原文标题:A review on the current state of the 'Trenches'

原文作者:@nicodotfun

原文编译:zhouzhou,BlockBeats

编者按:Pumpfun 生态在市场低迷时依然活跃,PumpSwap 上线推动交易回暖,每日交易额达 3-5 亿美元,手续费收入显著。尽管用户减少,战壕中老玩家仍活跃,新币热度高于旧币。Memecoin 仍是 Solana 生态中最具吸引力的投机工具,低门槛、高波动,持续吸引新流动性。

以下为原文内容(为便于阅读理解,原内容有所整编):

这段时间我一直扎在「战壕」里,而 Crypto Twitter 上的很多人早就说战壕已经「死了」。

确实,memecoin 的交易量已经不如几个月前,而 $TRUMP 这枚币可以说是在 memecoin 的热度、交易量和吸引流动性方面都达到了一个局部顶点。

不过,那时候是 $SOL 冲到 290 美元、BTC 超过 10 万、整个牛市正当时的背景下。

之后,BTC 回调到了 74k–88k 区间,SOL 一度跌到 95 的局部低点。但现在,SOL 又涨回到 140+(15 天涨了 46%),BTC 也重新站上了 90k,我们也该重新评估一下当前的局势了。

尽管 SOL 的价格还不算高,加上整体市场情绪偏空、大家也有些疲乏,但数据呈现出的却是另一番景象。我们来看看截至目前四月的数据:

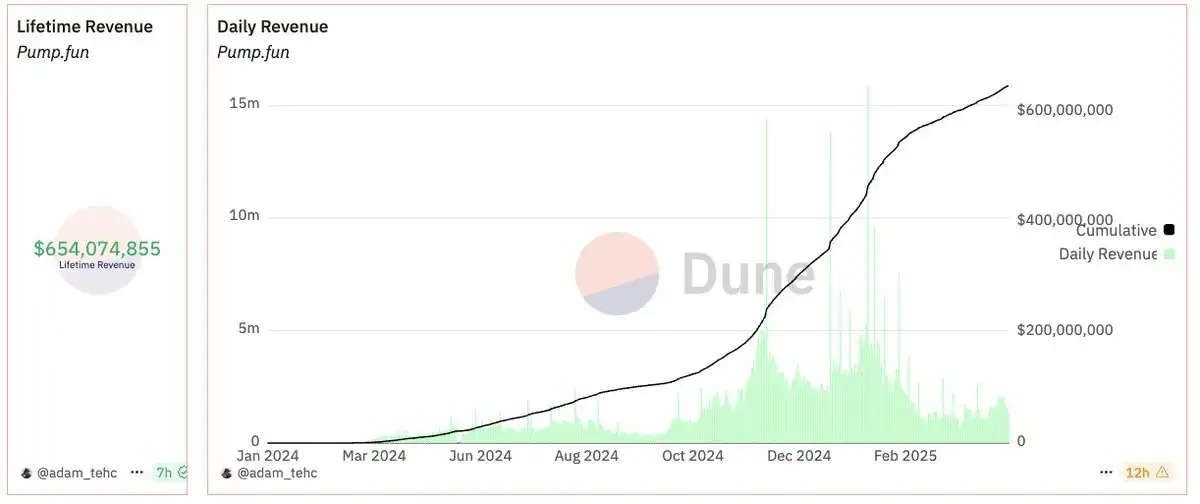

@pumpdotfun 到目前为止总共已经创造了大约 6.5 亿美元的交易量。仅在四月,它每天的交易额就在 100 万到 270 万美元之间浮动,日均大概在 150 万到 200 万美元之间,属于这个区间的高位水平。

