综编:Felix, PANews

USDC 稳定币发行商 Circle 于 4 月 21 日表示,预计于 5 月份推出由稳定币驱动的跨境支付网络 Circle Payments Network (CPN) 。

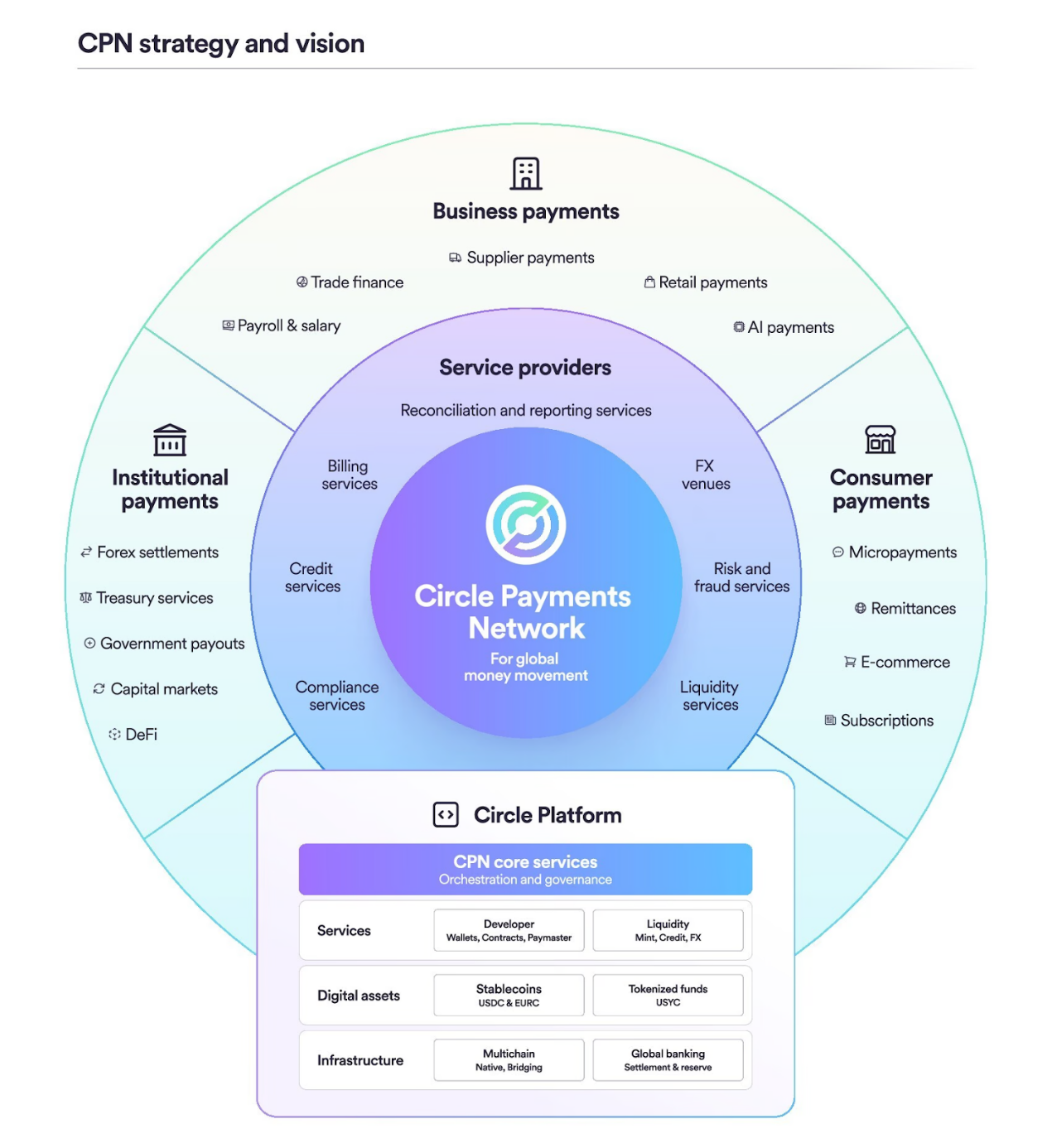

CPN 旨在通过利用 USDC、EURC 等稳定币和其他受监管的数字货币在银行、支付提供商、虚拟资产服务提供商和数字钱包等参与者之间进行全天候实时结算,实现更快、更低成本的国际汇款。

此次发布代表着 Circle 角色的战略扩展,从稳定币发行商转变为大规模转移这些资产的基础设施提供商。

搭建框架,消除障碍

据世界银行(World Bank)数据显示,目前跨境支付的结算时间仍可能超过一个工作日,成本超过 6%,对新兴市场造成了一定影响,限制了全球竞争力。

尽管稳定币长期以来一直有望成为互联网支付和资金流动的新基础,但目前稳定币在主流支付中的采用仍存在许多障碍。这些障碍包括用户入门挑战、模糊的合规要求、技术复杂性以及对数字现金安全存储的担忧。

CPN 旨在消除这些障碍。通过将金融机构整合到一个合规、无缝且可编程的框架中,以协调法币、USDC 和其他支付稳定币的全球支付。这些金融机构的企业和个人客户可以享受比传统支付系统更快、更低的支付体验。参与该网络的金融机构必须满足严格的资格标准,包括许可、AML/CFT合规性、财务风险管理和网络安全协议。

愿景与用例

借助 CPN,Circle 正构建一个全新的平台和网络生态系统,为企业、金融机构和个人提供广泛的跨境资金流动用例,包括供应商付款、汇款、工资单、资本市场结算、内部资金运营以及链上金融应用。其中:

企业

进口商、出口商、商户和大型企业可以利用支持 CPN 的金融机构消除重大成本和摩擦,强化全球供应链,优化资金运营,并减少对成本高昂的借入营运资金的依赖。

个人

汇款人和收款人、内容创作者以及其他倾向于发送或接收小额支付的个人将实现更多价值,使用 CPN 的金融机构将能更快、更低成本、更简化地提供这些改进的服务。

建设者

银行、支付公司和其他提供商可以利用 CPN 的平台服务开发创新的支付用例,利用稳定币、SDK 和智能合约的可编程性,构建生态系统。第三方开发者和企业可以引入增值服务,进一步扩展网络功能。

此外,CPN 由智能合约基础设施和模块化 API 提供支持,使第三方开发者能够直接在 CPN 上构建高级模块、应用服务和自动化财务工作流。

与此同时,为确保 CPN 的构建符合高标准的信任度和运营诚信度,桑坦德银行、德意志银行、法国兴业银行和渣打银行正以顾问身份,为该网络的设计提供咨询。

CPN 也已有 20 多家设计合作伙伴,包括 Alfred Pay、BCB Group、BVNK、CoinMENA等。这表明该平台将重点关注在新兴市场和大宗汇款渠道运营的机构。

瞄准支付巨头

随着稳定币在全球范围内日益普及,监管框架也开始趋于统一,Circle 看到了实现全球货币流通现代化的机会。

Circle 的新平台旨在与 Visa 和 Mastercard 等老牌支付平台展开直接竞争。尽管 Circle 的影响力和监管力度不断增强,但 USDC 的市场份额仍落后于竞争对手 Tether (USDT)。

截至 2025 年第二季度,USDC 的市值为 601.7 亿美元,而 USDT 的市值为 1440.5 亿美元。尽管如此,Circle 仍致力于提升透明度、合规性和功能性,以缩小差距。

此外值得一提的是,Circle 并不是首家试图彻底改变跨境支付或取代 SWIFT 的公司,但目前还没有一家成功。Circle 未来能否打破魔咒,值得期待。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。