周末的最后一天,今天过的很丰富,几乎是放松了一整天,今天的作业也不难,虽然稍微有点震荡,但在周末这都是正常的事情,重点关注的还是周一晚上美股开盘以后的走势,不过下周并没有什么太重要的数据,仍然是川普的关税以及美国的经济作为市场的主导。

关税其实已经差不多了,最终如何执行市场已经逐渐没了脾气,因为经济问题已经迫在眉睫了,下周以后就会公布2025年第一季度的 GDP ,这个数据出来后基本上是不是会交易衰退就能有了指引,但美国经济目前并不乐观是必然的了,这时候留给川普的选项并没有很多。

另外从下周开始就是密集的财报季了,尤其是美股的七姐妹中 TSLA 和 Alphabet 分别在周二和周四盘后公布,可能会对市场产生一些影响,而再一周以后就是除 NVDA 以外其它四支公布财报的时间,到时候还有 $MSTR 和 $COIN 的财报,嗯,还有 GDP 。

下周还是会稍微轻松一些,下下周难度就要增加了。

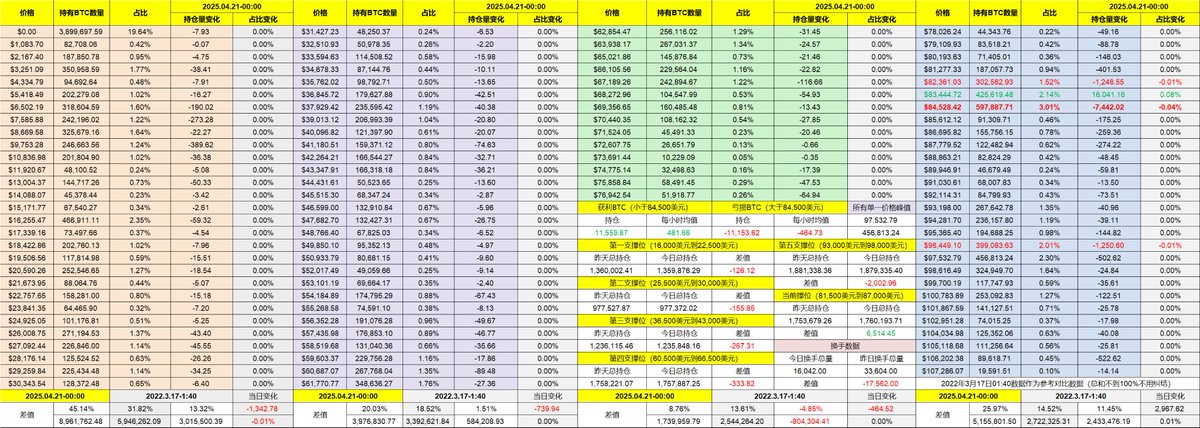

回到 Bitcoin 的数据来看,周末的最后一天不仅仅是低流量,而是还是最近几年以来最低换手的一天,24小时内只有1.6万枚 $BTC 在链上发生了地址变化,这个数据甚至低于2022年底熊市最熊的时候,当时 BTC 才 1.7万 美元左右,而现在是 8.5万 美元左右。

当然这并不是说现在的市场就像当时一样那么熊,而是说目前的价格对于大多数的投资者来说已经完全没有交易的兴趣了,既没有买的兴趣也没有卖的兴趣,有空的小伙伴可以看看置顶的推文,里边有最近一周 BTC 未平合约的数据,也是低的一塌糊涂。

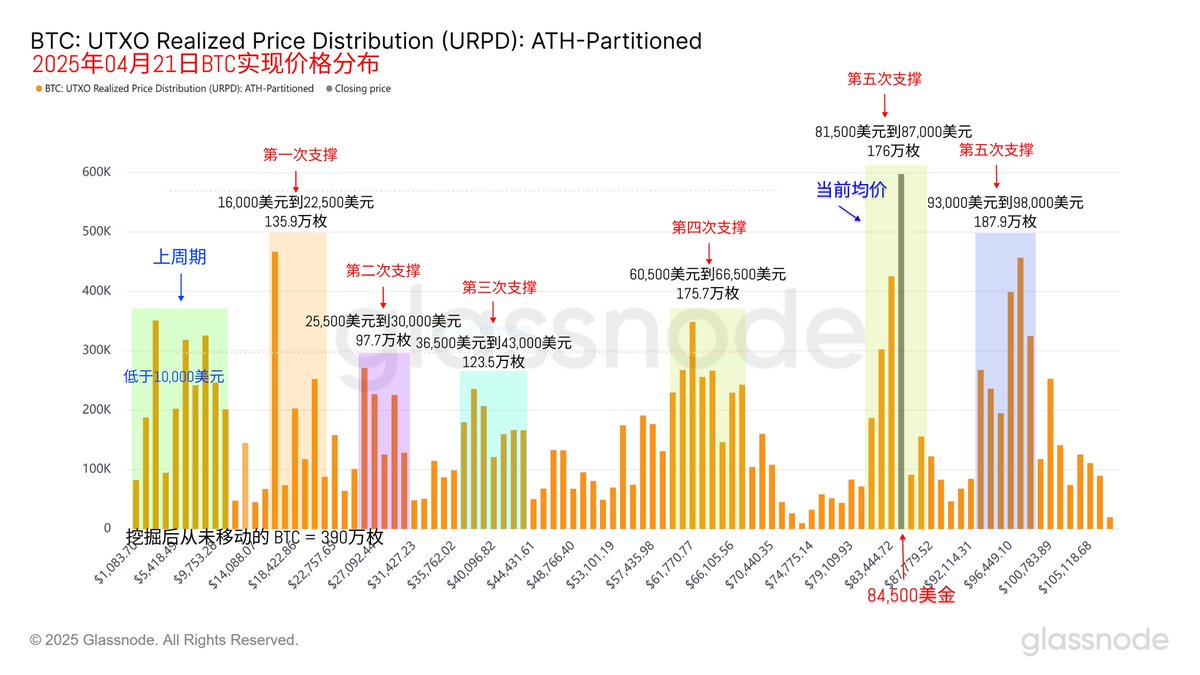

这就说明包括了合约投资者在内都不太清楚接下来方向的选择,而是选择以观望为主。支撑面自然没有变化,以 83,000 美元为中线的投资者已经堆积的越来越多了,而 93,000 美元到 98,000 美元之间的筹码还是最高的聚集位置,只要这两个位置的投资者没有发生恐慌离场,BTC 的压力就不会很大。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。