Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

On April 16, Raydium officially announced the launch of its token issuance platform, LaunchLab, allowing users to quickly issue tokens through the platform and automatically migrate to Raydium AMM once the token liquidity reaches a certain scale (85 SOL). Clearly, this is Raydium's direct counterattack against the aggressive pump.fun.

The "Grudge Match" between Raydium and pump.fun

The rivalry between Raydium and pump.fun is relatively recent; during the last meme explosion cycle in the Solana ecosystem, they were somewhat "allies."

In the early design of pump.fun, token issuance required two phases: "internal" and "external" trading. After the token issuance, it would first enter the "internal" trading phase, relying on pump.fun's own Bonding Curve for matching. Once the trading volume reached $69,000, it would enter the "external" trading phase, at which point liquidity would migrate to Raydium, where a pool would be created on the DEX and trading would continue.

However, on March 21, pump.fun announced the launch of its own AMM DEX product, PumpSwap. Since then, the liquidity of pump.fun tokens will no longer migrate to Raydium during the "external" phase but will instead direct to PumpSwap — this move directly cut off the flow path from pump.fun to Raydium, thereby reducing the latter's trading volume and fee income.

- Odaily Note: We have statistics in our article "Data Analysis: How Much Does Raydium Rely on pump.fun?," showing that the trading volume of pump.fun tokens on Raydium accounts for about 20%.

