今天晚上一直在吃瓜了,终于吃的明白了,相比交易所的解决方案我更加佩服能发现这个标的小伙伴,除了反复撸合约的,还看到了专门撸资金费率的,真的是很佩服啊,尤其是在 2025年 交易难度上升的时候,能抓住这种机会真的很厉害了。

刚刚看了 @coingecko 的2025年第一季度加密行业报告,确实证明了 2025年 的难度在上升,第一季度加密货币总市值下降了 18.6%,而第一季度的最高点就是在川普就职前。我还记得就在川普的就职典礼的当天早晨 Bitcoin 突破了历史新高,然后随着川普并没有像市场预期一样公布了加密货币相关的内容就开始下跌,一直到川普公布了关税,就一直到现在了。

第一季度平均每日交易量环比下降 27.3%,至 1,460 亿美元。

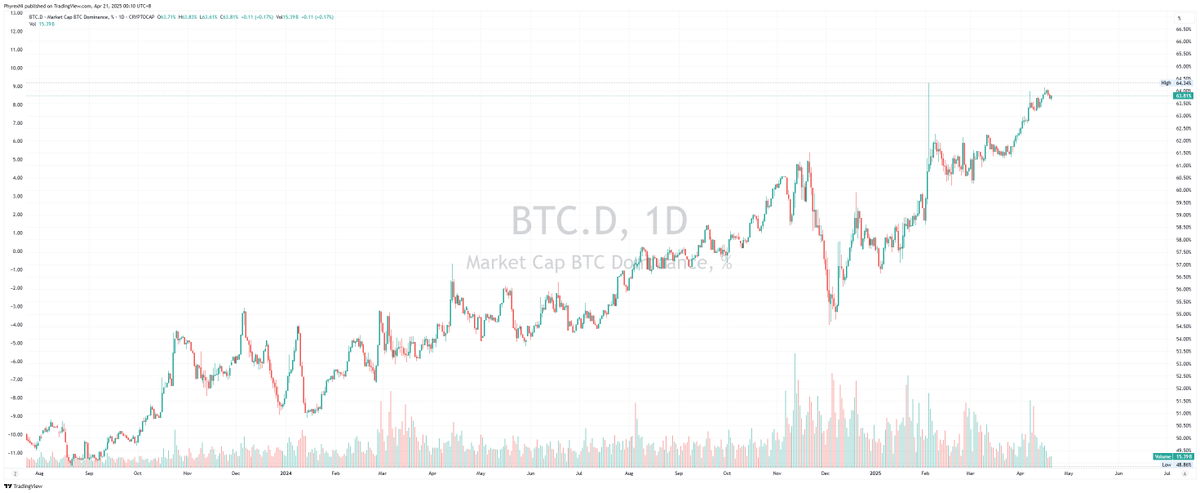

Bitcoin 虽然到现在还在 85,000 美元附件徘徊,但这并不影响 $BTC 的统治地位达到了 59.1% ,而在第一季度最高达到了 64.34% ,但不知道小伙伴们注意到没有,实际上 BTC 的市场占比是每个周期都在下降的,其实也不难理解,每个周期都有新的叙事出来,分担了 BTC 的领地。

2021年最高的时候到过 74% ,2017年最高的时候超过了 96% ,这也是一件好事,很多小伙伴都认为 Bitcoin 太贵了,没有翻身机会了,新的资产产生新的机会,也带来新一批的版本之子,这对行业也是好事。

但这个周期虽然 BTC 的市场占比还是下降了,但能和 BTC 一战的还是屈指可数,尤其是在上个周期最有希望挑战 BTC 的 $ETH ,这个周期也占有率下降到只有 7.24% ,距离历史最低的 7.04% 也不远了,ETH 的没落也代表了这一周期山寨币在流动性缺失下的无力。

