According to a report by CryptoSlate, the U.S. Securities and Exchange Commission (SEC) has recently concluded its financial disclosure review of Coinbase, a leading global cryptocurrency exchange, which lasted over two years. The conclusion is that no modifications or restatements are required for the company's 10-K filings for 2022 and 2023.

Review Process: Over Two Years of In-Depth Negotiation

As the largest cryptocurrency trading platform in the U.S., Coinbase has been under the SEC's scrutiny regarding its financial disclosures and business compliance since it became a publicly traded company on NASDAQ through a direct listing (DPO) in April 2021. This review began in early 2022, focusing on the Form 10-K annual reports submitted by Coinbase for 2022 and 2023, covering the company's financial condition, business model, risk disclosures, and operational details related to crypto assets. During the review, the SEC's Division of Corporation Finance conducted a thorough analysis of Coinbase's disclosure documents to ensure compliance with the stringent requirements of U.S. securities laws.

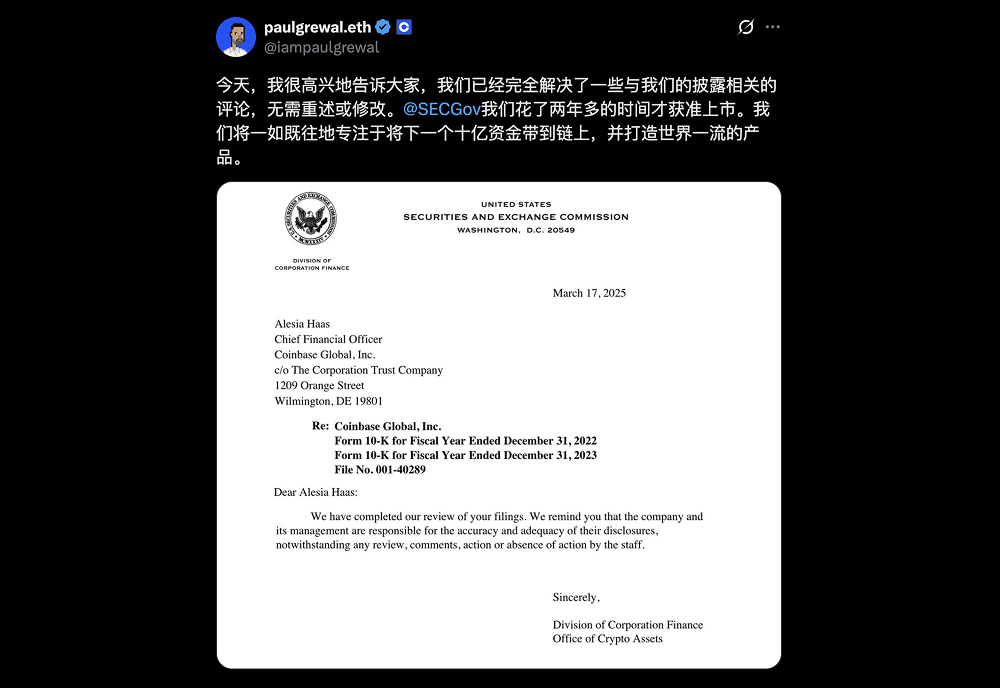

Coinbase's Chief Legal Officer Paul Grewal revealed in a social media post on April 15 that the company had engaged in over two years of ongoing communication with the SEC, successfully resolving multiple disclosure-related issues without the need for any restatements or corrections to the original documents. He emphasized that this outcome reflects Coinbase's relentless efforts in compliance building and also demonstrates the company's firm commitment to promoting transparency in the crypto industry. Grewal further stated that Coinbase will continue to strive to "bring the next billion users to blockchain" and develop world-class products to drive the growth of the crypto economy.

In a letter dated March 17 to Coinbase's Chief Financial Officer Alesia Haas, the SEC confirmed the conclusion of the review. The letter explicitly stated that the SEC had completed its review of Coinbase's 10-K reports for 2022 and 2023 and reminded the company and its management of their ultimate responsibility for the accuracy and adequacy of the disclosures. However, the SEC particularly emphasized that the completion of the review does not imply its endorsement or approval of Coinbase's filings.

Background: The Tense Relationship Between the Crypto Industry and the SEC

The smooth conclusion of this review should be viewed in the context of the long and complex relationship between Coinbase and the SEC. Since 2022, under the leadership of then-chair Gary Gensler, the SEC has adopted a law enforcement-led regulatory strategy towards the crypto industry, asserting that many crypto assets should be classified as securities and requiring relevant platforms to comply with securities law registration requirements. In June 2023, the SEC filed a lawsuit against Coinbase, accusing it of operating as an unregistered securities exchange, broker, and clearing agency, and illegally providing securities services through its staking program.

However, with the political landscape in the U.S. changing in early 2025, the regulatory approach towards the crypto industry began to shift. In February 2025, under the leadership of new acting chair Mark Uyeda, the SEC announced the withdrawal of its civil enforcement action against Coinbase, citing plans to establish a special working group for crypto asset regulation to create clearer industry rules.

In this context, the conclusion of the SEC's review of Coinbase's financial disclosures further reinforces this trend. Several industry observers on the X platform expressed optimism, viewing it as a sign of easing relations between the crypto industry and regulators. For example, user @Ruby_Avax posted on April 16, stating, "The SEC's conclusion of the Coinbase disclosure review without modifications is a significant victory for the entire crypto ecosystem, signaling that a more rational regulatory landscape is emerging."

Future Outlook: Balancing Regulation and Innovation

Although the conclusion of this review has instilled confidence in Coinbase and the crypto industry, regulatory uncertainties are far from fully resolved. The SEC reiterated in its letter that the completion of the review does not equate to an endorsement of its disclosure content, suggesting that future investigations into other aspects of Coinbase's business may still occur. Meanwhile, the regulatory framework for the crypto industry remains in its early stages, particularly concerning asset classification, stablecoin regulation, and decentralized finance (DeFi).

At the same time, Coinbase has not halted its efforts to promote regulatory transparency. In March 2025, Grewal revealed that the company had submitted a Freedom of Information Act (FOIA) request, asking the SEC to disclose its resource allocation and costs related to crypto enforcement actions, aiming to reveal the impact of the previous leadership's strategy of "substituting enforcement for rulemaking" on the industry and taxpayers.

Looking ahead, as the SEC's special working group progresses, U.S. crypto regulation is expected to gradually move towards normalization. Coinbase CEO Brian Armstrong stated in February 2025 that a clear regulatory framework would lay the foundation for industry innovation and the U.S.'s leadership position in the global crypto market. The conclusion of this review may very well be the starting point of this process.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。