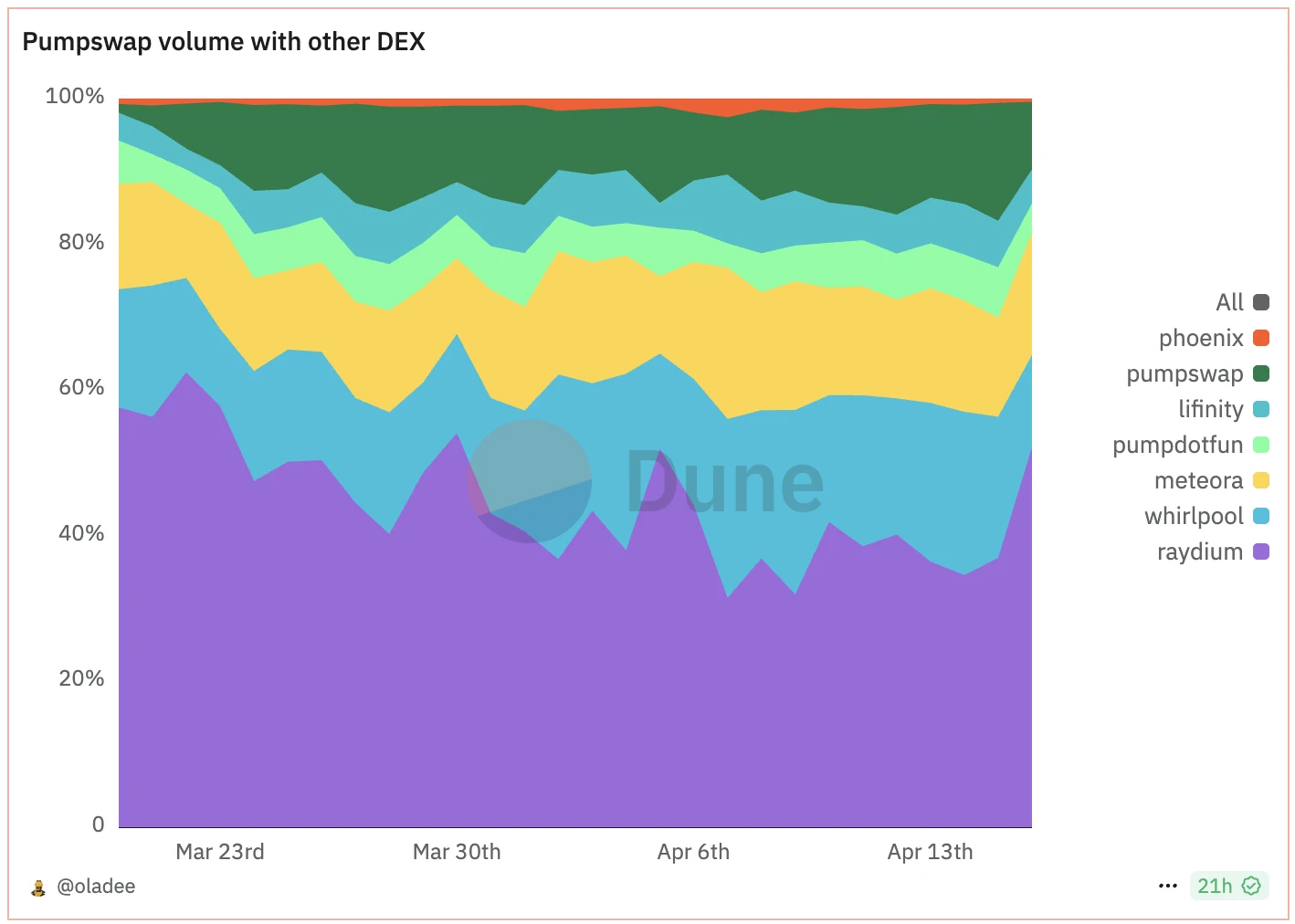

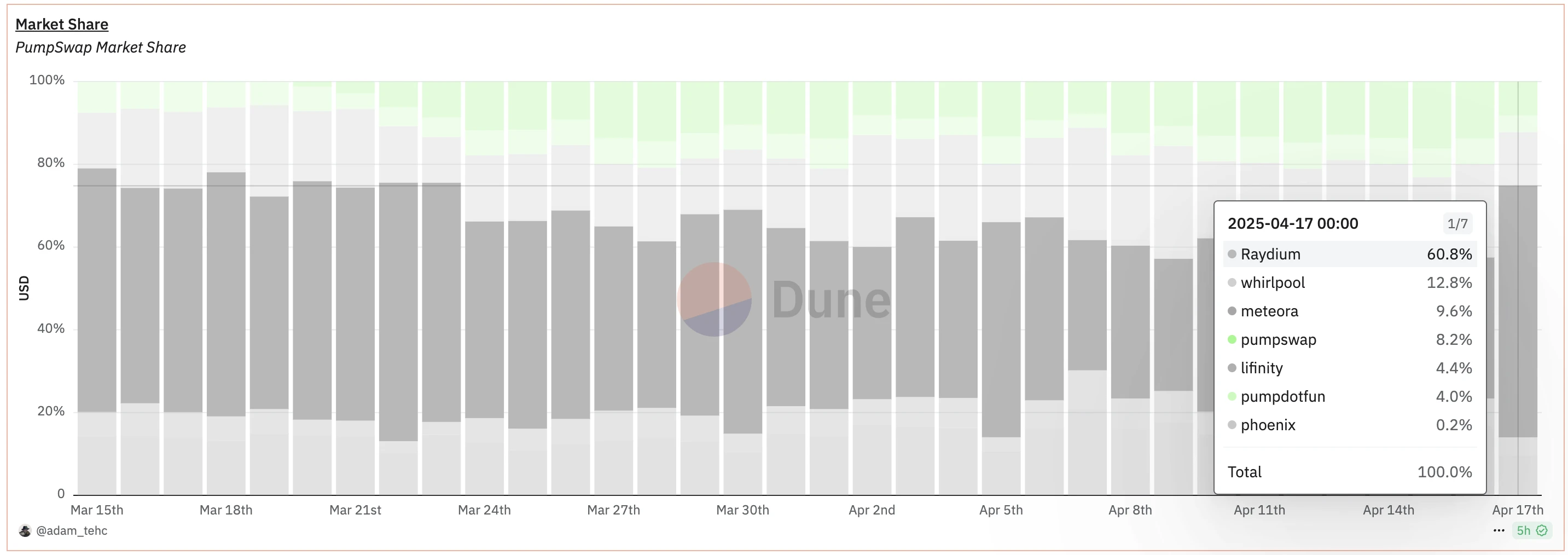

Data from Dune shows that despite being online for less than a month, PumpSwap's trading volume (the green part in the chart below) now occupies about 15% of the market share in the Solana ecosystem. Although Raydium (the purple part in the chart below) still holds the top market share position, it is clearly under pressure.