而且随着 ETH 的没落,链上的 DeFi 生态都大幅缩水,2025 年第一季度,多链 DeFi 总锁仓价值减少了 489 亿美元,下降了 27.5%。

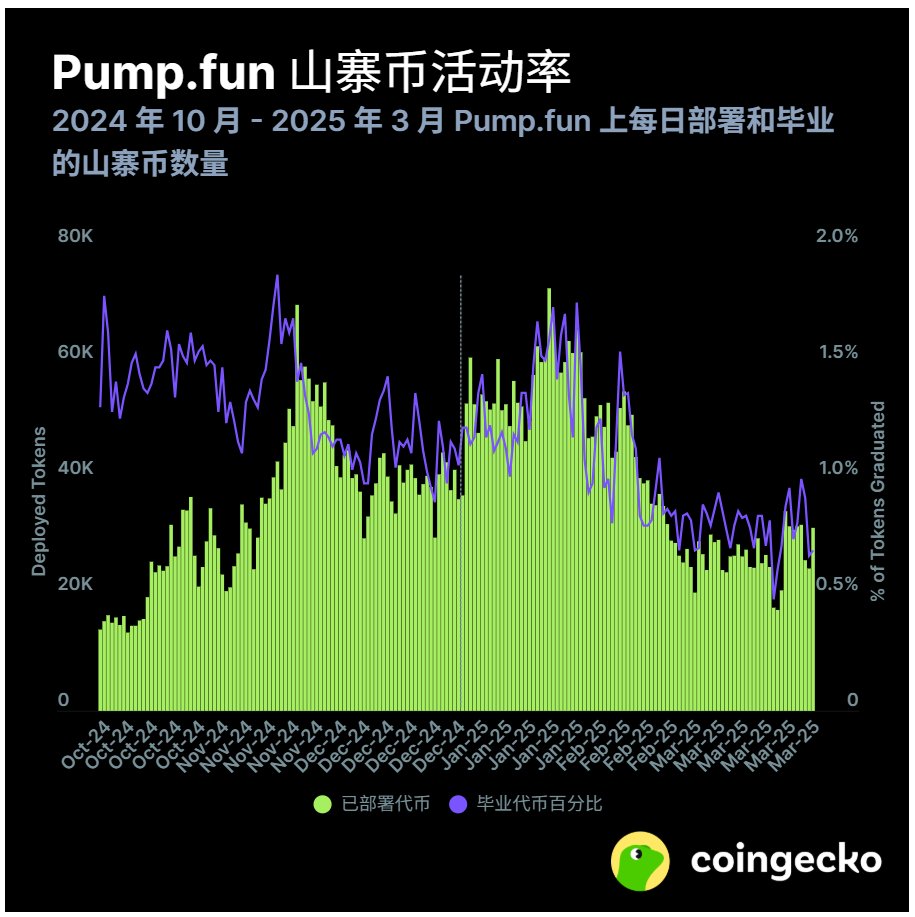

这个周期的版本之子其实有几个,包括了铭文,NFT(BTC)和 Meme,目前来看当之无愧的子中子还是 Meme,但 Meme 也并不是一帆风顺,coingecko 认为是从 $Libra 开始市场份额开始衰减的,而从个人来说 $Trump 发币是高峰 $MELANIA 就是衰退的开始。

而 Libra 只是残忍的揭开了皇帝新衣的真相,但即便如此,Meme 仍然是目前造富的神话,几乎每隔几天就能看到拿到“大结果”的小伙伴,也是敬佩不已。

而通过 Meme 带动的生态和链当中 #Solana 和 $Sol 是毫无疑问的赢家。而 http://pump.fun 就是这个时代的代名词,ETH和智能合约奠定了一键发币,而 http://pump.fun 的一键发 Meme ,让更多小伙伴都能体验一把“狗庄瘾”,但对于 Solana 来说,成也是 Meme ,但头疼也是在 Meme 上。

在 Solana 之后能成功接棒的就是 BNBChain 了,但也是因为整体市场的流动性太差,造富效应过于集中,大量的散户无非是从 Solana 上亏到了 BNBChain 上,整体活跃时间和峰值相比之前还是差了很多,但相对于川普和马斯克来说,版本更新前的 CZ 确实有卖力的引流,#Binance 甚至把延续多年的内部不能短期交易的规则都解除了。