在 SOL 涨到高位、以及 $TRUMP 币热度见顶之后,交易量一度下滑。但到了四月,交易量又开始明显回升。

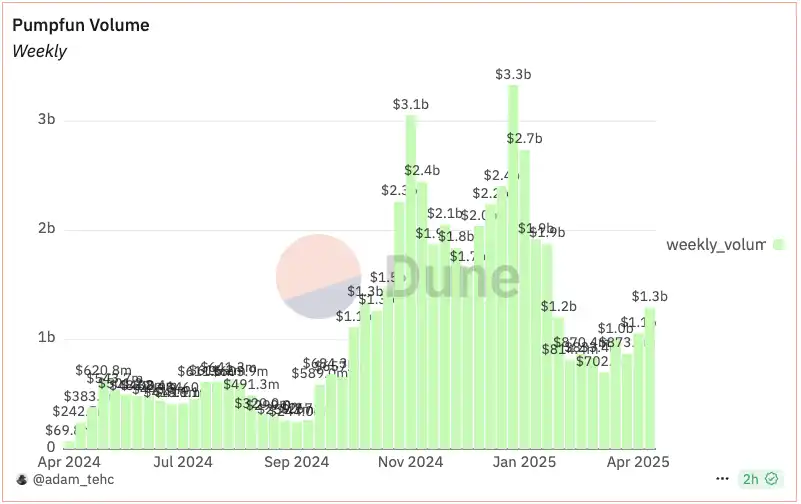

随着 pumpswap 的上线以及几乎「秒迁移」的体验,围绕「迁移事件」的玩法变得更加顺滑,整体交易体验也提升了。从每周的 pump 总交易量增长就能看出这一点。

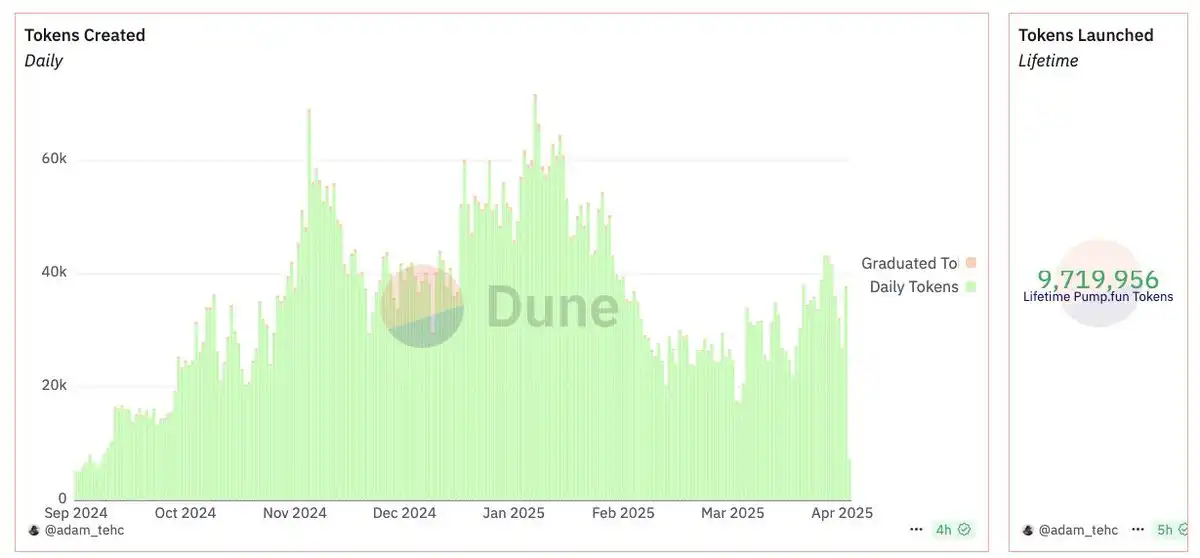

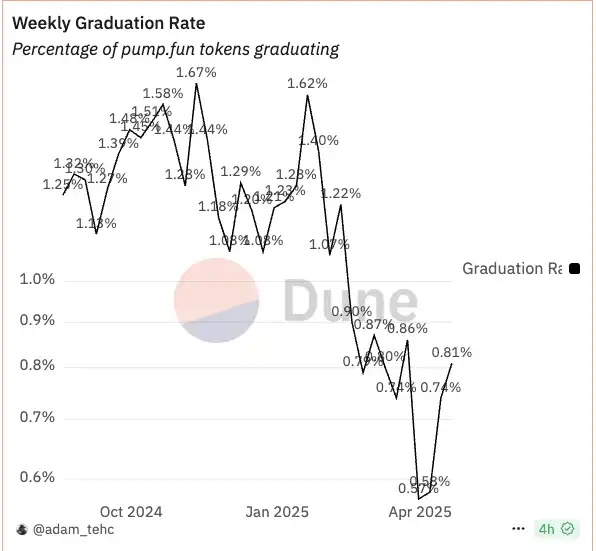

截至目前,pump 上已经诞生了 970 万个代币。仅在四月,每天都有 2 万到 4 万个新币上线,而其中每天大约有 100 到 350 个完成「毕业」(即进入交易池),毕业率大概在 0.4% 到 0.8% 之间。

