比特币在整个星期保持了上升的轨迹,尽管经济环境不确定,受到总统唐纳德·特朗普不可预测的贸易政策变化的困扰。一个有趣的发展是,这种数字资产与纳斯达克和标准普尔500指数的相关性稳步下降。

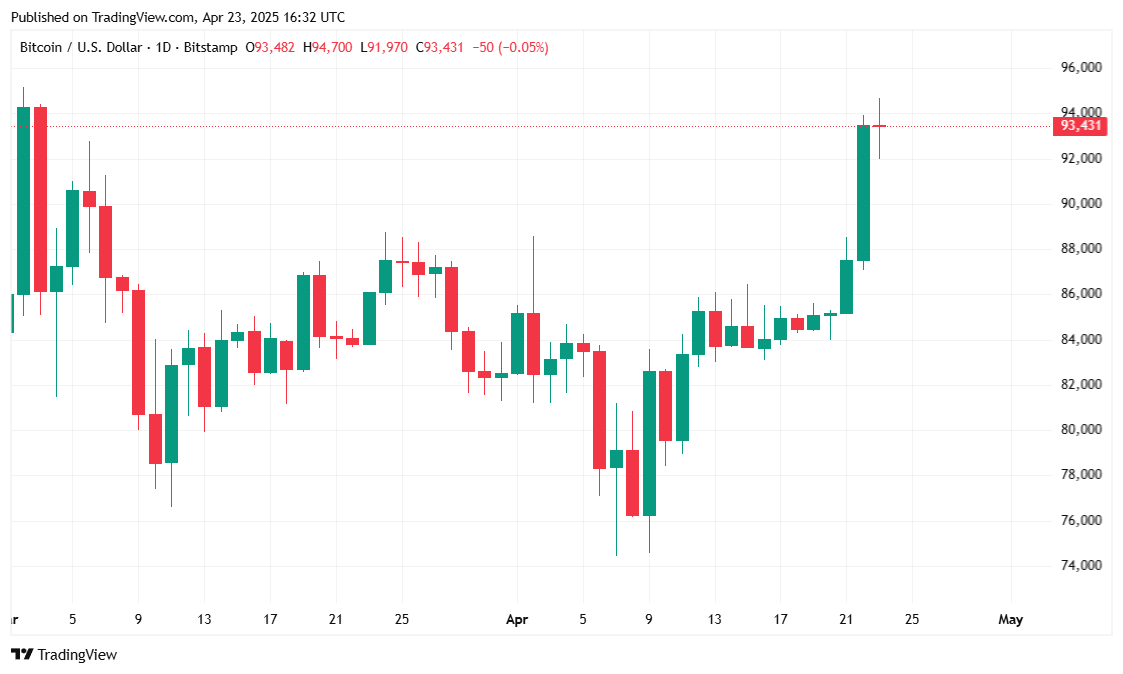

在报告时,比特币的交易价格在94,535.73美元和90,455.69美元之间波动,最终定格在93,406.06美元。自昨天以来,这种加密货币上涨了2.97%,在过去七天中实现了10.09%的稳健增长。

( BTC价格 / Trading View)

