加密市场在2025年初出现动荡,交易活动低迷,损失了6335亿美元,Coingecko研究人员在最近的报告中详细说明。比特币的市场份额攀升至59.1%——这是自2021年以来首次达到这一阈值——投资者纷纷远离波动性较大的山寨币。稳定币如USDT和USDC获得了关注,而以太坊的市场份额滑落至五年来的低点7.9%,报告指出。

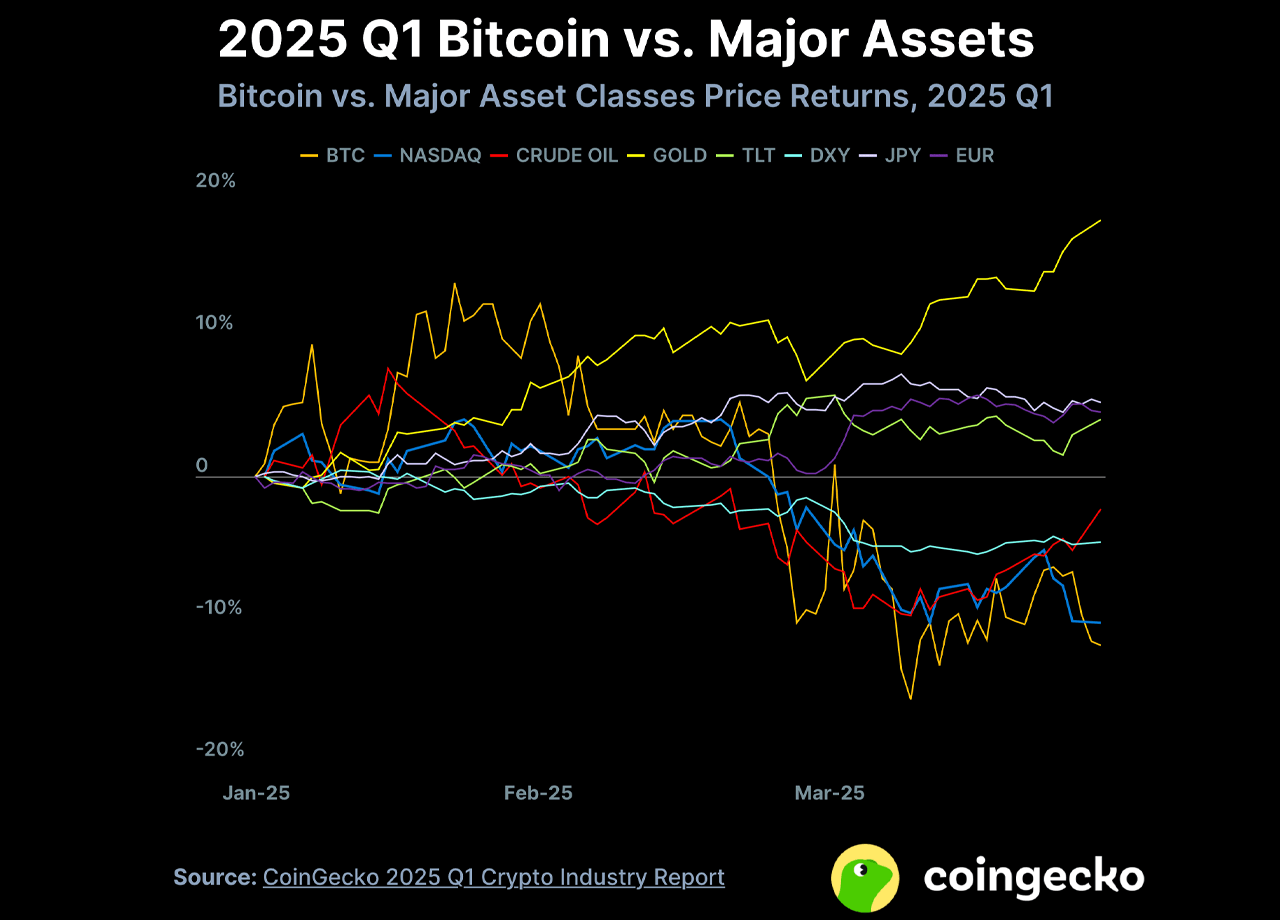

比特币在1月份短暂达到超过10万美元的历史最高价,但在第一季度结束时报82,514美元,下降了11.8%。它的表现超过了纳斯达克等风险资产,后者下跌了10.3%,但落后于黄金,上涨了18%,以及美国国债,Coingecko的数据揭示了这一点。这一下滑与日元和欧元走强相吻合,背景是货币政策的变化和地缘政治的不确定性。

尽管比特币超越了山寨币,但它并没有比黄金更耀眼。

以太坊(ETH)暴跌45.3%,至1,805美元,抹去了2024年的所有涨幅。每日交易量下降至244亿美元,Coingecko的研究报告显示,在交易量较大的日子里,价格下跌加剧。主要山寨币如Solana(SOL)、XRP和BNB的回调幅度较小,突显了以太坊的相对疲软。

受政治主题代币如TRUMP和MELANIA驱动的迷因币在与阿根廷总统哈维尔·米莱相关的LIBRA抽水事件后崩溃。Coingecko记录了Pump.fun上每日代币部署量下降56.3%,从72,000下降至季度末的31,000。

中心化交易所(CEX)平台的现货交易量下降16.3%,至5.4万亿美元,尽管在3月份出现下滑,Binance仍保持40.7%的市场份额。HTX是唯一一家在前十名交易所中实现增长(11.4%)的交易所,而Bybit在2月份黑客攻击后交易量减半,Coingecko的分析强调了这一点。

Solana在去中心化交易所(DEX)交易中领先,占据了第一季度39.6%的活动份额,尽管以太坊在3月份短暂重新夺回了第一的位置。去中心化金融(DeFi)中多个链的总锁定价值(TVL)下降27.5%,至1286亿美元,主要受山寨币下跌的影响。以太坊的DeFi份额滑落至56.6%,而新兴的Berachain的TVL上升至52亿美元,Coingecko的报告总结道。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。