毕业率的逐渐下降,其实跟用户数量和整体交易量的减少是同步的。这也说明现在「战壕」里的 PVP(玩家对玩家)成分更高了——一些小团体会在新币刚上线时抱团控盘,然后互相砸盘。一旦他们发现吸引不到足够的流动性来继续绑定代币,就会很快选择放弃、退出。

活跃用户情况

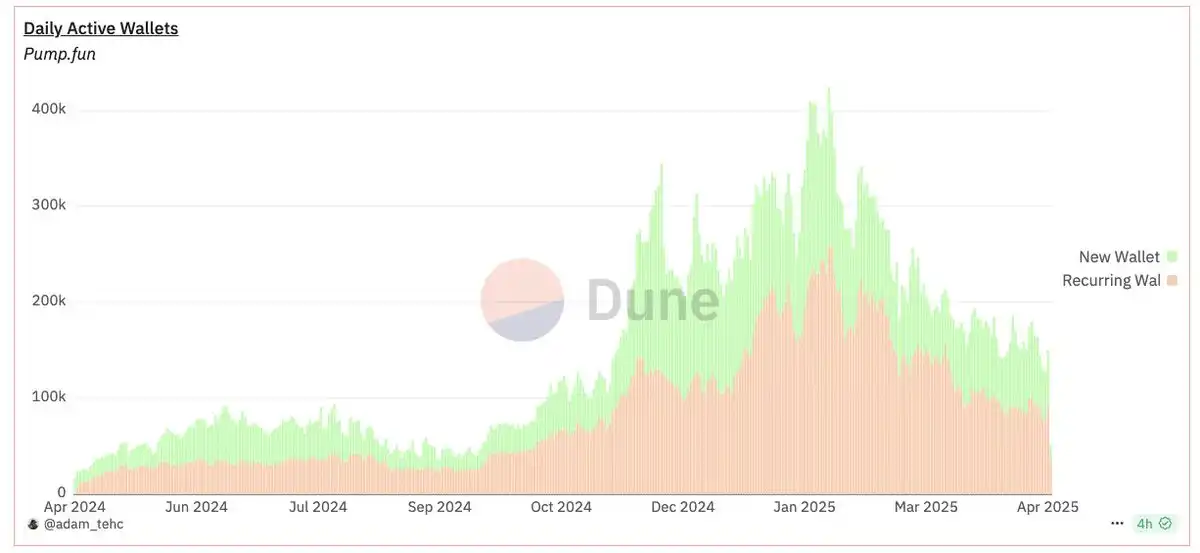

在高峰期(2024 年 12 月到 2025 年 2 月),每天有大约 20 万到 40 万用户在交易 pumpfun 上的 memecoin。自那之后,用户数一路下滑,过去两个月里一直都没能回到 20 万以上。

目前,每天大约有 15 万个活跃钱包,且新钱包和老钱包的占比相对均衡。但需要注意的是,大多数「战壕玩家」会用多个钱包进行交易,并且偶尔会更换活跃钱包。

交易机器人数据

大家都知道,现在大部分 memecoin 的交易活动,都是通过前五大终端进行的,包括:@AxiomExchange、@bullx_io、@tradewithPhoton、@gmgnai 和 @TrojanOnSolana。

平台日活用户(DAU)日交易量每日交易次数 Axiom1.7-3 万$2000 万 - $3300 万 70 万 - 150 万笔 Bullx2-3 万$2000 万 - $3300 万 20 万 - 40 万笔 Photon1.8-2.7 万$3000 万 - $5000 万 25 万 - 35 万笔 GMGN1 万 - 1.8 万$800 万 - $2000 万 18 万 - 29 万笔 Trojan1.4-2.5 万$700 万 - $3000 万约 20 万笔

