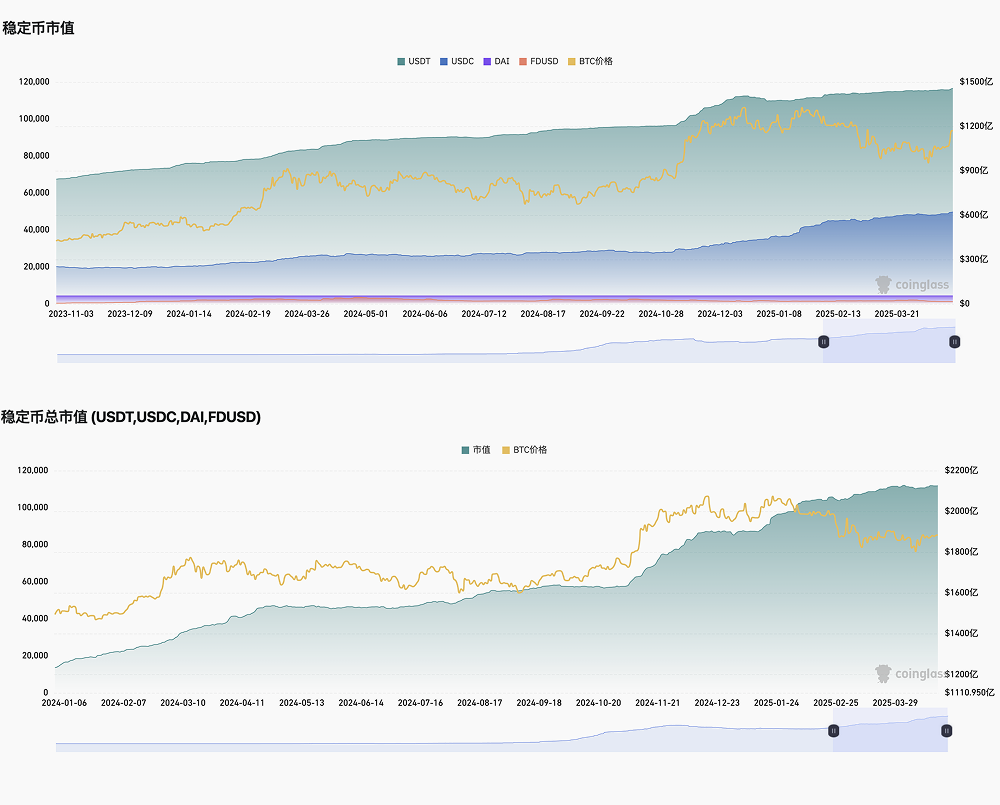

In the first quarter of 2025, the global circulation of stablecoins has climbed to $218 billion, a 13% increase compared to the same period in 2024. Predictions suggest that by 2030, the stablecoin market size could range between $0.5 trillion and $3.7 trillion, indicating significant growth potential. Even more shocking is that the on-chain trading volume of stablecoins reached $5.6 trillion in 2024, equivalent to 40% of Visa's payment transaction volume, and this figure further soared in 2025, with monthly trading volumes surpassing $700 billion, officially exceeding Visa's annual payment scale.

The explosion in stablecoin trading volume is not coincidental. USDT (Tether) and USDC (USD Coin), as market leaders, have solidified their dominance in cross-border payment and trading scenarios through regulatory clarity (such as the EU's MiCA framework and Dubai's DIFC approval) and strategic partnerships with traditional financial giants like Stripe and MoneyGram. For instance, Stripe's high-profile acquisition of the stablecoin service provider Bridge highlights traditional finance's recognition of stablecoin potential. Meanwhile, the number of active addresses for stablecoins grew by 53% in February 2025, reaching 30 million, with institutional adoption accelerating at an unprecedented pace, hastening the integration of traditional finance (TradFi) and the crypto space.

Policy and Regulation: U.S. "Deregulation" Ignites New Momentum

In 2025, changes in the global regulatory environment injected a strong dose of confidence into the stablecoin market. The U.S. Treasury Secretary publicly stated that they would review regulatory barriers hindering the development of blockchain and stablecoins, aiming to make the financial system serve a broader range of ordinary users. The pro-crypto policies of the Trump administration further boosted market confidence.

At the same time, the EU's MiCA regulations provide a clear compliance framework for stablecoins, while emerging markets like Dubai attract stablecoin issuers through regulatory sandboxes. These policy signals not only reduce market uncertainty but also attract more institutions to enter the space. Giants like Visa and BlackRock are accelerating their involvement in stablecoin-related businesses, promoting their application in remittances and merchant payments.

New Trends: Yield-Bearing Stablecoins (YBS) Emerge

In 2025, the stablecoin market experienced differentiation. In addition to trading stablecoins like USDT and USDC continuing to dominate the market, Yield-Bearing Stablecoins (YBS) rapidly emerged as a new ecosystem. YBS offers users stable returns through risk-layered design, particularly favored in environments with significant market volatility. Analysts predict that if the crypto market remains sluggish, YBS could capture 20-30% of the stablecoin market.

For example, platforms like Resolv have redefined the yield model of stablecoins through innovative YBS paradigms. The rise of such products enriches the application scenarios of stablecoins and attracts more developers and DeFi innovators, promoting the diversified development of the stablecoin ecosystem.

Real-World Applications: From Crypto to Global Capital Flow

The success of stablecoins is not limited to the crypto market; their application in the real economy is expanding at an unprecedented pace. In 2025, the role of stablecoins in cross-border remittances, merchant payments, and corporate settlements has significantly strengthened, especially in emerging markets. Data shows that the trading volume of stablecoins exceeded $27 trillion in 2024, three times that of 2023, and this trend accelerated further in 2025.

Stablecoins serve a wide range of users, from micro-enterprises to the largest global companies, by providing faster and cheaper payment methods. For instance, the integration of stablecoins with Stripe and Visa has made them the preferred tool for cross-border payments for small and medium-sized enterprises, while the participation of institutions like BlackRock further validates their potential in global capital flow. Additionally, the holdings of stablecoins in government bonds ranked 17th globally in 2025, surpassing countries like Saudi Arabia and South Korea, becoming an important tool for U.S. debt management.

Challenges and Outlook: Opportunities and Risks Coexist

Despite the booming stablecoin market, challenges remain. Regulatory uncertainty continues to be the biggest risk, especially with potential adjustments in U.S. SEC policies due to personnel changes. Furthermore, the monopolistic positions of Tether and Circle face challenges from emerging competitors, and market differentiation may bring new uncertainties.

Looking ahead, 2025 is set to be a pivotal year for the stablecoin market. With a clearer regulatory environment, accelerated institutional adoption, and the emergence of innovative products like YBS, stablecoins are expected to further integrate into the global financial system. Analysts predict that by the end of 2025, the stablecoin market size could exceed $400 billion, with on-chain trading volumes continuing to set new records.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。