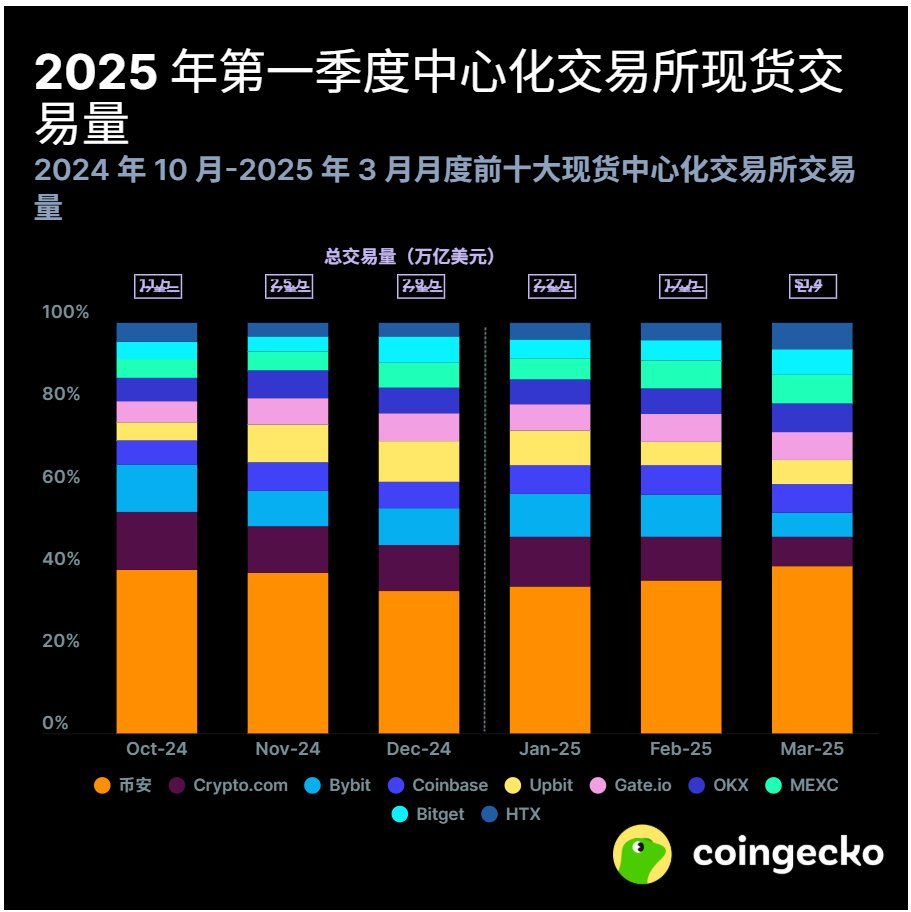

最后就是中心化交易所了,2025 年第一季度,十大中心化交易所现货交易量仅为 5.4 万亿美元,环比下降 16.3%。

Binance 依然是主导的现货中心化交易所,3 月底市场份额达到 40.7%。市场份额在整个季度持续上升。但 Binance 的交易量从 2024年12月的突破了 1万亿 美元到 3 月份也降低至 5,887 亿美元,可见市场的交易情绪低沉到什么样的程度。

其它的 #Coinbase 的表现还是中规中矩的,没有太大的变化,而 #Bybit 因为被盗事件收到了一些影响, http://Crypto.com 的市场份额也被压缩了一些, #Upbit 也是一样。

而市场份额在 2025年 增加的首先就是 #OKX ,现货交易量增加了 1.14% ,而且 OKX 和 Coinbase 少有的在 2024年和 2025年交易量稳定(平均)的交易所,其次是 #HTX ,没想到 HTX 在2025年三月的交易量大幅拉升,增加量超过了 2% ,#Bitget 虽然今天有些争议,但第一季度的成交量相比2024年第四季度也增加了 1.53% ,而 #Gate 也有将近 1% 的增涨。

其实还有一些公联的信息,我就不多说了,毕竟大家都看的很清楚了,现在新公链的成长还需要很长一段时间以及流动性的支持。

原文地址:https://www.coingecko.com/research/publications/2025-q1-crypto-report

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。