这个数据基本符合我们看到的整体趋势——每天大约有超 10 万活跃用户,总交易量超过 1 亿美元。

累计手续费 & 平台管理资产(以 SOL 计)——按 SOL 价格 $140 估算

Bullx:累计手续费 $1.86 亿|AUM:215k SOL(约 $3000 万)

Axiom:累计手续费 $3900 万|AUM:暂未公开,估计略低于 Bullx

Photon:累计手续费 $3.82 亿|AUM:539k SOL(约 $8260 万)

GMGN:累计手续费 $6600 万|AUM:未披露,估计至少为 Bullx 一半

综合来看,在这些平台以及其他相关场所,memecoin 生态内大概有超过 $2 亿的流动性 SOL 在活跃流通。

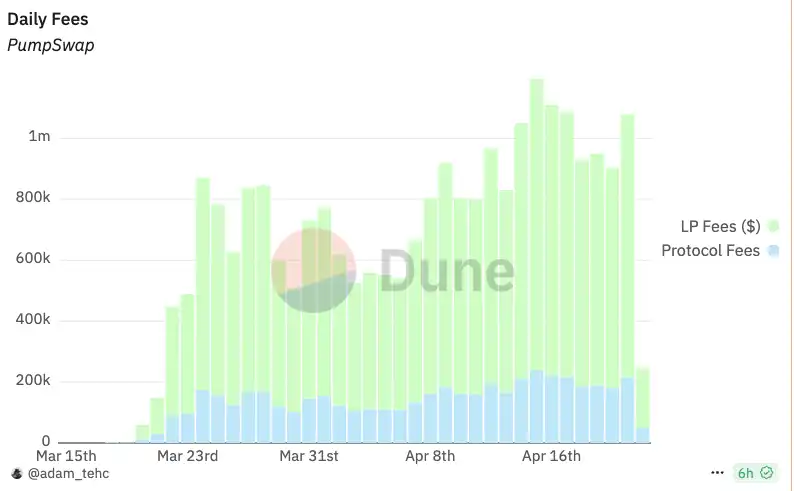

PumpSwap 数据

PumpSwap 目前每天的交易量在 $3 亿到 $4.8 亿之间,占 Solana DEX 总量的 9%-19%。由于现在所有 pumpfun 新币都在 PumpSwap 上发币并交易,这也说明还有相当一部分旧币仍在 Raydium 或 Meteora 等平台上活跃交易。

PumpSwap 是 pumpfun 团队非常聪明的一步棋

他们设置了 0.25% 的交易费,其中 0.02% 给 LP(做市商),0.05% 给协议本身。

上线一个月左右,PumpSwap 已经累计收了约 2500 万美元手续费(每天在 10 万到 24 万之间),其中大约 2000 万分给了 LP,剩下的 500 万进了协议口袋。

而且这个数字还在涨,因为 PumpSwap 的市场份额持续扩大。我们可以明显看到趋势:大家更愿意交易新币,而不是老币。

这种偏好和我对 memecoin 发展路径的判断是一致的:现在「战壕」越来越难混,是因为留下来的人基本都是老兵,经历过 SOL 价格下跌、交易量冷清、用户流失的时期,依然坚持在场的硬核玩家。

memecoin 生态真正的动力来自「新流动性」,也就是新用户的进场。

而这波新用户,最开始其实是一些主流币血亏的「正经投资人」或「行业老韭菜」,他们为了追求更快的收益,转身投入 meme 的怀抱。

随着这个生态不断扩大,越来越多的散户也开始「浅尝一下战壕的深水」。

memecoin 依旧是最适合投机的载体,Solana 就像是赌场的主场。这些币容易理解、入门门槛低,而且对于新手来说,成功一次的收益往往是高度不对称的——赌赢一次就能翻好几倍。

而且内容多,每天都有新东西发生,一切都可以被做成代币:人、内容、事件、梗……相比之下,DeFi 项目就让人觉得无聊又麻烦,要盯策略、理解机制,操作上限低、风险大。

如果让我在 meme 以外选几个愿意押注的标的,那大概只有 Hyperliquid 及其生态,还有 fartcoin——毕竟热空气是会上升的(笑)。

你以为战壕死了?

不,战斗才刚刚开始,任务还没完成呢。

「原文链接」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。