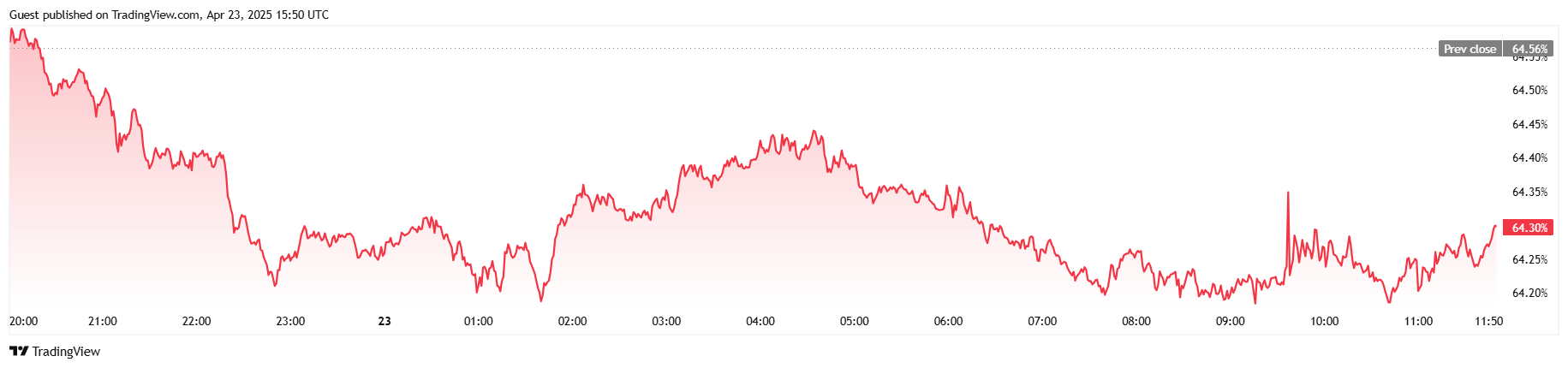

交易量显著上升,增长了19.93%,达到527.4亿美元,表明投资者参与度增加。比特币的市值也上升至1.83万亿美元,比前一天上涨了2.16%。然而,尽管价格上涨,比特币的市场主导地位略微下降至64.30%,这表明相对而言,山寨币的吸引力略有增加。

( BTC主导地位 / Trading View)

期货活动呈现出混合的局面。比特币期货的总未平仓合约下降了6.03%,降至639.4亿美元,表明一些杠杆头寸被减少。根据Coinglass的数据,在过去24小时内,1033万美元的头寸被清算,做多交易者承受了大部分损失,损失金额达到874万美元。做空交易者的清算金额仅为159万美元。

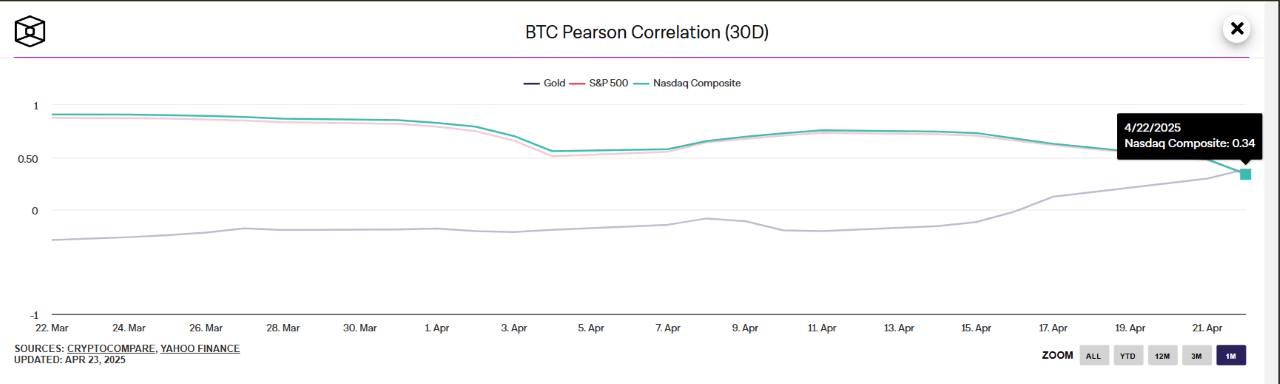

比特币曾被视为金融反文化的象征,最近与股市的相关性很强,在四月初与纳斯达克和标准普尔500指数的30天皮尔逊相关系数均超过0.80。

( 比特币与纳斯达克和标准普尔500的相关性 / The Block)

这一数字在过去一周显著下降,表明加密货币与股票之间的脱钩。根据The Block在报告时的数据,与纳斯达克和标准普尔500的相关系数分别为0.34和0.35,表明比特币与股票的分歧正在加大。

尽管现在下结论还为时尚早,但这一趋势可能预示着数字资产在经济不确定时期成为事实上的避风港的时代即将到来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。