LaunchLab: Raydium's Counterattack

Seeing its "territory" gradually encroached by pump.fun through PumpSwap, Raydium is naturally unwilling to sit idly by. The launch of LaunchLab can be seen as the beginning of Raydium's advance into pump.fun's "territory," further escalating the competitive relationship between the two.

According to the official documentation of LaunchLab, the platform provides comprehensive token issuance and liquidity cold start services. LaunchLab supports two token issuance modes — the JustSendit mode adopts a streamlined, standard bonding curve setup; the LaunchLab mode allows issuers to customize supply settings, total fundraising amount, distribution curve, unlocking conditions, and other parameters.

Compared to pump.fun, the biggest feature of LaunchLab is its architecture that supports third-party integration, allowing external teams and platforms to create and manage their own launch environments within the LaunchLab ecosystem. In other words, third parties can rely on LaunchLab's underlying technology (with a focus on liquidity pools remaining in LaunchLab and Raydium) to launch independent token launch frontends.

Currently, the leading token in the entire LaunchLab ecosystem, TIME, was issued through the third-party launch platform cook.meme. This token is the first launch token in the entire LaunchLab ecosystem, with a market cap currently reported at $5.7 million; the first token launched through LaunchLab's own UI is AURA, which currently has a market cap of $150,000.

- Odaily Note: Meme token prices are highly volatile; investors should participate with caution.

Who Will Laugh Last?

As the two key players in the current Solana ecosystem meme market, pump.fun and Raydium each "dominate" the token issuance side and the liquidity pool side, respectively, and both are now reaching into each other's "territory."

In terms of the current competitive situation, PumpSwap, with nearly 15% market share, has already caused some pain for Raydium, while LaunchLab, which has only been online for a day, has not yet shaken pump.fun's position due to the lack of sufficiently influential "golden dogs." However, this does not mean that pump.fun can declare victory, for several reasons.

- First, on the first day of LaunchLab's launch, Raydium's trading volume share rebounded from about 34% to 60%, indicating that LaunchLab has attracted some capital attention. Although it currently lacks representative tokens, this launch cannot be considered a failure.

Second, compared to the "smash and grab" approach of pump.fun, Raydium, which is relatively more "orthodox" and has received direct investment from the Solana Foundation, is not as difficult to digest, and may receive some resource tilt from the Solana Foundation in the future.

The third and most important reason is that most user trading in the current meme market is completed through aggregation trading platforms like GMGN. Both pump.fun and Raydium do not often face users directly, and users' perception of the backend issuance platforms and liquidity pools is not very clear — although pump.fun is currently clearly ahead in integration progress with various platforms, major platforms will inevitably add support for LaunchLab quickly due to competitive considerations. In this model, the wealth effect will be the key factor determining user choice — in simple terms, funds will flow to where the tokens are more likely to rise.

Therefore, my personal conclusion is that currently, pump.fun has a certain advantage in the offensive, while both sides have not yet formed a sufficiently solid moat, so who will laugh last remains uncertain.

Additionally, it is important to emphasize that all of this depends on the overall environmental changes in the meme market. Looking back at the evolution of the relationship between pump.fun and Raydium, they were once "lovey-dovey" during the incremental development phase of the meme market, but as the competition cooled and profits shrank, both sides consciously set their sights on the cake in each other's bowl. The meme market currently shows some signs of recovery, but it is still uncertain whether it can replicate the previous round of prosperity. If the market environment cools again, both sides may face difficult times ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。