After the prior adjustment delivered a 6.81% gain, Bitcoin’s difficulty has climbed anew. Moreover, since March 9, 2025, Bitcoin’s difficulty has risen on four occasions, with Saturday’s adjustment contributing another 1.42%. That uptick coincides with bitcoin’s price treading a tight corridor for over a week, alongside the estimated daily output value of a single petahash.

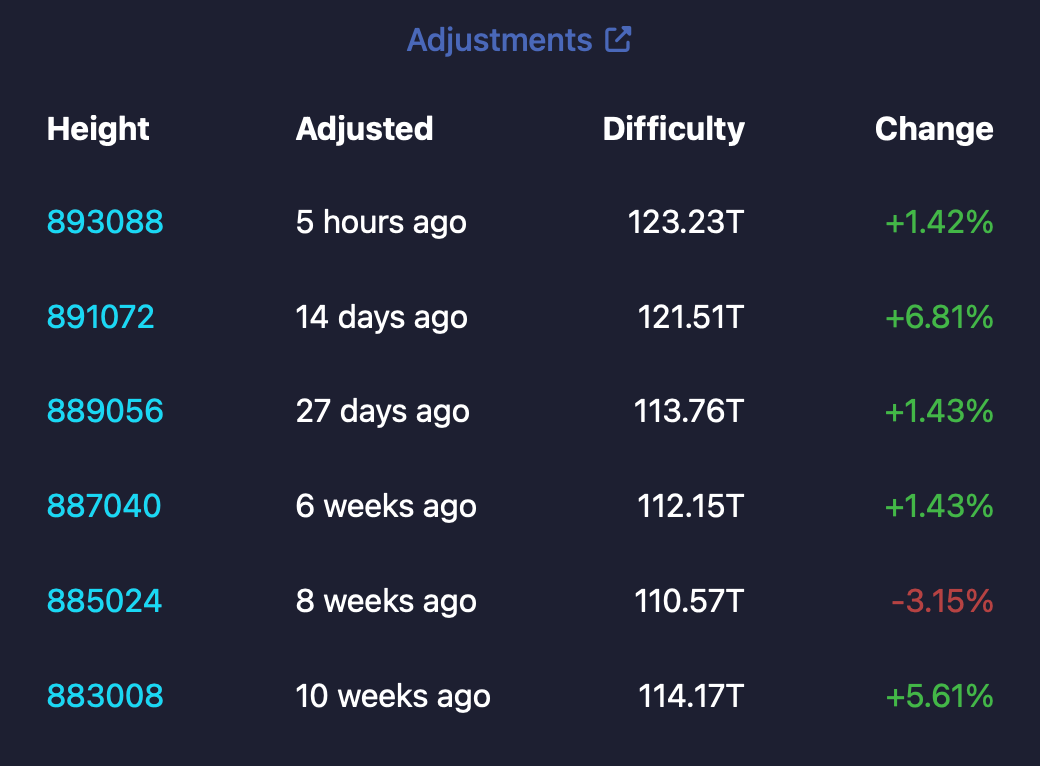

The last six difficulty adjustments. The last change was a 1.42% increase. Source: mempool.space.

During the past week, the network’s hashprice ranged from $42 to $45 per petahash per second (PH/s) of daily hashrate. At block 893,088, the recalibration propelled difficulty from 121.51 trillion to 123.23 trillion. The figure 123.23 trillion denotes the network difficulty target. It quantifies how much more complex the mining process is compared with the base difficulty of one.

In practical terms, miners must execute roughly 123.23 trillion double SHA‑256 hash attempts on average to discover a valid block. This metric highlights the immense computational effort and security built into Bitcoin’s proof‑of‑work (PoW) protocol. Bitcoin’s hashrate has continued its steep climb, recently peaking at an all‑time high of 926 exahash per second (EH/s) and currently cruising at 904.88 EH/s.

Thus far, the latest difficulty adjustment has failed to dissuade miners, just as they remained undeterred two weeks earlier when it spiked. Persistent computational commitment paired with measured adjustments suggests that Bitcoin’s protocol remains finely balanced, safeguarding block production. At this juncture, at least. As miners adapt to intensifying thresholds with unwavering determination, the network’s resilience signals continued maturation of its PoW framework.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。